Orthopedic Prosthetic Device Market Report Scope & Overview:

The orthopedic prosthetic device market size was valued at USD 2.25 billion in 2025E and is projected to reach USD 3.36 billion by 2033, growing at a CAGR of 5.16% during 2026-2033.

The global Orthopedic Prosthetic Devices Market is growing significantly due to the increasing geriatric population and the increasing incidence of infections, osteoarthritis, and osteoporosis in the population. Rising survival rates in accident-prone and conflict zones are also contributing to demand. Furthermore, the market perspective demonstrates remarkable growth in the developing regions, including Asia-Pacific, Latin America, and the Middle East & Africa, owing to the increase in healthcare infrastructure, increase in disposable income, and better access to advanced prosthetic solutions.

For instance, in June 2024, the global Orthopedic Prosthetic Device Market is driven by rising amputations, with over 130,000 U.S. lower-limb amputations in 2024 and increasing trauma cases in emerging regions.

Market Size and Forecast:

-

Market Size in 2025: USD 2.25 billion

-

Market Size by 2033: USD 3.36 billion

-

CAGR: 5.16% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information Orthopedic Prosthetic Device Market - Request Free Sample Report

Orthopedic Prosthetic Device Market Trends

-

Increasing cases of amputations and disabilities due to trauma, diabetes, chronic cardiovascular, and neurological disorders, along with the growing need for orthopedic prosthetic devices for both upper and lower extremities to offer enhanced mobility to the patients and improve the quality of life, are boosting the demand.

-

Rising bionic, myoelectric, and hybrid prosthetic innovations to provide improved performance, comfort, and patient acceptance are resulting in increased acceptance in Hospitals & Clinics and rehabilitation centers.

-

The use of 3D printing and CAD/CAM technologies is allowing the development of bespoke, lightweight prostheses that not only reduce fitting time, but also improve patient acceptability.

-

Sensor-based, digital prosthetics are also enabling real-time feedback and more accurate gait analysis, aiding in rehabilitation and quickening recovery.

-

Government programs, insurance reimbursement, and hospital safety programs are driving the prosthesis acceptance, particularly in developing countries, by lowering cost barriers and increasing access.

-

Prosthetic manufacturers partnering with AI developers and end users are powering advancements in the field, improving what is possible, and gaining market share.

-

Comfort and fitted for homecare and custom prosthesis is gathering growing interest, especially for the challenge of elderly patients and long-wearing patients, where portable and affordable/easy to use devices are in more demand.

U.S. Orthopedic Prosthetic Device Market Insights

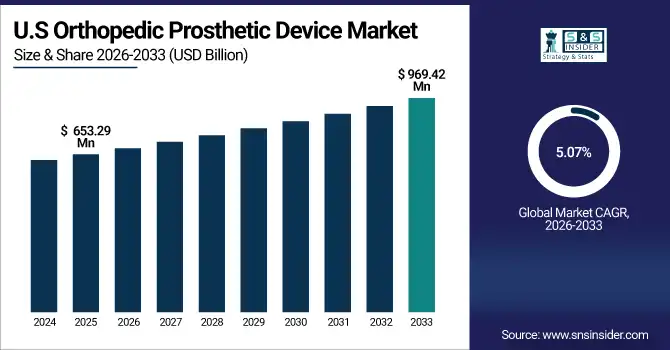

The U.S. orthopedic prosthetic device market size was valued at USD 653.29 million in 2025E and is projected to reach USD 969.42 million by 2033, growing at a CAGR of 5.07% during 2026-2033. The U.S. orthopaedic prosthetics device market is led by the uptick in healthcare infrastructure and adoption of myoelectric and bionic prosthetics, and large-scale rehabilitation program implementation in the country. Robust insurance and government reimbursement policies make prosthetics more accessible, and the number of amputations from diabetes and trauma is on the rise, adding to demand. Further, the continuous advancements in technology and the presence of prominent prosthetic manufacturers in the U.S. drive the market leadership and swift acceptance of the highly advanced devices.

Orthopedic Prosthetic Device Market Growth Drivers:

-

Rising Prevalence of Amputations and Disabilities Driving Orthopedic Prosthetic Device Consumption Growth

An increase in the number of amputations and disabilities is a key factor boosting the growth of the orthopedic prosthetic device market. The rising number of accident cases of trauma, diabetes-induced complications, vascular ailments, and congenital limb defects is a driver for both upper and lower limb prostheses. With increasing demand for mobilization from patients, the hospital authorities, and rehabilitation centers and home healthcare facilities investing in advanced prosthetics, would also contribute to accelerating the market growth and improving patient comfort and independent life globally.

For instance, in August 2025, the World Health Organization estimated over 30 million people globally require limb prosthetics, highlighting strong demand growth in emerging markets for orthopedic prosthetic devices.

Orthopedic Prosthetic Device Market Restraints:

-

Maintenance and Replacement Costs Limit Market Expansion Globally

The high cost of maintenance and replacement of orthopedic prosthetic devices stands as a challenge to further market growth. State-of-the-art forms of prosthesis, including bionic devices, myoelectric systems, and the including, generally require regular tuning or replacement of parts, or service from specialized technicians, to be maintained in good working order. Such recurring costs are a financial strain on patients and healthcare providers living in poor and middle-income areas, thereby preventing further widespread acceptability.

Orthopedic Prosthetic Device Market Opportunities:

-

Homecare and Tele-rehabilitation Create Growth Opportunities for the Orthopedic Prosthetic Device Market

Increasing demand for home care and tele-rehabilitation is a positive opportunity in the orthopedic prosthetic devices market. Portable, affordable prosthetic alternatives help people, especially the elderly and those in remote regions, to practice mobility and rehabilitation at home. Telehealth platform and remote monitoring integration help clinicians monitor progress, guide and adjust devices without the need for frequent hospital visits, creating less patient inconvenience, higher compliance, and overall better treatment outcomes as the market acceptance grows globally.

For instance, in January 2025, the American Academy of Orthotists & Prosthetists reported that over 40% of prosthetic users in the U.S. now utilize tele-rehabilitation services

Orthopedic Prosthetic Device Market Segmentation Analysis

-

By product type, lower limb prosthetics led the orthopedic prosthetic device market with a 60.80% share in 2025e, while the custom vs. Standard prosthetics are the fastest-growing segment with a CAGR of 6.16%.

-

By material type, the titanium and alloys segment dominated the market with a 37.12% share in 2025e, while carbon fiber is expected to grow fastest with a CAGR of 5.59%.

-

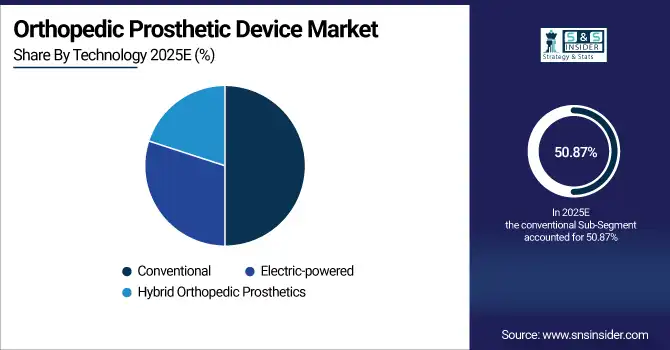

By technology, conventional led the market with a 50.87% share in 2025e, while electric-powered vehicles are registering the fastest growth with a CAGR of 5.47%.

-

By end user, hospitals & clinics held a 55.85%share in 2025e, while home care & personal use are growing the fastest with a CAGR of 5.80%.

By Product Type, Lower Limb Prosthetics Lead the Market, While Custom vs. Standard Prosthetics Register the Fastest Growth

The lower limb prosthetics segment dominated the orthopedic prosthetic device market in 2025E, owing to the high number of diabetes, trauma, and vascular-related amputations in the lower extremities. This momentum, in addition to the rise of rehabilitation programs, and not to mention increasing demand for mobility restoration in clinical settings, led to the rapid adoption of the product in hospitals, rehabilitation facilities, and developing countries globally. The custom vs. standard prosthetics segment will grow at the highest CAGR over the forecast period, as demand for bespoke, comfortable, and ergonomic devices grows, coupled with advances in technology, including 3D printing and demand for patient-specific rehabilitation.

By Material Type, Titanium and Alloys Dominate While Carbon Fiber Shows Rapid Growth

The titanium and alloys segment was estimated to be the largest revenue generator of the total market share in 2025E, due to its high strength, durability, and biocompatibility, which enable the manufacture of prostheses for both upper and lower limbs. The aforementioned drivers of growth, along with increased use of sophisticated and custom prostheses, uphold their market dominance on a global scale. For instance, carbon fiber is also anticipated to be the fastest growing with a CAGR by 2026-2033, driven by the increasing adoption of high-quality prosthetics in sport, rehabilitation, and bionics, owing to technological advancements and patient inclination towards better mobility.

By Technology, Conventional Lead, While Electric-powered Registers Fastest Growth

The conventional segment accounted for the highest share of revenues in the orthopedic prosthetic device market in the year 2025E, due to its low cost, ease of use, and wide range of availability. They can be used in developed and in developing areas. This primary motivation, alongside fundamental operational reliability, maintains their strong market share, despite the advent of sophisticated myoelectric and bionic devices. While the electric-powered segment is expected to achieve the fastest CAGR during the predicted period from 2026-2033, owing to the evolution of sensors and AI technology, improving accuracy, functionality, and patient mobility, leading to greater adoption in established healthcare markets.

By End User, Hospital Lead, While Homecare & Personal Use Grow Fastest

The hospital segment accounted for the largest share of the orthopedic prosthetic device market in 2025E, owing to the high number of patients, successful rehabilitation centres, and procurement systems in place. This market driver, combined with widespread adoption of both standard and advanced prosthetic technologies, will guarantee continual demand and healthcare market dominance. The home care & personal use segment will have the highest CAGR over the forecast period 2026–2033, as demand for low-cost, portable prosthetics grows and more tele-rehabilitation is carried out, allowing for easy, at-home care over the long term among the elderly and chronically ill.

Orthopedic Prosthetic Device Market Regional Analysis:

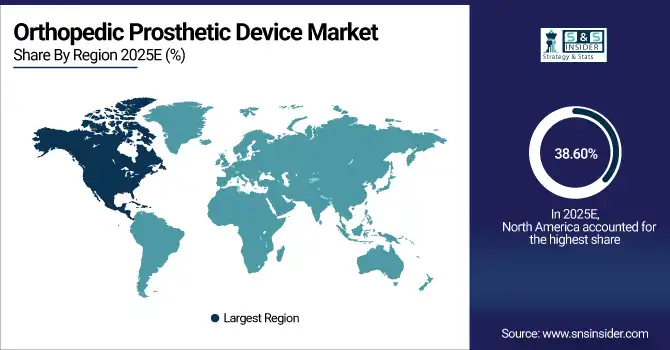

North America Orthopedic Prosthetic Device Market Insights

North America dominates the orthopedic prosthetic device market with a market share of 38.60% 2025E, owing to the good medical facilities, widely acceptance of myoelectric/bionic prosthesis, and rehabilitation programs. Rise in number of amputations due to diabetes, trauma, and vascular diseases, favorable insurance coverage and government reimbursement policies, and presence of established prosthetic manufacturers are also responsible for the growth of this market. New technologies, consumer/patient knowledge, and developed clinical networks continue to help maintain the market leader status of North America, the most mature market in the world.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Orthopedic Prosthetic Device Market Insights

The U.S. is leading the North American orthopedic prosthetic device market, the reasons behind its leading position being a well-established health care sector, greater adoption of myoelectric and bionic prosthetics in the region, huge insurance coverage, government compensation, and a vast and rapidly increasing number of patients with lost mobility.

Asia-Pacific Orthopedic Prosthetic Device Market Insights

Asia-Pacific is the fastest-growing region in the orthopedic prosthetic device market, registering a CAGR of 6.04% over the forecast period, owing to the growth in the healthcare sector, growing disposable income, and changing awareness toward prosthetic solutions. The growth is due to a high incidence of trauma-related amputations, diabetes, and vascular diseases, and government policies and public-private healthcare programs. Advanced prosthetics including bionic and myoelectric limbs are also becoming increasingly popular in India, Japan, China, and Australia. Growing rehabilitation centers, tele-rehabilitation, and mobile offerings also endorse the growth of this market in the region.

China Orthopedic Prosthetic Device Market Insights

The China orthopedic prosthetic devices market is leading the Asia-Pacific market in terms of value because of the growing healthcare infrastructure, growing trauma and diabetes-related amputee population, pediatric amputation population, increasing consumption of advanced prosthetic devices, government initiatives, and demographic growth with more patient awareness among people to improve mobility.

Europe Orthopedic Prosthetic Device Market Insights

Europe is the second most lucrative orthopedic prosthetic device market owing to robust healthcare infrastructure, high prosthesis awareness, and robust insurance and reimbursement policies in the major countries, including Germany, France, and the UK. The area is served by sophisticated rehabilitation systems, particularly for the limbs, an extensive market for standard and bionic prosthetics, and an increasing elderly population in need of mobility solutions. Furthermore, favourable government policies, technological advancements, and the established presence of some of the key prosthetic manufacturers will also push the market over the coming decades and explain why Europe holds a lion's share of the global market.

Germany Orthopedic Prosthetic Device Market Insights

Germany leads the European orthopedic prosthetic devices market because healthcare infrastructure is well developed, the prevalence of amputations is high, insurance coverage is strong, influence in the bionic and myoelectric prosthetics market is growing, and rehabilitation programs have been in place for some time to support patient mobility and treatment benefits.

Latin America (LATAM) and Middle East & Africa (MEA) Orthopedic Prosthetic Device Market Insights

Latin America and the Middle East & Africa account for a smaller share in the orthopedic prosthetic device market but are growing at a steady pace. In Latin America, Brazil and Mexico are among the countries that are promoting the adoption by investing in health care infrastructure, expanding insurance, and publicising prosthetic facilities. Government initiatives, hospital safety programs, and rising rehabilitation services are believed to boost market growth in the Middle East & Africa. Both areas demonstrate high potential for affordable, custom, and portable prosthetic devices, enabling growth prospects for the future.

Orthopedic Prosthetic Device Market Competitive Landscape:

Ottobock SE & Co. KGaA, with its headquarters in Duderstadt, Germany, was established in 1919 and is a global market leader in technical orthopedics. The Company has a portfolio of advanced powered and non-powered two, three, and four-wheeled products which provide increased mobility to people not allowed or unable to walk or lead a normal life due to certain physical disability.

-

In August 2024, Ottobock reported a 10% YoY increase in global prosthetic device sales, driven by bionic and myoelectric lower-limb prosthetics, especially in North America and Europe.

Össur was founded in 1971 and is headquartered in Reykjavik, Iceland. Össur is a global leader in non-invasive orthopaedics that helps people live life without limitations. Bionic- and myoelectric solutions are at the core of what we strive to provide, increasing mobility and functionality, and resulting in better patient outcomes at hospitals, rehabilitation centers, and, ultimately, even at home globally.

-

In September 2024, introduced Rheo Knee X, a powered prosthetic with advanced sensors and machine learning for real-time adjustment, improving safety and comfort for active users.

Blatchford Group Blatchford is a privately-owned company that was established in 1890 in the UK and provides a range of award-winning prosthetic rehabilitation products for both the upper and lower limbs. Specialising in high-performance and custom-fit prosthetics, the company uses the latest in materials science and design to deliver better comfort, mobility, and rehabilitation to patients and upgrade them globally.

-

In January 2025, expanded custom carbon-fiber prosthetics line with lightweight, 3D-printed designs, increasing adoption in rehabilitation centers and home care markets globally.

Orthopedic Prosthetic Device Market Key Players:

Some of the orthopedic prosthetic device market Companies are:

-

Ottobock SE & Co. KGaA

-

Össur hf.

-

Blatchford Group

-

Hanger, Inc.

-

WillowWood, Inc.

-

Fillauer Companies, Inc.

-

Touch Bionics

-

Endolite Ltd.

-

College Park Industries, Inc.

-

RSLSteeper

-

ALPS South, Inc.

-

Chas. A. Blatchford & Sons Ltd.

-

Savio Orthopedics

-

Proteor SA

-

Otto Bock HealthCare LP

-

Freedom Innovations, Inc.

-

Trulife, Ltd.

-

Medfit Ltd.

-

Endoskeletal Prosthetics Co.

-

Dynamic Prosthetics Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 2.25 Billion |

| Market Size by 2033 | USD 3.36 Billion |

| CAGR | CAGR of 5.16 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Upper Limb Prosthetics, Lower Limb Prosthetics, Custom vs. Standard Prosthetics) • By Material Type (Titanium and Alloys, Carbon Fiber, Plastics and Polymers, Silicone and Composites) • By Technology (Conventional, Electric-powered, Hybrid Orthopedic Prosthetics) • By End User (Hospitals & Clinics, Rehabilitation Centers, Homecare & Personal Use) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Ottobock SE & Co. KGaA, Össur hf. , Blatchford Group, Hanger, Inc., WillowWood, Inc. , Fillauer Companies, Inc., Touch Bionics, Endolite Ltd., College Park Industries, Inc., RSLSteeper, ALPS South, Inc. , Chas. A. Blatchford & Sons Ltd. , Savio Orthopedics, Proteor SA, Otto Bock HealthCare LP, Freedom Innovations, Inc., Trulife, Ltd., Medfit Ltd., Endoskeletal Prosthetics Co., Dynamic Prosthetics Ltd. and other players. |