Food Allergy Treatment Market Report Size Analysis:

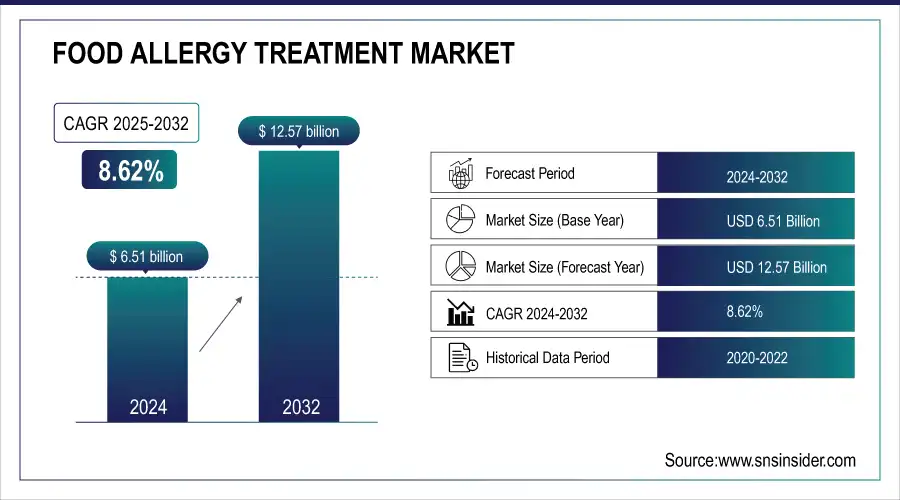

The Food Allergy Treatment Market size was valued at USD 6.51 billion in 2024 and is expected to reach USD 12.57 billion by 2032, growing at a CAGR of 8.62% over the forecast period of 2025-2032.

The global food allergy treatment market is growing steadily, primarily due to the increasing incidence of food allergies, particularly in children, along with growing awareness and improvement in immunotherapy. Introduction of new therapies, such as oral and epicutaneous immunotherapy and epinephrine auto-injectors, is changing the treatment landscape. Increasing investments in research and development for allergies and regulatory frameworks that facilitate development activities add to the food allergy treatment market analysis.

To Get more information on Food Allergy Treatment Market - Request Free Sample Report

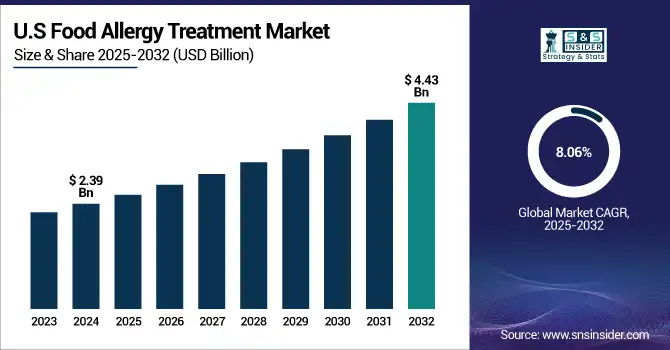

The U.S. food allergy treatment market size was valued at USD 2.39 billion in 2024 and is expected to reach USD 4.43 billion by 2032, growing at a CAGR of 8.06% over the forecast period of 2025-2032.

Among North American countries, the U.S. has the largest share of the food allergy treatment market, due to its high food allergy prevalence, access to advanced healthcare, and the early approval of drugs, such as Palforzia. The U.S. remains the dominant market in the region, which can be credited to both favorable reimbursement policies and a continually active clinical trial landscape.

According to FARE, FARE estimates that roughly 33 million Americans have at least one food allergy. At least 1 food allergy affects around 11% of adults 18 or older. That’s over 27 million adults.

Food Allergy Treatment Market Dynamics:

Drivers:

-

Rising Prevalence of Food Allergies is Driving the Market Growth

Increased incidences of food allergies globally, particularly among children. Peanuts, tree nuts, milk, shellfish, and eggs are among the most common allergens, causing an increasing number of allergic reactions, some of which are severe and life-threatening (anaphylaxis). Part of its increasing prevalence is attributed to sedentary lifestyle, environmental, and dietary changes. With an increasing number of people diagnosed with food allergies, the need for treatment and management grows. Allergy-related emergency visits are also increasing for healthcare providers, which creates the demand for both short-term and long-term medicines.

According to NIH, Food allergies affect about 520 million people globally, where 3–10% of children and 10% of adults having a food allergy.

-

Advancements in Immunotherapy Accelerating the Market Growth

Immunotherapy is becoming an approach strategy that targets beyond simply addressing allergic responses, it seeks to desensitize patients to allergens and decrease their sensitivity over time. New developments, such as oral immunotherapy (OIT) and epicutaneous immunotherapy (EPIT) have proven effective in clinical trials and received regulatory approvals (Palforzia for peanut allergy). These food allergy drugs hold promise for longer-lasting allergy control by enabling patients to tolerate allergens safely. Ongoing research and development in this area, such as treatments for multiple allergens, are fueling high levels of interest and investment, positioning immunotherapy as one of the most rapidly expanding food allergy treatment market trends within the market.

Omalizumab (Xolair), approved in Feb 2024 as adjunct therapy to decrease the frequency of allergic reactions (including anaphylaxis) in patients 1 year of age and older with IgE-mediated food allergies.

Restraints:

-

High Treatment Costs are Restraining the Market from Growing

High expenses of genuine treatment and securing devices for the administration of responses are one of the principal restraints influencing the food allergy treatment market growth. Prolonged treatments, complex formulations, and high clinical visit frequencies, seen in most OIT and EPIT immunotherapy treatments, have considerable costs to patients and healthcare systems. However, for many families, costs can prove to be prohibitive, and access to evidence-based treatment for effective care is restricted (many low and/or middle-income countries).

According to PubMed, the recent study on probiotic peanut oral immunotherapy (PPOIT) reported that the healthcare cost per patient at 10 years was estimated to be approximately USD 9,355 (USD 6,000), with over 50% of that cost attributable to treatment delivery.

Furthermore, emergency devices with proven life-saving potential, such as epinephrine auto-injectors (EpiPen), are high-priced, essential treatments to be used in case of anaphylactic reactions. Health insurance coverage for such devices is highly variable between countries, regions, and insurers, and disposable copayments can be excessive. The cost associated with these drugs typically results in patients postponing treatment or opting for non-optimal solutions, limiting the growth of the market and implementation of new therapies.

Food Allergy Treatment Market Segmentation Analysis:

By Drug Type

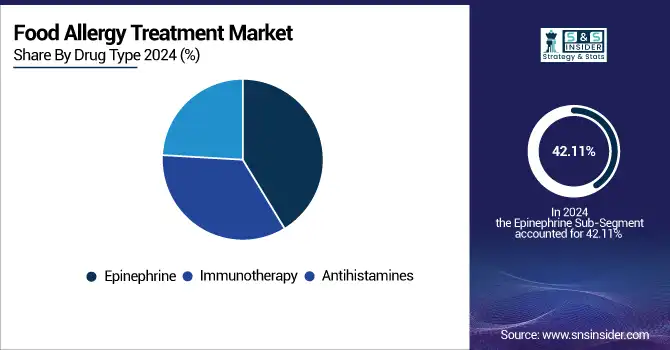

The food allergy treatment market was dominated by the epinephrine segment in 2024, with a 42.11% market share, as it is the first-line emergency treatment of choice in case of severe allergic reactions, such as anaphylaxis. Auto-injectors of epinephrine (EpiPen) are the most commonly prescribed and most carried devices for patients with known food allergies, affording rapid rescue from life-threatening situations. Epinephrine has remained the cornerstone of allergy treatment due to its potency, robustness, and track record for clinical use. Increased awareness programs, nearby college safety regulations that require auto-injectors on site, and insurance schemes support the segment's dominance, especially in the developed regions.

The immunotherapy segment is anticipated to grow at the fastest rate during the forecast period due to the increasing demand for preventive and long-term treatments. While epinephrine is used for the management of acute reactions, immunotherapy (both oral immunotherapy [OIT] and epicutaneous immunotherapy [EPIT]) is one of the clinical approaches that aims to desensitize patients to allergens and leads to reactivity-cauterization in the long term.

By Allergen Type

The peanuts segment dominated the food allergy treatment market in 2024 with 22.5% market share, owing to the widespread and severe nature of peanut allergies, especially in children from developed regions, such as North America and Europe. Allergic reactions to peanuts are typically permanent, and even small amounts can cause serious, life-threatening reactions, including anaphylaxis. Consequently, this has led to high demand for the focus of the treatments, such as epinephrine auto-injectors, as well as oral immunotherapy solutions, including Palforzia, the first FDA Green-lighted therapy for the peanut allergy treatment.

The tree nuts segment is projected to exhibit significant growth over the forecast period in the market, due to the increasing prevalence and high clinical interest in management of multiple nut allergies. Tree nuts, including almonds, cashew nuts, and walnuts, are high up on the list of major allergens that cause severe allergic reactions and are common in conjunction with peanut allergies. The segment is poised to benefit from developments in research and the advancement of new immunotherapy treatment options for access to multiple allergen targets, with tree nuts taking the lead in diagnosis and targeted therapies. Moreover, the rise in awareness, along with food labeling regulations and increasing investment in R&D for broader allergen-specific therapies, is expected to drive this segment during the forecast period.

By Route of Administration

The parenteral segment dominated the food allergy treatment market share in 2024, owing to the intramuscular route to the panoply of epinephrine auto-injectors that are utilized in the market to mitigate the vast arena of allergic reactions, including anaphylaxis. The parenteral route is the fastest, which results in many emergencies that require immediate intervention. This perfect clinical paradigm for the indication for parenteral usage in conjunction with high epinephrine prescription rates in the developed markets. Furthermore, the rise of user-friendly devices and improved knowledge about the need for them in allergy management have made this route nationalization proven as an efficient path.

The oral segment is anticipated to exhibit the fastest growth over the forecast period, owing to the rising usage of oral immunotherapy (OIT) as a durable food allergy treatment. Immunotherapy consists of a long-term, gradual, and controlled introduction of allergens that activate the immune system to create tolerance against the respective allergen and assumes a progressive decrease in allergic sensitization. This approach has been validated by the FDA approval of Palforzia for peanut allergy and has generated tremendous clinical and commercial interest. As research continues to broaden the potential for OIT (including new allergens) and physicians find patients are preferring non-invasive home-based approaches to treatment, the oral route is becoming the method of choice for the future of allergy therapy.

By End Use

In 2024, the hospital pharmacies segment dominated the food allergy treatment market, as hospitals are a substantial medium of action for serious allergy management and emergency care. In an acute care setting, hospital pharmacies are well equipped to dispense life-saving medications, such as epinephrine and antihistamines. They provide a wide range of specialized treatments and are also involved in providing parenteral medications that require clinical supervision.

The retail pharmacies segment is projected to witness the fastest growth during the forecast period due to profit from patients seeking integrated and fast relief allergy therapy. With the growing awareness of food allergies, many patients are more likely to ask for maintenance medications, epinephrine auto-injectors, and antihistamines, all of which are to be accessed at a retail pharmacy without problems. They provide counseling services, medication management, and broader geographic reach for the chains, particularly in suburban and rural markets.

Regional Analysis:

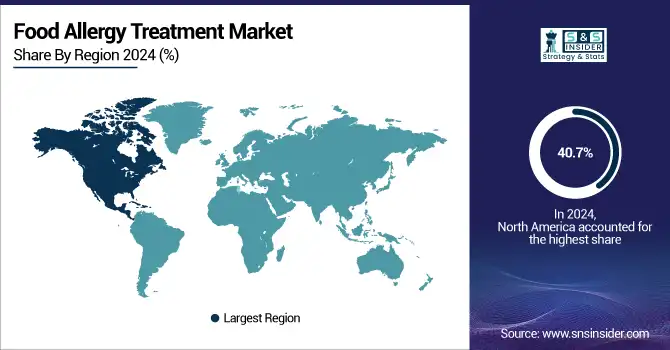

North America dominated the food allergy treatment market with around 40.7% market share in 2024, owing to advanced healthcare infrastructures, a high level of awareness among payers, healthcare providers, and patients in the region, along with quick and early approvals for innovative therapies that can be used to treat food allergies. In the U.S., the path has been paved with the first oral immunotherapy for peanut allergy, Palforzia, receiving FDA approval, and epinephrine auto-injectors, such as EpiPen. The ubiquity of innovative treatment approaches is driven by strong research funding and general allergy screening, as well as favorable reimbursement policies.

According to NCBI, nearly 32 million Americans (almost 10% of the US population) have food allergies, including almost 6 million children. Self-reported allergy surveys in Canada show that around 7% of the population reports they have at least 1 food allergy.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific is the fastest-growing region with a 9.30% CAGR due to increasing urbanization, westernization of dietary patterns, and a surge in the population of food allergies among individuals. China, Japan, and India are some of the few countries driving the market. Food allergy has long been underdiagnosed in the region, but is increasingly coming into the public health spotlight against a backdrop of policy initiatives to raise awareness among practitioners. The market expansion is attributed to advancements in diagnostics, an increase in healthcare expenditure, and a slow diffusion of immunotherapy.

The food allergy treatment market in the European region is projected to experience significant growth with huge development due to high awareness about food allergies, improved diagnostic abilities, and a higher quantity of clinical trial population in the region. The U.K., Germany, and France lead the way, backed by robust regulatory frameworks and health systems that are assimilating food allergen management more holistically. In this regard, rising use of immunotherapy, comprising oral and epicutaneous immunotherapy, together with the availability of emergency medication, such as epinephrine auto-injectors, are some of the factors reflecting a positive impact on market growth.

Moreover, public health initiatives, such as allergen labeling, food safety, and school-based allergy management programs, are increasing the need for early identification and treatment. In Europe, there are influential collaborations between the academic institutions, the biotech firms, and regulatory bodies that are also accelerating the development of new therapies and getting them approved in both continents. Europe is a key player in the food allergy treatment landscape and is increasingly making its mark on the global arena in line with FP awareness and diagnosis rate increases.

Latin America and the Middle East & Africa (MEA) hold a moderate share in the food allergy treatment market that is likely to grow at a moderate rate, owing to increasing awareness and gradual improvement in health infrastructure. The lack of availability of specialized allergy care, underdiagnosis, and the uneven distribution of other medical resources in rural areas and resource-rich urban areas prevent fast market growth. Despite that, expanding investments in health care and educational campaigns about food sensitivity are helping sustain steady market development.

Food allergy awareness is gradually emerging in the MEA region, most notably in the wealthier Gulf countries, such as the UAE and Saudi Arabia, where healthcare modernization is moving quickly. However, the area continues to struggle with insufficient numbers of trained allergists, poor access to advanced treatments, such as immunotherapy, and low diagnoses overall. That being said, the market is anticipated to experience growth owing to rising health awareness, urbanization, and increasing emphasis on food safety and pediatric care.

Food Allergy Treatment Market Key Players:

Food allergy treatment companies are Aimmune Therapeutics, DBV Technologies, ALK-Abelló, Stallergenes Greer, Camallergy, Alladapt Immunotherapeutics, Aravax, Intrommune Therapeutics, Prota Therapeutics, Regeneron Pharmaceuticals, and other players.

Recent Developments in the Food Allergy Treatment Market:

-

January 2025 – DBV Technologies, a clinical-stage biopharmaceutical company, reported positive 24-month data from the Open-Label Extension (OLE) of its Phase 3 EPITOPE trial assessing VIASKIN Peanut 250 µg (VP250) in children aged 1 to 3 years. The results show that sustained treatment with VIASKIN Peanut showed continued improvement in all efficacy measures through 36 months of therapy.

-

June 2024 – ALK-Abelló launched its new corporate strategy, Allergy+, and its financial targets for 2028. Allergy+ is ALK's strategy to increase its leadership in allergy immunotherapy by creating a leading position in the food allergy and anaphylaxis treatment market, in addition to pushing innovation into adjacent allergic diseases with high unmet medical needs.

Food Allergy Treatment Market Report Scope:

Report Attributes

Details

Market Size in 2024

USD 6.51 Billion

Market Size by 2032

USD 12.57 Billion

CAGR

CAGR of 8.62% From 2025 to 2032

Base Year

2024

Forecast Period

2025-2032

Historical Data

2021-2023

Report Scope & Coverage

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook

Key Segments

• By Allergen Type (Dairy Products, Poultry Products, Tree Nuts, Peanuts, Shellfish, Wheat, Soys, Other)

• By Drug Type (Antihistamines, Epinephrine, Immunotherapy)

• By Route of Administration (Parenteral, Oral, Topical)

• By End Use (Hospital Pharmacies, Retail Pharmacies, Others)Regional Analysis/Coverage

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America)

Company Profiles

Aimmune Therapeutics, DBV Technologies, ALK-Abelló, Stallergenes Greer, Camallergy, Alladapt Immunotherapeutics, Aravax, Intrommune Therapeutics, Prota Therapeutics, Regeneron Pharmaceuticals, and other players.