Ovulation Test Kits Market Report Scope & Overview:

Get More Information on Ovulation Test kits Market - Request Sample Report

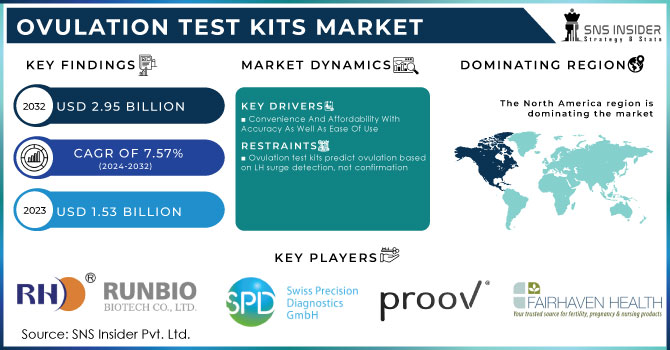

The Ovulation Test Kits Market size was valued at USD 1.53 billion in 2023, and is expected to reach USD 2.95 billion by 2032, and grow at a CAGR of 7.57% over the forecast period 2024-2032.

Demand for ovulation testing kits is rising as a cost-effective alternative to fertility treatments, which often have limited insurance coverage, these kits empower individuals to track their ovulation cycle at home. This information is crucial for couples trying to conceive naturally or those undergoing fertility procedures like IUI, helping to optimize timing for conception.

Factors influencing ovulation, such as BMI and hormone levels, underscore the potential for ovulation test kits. Research indicates a strong correlation between BMI and ovulation irregularity, with higher BMI often linked to anovulation. Hormonal factors which include testosterone and insulin-like growth factors, also play a crucial role. These findings highlight the need for accurate ovulation prediction tools, driving demand for ovulation test kits. By incorporating factors like BMI and hormone levels into test kit algorithms, manufacturers can develop more precise and effective products to support fertility planning.

Conditions such as PCOS, perimenopause, thyroid disorders, and eating disorders are common culprits. Hormonal imbalances, both natural and medication-induced, can also interfere with ovulation. These factors drive the demand for ovulation test kits as women seek to understand and manage their reproductive health. A staggering one in eight women in the U.S. will experience thyroid disfunction in their lifetime.

The significant physical and emotional impact of PCOS underscores the need for advanced ovulation prediction tools. While current ovulation test kits offer general fertility insights, there's a growing demand for more specialized solutions tailored to conditions like PCOS. A nomogram model, could provide valuable data for personalized fertility planning.

As the ovulation test kits market expands, there's a substantial opportunity to create products that address the specific needs of PCOS patients, potentially improving treatment outcomes and reducing the emotional burden of the condition.

The prevalence of Polycystic Ovary Syndrome (PCOS) emphasizes a significant unmet need in women's health. With an estimated 5-10% of women aged 18-44 affected, and less than half accurately diagnosed, there is a substantial opportunity for ovulation test kit manufacturers to address the unique challenges faced by this population. By providing tools for precise ovulation tracking, these kits can empower women with PCOS to take control of their reproductive health and increase their chances of conception.

Beyond PCOS, several factors can influence ovulation and fertility. Lifestyle elements such as stress, excessive exercise, and weight fluctuations can disrupt hormonal balance and affect ovulation regularity. These variables underscore the complexity of fertility and the importance of comprehensive fertility management tools.

Ovulation test kits have become a staple in the fertility planning toolkit. Their ease of use, high accuracy in detecting the LH surge, widespread availability, and convenience have made them a popular choice for couples trying to conceive. Ovulation test kits boast a 97% accuracy rate in identifying the LH surge, a key indicator of impending ovulation.

Ovulation test kits are typically available in two forms includes, the first is a strip format, containing multiple test strips, a collection cup, and instructions. The second is a stick format, resembling a pregnancy test, often with a digital reader to display results.

Endorsement by professional bodies such as the U.S. National Academy of Clinical Biochemistry Laboratory Medicine further solidifies the credibility and efficacy of ovulation test kits.

Ovulation detection devices have evolved significantly. Today's market offers a range of options. Urine-based LH detection kits, the most common, measure luteinizing hormone levels to predict ovulation with up to 97% accuracy. Products like Clearblue's easy fertility monitor and digital ovulation test with dual hormone indicator are popular choices. Basal body temperature (BBT) monitoring devices, such as OvuSense, track temperature changes to identify ovulation with a claimed accuracy of 99% for ovulation date detection. For a more visual approach, salivary ferning analysis microscopes are available. While these devices offer varying levels of accuracy and information, they collectively empower women with tools to effectively plan and manage their fertility.

Market Dynamics

Drivers

-

Convenience And Affordability With Accuracy As Well As Ease Of Use

The increasing prevalence of fertility challenges, including polycystic ovary syndrome (PCOS), and the rising age of first-time motherhood are driving demand for effective fertility planning tools. Advancements in assisted reproductive technologies (ART) like IVF, where precise ovulation timing is critical, have also contributed to market expansion.

Furthermore, the growing emphasis on women's health and wellness has led to increased awareness of ovulation and its role in conception. Over-the-counter ovulation test kits offer a convenient, accessible, and relatively affordable solution for women seeking to optimize their chances of pregnancy. These kits provide reliable information about ovulation timing through the detection of the luteinizing hormone (LH) surge, empowering women to make informed decisions about family planning. The combination of these factors has positioned ovulation test kits as essential tools for modern fertility management.

Restraints

-

Ovulation test kits predict ovulation based on LH surge detection, not confirmation

Several factors impede the growth of the ovulation test kit market. Firstly, while readily available, these kits cannot definitively confirm ovulation but merely indicate the likelihood by detecting the LH surge. Secondly, their efficacy is compromised in certain populations, including those undergoing fertility treatments, women over 40, or those nearing menopause. Additionally, low awareness about the benefits and correct usage of ovulation test kits, particularly in underdeveloped regions, poses a significant challenge to market expansion.

Key Segmentation

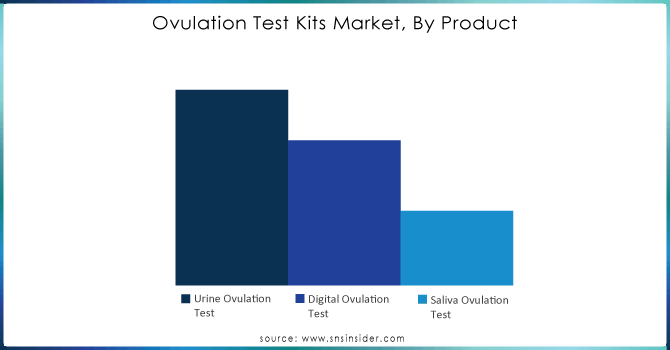

By Product

Urine Ovulation Test dominated the market with 47.2% share in 2023 due to their accuracy and ability to detect pregnancy indicators. However, the digital ovulation test segment is projected to experience the fastest growth, driven by user-friendly features like built-in memory and smartphone connectivity.

The increasing trend of self-care and at-home diagnostics has fueled the overall market expansion. Consumers are seeking convenient and accessible tools to manage their reproductive health. Moreover, the evolving regulatory landscape is fostering a conducive environment for market entry and innovation.

Need any customization research on Ovulation Test Kits Market - Enquiry Now

By Distribution Channel

Pharmacies and Drugstores held the largest market share in 2023 with 38.9% share. However, the e-commerce segment is projected to experience the fastest growth due to the increasing preference for online shopping, especially following the COVID-19 pandemic. The availability of a wide range of products, coupled with convenient access and customer support, is driving the expansion of the e-commerce channel.

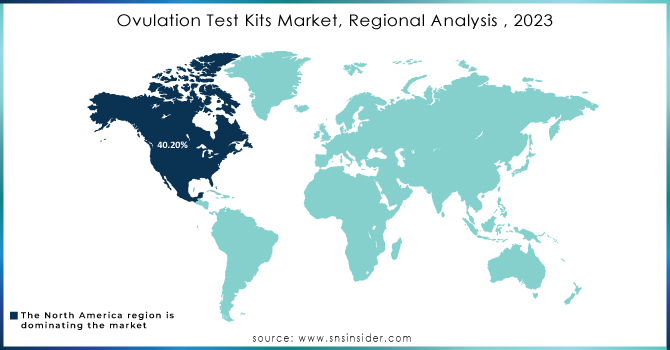

Regional Analysis

North America was the dominated region of the ovulation test kit market with 40.2% share in 2023, driven by factors such as the presence of a large working-class population, the demand for advanced features, and a focus on product innovation by key players. The region is witnessing strategic collaborations and partnerships to expand product offerings.

Asia Pacific is projected to be the fastest-growing market, fueled by increasing fertility challenges, rising disposable incomes, and advancements in ovulation testing technology. The growing awareness of women's health and the availability of affordable products are also contributing to market growth in this region.

Key Players

The Major Players are Runbio Biotech Co. Ltd., Swiss Precision Diagnostics GmbH, PREGMATE, Proov, Fairhaven Health, Easy@Home Fertility, Accuquik, Ro, Wondfo, Piramal Healthcare, NecLife and others Players

Recent Developments

Fertility tracking startup Inito has raised USD 6 million in Series A funding led by Fireside Ventures. The company's fertility monitor offers women fast and convenient at-home hormone testing with results accessible on their phones in 10 minutes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.53 billion |

| Market Size by 2032 | US$ 2.95 Billion |

| CAGR | CAGR of 7.57% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Urine Ovulation Test, Digital Ovulation Test, Saliva Ovulation Test] • By Distribution Channel [Hypermarkets and Supermarkets, E-Commerce, Pharmacies and Drugstores] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Runbio Biotech Co. Ltd., Swiss Precision Diagnostics GmbH, PREGMATE, Proov, Fairhaven Health, Easy@Home Fertility, Accuquik, Ro, Wondfo, Piramal Healthcare, NecLife and others |

| Key Drivers | • Convenience And Affordability With Accuracy As Well As Ease Of Use |

| Restraints | • Ovulation test kits predict ovulation based on LH surge detection, not confirmation |