Cellulose Film Packaging Market Report Scope & Overview:

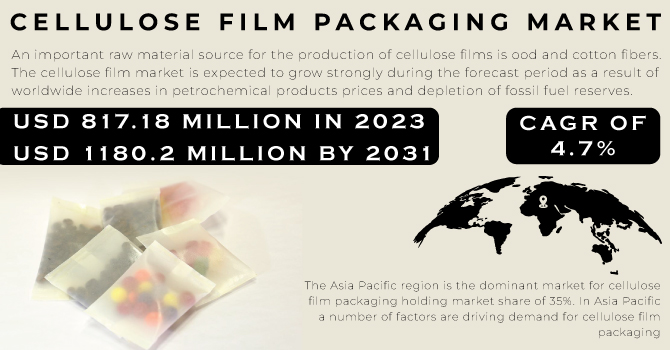

The Cellulose Film Packaging Market size was USD 817.18 million in 2023 and is expected to Reach USD 1180.2 million by 2031 and grow at a CAGR of 4.7% over the forecast period of 2024-2031.

An important raw material source for the production of cellulose films is ood and cotton fibers. The cellulose film market is expected to grow strongly during the forecast period as a result of worldwide increases in petrochemical products prices and depletion of fossil fuel reserves. Cellulose films are seen as an environmentally and economically viable alternative to existing petrochemical products.

Get E-PDF Sample Report on Cellulose Film Packaging Market - Request Sample Report

Petrochemically manufactured polymers are not biodegradable films, degradable and irreversibly unrecyclable; they are hazardous to the environment. Demand for cellulose films is estimated to be driven by an increase in government regulation due to environmental concerns. Increasing the production of bio polylactic acid (PLA) is expected to have a negative impact on demand for cellulose films. Chemical modification techniques are used to make different cellulose polymers, such as coagula esters, chelating ethers and regenerate cellulose. Cellulose ester includes cellulose nitrates and cellulose acetate is particularly developed for fibre & film applications.

In particular, Hydroxyethyl cellulose and carboxymethylcellulose are present in the form of Cellulose ethers which have been applied mainly for infrastructure, personal care, pharmaceutical products, food and paints. In hygiene products and home furnishings as well as textiles, regenerated cellulose is increasingly used because of its excellent thermal stability.

MARKET DYNAMICS

KEY DRIVERS:

-

The increasing demand for environmentally friendly packaging products

The use of renewable resources that are sustainable, environmentally friendly and biodegradable may be used to produce cellulose film packaging. Consequently, consumers have switched to greener packaging products as a result. The demand for cellulose packaging is expected to be driven by this factor, which will further increase market growth.

-

Increase awareness of the use of wood based cellulose packaging

-

Transparent cellulose films are being increasingly demanded

RESTRAIN:

-

Due to the mechanical characteristics, the use of cellulose film packaging in the industrial sector is low

Due to the mechanical characteristics and some barrier properties of the material compared to conventional plastic, cellulose films are restricted to a limited industrial use. Moreover, due to their limited water and moisture resistance biopolymers like cell film are also restricted. Nevertheless, the development of nanocomposite technology is expected to circumvent these problems. Therefore, market growth is expected to be hampered by a low use of cellulose film packaging in the manufacturing sector due to its mechanical characteristics. Therefore, market growth is expected to be hampered by a low use of cellulose film packaging in the manufacturing sector due to its mechanical characteristics.

OPPORTUNITY:

-

Increasing efforts towards the use of biodegrading and sustainable packaging

Landfill is largely caused by the extensive use of traditional plastic. In addition, the packaging of cellulose films is recyclable and biodegradable. A significant amount of landfill problems can be solved by it.

CHALLENGES:

-

Limited barrier properties

The barrier properties of the cellulose film are lower than those of some types of plastic packaging, e.g. polyethylene terephthalate PET and polyethylene phthalate (PEP) respectively. This may make the product unsuitable for packaging products, which need to be protected very strongly against moisture, oxygen and certain gases.

IMPACT OF RUSSIAN UKRAINE WAR

In particular, Ukraine is one of the world's main exporters of wood pulp which is a basic input material in the manufacture of Cellulose Film Packaging. The war caused a disruption to the supply of timber from Ukraine, and this has led to sharply higher prices. The cost of packaging cellulose film has been increased as a result. The war also disturbed the global chain of supplies for Cellulose film packaging. In Russia and Ukraine, many manufacturers of cellulose film packaging are located. The war made it necessary for those manufacturers to either stop operations or reduce production. This has resulted in the global market being oversupplied with Cellulose film packaging.

Stora Enso, a company that owns 3 corrugated board factories and 2 wood products sawmills in Russia with a total annual sawn timber production capacity of 340,000 m³ and 1,100 employees, has decided to stop all production activities. Until such time as more information becomes available, and trade in Russia. Due to the current situation in Ukraine, an advance notice has been issued. As a result, Stora Enso's presence in Russia accounts for 3% of the group's overall revenue and it will also terminate all exports to or imports from that country.

In Europe, most affected will be countries like Estonia (20%), Finland17%, Germany17%) and the United Kingdom12%) because they import the highest volumes of wood.

IMPACT OF ONGOING RECESSION

As consumers and businesses rein in their spending on goods other than essential, the economic downturn is expected to have a negative effect on demand for Cellulose film packaging. This could result in a surplus on the market of PP packaging, which can lead to price reductions. As consumers and businesses are reducing their spending on essential goods, the recession is supposed to result in a reduction in demand for cellulose film packaging. In areas such as food, beverage products and consumer goods where packaging of cellulose films is a very widespread use, this may be the case.

KEY MARKET SEGMENTS

By Source

-

Wood

-

Cotton

By Film Type

-

Transparent

-

Coated

-

Colored

-

Laminated

By Thickness

-

Up to 30 microns

-

31-60 microns

-

61-90 microns

-

Above 90 microns

By Packaging Format

-

Bags & Pouches

-

Labels & Tapes

-

Blister Packs

-

Wraps & Laminates

-

Sachets & Stick Packs

-

Others

By End Use

-

Food & Beverage

-

Personal Care

-

Retail

-

Pharmaceuticals

-

Homecare

REGIONAL ANALYSIS

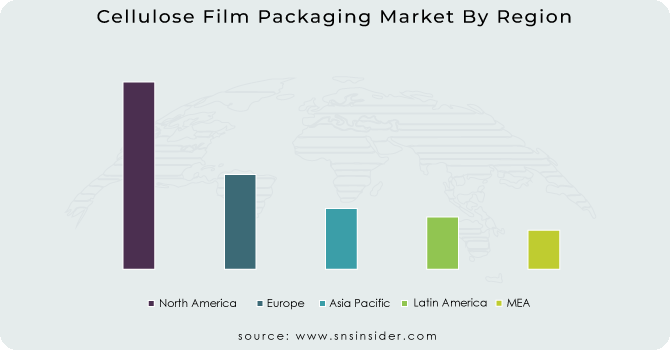

The Asia Pacific region is the dominant market for cellulose film packaging holding market share of 35%. In Asia Pacific, a number of factors are driving demand for cellulose film packaging, including increasing income from consumption, increased urbanization and growing awareness on the benefits of sustainability solutions. In Asia Pacific, China and India are both the largest markets for Cellulose Paper Packaging. The Asia Pacific cellulose film packaging market is expected to grow at a CAGR of 4.5% during the forecast period of 2024-2031.

The North American region is the second largest cellulose film packaging market with a significant share of 30%. As a result, consumers and business in the region are increasingly demanding recyclable packaging solutions. In North America, the United States is the largest market for cellulose film packaging. The North American cellulose film packaging market is expected to grow at a CAGR of 6% during the forecast period of 2023-2030.

The European market for cellulose film packaging is the third largest in the world holding market share of 25%. Factors like increased consumer awareness of the environment impacts of plastics packaging and strict government regulations in favour of Sustainable Packaging Solutions are leading to an increasing demand for Cellulose Film Packaging in Europe. The most important markets for cellulose film packaging in Europe are Germany and the United Kingdom. In the forecast period from 2024 to 2031, Europe's cellulose film packaging market is projected to grow at a compound annual growth rate of 4 %.

The market for cellulose packaging is relatively small in Latin America, the Middle East and Africa. However, the growth of cellulose film packaging demand in these regions is due to a number of factors including increased urbanisation and rising awareness among consumers about the harmonising effects of plastics on the environment. The Middle East and African cellulose film packaging market is expected to grow at a CAGR of 4%. The Middle East and African cellulose film packaging market is expected to grow at a CAGR of 4% during the forecast period of 2024-2031.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Cellulose Film Packaging market Futamura Group, Rotofil Srl, Sappi Limited, Rhodia Acetow GmBH, Eastman Chemical Company, Tembec Inc, Celanense Corporation, Weifang Henglian Cellophane Co Ltd, Hubei Golden Ring Co Ltd, Footprint and other players.

Futamura Group-Company Financial Analysis

RECENT DEVELOPMENT

-

Compostable Cellulose Film Packaging solutions were launched in the food sector by Footprint, an American Sustainable Technology Company.

| Report Attributes | Details |

| Market Size in 2023 | US$ 817.18 Mn |

| Market Size by 2031 | US$ 1180.02 Mn |

| CAGR | CAGR of 4.7 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Source (Wood, Cotton) • by Film Type (Transparent, Coated, Colored, Laminated) • by Thickness (Up to 30 microns, 31-60 microns, 61-90 microns, Above 90 microns) • by Packaging Format (Bags & Pouches, Labels & Tapes, Blister Packs, Wraps & Laminates, Sachets & Stick Packs, Others) • by End Use (Food & Beverage, Personal Care, Retail, Pharmaceuticals, Homecare) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Futamura Group, Rotofil Srl, Sappi Limited, Rhodia Acetow GmBH, Eastman Chemical Company, Tembec Inc, Celanense Corporation, Weifang Henglian Cellophane Co Ltd, Hubei Golden Ring Co Ltd, Footprint |

| Key Drivers | • The increasing demand for environmentally friendly packaging products • Increase awareness of the use of wood based cellulose packaging. • Transparent cellulose films are being increasingly demanded. |

| Key Restraints | • Due to the mechanical characteristics, the use of cellulose film packaging in the industrial sector is low. |