Medical device packaging market report scope & overview:

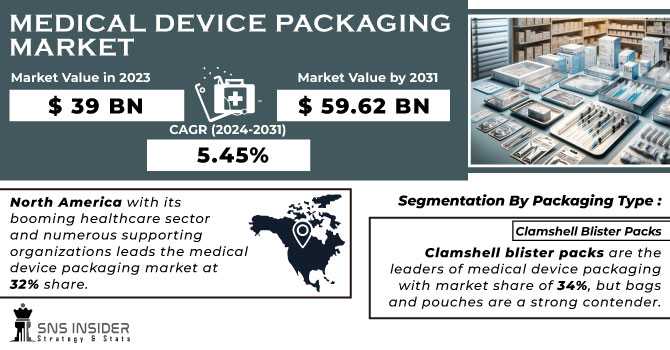

Medical device packaging market Size was valued at USD 39 billion in 2023 and is expected to reach USD 59.62 billion by 2031 and grow at a CAGR of 5.45% over the forecast period 2024-2031.

The medical device packaging market is growing quickly around the world for a few reasons. More money is being spent on healthcare everywhere, which means more medical devices are needed and more packaging is needed for them. People are looking for packaging that's easy to use and throw away.

Get More Information on Medical device packaging market - Request Sample Report

This is good for both convenience and the environment. The industry is working on reducing waste and managing it better. Easy-to-throw-away options like compostable or biodegradable materials are becoming more popular because they are a greener choice than traditional packaging. Fueled by rising demand in the medical packaging market, Tjoapack, a leading contract packaging company, strategically acquired Pharma Packaging Solutions (PPS). PPS, a prominent US-based healthcare packaging service provider, strengthens Tjoapack's position in the global market. But the most important thing for medical device packaging is to keep the product safe and sterile from the time it's made until it's used. Strict rules and the need for better ways to prevent inauthentic products are also driving growth in this market, especially in developed countries like North America, Europe and Asia. Finally, switching from glass to plastic materials makes packaging lighter and cheaper, while still keeping medical devices in a sterile environment

Government Initiatives

Programs like the Production Linked Incentive Scheme (PLI) and the Promotion of Medical Devices Parks Scheme are strategically designed to incentivize large-scale manufacturing and build manufacturing infrastructure. These schemes provide financial benefits to companies that establish large-scale medical device manufacturing. The initiatives also promote the development of dedicated medical device parks. This will create a stronger, more interconnected ecosystem for the entire medical device industry.

MARKET DYNAMICS:

KEY DRIVERS:

-

The growing burden of chronic diseases like diabetes, heart disease, and cancer is a key driver in the medical device packaging market.

The growing prevalence of infectious and chronic diseases is fueling the demand for effective healthcare products, and hence the medical device packaging market. This packaging plays a crucial role, it safeguards the integrity and sterility of medical devices, ensuring they reach patients in optimal condition. As disposable incomes rise, people are increasingly willing to invest in their health, further propelling the market for high-quality medical equipment and the essential packaging that protects it.

-

Wearable devices are booming as consumers use them for fitness, communication, and health.

RESTRAINTS:

-

Stringent regulatory requirements for medical device standardization could potentially impede innovation and market growth.

Medical device authorities enforce stringent regulations to ensure standardized medical devices. This is an absolute necessity for patient safety and efficacy. However, these rigid policies can create hurdles for manufacturers. Lengthy approval processes can delay the introduction of innovative packaging solutions to the market.

-

Improper medical equipment packaging can shorten shelf life and compromise product integrity.

OPPORTUNITIES:

-

The medical device packaging market is surging alongside advancements in medical technology, creating a demand for innovative, secure solutions.

-

An aging population creates a growing demand for medical equipment, particularly those suited for home healthcare

As life expectancy rises, the number of elderly individuals requiring medical attention increases. This fuels the need for user-friendly medical equipment that can be effectively utilized in home settings, facilitating easier management of chronic conditions or recovery from procedures.

CHALLENGES:

-

Finding sustainable alternatives to plastic packaging poses a significant challenge for companies in the medical device industry.

-

Ensuring proper medical device packaging presents a significant challenge.

During storage and transportation, medical equipment needs robust outer protection to withstand bumps, vibrations, and other physical stresses. Improper packaging can leave the device unusable. Many medical devices are sterile and require a barrier against biological contamination. Improper packaging significantly increases the risk of contamination.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Ukraine has significantly disrupted the medical device packaging market there. Destroyed healthcare facilities and limited access to medicine, particularly in occupied territories where 505 pharmacies were damaged and 47 destroyed, create major challenges. While the acute shortage of medicine observed early in the war has eased in government-controlled areas, full availability remains an issue. Rising medication costs and falling salaries further strain economic access. The Ukrainian government is attempting to mitigate these issues through measures like simplifying import procedures and expanding access to healthcare for displaced people. The war in Ukraine has caused medicine sales to fall sharply. In May and June, sales were down by 24%.

IMPACT OF ECONOMIC SLOWDOWN

The economic slowdown is impacting the medical device market in a few ways that could affect medical device packaging. With tighter budgets, healthcare investors are being more selective funding for digital health start-ups fell in half and hospitals are facing financial strain nearly half of US hospitals had negative operating margins. This means medical device makers need to focus on innovations that demonstrably improve patient outcomes and reduce costs for providers to justify investment. As a result, the market may see a shift towards more cost-effective packaging solutions for new medical devices.

KEY MARKET SEGMENTS:

By Packaging Type

-

Bags & Pouches

-

Containers

-

Trays

-

Stick Packs

-

Clamshell Blister Packs

-

Boxes

-

Others (Flow Wraps etc.)

Clamshell blister packs are the leaders of medical device packaging with market share of 34%, but bags and pouches are a strong contender. Their small size and efficient use of space make them ideal for storing and handling devices. Made with the right materials, they can even protect equipment from external threats. Boxes remain a substantial player as well, valued for their secure transportation capabilities.

By Raw Material

-

PE

-

HDPE

-

LDPE

-

LLDPE

-

-

PET

-

PP

-

PS

-

PVC

-

Aluminum

-

Glass

-

Paper Laminates

-

Fabric

-

Others (PLA, PHA, etc.)

Polyethylene (PE) holds dominant position for its overall versatility, followed by paper laminates offering a more cost-effective option. However, when it comes to critical barriers against external threats, aluminum takes center stage. Its exceptional protection from oxygen, moisture, and light makes it the go-to choice for safeguarding sensitive medical equipment.

By Application

-

Disposable Consumables

-

Monitoring & Diagnostic Equipment

-

Therapeutic Equipment

Disposable consumables the current leader in both value and volume within medical device packaging, is expected to maintain its dominance. The implantable device segment presents an exciting growth area. The pandemic slowed demand for elective implantable devices, but with normalcy returning, this market segment is set to grow. Areas with a high concentration of research institutions and advanced healthcare facilities, like California and Massachusetts, might see a higher demand for packaging solutions for sophisticated diagnostic equipment.

By End-use Industry

-

Medical Manufacturing

-

Contract Packaging

-

Others

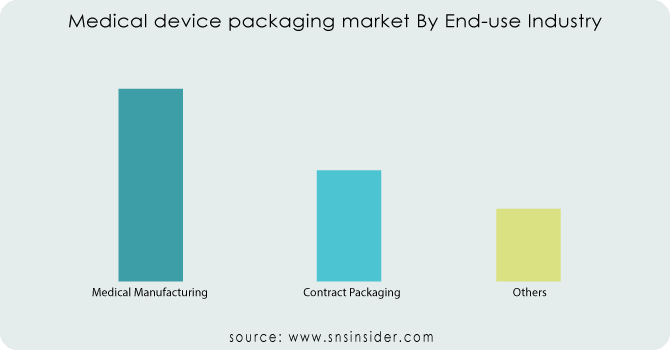

Medical Manufacturing currently hold the largest market share of 45% in medical device packaging. However, contract packaging is poised for significant growth. This trend is supported by companies like MedAccred, which announced its continued support for the medical device sector. They've seen a surge in new suppliers and implemented new audit methods for sterile packaging and device assembly. This along with the MedAccred Accreditation Pathway's second year in collaboration with the US Department of Commerce, indicates a growing focus on contract packagers for medical device packaging needs. The US has a robust medical device manufacturing industry concentrated in certain regions. Areas like California, Massachusetts, Texas, and Minnesota are major hubs for medical device development and production. These regions naturally see a higher concentration of medical device manufacturers handling their own packaging needs. Contract packagers are more geographically dispersed. They strategically locate themselves near medical device manufacturing clusters to provide convenient access to their services. However, with the increasing adoption of contract packaging their presence is spreading across the US.

Need any customization research on Medical device packaging market - Enquiry Now

REGIONAL ANALYSES

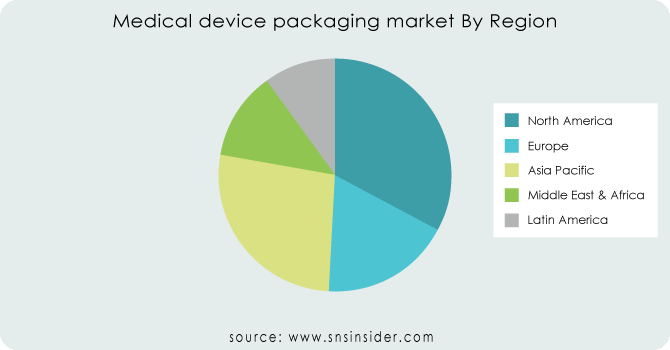

North America with its booming healthcare sector and numerous supporting organizations leads the medical device packaging market at 32% share. The US a major player within this region, enjoys a competitive edge in medical device production due to factors like advanced software development, sophisticated instrumentation, and significant investments in R&D. Market will keep growing strongly and reach a value of $5 billion by 2033. Regulations play a vital role for instance, Canada's interim order in March 2020 allowed the sale of specific medical devices for COVID-19 use, provided their packaging adhered to all relevant regulations.

Europe captures the second-largest market share over 25% Notably, the UK is expected to surpass Germany as a key player within Europe. This rise can be attributed to the UK's presence of numerous well-established medical device manufacturers catering to both domestic and international markets. Furthermore, the UK is a leader in medical technology innovation and a significant global exporter of medical devices. The Asia Pacific region is set to experience for significant growth in medical device packaging, driven by several factors. China is a major market for medical equipment globally and experiencing substantial economic growth. This economic boom is fueling significant investments in the healthcare sector, which is expected to continue flourishing in the coming years. This growth in the healthcare industry will translate to a rising demand for medical device packaging solutions in the region.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are I. du Pont de Nemours and Company, Chesapeake Limited, Klöckner Pentaplast Group, 3M Company, Mitsubishi Chemical Holdings Corporation, Bemis Company Inc., Aphena Pharma Solutions, WestRock Company, SIGMA MEDICAL SUPPLIES CORP., Amcor Limited, Sonoco Products Company, CLONDALKIN GROUP, Berry Global Inc., Oliver-Tolas, Tekni-Plex. and other key players.

Chesapeake Limited-Company Financial Analysis

RECENT DEVELOPMENT

-

In July 2023, Oliver Healthcare Packaging, a supplier of medical packaging, acquired EK-Pack Folien, a German film and foil technology manufacturer, to expand its production capabilities. This acquisition includes Vacopack H. Buchegger, a Swiss subsidiary of EK-Pack. The deal grants Oliver access to an 23,000 square meter facility with eight production lines for complex packaging materials.

-

In July 2023, TotalEnergies, SABIC, and Aramco successfully converted recycled plastic waste into certified circular polymers. They achieved this by turning the plastic waste into oil at a Saudi Arabian refinery and then using that oil to create new plastic at a SABIC facility. This marks a significant step towards a more circular plastics economy in the region.

-

Repetitive manual sealing of medical device pouches and trays can lead to errors due to human factors like fatigue or distraction. This February 2023 report highlights the importance of using sensors to prevent these errors before they occur, safeguarding the integrity of medical device packaging.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 39 Bn |

| Market Size by 2031 | US$ 59.62 Bn |

| CAGR | CAGR of 5.45% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Packaging Type (Bags & Pouches, Containers, Trays, Stick Packs, Clamshell Blister Packs, Boxes, Others) • By Raw Material [PE (HDPE, LDPE, LLDPE], PET, PP, PS, PVC, Aluminum, Glass, Paper Laminates, Fabric, Others (PLA, PHA, Etc.)] • By Application (Disposable Consumables, Monitoring & Diagnostic Equipment, Therapeutic Equipment) • By End-Use Industry (Medical Manufacturing, Contract Packaging, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | I. du Pont de Nemours and Company, Chesapeake Limited, Klöckner Pentaplast Group, 3M Company, Mitsubishi Chemical Holdings Corporation, Bemis Company Inc., Aphena Pharma Solutions, WestRock Company, SIGMA MEDICAL SUPPLIES CORP., Amcor Limited, Sonoco Products Company, CLONDALKIN GROUP, Berry Global Inc., Oliver-Tolas, Tekni-Plex. |

| Key Drivers | • The growing burden of chronic diseases like diabetes, heart disease, and cancer is a key driver in the medical device packaging market. • Wearable devices are booming as consumers use them for fitness, communication, and health. |

| Key Restraints | • Stringent regulatory requirements for medical device standardization could potentially impede innovation and market growth. • Improper medical equipment packaging can shorten shelf life and compromise product integrity. |