Packaging Solution Market Report Scope & Overview:

Get More Information on Packaging Solution Market - Request Sample Report

The Packaging Solution Market Size was valued at USD 1184.3 billion in 2023 and is projected to reach USD 1845.13 billion by 2032 growing at a CAGR of 5.05% from 2024 to 2032.

The packaging solutions market is thriving, fueled by a surge in demand from the food, beverage, and cosmetics industries. Companies like Nestle are building new facilities to keep pace, while eco-friendly innovations like Albea's paper bottle are capturing market share.

This growth is creating a ripple effect, benefiting related markets for packaging design and machinery. However, the road is not without obstacles. Manufacturers struggle with fluctuating raw material costs, stricter environmental regulations, and fierce competition from established players like Mondi Group.

Despite ongoing global challenges, the long-term forecast remains bright. Rising incomes and a growing focus on fresh produce packaging to minimize food waste are key drivers. This fragmented market offers fertile ground for companies to develop innovative and sustainable solutions, ensuring a future filled with opportunity.

MARKET DYNAMICS

KEY DRIVERS:

-

The packaging market is positioned to boom as demand for packaging in food, beverages, and cosmetics surges.

-

The surge in demand for cosmetic products directly translates to growth in the packaging solutions market.

The rise of the cosmetics industry is a benefit for the packaging solutions market. Since most cosmetics need jars, bottles, or tubes, this surge in demand translates directly to a need for innovative and functional packaging. For example, Albea, a leading beauty packaging manufacturer, introduced the world's first squeezable paper-based bottle in October 2022, showcasing the push for sustainable solutions.

RESTRAINTS:

-

Tighter government regulations on non-ecofriendly packaging could hamper the packaging market's growth.

Shifting production towards eco-friendly materials may require upfront investments in new technologies and supply chains, potentially raising production costs. Strict regulations could discourage innovation in the packaging sector. Manufacturers may be hesitant to invest in developing novel packaging solutions if they fear these innovations might not meet evolving regulatory standards.

OPPORTUNITY:

-

Tamper-proof packaging has revolutionized the market, driving its growth.

As regulations become more stringent, the potential for reputation damage for companies due to product tampering increases. Criminal activities like theft, counterfeiting, and deliberate product tampering pose a significant risk within food, beverage, and healthcare sectors. Tamper-proof packaging is no longer just an option it's becoming a necessity that aligns perfectly with current industry trends and analysis.

-

The development of novel packaging solutions opens doors to exciting product presentations and functionality.

CHALLENGES:

-

The unpredictable fluctuations in the cost of raw materials create challenges for manufacturers in the packaging industry.

-

Global packaging regulations pose challenges in navigating trade access and fostering technological innovation for the packaging industry.

Globalization has created pressure on the packaging industry to adapt rapidly with ever-changing technologies and practices. However, national regulatory bodies often struggle to keep pace, hindering trade access for developing countries in particular. The constant variations and policy changes, coupled with compliance challenges, can lead to product damage, shipment rejections, and unnecessary waste. This lack of clear information sharing, especially regarding packaging requirements, is a major contributor to these issues.

IMPACT OF RUSSIA UKRAINE WAR

The Russia-Ukraine conflict is disrupting the recovering global supply chain, posing significant challenges to the packaging solutions market. The war adds another layer of complexity to the already stressed supply chains recovering from the pandemic. The war adds another layer of complexity to the already stressed supply chains recovering from the pandemic. Lack of raw materials and components from Ukraine disrupts factories in key markets like Germany and Japan. The invasion triggers a spike in oil and gas prices, impacting production costs for packaging materials. The conflict has driven up oil prices to $120/bbl for dated BFOE, a multi-year high. Similarly, natural gas prices in northwest Europe surged to over €270 per megawatt-hour. Uncertainty surrounding Russia's export capabilities for oil and gas further fuels price hikes. Many Western companies are exiting Russia and Ukraine, leading to widespread closures of packaging and production facilities.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can have a mixed impact on the packaging solution market, with both challenges and opportunities emerging. Consumer product goods (CPG) companies may be more hesitant to invest in brand new packaging machinery during a recession. As companies seek to reduce overhead costs, there could be a surge in demand for co-packing and contract-packaging services. Companies may seek out packaging partners with strong project management skills to minimize errors, delays, and cost overruns during production and distribution. Overall, an economic slowdown can lead to a shift in the packaging solutions market, with a focus on cost-effectiveness and efficiency. Companies that can adapt their offerings and provide valuable partnerships to manufacturers are likely to be more successful during these challenging times.

KEY MARKET SEGMENTS

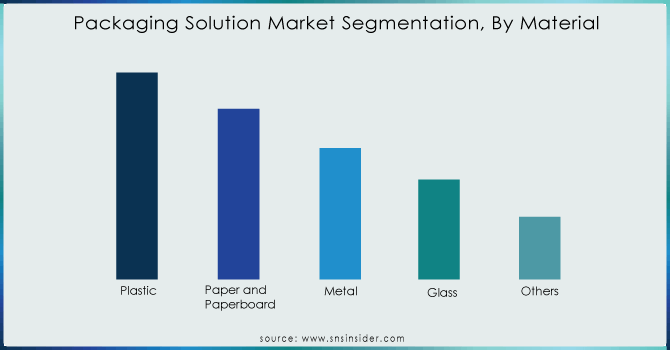

By Material

-

Paper and Paperboard

-

Plastic

-

Metal

-

Glass

-

Others

Plastic dominates in the packaging solution market with share of 48%, plastic packaging is known for its durability, moisture resistance, and ability to shield products from contamination. Its lightweight nature makes it easy to handle for both consumers and those working in the supply chain. Paper & Paperboard is versatile category encompasses everything from lightweight tissues to sturdy corrugated boxes. It's a popular choice for paper bags, cartons, and even molded pulp containers.

Get More Information on Packaging Solution Market - Enquiry Now

By Packaging Type

-

New

-

Recycled

The packaging solutions market can be categorized into two main segments: new and recycled. While new packaging currently holds the larger revenue share of 55%, the recycled segment is projected to experience the fastest growth in the coming years.Recycled packaging utilizes materials that have already been used, such as glass, metal, cardboard, and some plastics. Consumer demand for eco-friendly options is driving this growth.

By End-user Industry

-

Food and Beverage

-

Healthcare

-

Personal Care

-

Industrial

-

Others

The packaging industry caters to a wide range of needs. Food and beverages utilize everything from cans and cartons to plastic wrap. Healthcare prioritizes safety with blister packs and vials, while personal care products often feature aesthetically pleasing glass or plastic containers. Industrial packaging is heavy-duty and custom-made, while other consumer goods encompass everything from packaging for electronics to clothing. This segmentation ensures the perfect fit for every product.

REGIONAL ANALYSIS

Asia-Pacific region is forecast to dominate the market due to its established packaging industry. India's growing population fuels investments in paper packaging, anticipating significant sector expansion. Latin America, Middle East, and Africa are projected for significant growth as their packaging industries expand. This region sees high demand for flexible packaging in the food and beverage industry, as demonstrated by Smurfit Kappa's recent acquisition in Brazil.

The rise of eco-friendly alternatives like corrugated packaging is gaining traction globally, as seen in WestRock Company's "EverGrow" product launch in the US. European manufacturers are leading the way in innovation, with examples like Mondi Group's recyclable packaging solutions. The packaging solutions market experiences a boom across the globe, with each region experiencing its own unique trends and drivers.

REGIONAL COVERAGE:

North America

- US

- Canada

- Mexico

Europe

- Eastern Europe

- Poland

- Romania

- Hungary

- Turkey

- Rest of Eastern Europe

- Western Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Switzerland

- Austria

- Rest of Western Europe

Asia Pacific

- China

- India

- Japan

- South Korea

- Vietnam

- Singapore

- Australia

- Rest of Asia Pacific

Middle East & Africa

- Middle East

- UAE

- Egypt

- Saudi Arabia

- Qatar

- Rest of Middle East

- Africa

- Nigeria

- South Africa

- Rest of Africa

Latin America

- Brazil

- Argentina

- Colombia

- Rest of Latin America

Key players

Some of the major players in the Packaging Solution Market are Smurfit Kappa Group PLC, Ball Corporation,WestRock Company, Crown Holdings, Inc., Sealed Air Corporation, International Paper Company, Mondi Group, DS Smith Plc, Silgan Holdings Inc., Amcor PLC, stora enso oyj, Berry Global Group, Graphic Packaging International And Others Players.

RECENT DEVELOPMENTS

-

Amcor PLC acquired a cutting-edge flexible packaging facility in the Czech Republic in August 2022. This well-located plant allows Amcor to significantly boost its ability to meet the rising demand for flexible packaging solutions across its entire European network.

-

Crown Holdings, Inc. announced plans to solidify its foothold in Europe in March 2022. To achieve this, they're constructing a brand new beverage can facility in Peterborough, UK. This expansion will significantly strengthen their position within the European beverage can market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1184.3 Bn |

| Market Size by 2032 | US$ 1845.13 Bn |

| CAGR | CAGR of 5.05% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Paper And Paperboard, Plastic, Metal, Glass, Others) • By Packaging Type (New, Recycled) • By End-User Industry (Food And Beverage, Healthcare, Personal Care, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Smurfit Kappa Group PLC, Ball Corporation,WestRock Company, Crown Holdings, Inc., Sealed Air Corporation, International Paper Company, Mondi Group, DS Smith Plc, Silgan Holdings Inc., Amcor PLC, stora enso oyj, Berry Global Group, Graphic Packaging International |

| Key Drivers | • The packaging market is positioned to boom as demand for packaging in food, beverages, and cosmetics surges. • The surge in demand for cosmetic products directly translates to growth in the packaging solutions market. |

| Key Restraints | • Tighter government regulations on non-ecofriendly packaging could hamper the packaging market's growth. |