Beverage Cartons Market Report Scope & Overview:

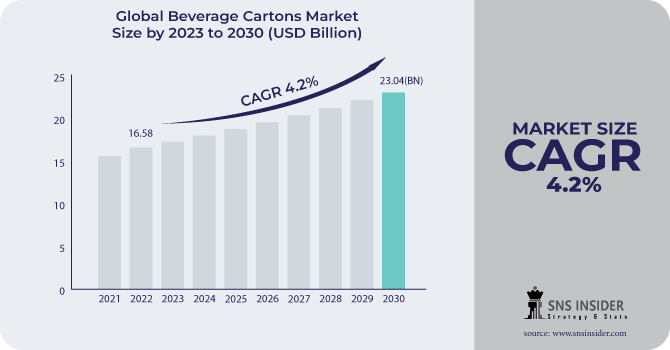

The Beverage Cartons Market size was USD 17.30 billion in 2023 and is expected to Reach USD 24.42 billion by 2031 and grow at a CAGR of 4.4 % over the forecast period of 2024-2031.

With the increase in demand for the Beverage Packaging and an increasing emphasis on sustainability, the beverage carton market has been experiencing rapid growth within the packaging sector. Paperboard is the principal material used to produce beverage packaging, and it benefits from a wide range of characteristics including strength, durability and environmental compatibility For the packaging of a variety of beverages such as milk, juice, soft drinks, or alcohol it has become more and more popular.

Get More Information on Beverage Cartons Market - Request Sample Report

In recent years, the global beverage carton market has experienced considerable growth and is expected to continue its upward trend. Factors such as lifestyle changes, urbanization, and convenience have increased the consumption of packaged beverages, which is a key driver of market expansion. Moreover, the growth in the market for beverage cans has continued to grow as more and more consumers are becoming aware of environmental sustainability and demand for green packaging solutions.

In order to satisfy various categories of drink, beverage packaging is available in a variety of types. Gable top cartons, characterized by their distinctive triangular shape and pour spouts, are commonly used for packaging milk and juices. Rectangular brick cartons are suitable for a variety of beverages, including soft drinks and non-dairy alternatives. Molded cartons are designed to stand out in-store, increase brand awareness and capture consumer attention.

Beverage cartons typically consist of multiple layers of Paper & Paperboard Packaging, plastic (polyethylene), and aluminium foil. This layered structure effectively protects against light, moisture and oxygen, keeping packaged beverages fresh and extending their shelf life. Combining cardboard and plastic not only increases strength and durability but also makes the box lighter and more recyclable. Aluminium foil provides additional barrier properties to preserve the taste and quality of your beverage.

One of the main advantages of beverage cartons is their sustainability. The cardboard used to manufacture our cardboard comes from responsibly managed forests and is therefore a renewable raw material. In addition, advances in recycling technology have made beverage cartons more and more recyclable. Layers of cardboard, plastic and aluminium foil can be separated during the recycling process, allowing materials to be efficiently recovered and made into new cardboard and other paper-based products. The emphasis on sustainability and environmental friendliness of beverage cartons contributes to their popularity as a preferred packaging option.

MARKET DYNAMICS

KEY DRIVERS:

-

The growing consumption of packaged beverages

Increasing consumption of packaged beverages such as milk, juice, soft drinks, and alcoholic beverages is the major driving factor for the beverage cartons market. Changes in consumer lifestyles, urbanization and convenience have resulted in changing preferences for ready-to-drink beverages, resulting in increased demand for edible packaging solutions.

-

The market for beverage cartons is also being further developed by continuing technological progress.

RESTRAIN:

-

In all regions, recycling infrastructure and facilities for the recycling of cartons may not be available

OPPORTUNITY:

-

An important opportunity exists for beverage cartons as attention is increasingly paid to sustainability and the environment.

Environmentally friendly properties, such as being made from renewable resources and being recyclable, align well with consumer preferences for sustainable packaging solutions. To capitalize on this opportunity, there is a need to further promote the environmental benefits of beverage cartons and educate consumers about the positive environmental impact of beverage cartons.

-

Beverage packages offer a good opportunity for businesses to raise their brand awareness and engage with customers, offering an extensive range of options for personalization and labeling.

CHALLENGES:

-

Alternative packaging formats like plastic bottles, aluminium cans or glass containers present competition for beverage cartons.

IMPACT OF RUSSIAN UKRAINE WAR

Since the start of the Ukraine war and the imposition of drastic economic sanctions in late February/early March 2022, the Russian economy has deteriorated. In 2022, personal consumption in Russia, which accounts for 47% of gross domestic product (GDP), is expected to decline significantly. Declining incomes are forcing consumers to change their buying habits and look for cheaper options. Restrictions on liberty, high penalties, rising inflation, declining disposable income, and rising unemployment all contribute to an increase in immigration. Beverage packaging production decreased due to a decline in personal consumption. Decrease in imports and exports of raw materials due to trade turmoil.

The major suppliers of raw materials have been forced to raise prices for their customers because of the energy surcharge caused by the Russian supply disruption. This increase is similar to other glass suppliers such as Algeria and the United States. Raw material prices such as aluminium rose due to the impact of the aluminium trade ban by Russia. Paper is a major material in beverage packaging and consumes a total of 4% of the world's energy.

IMPACT OF ONGOING RECESSION

During the recession, businesses typically seek cost-reduction strategies to deal with financial difficulties. According to AF&PA, carton production in the first quarter he decreased by 5% compared to the first quarter of 2022, and the production rate of 87.8 cartons decreased by 6.1% year-on-year. Manufacturing profits are expected to increase by 3.8%, while services sector growth is 14.9%. The International Paper (IP) reported that the economic shutdown will occur in the first quarter of 2023. In addition to losses of 265,000 tons due to the economic downturn, Westrock reported a loss of $2 billion and IP reported a time loss of 421,000 tons.

KEY MARKET SEGMENTS

By Product Type

-

Refrigerated Cartons

-

Shelf-Stable Cartons

By Application

-

Fruit & Vegetable Juices

-

Dairy Products

-

Others

.png)

Get Customised Report as per Your Business Requirement - Enquiry Now

REGIONAL ANALYSIS:

Asia-Pacific dominated the beverage cartons packaging market in 2022. The growing economies such as India, China, Indonesia and Thailand will provide opportunities for the growth of the market in this region. Consumption of beverages in this region is expected to rise, giving a boost to the beverage cartons packaging market. This is due to the rise in disposable incomes. China in Asia-Pacific region holds the largest market share and India is the fastest-growing market.

North American market will show the fastest growth over the forecast period. North America is the biggest market for processed and packaged beverages. The consumption of alcoholic beverages in this region is increased. US holds the largest market share for beverage cartons in this region.

Europe region will show significant growth over the forecast period. Demand for alcoholic/non-alcoholic beverages is rising in this region due to the growth in the young population demanding for these beverages. The new generation is demanding packaged drinks as well as mocktails, which will rise the market for beverage cartons. German Beverage Cartons holds the largest market share in this region followed by the UK which is the fastest-growing market.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Beverage Cartons market are Great View Aseptic Packaging Co. Ltd, Mondi Group, Tetra Pak, IPI Srl, Westrock Company, Elopak, Pactiv Evergreen, Stora Enso, Visy, Sig Combibloc Group Ltd and other players.

Westrock Company-Company Financial Analysis

RECENT DEVELOPMENT

-

Food processing and packaging company Tetra Pak has partnered with The Walt Disney Company (Disney) to revitalize the dairy category.

-

Andritz to supply Dong Tien Binh Duong Paper in Vietnam with a beverage carton recycling line.

-

To significantly improve the recycling of beverage cartons placed on the Irish market, the Dublin-based Alliance for Beverage Cartons and the Environment Ireland has entered into partnerships with an Irish waste and recycling company called Panda.

| Report Attributes | Details |

| Market Size in 2023 | US$ 17.30 Bn |

| Market Size by 2031 | US$ 24.42 Bn |

| CAGR | CAGR of 4.4 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Refrigerated Cartons, Shelf-Stable Cartons) • By Application (Fruit & Vegetable Juices, Dairy Products, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Great View Aseptic Packaging Co. Ltd, Mondi Group, Tetra Pak, IPI Srl, Westrock Company, Elopak, Pactiv Evergreen, Stora Enso, Visy, Sig Combibloc Group Ltd |

| Key Drivers | • The growing consumption of packaged beverages • The market for beverage cartons is also being further developed by continuing technological progress. |

| Market Restraints | • In all regions, recycling infrastructure and facilities for the recycling of cartons may not be available |