Pancreatic and Biliary Stents Market Report Scope & Overview:

Get more information on Pancreatic and Biliary Stents Market - Request Sample Report

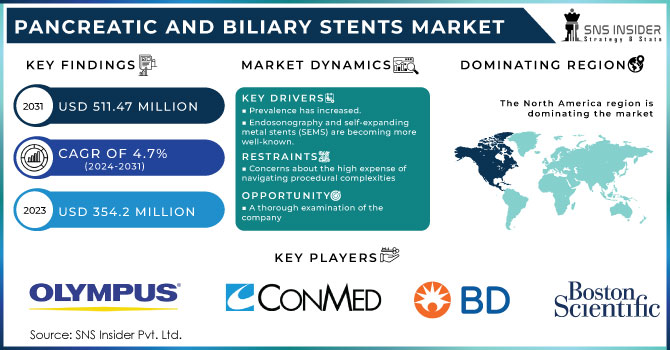

According to SNS Insider, the Pancreatic and Biliary Stents Market was valued at USD 354.2 Mn in 2023 and is expected to reach 511.47 Mn in 2031, and grow at a CAGR of 4.7% over the forecast period of 2024-2031.

Endoscopic stenting has been demonstrated to be an effective treatment for a variety of pancreaticobiliary disorders. This includes treating biliopancreatic leaks and preventing pancreatitis after endoscopic retrograde cholangiopancreatography (ERCP). The market for endoscopic stenting has benefited from ongoing developments in therapeutic endoscopy, particularly in terms of device design and insertion procedures. Several developments in pancreatic and biliary stent technology have allowed clinicians to provide lumen-to-lumen anchorage and minimize bilia-pancreatic leakages. In the pancreatic and biliary stents market, lumen-apposing metal stents have gained traction for treating both malignant and benign disorders.

Pancreatic and biliary stents are a relatively recent interventional therapeutic option for pancreatic cancer. Palliative stent therapy is rapidly changing its paradigm. Just about all the palliative care involves the use of self-expanding metal stents in this regard. Pancreatic ductal stent insertion is becoming increasingly popular among individuals with chronic pancreatitis. Endoscopists have been updating their skills with novel endosonography techniques and self-expanding metal stents in order to broaden the range of pancreatic and biliary stent applications in recent years.

MARKET DYNAMICS

DRIVERS

-

Prevalence has increased.

-

Endosonography and self-expanding metal stents (SEMS) are becoming more well-known.

-

The stent industry is boosted by the use of a minimally invasive transpapillary technique.

RESTRAINTS

-

Concerns about the high expense of navigating procedural complexities

-

Government Regulations are Strict

OPPORTUNITIES

-

A thorough examination of the company

IMPACT OF COVID-19

The COVID-19 pandemic had a detrimental influence on the biliary stents industry because it affected the global healthcare system, creating considerable delays in surgeries, treatment, and diagnosis of non-emergency medical problems. Several municipal and national regulatory organisations instituted lockdowns, prohibiting the movement of persons and products, as the number of COVID-19 instances increased. The mandated lockdowns had a significant impact on the company's operations, as well as the whole market's supply chain, resulting in delayed and limited biliary stent supply to end users.

In the early months of the COVID-19 pandemic, the considerable effect of the pandemic on product distribution is predicted to have impeded industry expansion and led to a drop in bile duct cancer care. A relationship was also identified in some cases between coronavirus infection and a significant consequence of liver injury. Once a result, as the limits are relaxed, it is expected to have a positive impact on the global market.

By Product Type:

Metal stents and polymer stents are the two types of stents on the market. Metal stents accounted for about 65% of the market in 2023 and are predicted to grow at a healthy pace during the forecast period. Metal stents are mesh-like tubes made up of thin wires that come in a wide range of diameters and lengths. The post-expansion diameter of the self-expandable metal stents ranges from 5 to 10 mm. The increased incidence of bile duct-related disorders like biliary leakage, pancreatic cancer, and other malignant obstructions, such as gallstones, leading to bile duct blockage, are the main drivers of metal stents.

By Application:

Bilio-pancreatic leakages, pancreatic cancer, benign biliary strictures, gallstones, and other conditions are all treated using biliary stents. In 2023, the gallstones segment generated USD 167.2 million in revenue. The adoption of an unhealthy and sedentary lifestyle, as well as a family history of gallstones, have been identified as some of the major factors contributing to the high occurrence of gallstones. Gallstones are a non-fatal condition of the biliary system that affects millions cheval.

By End-User

Between 2024 and 2031, ambulatory surgical centres are predicted to grow at a rate of more than 6.8%. With various advantages of ambulatory care, such as reduced costs, faster recovery, and lower infection rates, as well as a growing preference for minimally invasive procedures, the segment is seeing increased demand in developed and developing countries alike. In order to attract a larger client base, boosting the adoption of biliary stents and related treatments requires a low risk of consequences.

KEY MARKET SEGMENTATION

By Product Type

-

Metal Stents

-

Plastic Stents

By Applications

-

Bilio-pancreatic leakages

-

Pancreatic Cancer

-

Benign Biliary strictures

-

Others

By End Users

-

Hospitals

-

Ambulatory Surgical Centers

-

Speciality Clinics

-

Others

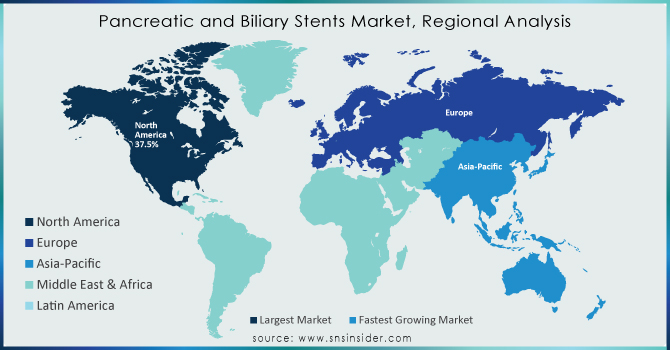

REGIONAL ANALYSIS

North American region accounted for over 37.5 percent of the total world biliary stents market. The regional market size would be driven by an increasing geriatric population prone to ailments including pancreatic cancer, gallstones, and other malignant obstructions. Furthermore, rising awareness of modern technologies for treatment would boost the biliary stents industry projections in North America.

Need any customization research on Pancreatic and Biliary Stents Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS:

Some of the major key players are Boston Scientific Corp, Becton Dickinson and Co, ConMed Corp, Hobbs Medical Inc Medtronic Plc, Olympus Corp, Hellman & Friedman LLC., Cook Group Inc, W. L. Gore & Associates Inc, and other players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 354.2 Million |

| Market Size by 2031 | US$ 511.47 Million |

| CAGR | CAGR of 4.7% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Metal Stents, Plastic Stents) • By Applications (Bilio-pancreatic leakages, Pancreatic Cancer, Benign Biliary strictures, Others) • By End Users (Hospitals, Ambulatory Surgical Centers, Speciality Clinics, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Boston Scientific Corp, Becton Dickinson and Co, ConMed Corp, Hobbs Medical Inc Medtronic Plc, Olympus Corp, Hellman & Friedman LLC. Cook Group Inc, W. L. Gore & Associates Inc, and other players. |

| DRIVERS | • Prevalence has increased. • Endosonography and self-expanding metal stents (SEMS) are becoming more well-known. • The stent industry is boosted by the use of a minimally invasive transpapillary technique. |

| RESTRAINTS | • Concerns about the high expense of navigating procedural complexities • Government Regulations are Strict |