Laboratory Supplies Market Overview:

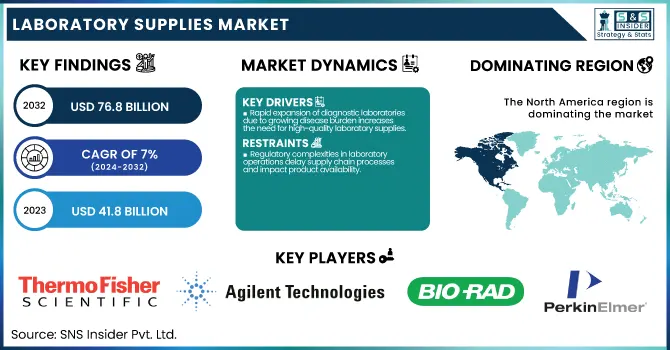

The Laboratory Supplies Market Size was valued at USD 41.8 Billion in 2023 and is expected to reach USD 76.8 billion by 2032, growing at a CAGR of 7% over the forecast period 2024-2032.

To Get more information on Laboratory Supplies Market - Request Free Sample Report

This report will identify crucial statistical views and emerging trends in the Laboratory Supplies Market. This report focuses on a diagnostic test's existence by prescription trends among major regions in the growing demand for lab consumables and instruments. The report analyzes consumption volumes by supply type and end-use sectors, alongside regional variations in healthcare spending on lab supplies, segmented by payer type. In addition, evolving supply chain patterns would be covered, like developing e-commerce distribution and regionally sourced supplies. Sustainability and regulatory compliance are also noted in their product demand, as mandated by environmental and safety legislation. Laboratory supplies are parts of progress in the research of science, diagnostics in health care, and quality control by industries.

U.S. Laboratory Supplies Market Size & Forecast

The U.S. Laboratory Supplies Market has always been recorded to grow steadily, increasing from USD 13.02 billion in 2023 to USD 23.64 billion by 2032, with a CAGR of 6.86%. This is largely because of the rising diagnostic tests and advanced research programs and also the infrastructural strength of the health sector. Continuous demand for good consumables with quality compliance has made the market momentum going on both in clinical and academic settings. The development of advanced laboratory equipment and consumables for this technology demands further arguments around the world. According to the UNESCO Institute of Statistics, global R&D expenditure is at about USD 1.7 trillion figure is assumed to grow, as most developing countries will enhance their public and private research investments and develop the number of researchers by 2030.

Laboratory Supplies Market Dynamics

Drivers

-

Rapid expansion of diagnostic laboratories due to growing disease burden increases the need for high-quality laboratory supplies.

The rapid expansion of diagnostic laboratories due to the increasing prevalence of infectious and chronic diseases has intensified the requirement for reliable laboratory supplies. Additionally, there is an increased dependence of healthcare providers on laboratory-based testing for such services, creating a high demand for consumable products such as specimen containers, test tubes, and reagents. The COVID-19 pandemic also helped in hastening the establishment of diagnostic labs around the country which has led to high levels of testing capabilities. And then personalized medicine and genetic testing, which require specialty and often customized lab supplies, have also become growth engines. Laboratories are facing increased regulatory scrutiny that drives laboratories to continuously have calibrated and standardized tools at their disposal. Consequently, lab supply manufacturers continue to see stable demand from both hospital-based and standalone diagnostics laboratories, particularly in areas where healthcare infrastructure is developing and patient volumes are increasing.

Restrain

-

Regulatory complexities in laboratory operations delay supply chain processes and impact product availability.

Regulatory complexities in laboratory operations delay supply chain processes and impact the availability of laboratory supplies across key markets. Compliance with region-specific guidelines related to safety, quality control, and import/export laws requires significant time and documentation. For instance, the requirements of the CE or ISO certification will further delay the approval of products related to different lab consumables. Regulatory inconsistencies between international and domestic rules frequently complicate imports causing shipment delays and backlogs. Furthermore, changing standards and the need for periodic audits further create uncertainty in the procurement cycle. These regulatory barriers not only delay the timely access to core supplies but also increase costs incurred over the barrier for manufacturers and distributors. Laboratories that depend just-in-time inventory systems are susceptible to these disruptions directly affecting their testing and research capabilities during peaks of demand.

Opportunities

-

Rising adoption of digital lab technologies and automation offers new revenue opportunities for lab equipment manufacturers.

Rising adoption of digital lab technologies and automation presents lucrative revenue opportunities for laboratory supply manufacturers worldwide. Laboratories are integrating automated sample handling, digital inventory management, and smart instruments to improve operational efficiency and data accuracy. The emergence of Lab Information Management Systems (LIMS), robotic pipetting systems, and IoT-enabled devices enhances throughput and reduces human error. As a result, suppliers are developing compatible lab consumables and smart tools that integrate seamlessly with these digital ecosystems. Additionally, artificial intelligence and machine learning are being embedded into lab operations, enabling predictive analytics and faster decision-making. This shift toward automation is not limited to elite institutions; even mid-sized labs are investing in semi-automated platforms. Consequently, manufacturers who innovate and align their products with this digital transformation are well-positioned to tap into high-growth segments of the Laboratory Supplies Market.

Challenges

-

Sustainability and waste management issues challenge manufacturers to reduce environmental impact of disposable lab consumables.

The growing trends of sustainability and waste management only pose a challenge to manufacturers to help reduce the environmental impact of disposable lab consumables. Faced with increasing scrutiny around single-use plastics and chemical waste, laboratories are coming under pressure to adopt greener practices. Nevertheless, the majority of consumables which include pipette tips, petri dishes, and reagent bottles, are still produced from non-biodegradable materials, accumulating in landfills and toxic waste. Regulatory agencies are tightening environmental compliance, and pressuring labs to minimize plastic usage, but options are still limited and usually costly. The hardest part is making sure you are creating the best-performing product you can while innovating with eco-friendly materials. Manufacturers are being challenged to create recyclable or biodegradable alternatives without compromising sterility or durability. Until a solution can scale and gain traction, environmental sustainability will continue to be a heavy burden for both lab operators and supply chain players in the market.

Laboratory Supplies Market Segmentation Analysis

By Product

The equipment segment’s dominance in the Laboratory Supplies Market, with a commanding 64% revenue share in 2023, is the result of several converging trends and priorities within the global research and healthcare landscape. Laboratory equipment such as analytical instruments of very high precision, centrifuges, incubators, and photometers make up the core elements of modern scientific inquiry and diagnostics. These precious items are essential for basic laboratory operations as well as high-dimension research activities in genomics, proteomics, drug discovery, and personalized medicine. The high cost and long lifespan of these instruments mean that each purchase represents a significant investment, which is often supported by government grants and institutional funding. For instance, funding priority has been on acquisition or modernizing laboratory equipment under the U.S. National Institutes of Health (NIH) and the Canadian Foundation for Innovation as both organizations ensure that research facilities have systems that are improved technology-wise at any given time. Apart from the pace with which the innovations in laboratory automation, digital integration, and smart lab solutions methods, labs are frequenting equipment upgrades because of operational efficiency and regulatory compliance. Regulators in North America and Europe, such as those of the FDA and EMA, require laboratories to have certified, calibrated equipment that guarantees the safety and accuracy of data, thereby inciting the demand for new and replacement instruments. The proliferation of contract research organizations (CROs), biopharmaceutical companies, and academic research centers has also contributed to the robust growth of the equipment segment. As research becomes more complex and data-driven, the need for sophisticated, high-throughput instruments continues to rise.

Laboratory Supplies Market Regional Insights

In 2023, North America solidified its position as the leading region in the global Laboratory Supplies Market, accounting for approximately 38% of total market revenue. The characteristics that make this region unique include huge government investments; a well-established biopharmaceutical and healthcare industry; and a highly developed research ecosystem. The continued commitment of the U.S. government towards research is clearly illustrated in the NIH 2024 budget allocation that exceeded USD 48 billion, most of which is earmarked for laboratory infrastructure, modernization, and advanced equipment. All these make demands for laboratory supplies higher, as databases contain some of the most prestigious research universities in the world as well as the finest hospitals and the highest concentration of biotechnology and pharmaceutical companies. Moreover, the regulatory framework of North America is heavily and strictly controlled by agencies such as the U.S. Food & Drug Administration, which ensures that all laboratories in the region keep upgrading their equipment to high standards for safety and data integrity.

Europe region is growing with significant growth rate during the forecast period. Countries like Germany, the UK, and France are intensively ramping up their research capabilities, investing in advanced laboratory infrastructure, and developing biotech hubs. A lot of this will also contribute to the focus on sustainability and increased digitalization in European laboratories. Moreover, the regulatory framework for quality and eco-friendly practices in this region is also resulting in a demand for new equipment and consumables. Thus, while North America retains its leadership through size and maturity, Europe's accelerated growth trajectory is shaping it into a major vehicle of international laboratory supplies driven by innovations, regulatory advancements, and strategic government support.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Laboratory Supplies Market

Key Service Providers/Manufacturers

-

Thermo Fisher Scientific (NanoDrop One Microvolume UV-Vis Spectrophotometer, Orion Star A215 pH/Conductivity Benchtop Meter)

-

Agilent Technologies (Agilent 8890 GC System, Agilent 1260 Infinity II LC)

-

Bio-Rad Laboratories (CFX96 Touch Real-Time PCR Detection System, ChemiDoc MP Imaging System)

-

PerkinElmer (Lambda 365+ UV/Vis Spectrophotometer, NexION 2000 ICP-MS)

-

Bruker Corporation (MALDI Biotyper Microbial Identification System, Avance NEO NMR Spectrometer)

-

Danaher Corporation (DxH 900 Hematology Analyzer, Biomek i-Series Automated Workstations)

-

Fujifilm Irvine Scientific (CHOgro High Yield Expression System, IS Sf Insect Cell Culture Medium)

-

Sartorius AG (Cubis II Premium Laboratory Balance, Ambr 15 Cell Culture System)

-

Shimadzu Corporation (LCMS-8060NX Mass Spectrometer, UV-1900i UV-Vis Spectrophotometer)

-

Waters Corporation (ACQUITY UPLC H-Class PLUS System, Xevo TQ-S micro Mass Spectrometer)

-

Eppendorf AG (Eppendorf Centrifuge 5425 R, Eppendorf Research plus Pipette)

-

Merck Group (MilliporeSigma) (Milli-Q IQ 7000 Water Purification System, Stericup Quick Release Vacuum Filtration System)

-

VWR International (Avantor) (VWR Symphony UV-Visible Spectrophotometer, VWR Advanced Hotplate Stirrer)

-

Beckman Coulter (CytoFLEX Flow Cytometer, Optima XPN Ultracentrifuge)

-

Sysmex Corporation (XN-Series Hematology Analyzer, UF-5000 Urine Particle Analyzer)

-

INTEGRA Biosciences AG (EVOLVE Manual Pipette, VACUSAFE Aspiration System)

-

Antylia Scientific (Cole-Parmer) (Masterflex L/S Peristaltic Pump, Traceable Digital Thermometers)

-

Liberty Industries, Inc. (Modular Cleanrooms, Air Showers)

-

Fox Scientific, Inc. (FSI Analytical Balances, FSI Laboratory Glassware)

-

International Crystal Laboratories (KBr Optical Crystals, FTIR Gas Cells)

Recent Developments

-

In June 2024, Cytiva introduced Supor Prime sterilizing-grade filters, designed for high-concentration biologic drug production. This innovation addresses the growing demand for advanced filtration solutions in pharmaceutical and bioprocessing labs.

-

In October 2023, Sartorius introduced the Picus 2 Electronic Pipette to enhance connectivity with the most advanced performance for precise and repeatable dispensing in biopharmaceutical and quality control applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 41.8 Billion |

| Market Size by 2032 | USD 76.8 Billion |

| CAGR | CAGR of 7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Equipment {Incubators, Laminar Flow Hood, Lab Air Filtration System, Micro Manipulation Systems, Centrifuges, Scopes, Spectrophotometer & Microarray Equipment, Sonicators & Homogenizers, Autoclaves & Sterilizers, Others}, Disposables {Pipettes, Tips, Tubes, Gloves, Cuvettes, Masks, Dishes, Cell Imaging Consumables, Cell Culture Consumables}) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Agilent Technologies, Bio-Rad Laboratories, PerkinElmer, Bruker Corporation, Danaher Corporation, Fujifilm Irvine Scientific, Sartorius AG, Shimadzu Corporation, Waters Corporation, Eppendorf AG, Merck Group (MilliporeSigma), VWR International (Avantor), Beckman Coulter, Sysmex Corporation, INTEGRA Biosciences AG, Antylia Scientific (Cole-Parmer), Liberty Industries, Inc., Fox Scientific, Inc., International Crystal Laboratories |