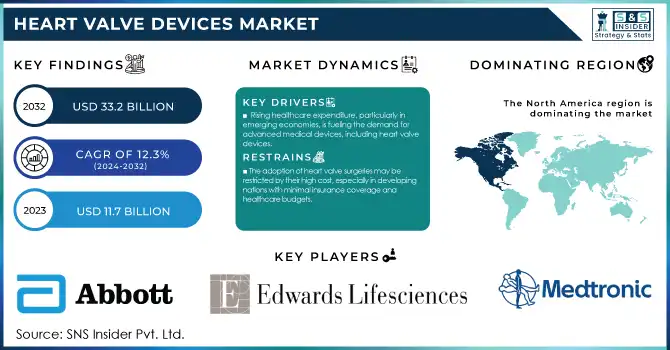

Heart Valve Devices Market Size & Overview:

The Heart Valve Devices Market was valued at USD 11.7 billion in 2023 and is projected to grow to USD 33.2 billion by 2032, with a CAGR of 12.3% from 2024 to 2032.

To get more information on Heart Valve Devices Market - Request Free Sample Report

The heart valve devices market has seen a substantial surge in market growth factors like the rising prevalence of cardiovascular diseases growing technological advancements in valve design and the expanding geriatric population. As reported by the World Heart Federation, deaths due to cardiovascular disease (CVD) globally increased from 12.1 million in 1990 to 20.5 million in 2021, underscoring the demand for effective treatment of heart valves. According to the Centers for Disease Control and Prevention (CDC), 7.1% of adults aged 45 to 64 years and 17% of adults aged 65 years and older had coronary heart disease (CHD) in 2019, translating to a greater need for heart valve devices in elderly populations

Many countries are increasing healthcare expenditure and preventive care as governments around the world focus on initiatives to combat cardiovascular diseases. As an example, the U.S. Department of Health and Human Services has initiated the Million Hearts initiative to help prevent one million heart attacks and strokes by 2027. The focus on early detection and treatment of heart valve diseases through government initiatives indirectly contributes to the growth of the heart valve devices market. Minimally invasive procedures like transcatheter aortic valve replacement (TAVR) and transcatheter mitral valve repair (TMVR), thanks to technological advancements, come with a lesser recovery period and lower surgical risk. Such innovations have broadened the specter of treatment for patients who were previously untreatable by traditional open-heart surgical means, particularly high-risk patients. In addition to biological and mechanical heart valves, continuous research of biocompatible materials and tissue-engineered valves is expected to improve the long-term durability and effectiveness of the heart valve, thereby leading to high absolute value growth in the heart valve devices market over the forecast period.

Heart Valve Devices Market Dynamics

Drivers

- The rising incidence of heart valve diseases, such as aortic stenosis and mitral regurgitation, is a primary driver for the market. Factors like unhealthy lifestyles, genetic predisposition, and the aging population contribute to the growing prevalence of these diseases.

- Procedures like transcatheter aortic valve replacement (TAVR) offer reduced recovery times and lower surgical risks, driving the demand for heart valve devices.

- Rising healthcare expenditure, particularly in emerging economies, is fueling the demand for advanced medical devices, including heart valve devices.

Cardiovascular diseases (CVDs) remain a leading cause of mortality, including heart valvular disorders like aortic stenosis and mitral regurgitation. The increase in the prevalence of these diseases is a key factor fuelling the growth of the Heart Valve Devices Market. The Problem of Aging Heart Valve Disease The aging population is the biggest driver of the heart valve disease epidemic, with many patients requiring valve replacement or repair for aortic stenosis, one of the most common heart valve disorders, affecting an estimated 4.5 million people in the U.S. The increasing trend of diseases related to heart valves is attributed to various aspects such as lack of physical activity, unhealthy diet, smoking, and an increasing number of people suffering from hypertension and diabetes. According to American Heart Association Study, nearly 40% of the U.S. population will be afflicted with some form of cardiovascular disease by 2030. Consequently, demand for heart valve replacement operations, either by standard open surgical methods or through less invasive intervention, such as transcatheter aortic valve replacement (TAVR), is expected to increase.

Furthermore, the increase in cardiovascular diseases is mainly due to the aging population. The number of people aged 60 years and older is projected to double from 12% to 22% of the global population by 2050, and this correlates well with the increasing incidence of cardiovascular diseases (CVDs) as one of the leading causes of death and disability globally, according to the World Health Organization. With the proliferation of these devices that provide superior outcomes and reduced recovery times, they have become a staple of cardiovascular care.

Restraints

- The adoption of heart valve surgeries may be restricted by their high cost, especially in developing nations with minimal insurance coverage and healthcare budgets.

- The heart valve devices market is subject to stringent regulatory requirements imposed by authorities such as the FDA and the European Medicines Agency (EMA), which can increase the time and cost of bringing new devices to market.

The high cost of heart valve procedures is one of the key restraints in the heart valve devices market. Replacement of valve and global patchwork is another technique performed with advanced technology built out of costly technology and atomics system. Patients may also require long-term follow-up, which can only add to the cost. The cost of the devices themselves, alongside the related surgical and post-operative care, are cost prohibitive, especially for patients in low- and middle-income countries or regions with limited healthcare budgets or without universal coverage. The cost can be considered a financial barrier to treatments, and this aspect clearly impacts in developing countries or lower-income populations. Consequently, some patients may avoid interventions or may not initiate treatment resulting in poorer outcomes. Such high cost, in turn, exerts pressure on the healthcare systems and prohibits the popularization of innovative heart valve devices with the potential for a better long-term health status and quality of life in these patients.

Heart Valve Devices Market Segmentation Analysis

By age group

In 2023, the heart valve devices market was dominated by the adult age group with 42% revenue share. This dominance is due to a combination of factors, mainly the higher incidence of valvular heart diseases in adults, especially the elderly. Data from the American Heart Association has shown that the rate of valvular heart disease rises with age, from 0.7% in 18–44-year-olds to 13.3% in those aged 75 and older. The CDC estimates that nearly 2.5% of the U.S. population has valvular heart disease, with a significant risk increase after age 65. Such a rise in valvular heart disease with age parallels the increasing need for heart valve devices in the adult population. Additionally, adults (and older adults in particular) are more likely to have preexisting conditions and other risk factors that increase the risk of heart valve complications e.g. high blood pressure, high blood cholesterol, and diabetes. According to the National Heart, Lung, and Blood Institute, these adult conditions can speed up the progression of heart valve diseases. Furthermore, an aging population due to better healthcare and longer life expectancy also means that more elderly patients are eligible for heart valve interventions, which further cements the increasing market share of elderly patients.

By End-user

In 2023, the hospitals segment accounted for the largest share of the heart valve devices market. The overwhelming majority of heart valve procedures are done in hospital settings because they are complex, requiring facilities, equipment, or expertise that is less likely to be found at an outpatient surgical facility. At the time of writing, the American Hospital Association reported 6,093 hospitals in the United States which creates a huge network place for heart valve cases. In 2019, there were around 1,013,000 hospitalizations for diseases of the heart valves and pulmonary circulation, according to the Centers for Medicare & Medicaid Services, highlighting the high volume of heart valve-related cases managed by hospitals. They are also more equipped for both surgical and transcatheter heart valve interventions, including the hybrid operating theatre and advanced imaging technologies. In 2019-2020, there were 6,898 heart valve replacement or repair procedures in NHS hospitals according to the National Health Service in the UK, emphasizing the importance of hospitals in providing these specialized treatments. In addition, hospitals are typically the leading sites of clinical trials and research of heart valve technologies, which results in them being the earliest adopters of new devices and techniques. Such a positioning enables hospitals to provide advanced treatments, which enhances the hospital's dominance in the heart valve devices market.

By Type of Heart Valve

In 2023, the aortic valve segment accounted for the largest share of the overall heart valve devices market. The predominance of aortic valve disease, especially aortic stenosis, which is the most prevalent valvular heart disease present in developed countries, is primarily responsible for this dominance. Aortic valve disease is common in adults over the age of 75, with an estimated prevalence of 2.5% in this population based on the American Heart Association. According to the Centers for Disease Control and Prevention (CDC), aortic valve disease causes more than 25,000 deaths in the United States each year. This is due to the high penetration and broad acceptance of TAVR procedures. Low-risk patients were included when TAVR approvals expanded with the non-inferiority finding from the PARTNER 2 trials to the U.S. Food and Drug Administration (FDA). As a result, TAVR volumes have exploded, with the Society of Thoracic Surgeons (STS) noting that TAVR volumes in the U.S. have exceeded surgical aortic valve replacement (SAVR) volumes in 2019. Next, similar to the aortic valve segment, a significant amount of research and development has already produced a plethora of novel devices, with ongoing iterations of prosthetic valve designers and delivery systems.

By Material

The biological valve is dominated the market throughout the forecast period. Several aspects contribute to this superiority, including their biocompatibility and lower risk of thrombosis than their mechanical counterparts. Data from the Society of Thoracic Surgeons National Database shows that the percentage of aortic valve replacements with biological valves increased from 37.7 percent in 1997 to 63.6 percent in 2006. This pattern has persisted with the emergence of increasingly preferable biological valves, especially in older patients. In the early 2010s, biological valves accounted for 80% of all aortic valve replacements in those 65 years old, according to data from the American College of Cardiology. Biological valves are especially suitable for the elderly, who may have difficulty taking long-term anticoagulation therapy, as they will not usually need it for the long term. The improvement in the durability of biological valves due to progress made in tissue engineering has also prolonged the life of biological valves, making them a more viable choice for a greater number of patients. With increasing minimally invasive procedures, TAVR, predominantly uses biological-based heart valves which mathematically add to the current market share.

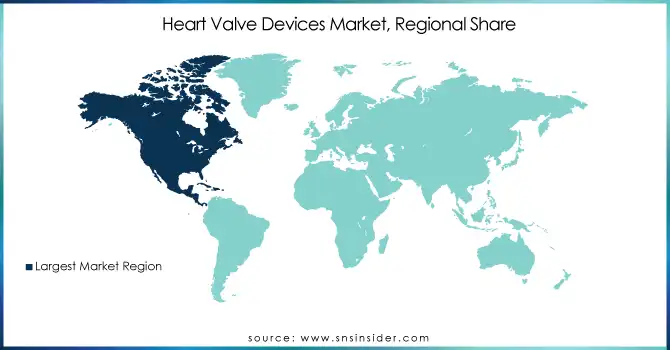

Heart Valve Devices Market Regional Insights

In 2023, North America led the global heart valve devices market while the heart valve devices market. The large share of North America is due to developed healthcare infrastructure, high healthcare expenditure, and early adoption of advanced diagnostic and treatment technologies. In the US, healthcare spending will be around $4.3 trillion in 2021, which is about 18.3% of the entire GDP of the nation, according to the United States Centers for Medicare & Medicaid Services. This large investment in care propagates advanced heart valve devices. In addition, the country hosts a high prevalence of valvular heart diseases and a large aging population in the region. According to the U.S. Census Bureau, over the next decade, everyone who was born from 1946 to 1964 will turn 65, leading to more candidates for heart valve procedures.

On the other hand, rapid market growth in the Asia-Pacific region is attributed to improving healthcare infrastructure, increasing healthcare expenditure, and raising awareness about heart valve diseases. Cardiovascular (CV) diseases represent a leading cause of death in the Western Pacific Region, with the World Health Organization estimating that cardiovascular conditions accounted for 9.3 million deaths in 2019. Other factors contributing to the growth of the heart valve devices market include high disease burden and economic growth in the developing countries such as China and India as well as rapid healthcare reforms. One such example is that China's healthcare spending has been growing at 13% per annum since 2000, much faster than its GDP.

Get Customized Report as per Your Business Requirement - Enquiry Now

Recent developments in Heart Valve Devices Market

-

Medtronic launched the next-generation Avalus Ultra Bioprosthesis, a new surgical aortic tissue valve that allows for less invasive implantation and enhanced visibility for any future valve-in-valve procedures and expanded sizing solution, in April 2024. The base frame is made with polyetheretherketone (PEEK) to achieve consistent circularity.

-

Abbott recently received U.S. FDA approval in January 2023 for its Navitor TAVI system for the treatment of patients suffering from severe aortic stenosis, or those patients at high risk for complications from surgery.

Key Players in Heart Valve Devices Market

Key Service Providers/Manufacturers

-

Medtronic (CoreValve, Evolut R)

-

Edwards Lifesciences (SAPIEN 3, SAPIEN 3 Ultra)

-

Abbott Laboratories (Mitraclip, TricValve)

-

Boston Scientific (Lotus Edge, AccuCinch)

-

JenaValve Technology (JenaValve Pericardial Bioprosthesis, JenaValve IntraAortic Balloon Pump)

-

LivaNova (Perceval, S3 Aortic Valve)

-

CryoLife (CardioGenesis, On-X Prosthetic Heart Valve)

-

Neovasc (Tiara, Neovasc Reducer)

-

Meril Life Sciences (Perceval, Myval)

-

Direct Flow Medical (Direct Flow Valve, Direct Flow Catheter)

-

Biomerics (Biomaterials, TAVR Delivery Systems)

-

Abbott Vascular (Mitral Valve Repair Systems, Transcatheter Aortic Valve Systems)

-

CardiAQ Valve Technologies (CardiAQ Transcatheter Mitral Valve System, CardiAQ-4)

-

Supramind (Surgical Heart Valve, Transcatheter Valve System)

-

Micro Interventional Devices (MitraClip, Valve Technologies)

-

Thoracic Design (Thoracic Bioprosthesis, TAVR)

-

Braile Biomedica (Braile Mitral Valve, Braile Aortic Valve)

-

Medtronic Sofamor Danek (Corinth, ThoraClips)

-

St. Jude Medical (Trifecta, Epic Plus)

-

VitaFlow (VitaFlow Transcatheter Valve, VitaFlow Delivery System)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 11.7 Billion |

| Market Size by 2032 | USD 33.2 Billion |

| CAGR | CAGR of 12.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Age Group (Pediatric Patients, Adults, Geriatric Patients) • By Type of Heart Valve (Aortic Valve {Less than 20 mm, 20-23 mm, 23-26 mm, More than 26 mm}, Mitral Valve {Less than 26 mm, 26-28 mm, 29-31 mm, More than 31 mm}, Tricuspid Valve, Pulmonary Valve) • By Material (Biological Valves {TAVI, Surgical, Others}, Mechanical Valves) • By End-user (Hospitals, Ambulatory Surgical Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic, Edwards Lifesciences, Abbott Laboratories, Boston Scientific, JenaValve Technology, LivaNova, CryoLife, Neovasc, Meril Life Sciences, Direct Flow Medical, Biomerics, Abbott Vascular, CardiAQ Valve Technologies, Supramind, Micro Interventional Devices, Thoracic Design, Braile Biomedica, Medtronic Sofamor Danek, St. Jude Medical, VitaFlow. |

| Key Drivers | • The rising incidence of heart valve diseases, such as aortic stenosis and mitral regurgitation, is a primary driver for the market. Factors like unhealthy lifestyles, genetic predisposition, and the aging population contribute to the growing prevalence of these diseases. • Procedures like transcatheter aortic valve replacement (TAVR) offer reduced recovery times and lower surgical risks, driving the demand for heart valve devices. |

| Restraints | • The adoption of heart valve surgeries may be restricted by their high cost, especially in developing nations with minimal insurance coverage and healthcare budgets. |