Paperboard Folding Carton Market scope & overview:

Get More Information on Paperboard Folding Carton Market - Request Sample Report

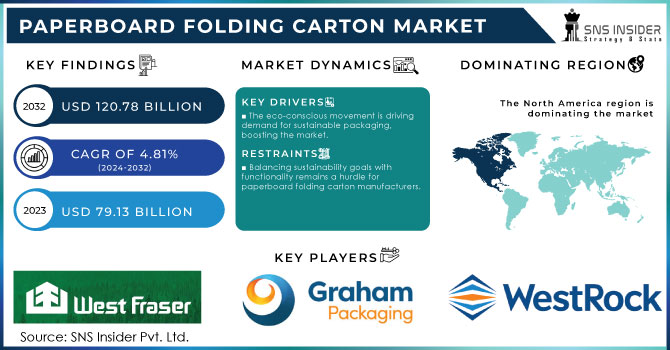

Paperboard Folding Carton Market Size was valued at USD 79.13 billion in 2023 and is expected to reach USD 120.78 billion by 2032 and grow at a CAGR of 4.81% by 2024-2032

The paperboard folding carton market stands poised for significant growth fueled by evolving consumer preferences, stricter environmental regulations, and continuous technological advancements. Sustainability remains a key driver, with the eco-friendly nature of paperboard propelling demand. Furthermore, the integration of smart packaging and augmented reality opens doors for innovation, allowing brands to enhance customer engagement and add value to their packaging solutions.

Additionally, collaborations throughout the supply chain, including packaging manufacturers, recyclers, and governing bodies, are fostering a circular economy for paperboard folding cartons. Sonoco Products Company, a South Carolina-based industry leader, delivers a comprehensive range of consumer packaging, industrial products, and packaging supply chain services worldwide. By optimizing recycling infrastructure and promoting closed-loop systems, stakeholders can minimize environmental impact and maximize resource efficiency. Looking ahead, untapped opportunities lie in expanding the use of paperboard folding cartons into niche markets like healthcare and electronics. Customized solutions tailored to these industries can unlock new revenue streams and propel further market growth.

MARKET DYNAMICS:

KEY DRIVERS:

-

The eco-conscious movement is driving demand for sustainable packaging, boosting the market.

Eco-consciousness is fueling the paperboard folding carton market within medical device packaging. Growing concern about plastic waste is pushing consumers and businesses towards sustainable solutions. Paperboard's recyclability and biodegradability make it an attractive alternative, propelling its market growth.

-

Stricter plastic regulations are driving the move to paperboard folding cartons.

RESTRAINTS:

-

Balancing sustainability goals with functionality remains a hurdle for paperboard folding carton manufacturers.

The market faces a challenge in bridging the gap between consumer demand for both eco-friendly packaging and robust product protection. Continuous innovation and investment in R&D are crucial to develop sustainable solutions that don't compromise on functionality.

-

Compliance with environmental regulations gives paperboard folding cartons a competitive edge in the marketplace.

OPPORTUNITIES:

-

Cutting-edge printing and design tech allows for intricate, attractive cartons.

The rise of sophisticated printing and digital technologies creates a market opportunity for paperboard folding cartons by enabling visually striking product presentations, enhanced brand visibility, and cost-effective customization for businesses of all sizes.

-

E-commerce's demand for lightweight, durable paperboard folding cartons fuels market growth.

CHALLENGES:

-

Paperboard folding carton makers face volatile raw material costs.

Paperboard folding carton manufacturers face a challenge in fluctuating raw material costs, particularly pulp prices and supply chain disruptions. These factors directly impact the overall production cost, potentially squeezing profit margins.

-

Paperboard folding cartons face competition from alternative packaging options.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Ukraine has adversely impacted the paperboard folding carton market by disrupting the already troubled supply chain. This shortage affects all paper types. Previously, Russia, Ukraine, and Belarus together exported over €12 billion worth of wood each year, playing a vital role in the market. European paper mills can no longer get materials from these countries, and some European producers even have factories there. Financial problems make the supply chain problems even more difficult. Sanctions restrict Russia's access to global banking systems, making it harder for European mills to do business there. Ukraine used to import over 440,000 tons of paper and board from Europe, mainly from Germany, Finland, and Poland. This trade is likely on hold for a significant amount of time. While Russia exported paper to the EU (especially Italy, Germany, and Poland), European mills can adjust to find new buyers. The bigger concern is the rise in energy prices due to the war. Since both paper and pulp production rely heavily on energy, the sanctions and rising costs of natural gas and coal will push prices up across the globe.

IMPACT OF ECONOMIC SLOWDOWN

The recent economic slowdown is expected to cause a temporary decline in the paperboard folding carton market. An anticipated decline in consumer spending on goods is expected to result in a 3.8% decrease in carton shipments for 2023 compared to the prior year. However, the long-term forecast remains positive with an average growth of 0.4% annually expected over the next five years, reaching 5.4 million tons. This growth is driven by factors like increasing demand for non-durable goods and a projected rise in consumer spending despite the slowdown.

KEY MARKET SEGMENTS:

By Type

Paperboard folding cartons come in standard and aseptic varieties. Aseptic cartons hold dominant position due to their ability to keep liquids fresh without refrigeration. Special sterilization process that extends shelf life and reduces the need for preservatives. As consumers seek convenient, long-lasting, and eco-friendly options, aseptic cartons' lightweight and recyclable build make them a market favorite.

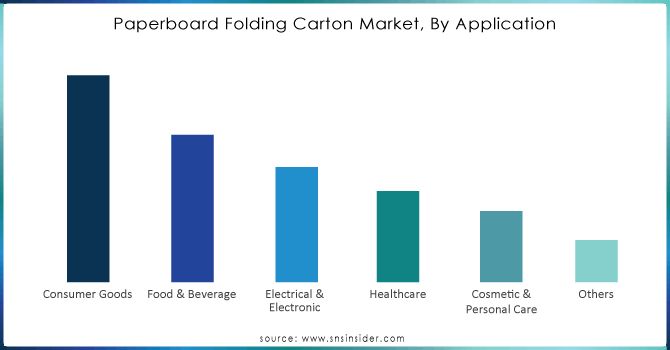

By Application

Paperboard folding cartons find uses across various industries, with food & beverage leading by market share of 43%. Their versatility lets them handle diverse shapes and sizes while ample space allows for compelling graphics and information. Additionally, their eco-friendly nature and lightweight sturdiness align with consumer preferences and logistics needs. The electrical and electronics segment is another growth area, driven by the rising demand for consumer electronics that often use folding cartons as packaging.

Need any customization research on Paperboard Folding Carton Market - Enquiry Now

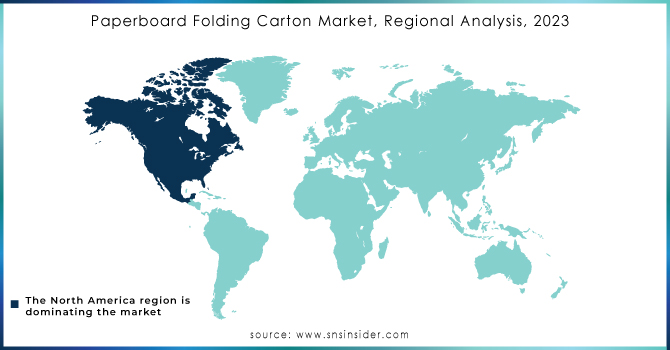

REGIONAL ANALYSES

North America leads the paperboard folding carton market for two main reasons. The region has a large and successful food and beverage industry, which uses a lot of these cartons. North America has strict laws that encourage sustainable packaging, which aligns perfectly with the eco-friendly benefits of paperboard folding cartons.

Europe follows North America in paperboard folding carton market share, driven by a growing focus on eco-friendly practices and regulations. Germany holds the biggest market share within Europe, while the UK market witnesses the fastest growth. The Asia-Pacific region is poised for the fastest growth in paperboard folding cartons fueled by a booming economy, surging consumer demand for sustainable packaging, and a rapidly expanding food and beverage sector. Within this region, China holds the largest market share, while India is experiencing the fastest growth.

KEY PLAYERS

The major key players are West Fraser Timber Co. Ltd., Graphic Packaging International LLC, Sonoco Products Company, Smurfit Kappa Group, International Paper Company, WestRock Company, Mondi Group, Elopak, Mayr-Melnhof Karton AG, Huhtamaki Oyj, Nippon Paper Industries Co. Ltd., Metsa Board Oyj, Oji Holdings Corporation and other key players.

RECENT DEVELOPMENT

-

Smurfit Kappa and Avery Dennison joined forces in November 2023 to create eco-friendly pressure-sensitive labels for folding cartons, using recycled and recyclable materials.

-

In October 2023, WestRock partnered with Henkel to create eco-friendly folding cartons made from recycled and recyclable materials for Henkel's personal care products.

-

Graphic Packaging International (GPI) strategically acquired Specialty Folding Carton, a prominent U.S. producer, in September 2023.

-

In September 2023, International Paper and Mondi teamed up to develop eco-friendly folding cartons for food and beverages, prioritizing recycled and recyclable materials.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 79.13 Bn |

| Market Size by 2032 | US$ 120.78 Bn |

| CAGR | CAGR of 4.81% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Standard Carton, Aseptic Carton) • By Application (Consumer Goods, Food & Beverage, Electrical & Electronic, Healthcare, Cosmetic & Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | West Fraser Timber Co. Ltd., Graphic Packaging International LLC, Sonoco Products Company, Smurfit Kappa Group, International Paper Company, WestRock Company, Mondi Group, Elopak, Mayr-Melnhof Karton AG, Huhtamaki Oyj, Nippon Paper Industries Co. Ltd., Metsa Board Oyj, Oji Holdings Corporation |

| Key Drivers | • The eco-conscious movement is driving demand for sustainable packaging, boosting the market. • Stricter plastic regulations are driving the move to paperboard folding cartons. |

| Key Restraints | • Balancing sustainability goals with functionality remains a hurdle for paperboard folding carton manufacturers. • Compliance with environmental regulations gives paperboard folding cartons a competitive edge in the marketplace. |