Patient Monitoring Devices Market Size & Trends:

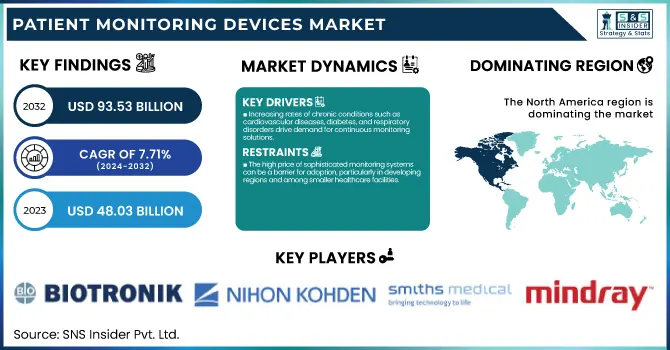

The global Patient Monitoring Devices Market was valued at USD 48.03 billion in 2023 and is expected to grow to USD 93.53 billion by 2032 and grow at a CAGR of 7.71% over the forecast period of 2024-2032.

Get More Information on Patient Monitoring Devices Market - Request Sample Report

Growing prevalence of diagnostic and monitoring devices for measuring, recording as well displaying biometric data from blood pressure, temperature to the detection status with a need in demand escalates market growth Shifting hospital care to homecare environments is a move designed in order to cut cost of treatment and it is getting common now. The COVID-19 pandemic has accelerated the utilization of remote patient monitoring devices, showing their value in providing more accessible and cost-effective care. Not only has it significantly increased the adoption of remote patient monitoring, thus supporting continuous health tracking beyond clinical settings and generating new revenue opportunities for healthcare providers while decreasing overall costs.

Chronic diseases are becoming increasingly common worldwide, which is driving the market for patient monitoring devices. The World Health Organization (WHO) reports that chronic diseases kill almost 73 % of the global deaths and cause roughly 60% burden in disease. Chronic diseases such as cardiovascular disease, chronic obstructive pulmonary disease (COPD), cancer and type II diabetes. However, by 2024 nearly 1.5 billion people live with at least one chronic disease while cardiovascular diseases are the leading cause of death worldwide affecting an estimated $520 million people globally. The diabetes affects such 537 million adults and then there are the chronic respiratory diseases spread among approximately 545 million people. A increasing number of these diseases result to growing requirement for patient monitoring devices.

Advanced monitoring systems are essential as healthcare organizations transition from ad-hoc to continuous monitoring to provide accurate data for treatment decisions. The devices are advanced technologically to help clinicians manage patients with chronic diseases, and ultimately improve care quality, reduce readmission rates and lower costs. Patient monitoring device is expected to have a market share growth as incidence of chronic disease increases and more need for regular assessment.

Patient Monitoring Devices Market Dynamics

Drivers

-

Increasing rates of chronic conditions such as cardiovascular diseases, diabetes, and respiratory disorders drive demand for continuous monitoring solutions.

-

Innovations in sensor technology, wireless communication, and integration of multiple monitoring parameters into compact devices enhance the functionality and appeal of patient monitoring systems.

-

The expanding elderly population requires regular health monitoring, boosting the demand for patient monitoring devices for managing age-related health issues.

-

The trend toward home-based care and remote patient monitoring reduces healthcare costs and increases convenience, driving the adoption of portable and user-friendly monitoring devices.

One of the major factors driving this market is growing incidence rate of chronic diseases in critical care patients. With diseases such as cardiovascular related, diabetes and respiratory issues on the rise across world we need to continuously monitor our health. The World Health Organization (WHO) reports that 73% of global deaths and 60% of the global disease burden are due to chronic diseases as of last year. Cardiovascular diseases account for around 18 million deaths in a year and are the number one cause of death globally. In the United States continue to feel an increasing burden of chronic disease on their shoulders as illustrated by data collected and compiled by the Center for Disease Control (CDC), 6.2 million adults in the U.S. have heart failure according to data from CDC, and diabetes remains on an upward trajectory with approximately 37.3 million individuals affected as of 2022. This high prevalence of chronic diseases drives the demand for patient monitoring devices, as these devices are crucial for managing and tracking the progression of such conditions.

The chronic diseases necessitate regular monitoring and long-term management, which further emphasizes the need for advanced patient-monitoring solutions. The integration of these devices into routine health practices is a good way to detect diseases early, manage them on an ongoing basis and alert timely intervention which transitionally stabilizes the patient outcomes and quality of life.

Restraints

-

The high price of sophisticated monitoring systems can be a barrier for adoption, particularly in developing regions and among smaller healthcare facilities.

-

Strict regulatory requirements and lengthy approval processes can delay the introduction of new devices to the market and increase development costs.

-

Technical issues, such as device malfunctions or calibration errors, and the costs associated with maintaining and upgrading monitoring systems can impact market growth.

The regulatory and compliance landscape for patient monitoring devices could be complicated and restrictive in nature which may hamper market growth. For example, the U.S. Food and Drug Administration (FDA) has very stringent regulations on medical device approval which includes extensive clinical testing documentation & quality control measures The FDA notes that the approval of a new medical device may require several months to even years, based on how it is classified and whose level of risk. According to the FDA's guidance on medical device regulations, establishing rigorous conditions of safety and efficacy is a prerequisite for protecting patient health FDA, "Medical Devices". This is similarly true in the European Union, where compliance with Medical Device Regulation (MDR) and a legal process will create another veil of checks to assure product integrity that can be impeded further by additional documentation demands as required by any focused audit regime which may occur from enactment till eventual legislation closure date in addition to this new EU-logical implantation. These challenges are known to slow down the product launch, raise development costs and act as a barrier for market entry or even expansion.

Patient Monitoring Devices Market Segmentation Analysis

By Product

The multi-parameter patient monitoring devices segment captured the significant revenue share 21% in 2023 of global market. They have these benefits because they operate on batteries, are cheap to implement, and the silicon systems used are very integrated combining many parameters into one compact low power solution. These recent developments can be integrated in a single chip, containing computing units and Bluetooth low-energy radios as well as ECG, respiration and pulse oximetry all along with the same circuit leading to efficient multi-parameters devices at an affordable price. This is changing as they become more important, not just in hospitals but also home care situations that are used to help diagnose a patient before being transported to an hospital and monitor the patient’s compliance with caregiver instructions.

Cardiology segment projected to grow with significant CAGR. The diagnosis and management of these heart diseases as well as cardiovascular system, Monitoring devices play a important role. This increased prevalence of cardiovascular diseases and number of cardiac surgeries is expected to drive the growth in this market. In United States 6.2 million adults have heart failure each year and thousands of people undergo cardiac surgery. With doctors, regularly tracking for complications and keeping an eye on the recovery is critically important after surgery. This should strengthen the growth of this sector and more, with an increase in cardiac monitoring technology such as GE Healthcare's Portrait Mobile along with the acquisition of Preventice Solutions by Boston Scientific Corporation.

By End use

The Hospitals dominates the monitoring devices market, and accounted revenue share of over 49.6% in 2023. The need for fast and accurate disease detection among hospitals, coupled with the rising volume of medical procedures drives this dominance. Growth in this sector is fuelled by increase in the number of patient admissions related to injuries, chronic diseases and other ailments. Monitors with multiple parameters are used to monitor vital signs such as oxygen saturation, respiration rate, blood pressure and heart in general wards and intensive care units.

It is anticipated that the home care industry will grow significantly in the upcoming years. These devices, which are to be used at home or within the hospital bedside environment include portable, adaptive and accurate therapeutic, diagnostic as well as monitoring agents. The home care is becoming mainstream part of patient monitoring devices market and as the focus shifts to deliver healthcare at home, development of these next-generation device becomes faster.

Patient Monitoring Devices Market Regional Insights

North America was the leading market in 2023, accounted for over 40% revenue share. The growth of the market in this region is driven primarily by factors such as accessible large chronic patient group, development & expansion of healthcare infrastructure; significant advances are being achieved for wireless and portable devices compatible with smart gadgets aimed to reduce out-of-pocket expenditure. Key players, including GE Healthcare, Edwards Lifesciences, Masimo Corporation and Natus Medical are investing heavily in research to improve patient monitoring technologies also adds up market value. An aging population, increasing rates of chronic disease prevalence and the ability to access wireless or portable components along with complex reimbursement schemes that reduce patient cost. As an example, a study from the Public Health Agency of Canada found that seniors report high prevalence rates for ischemic heart disease and chronich obstructive pulmonary disorder. The Canadian Chronic Disease Surveillance System also estimated that close to 6.3 million adults aged 65 and older would live with chronic diseases in future. In the U.S., significant market growth is anticipated due to new product launches and approvals. Specifically, Abbott launched the insertable cardiac monitor Jot Dx in July 2021 and Sleepiz' named device Sleepiz One+ cleared by FDA in age of july 2022. It is anticipated that these advancements will fuel the growth of the market.

The Asia Pacific region reportedly shows significant growth on the grounds of sedentary lifestyle checked with growing chronic diseases such as obesity and diabetes. The large diabetic populations in China and India are helping fuel market growth due, at least partially to greater levels of awareness on diabetes prevention.

Need any customization research on Patient Monitoring Devices Market - Enquiry Now

Key Patient Monitoring Devices Companies in the Market

-

Smiths Medical: BCI Pulse Oximeters, Capnographs

-

Biotronik: BioMonitor Series

-

Mindray Medical International Ltd.: BeneVision Series

-

Koninklijke Philips N.V.: IntelliVue Series

-

Nihon Kohden: Life Scope Series

-

Welch Allyn: Connex Vital Signs Monitor

-

Health anywhere Inc.

-

Intel

-

GE Healthcare: CARESCAPE Monitor Series

-

Medtronic: Nellcor

-

Bosch

-

Masimo Corporation: Patient SafetyNet

Recent Developments in Patient Monitoring Devices Market

-

GE HealthCare’s CARESCAPE Canvas Patient Monitoring Platform secured clearance from the FDA in April 2023. Together with CARESCAPE ONE, the platform will allow for a modular system that can scale up monitoring features to match the severity of each patient's status.

-

In Jan 2023, Senet and Telli Health Introduce First LoRaWAN-based Remote Patient Monitoring Hardware It enables access to healthcare in distant places and regions with scarce resources, such as indigenous communities whose health inequalities can be reduced by the implementation of this type of technology opening the scenario for future smart home services.

-

In June 2022, Abbott received approval from the FDA for its FreeStyle Libre 2 (iCGM) device in adults and children with diabetes throughout the United States. It monitors blood sugar levels every minute and gives real-time alarms to help diabetics keep an eye on their glucose levels.

-

Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (Top 3 medical equipment manufacturer in the world) launched wearable patient monitor- mWear In May,2022. The unit has two configurations wearable mode (home monitoring mode) and continuous mode with indication lights showing carers the patient is ok in accordance with custom parameters set.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 48.3 Billion |

| Market Size by 2032 | USD 93.53 Billion |

| CAGR | CAGR of 7.71% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Blood Glucose Monitoring Systems, Cardiac Monitoring Devices, Multi-parameter Monitoring Devices., Respiratory Monitoring Devices, Temperature Monitoring Devices, Hemodynamic/Pressure Monitoring Devices, Fetal & Neonatal Monitoring Devices, Weight Monitoring Devices, Other Patient Monitoring Devices) • By End-use (Hospitals, Ambulatory Surgery Centers, Home Care Settings, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Smiths Medical, Biotronik, Mindray Medical International Ltd., Koninklijke Philips N.V., Nihon Kohden, Welch Allyn, Health anywhere Inc., Intel, GE Healthcare, Medtronic, Bosch, MASIMO CORPORATION |