Cardiac Monitoring Devices Market Size Analysis:

Get more information on Cardiac Monitoring Devices Market - Request Sample Report

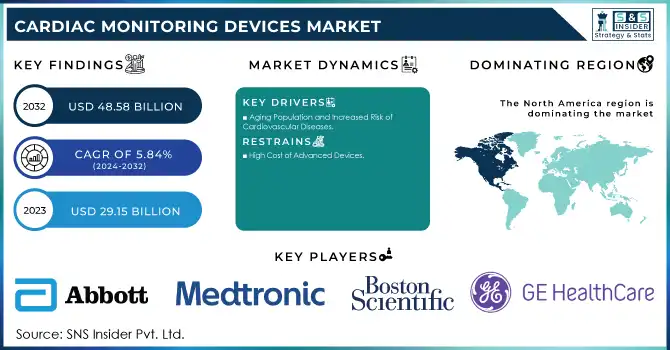

The Cardiac Monitoring Devices Market size is projected to grow from USD 29.15 billion in 2023 to USD 48.58 billion by 2032, at a Compound Annual Growth Rate (CAGR) of 5.84% during the forecast period 2024-2032.

The Cardiac Monitoring Devices Market is witnessing substantial growth, driven by the increasing prevalence of cardiovascular diseases (CVDs), technological advancements, and the growing adoption of remote patient monitoring systems. Cardiovascular diseases remain the leading cause of death globally, with the World Health Organization (WHO) estimating that 17.9 million deaths occur annually due to heart-related conditions, representing 31% of all global deaths. This rising burden of CVDs highlights the need for advanced cardiac monitoring solutions to ensure early diagnosis, timely interventions, and improved patient outcomes.

Technological innovations have revolutionized cardiac monitoring by introducing devices that offer real-time and remote tracking. Advances such as wearable electrocardiogram (ECG) monitors, wireless patches, and artificial intelligence (AI)-powered diagnostic tools have significantly improved the efficiency and accuracy of cardiac monitoring. For instance, AI-assisted ECG analysis has demonstrated a diagnostic accuracy of up to 99% in detecting arrhythmias, enabling clinicians to identify issues earlier and more reliably. Wearable technologies are particularly gaining momentum, with research indicating that continuous monitoring can enhance the early detection of conditions such as atrial fibrillation and other irregular heart rhythms.

The growing adoption of Remote Patient Monitoring (RPM) systems has further fueled market expansion. RPM allows healthcare providers to monitor patients’ cardiac health outside of clinical settings, reducing hospital readmissions and ensuring proactive care. Studies have shown that RPM significantly improves the management of chronic cardiac conditions, particularly in post-operative care and for patients with heart failure. This shift towards home-based care is also supported by increasing patient awareness and a rising preference for convenient, cost-effective healthcare solutions.

Additionally, the market is benefitting from a growing geriatric population, which is more susceptible to cardiac ailments, and improving healthcare infrastructure in emerging economies. Favorable regulatory policies and reimbursement frameworks have also played a critical role in expanding access to advanced cardiac monitoring devices globally.

Overall, the convergence of technological advancements, increasing disease prevalence, and shifting healthcare paradigms toward preventive care positions the cardiac monitoring devices market for strong and sustained growth in the coming years.

Cardiac Monitoring Devices Market Dynamics

Drivers

-

Aging Population and Increased Risk of Cardiovascular Diseases

The global aging population is one of the primary drivers of the Cardiac Monitoring Devices Market, as older adults are more susceptible to cardiovascular diseases such as arrhythmias, heart failure, and hypertension. As individuals age, their cardiovascular system undergoes changes that increase the risk of developing heart-related conditions. According to the World Health Organization (WHO), the number of people aged 60 and older is expected to double by 2050, contributing to a significant rise in cardiovascular diseases among the elderly. This demographic shift is driving the demand for advanced cardiac monitoring devices that can detect these conditions early and effectively manage them.

Older adults often require continuous monitoring to ensure that early signs of heart complications are identified before they escalate into more severe health problems. Cardiac monitoring devices, such as wearable ECG monitors, portable heart rate monitors, and smartwatches, are becoming increasingly important in enabling elderly individuals to track their heart health in real-time. These devices offer convenience, non-invasiveness, and continuous data collection, allowing healthcare providers to intervene promptly and improve patient outcomes. With the aging population set to grow substantially, the demand for innovative and reliable cardiac monitoring solutions will continue to increase, helping to enhance the quality of life and reduce the burden of heart diseases in this vulnerable group.

-

Lifestyle Changes and Rising Prevalence of Heart Diseases

The rise in sedentary lifestyles, poor dietary habits, and obesity has significantly contributed to the growing prevalence of cardiovascular diseases (CVDs) worldwide. With increased screen time, reduced physical activity, and unhealthy eating habits, more individuals are developing risk factors such as hypertension, high cholesterol, and diabetes, all of which are closely linked to heart disease. As a result, there is a heightened need for early detection and continuous monitoring of heart health to prevent complications like heart attacks, strokes, and heart failure.

These lifestyle changes have spurred demand for wearable cardiac devices that provide real-time monitoring of heart rate, blood pressure, and other vital signs. Wearable technologies, such as smartwatches and portable ECG monitors, are increasingly popular due to their ability to track heart health continuously, alert users to irregularities, and enable early intervention. These devices empower individuals to take proactive control of their cardiovascular health by offering constant insights into their condition.

-

Advancements in Remote Monitoring and Wearable Technology

Technological advancements in remote patient monitoring (RPM) and wearable devices are revolutionizing the landscape of cardiac care. RPM solutions enable healthcare providers to monitor patients' heart health outside of traditional clinical settings, reducing the need for frequent hospital visits and ensuring continuous observation. Innovations such as portable ECG monitors, smartwatches, and heart rate trackers are at the forefront of this transformation, offering non-invasive, real-time monitoring of vital cardiovascular data. These devices provide a convenient and accessible way for patients to track their heart health from the comfort of their homes, improving adherence to treatment plans and enabling timely interventions.

The integration of wearable technologies with digital health platforms allows healthcare providers to receive continuous data from patients, which can be analyzed for irregularities such as arrhythmias or abnormal heart rates. This continuous flow of data enhances the accuracy of diagnoses and leads to more personalized, tailored treatment plans. Additionally, by allowing for remote monitoring, these devices help reduce the burden on healthcare facilities and minimize unnecessary hospital admissions, especially for chronic conditions such as heart failure or hypertension. As these technologies evolve, they will continue to enhance the quality of cardiac care, improving patient outcomes and enabling more efficient healthcare delivery.

Restraints

-

High Cost of Advanced Devices

The high initial cost of advanced cardiac monitoring devices, including wearable ECG monitors and portable heart rate trackers, may limit their adoption, particularly in price-sensitive regions or among patients without adequate insurance coverage. This could hinder market growth, especially in emerging economies.

-

Data Privacy and Security Concerns

As remote monitoring devices collect sensitive patient data, concerns around data privacy and cybersecurity remain a significant barrier. Strict regulatory requirements and the potential for data breaches could slow the adoption of these devices, especially in regions with stringent data protection laws.

Cardiac Monitoring Devices Market Segmentation Analysis

By Type

In 2023, Cardiovascular Devices dominated the Cardiac Monitoring Devices Market, accounting for approximately 40% of the market share. This dominance is primarily due to their critical role in diagnosing, monitoring, and treating heart-related conditions. Devices such as ECG monitors, defibrillators, and stents are essential in hospitals, clinics, and diagnostic centers for managing heart conditions like arrhythmias, heart failure, and hypertension. The growing prevalence of cardiovascular diseases globally and the increasing healthcare investment contributed to the significant dominance of this segment.

Ambulatory Cardiac Monitoring emerged as the fastest-growing segment throughout the forecast period. This growth was driven by the rise in remote patient monitoring and the increasing demand for home-based care solutions. This segment includes wearable ECG monitors and mobile health platforms, allowing continuous tracking of heart health outside traditional clinical settings. The growth is fueled by the shift towards more flexible, patient-centric care, as ambulatory devices enable real-time data sharing with healthcare providers, making them an ideal solution for managing chronic heart conditions.

By Product Type

Multi-parameter ECG Monitors represented about 30% of the market in 2023. These monitors allow healthcare providers to track multiple vital signs—heart rate, blood pressure, oxygen levels—simultaneously, making them vital for patients with complex heart conditions. The increasing demand for real-time monitoring and the growing preference for comprehensive diagnostics contributed to the dominance of multi-parameter ECG monitors. This segment was widely used in both hospital and outpatient settings for continuous heart monitoring.

Smart Wearable Monitors, such as smartwatches and fitness trackers integrated with heart-monitoring capabilities, were among the fastest-growing product types throughout the forecast period. These devices provide users with continuous, non-invasive heart rate and rhythm tracking, along with other health metrics. As consumers increasingly prioritize personal health and fitness, the demand for smart wearable monitors has grown substantially. Their ease of use, integration with mobile applications, and ability to track heart health in real-time have made them increasingly popular, driving growth in this segment.

Cardiac Monitoring Devices Market Regional Overview

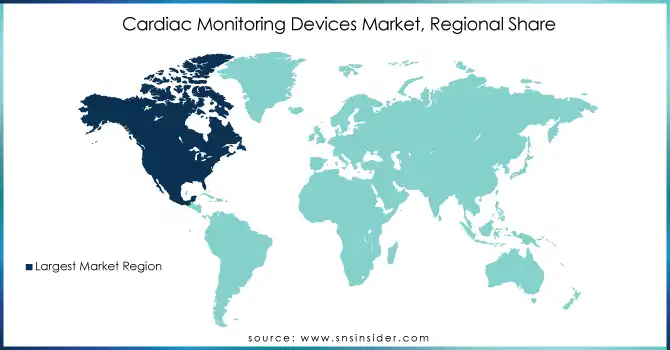

North America held the largest share of the Cardiac Monitoring Devices Market in 2023, driven by its advanced healthcare infrastructure, widespread adoption of innovative medical technologies, and a high prevalence of cardiovascular diseases. The U.S., in particular, plays a key role in the market, with substantial investments in research and development (R&D) of cardiac monitoring devices. The region is also witnessing a growing aging population, which further drives the demand for these devices. Additionally, remote patient monitoring is gaining traction, supported by favorable reimbursement policies and strong healthcare regulations. The combination of these factors contributes significantly to the growth of the cardiac monitoring devices market in North America.

Europe is the second-largest market for cardiac monitoring devices, with countries like Germany, the UK, and France at the forefront of demand. The growing incidence of cardiovascular diseases and improved healthcare access have led to an increased need for advanced cardiac monitoring solutions. Furthermore, the region's focus on preventive care and digital health has accelerated the adoption of wearable and ambulatory monitoring devices. As healthcare systems in Europe embrace the integration of advanced technologies, including artificial intelligence, this trend is expected to fuel further growth in the cardiac monitoring devices market.

The Asia-Pacific (APAC) region is the fastest-growing market for cardiac monitoring devices. Factors such as the large and aging population, increasing healthcare investments, and rising awareness of cardiovascular diseases are contributing to the demand for these devices. Countries like China, India, Japan, and Australia are witnessing rapid growth in the adoption of cardiac monitoring technologies. The rise in lifestyle diseases like hypertension and diabetes, along with the increasing use of wearable technologies, is accelerating market expansion. As healthcare infrastructure improves and government initiatives support healthcare access, the market for cardiac monitoring devices in APAC is expected to continue its rapid growth.

Need any customization research on Cardiac Monitoring Devices Market - Enquiry Now

Key Players

1. Medtronic

-

Reveal LINQ

-

HCT (Heart Failure Monitoring)

-

CareLink

2. Abbott

-

Freestyle Libre

-

Confirm Rx

-

Tavi

3. Boston Scientific Corporation

-

LUX-Dx

-

HeartLogic

-

ACUITY

4. iRhythm Technologies, Inc.

-

Zio XT

5. GE Healthcare

-

CardioSoft

-

MAC 400

-

CASE System

6. Biotronik, Inc.

-

BioMonitor 2

-

Edora 8/6/4

-

Visions 2

7. SCHILLER Healthcare India Pvt. Ltd

-

CARDIOVIT AT-102 G2

-

CARDIOVIT FT-1

8. Koninklijke Philips N.V.

-

Philips HeartStart

-

IntelliVue Patient Monitoring

-

BioTel Heart

9. MicroPort Scientific Corporation

-

Apollo

-

Renata

10. Honeywell Life Care Solutions

-

LifeStream

-

AMT Cardiac Monitoring System

-

Care Assure

Recent Development

In Nov 2024, Monitra Health secured a US patent for its innovative wireless cardiac monitoring technology. The newly patented device features a wireless patch designed to enhance patient compliance and improve diagnostic accuracy in cardiac monitoring.

In July 2024, Octagos Health secured over USD 43 million in a Series B funding round, led by Morgan Stanley Expansion Capital and supported by Mucker Capital and other investors. This investment will help advance the company's AI-driven cardiac device monitoring solutions and accelerate its mission to transform cardiac care.

In May 2024, OMRON Healthcare India partnered with AliveCor to launch AI-powered home heart health monitoring devices, aiming to enhance at-home cardiac care with advanced technology for better monitoring and early detection.

In May 2024, WearLinq acquired AMI Cardiac Monitoring and secured USD 6.7 million in funding to develop its FDA-cleared 6-lead ECG device. This acquisition strengthens WearLinq's position in the cardiac monitoring market, enhancing its product offerings.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 29.15 billion |

| Market Size by 2032 | USD 48.58 Billion |

| CAGR | CAGR of 5.84% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Cardiovascular Devices, Multi-Parameter ECG Monitors, Patient Monitoring Devices, Ambulatory Cardiac Monitoring, Cardiac Monitors) • By Product Type (Portable Monitor, Smart Wearable Monitor, Standard Monitor) • By Application (Coronary Heart Diseases, Sudden Cardiac Arrest, Stroke, Arrhythmia, Congenital Heart Diseases, Heart Failure, Pulmonary Hypertension, Heart Function, Pulmonary Artery Pressure) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic, Abbott, Boston Scientific Corporation, iRhythm Technologies, Inc., GE Healthcare, Biotronik, Inc., SCHILLER Healthcare India Pvt. Ltd, Koninklijke Philips N.V., MicroPort Scientific Corporation, and Honeywell Life Care |

| Key Drivers | • Aging Population and Increased Risk of Cardiovascular Diseases • Lifestyle Changes and Rising Prevalence of Heart Diseases • Advancements in Remote Monitoring and Wearable Technology |

| Restraints | • High Costs and Data Privacy Concerns Restricting Adoption of Advanced Cardiac Monitoring Devices |