Payment Analytics Software Market Report Scope & Overview:

The Payment Analytics Software Market was valued at USD 3.91 billion in 2025E and is expected to reach USD 5.83 billion by 2033, growing at a CAGR of 5.18% from 2026-2033.

The Payment Analytics Software Market is growing due to increasing digital payment adoption, rising transaction volumes, and the need for real-time monitoring and fraud prevention. Businesses across BFSI, retail, and e-commerce sectors are investing in advanced analytics solutions to optimize payment processes, enhance customer experience, and ensure regulatory compliance. Technological advancements in AI, cloud-based platforms, and predictive analytics further accelerate adoption, driving sustained market growth between 2026 and 2033.

Payment Analytics Software Market Size and Forecast

-

Payment Analytics Software Market Size in 2025: USD 3.91 Billion

-

Payment Analytics Software Market Size by 2033: USD 5.83 Billion

-

CAGR: 5.18% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Infrastructure as a Service Market - Request Free Sample Report

Payment Analytics Software Market Trends

-

Rising need for data-driven insights to optimize payment operations is driving the payment analytics software market.

-

Growing adoption of digital payments, e-wallets, and real-time transactions is boosting demand for advanced analytics tools.

-

Expansion of fraud detection, risk management, and compliance monitoring applications is fueling market growth.

-

Integration with AI, machine learning, and big data platforms is enhancing transaction visibility and predictive capabilities.

-

Increasing focus on improving customer experience, authorization rates, and revenue optimization is shaping adoption trends.

-

Advancements in cloud-based and API-driven analytics solutions are improving scalability and deployment flexibility.

-

Collaborations between payment service providers, fintech firms, and software vendors are accelerating innovation and global market expansion.

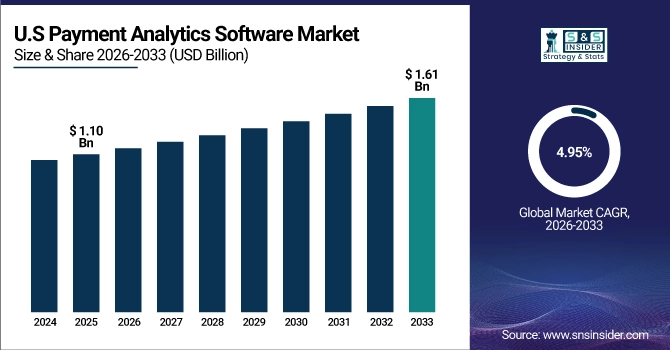

U.S. Payment Analytics Software Market was valued at USD 1.10 billion in 2025E and is expected to reach USD 1.61 billion by 2033, growing at a CAGR of 4.95% from 2026-2033.

The U.S. Payment Analytics Software Market is growing due to widespread digital payment adoption, increasing transaction volumes, rising fraud prevention needs, and strong investments by banks and e-commerce businesses in AI-driven analytics solutions to optimize payments and ensure compliance.

Payment Analytics Software Market Growth Drivers:

-

Real-time digital payment expansion and rising transaction volumes demand advanced analytics for visibility, control, and performance optimization

Rapid growth in digital payments across e-commerce, mobile wallets, and cross-border transactions is increasing transaction complexity and volume. Businesses require immediate visibility into payment performance, failures, settlement delays, and conversion rates to protect revenue. Payment analytics software enables real-time monitoring, pattern identification, and actionable insights across multiple payment channels. Merchants, banks, and payment processors rely on analytics to reduce declines, optimize authorization rates, and improve customer checkout experiences. As payment ecosystems become multi-provider and multi-currency, analytics tools support operational efficiency and strategic decision-making. This increasing dependency on data-driven payment intelligence is strongly accelerating market adoption across industries.

Payment Analytics Software Market Restraints:

-

High implementation costs and integration complexity limiting adoption among smaller organizations and legacy infrastructure environments

Payment analytics solutions often require significant upfront investment in software licensing, infrastructure, and skilled personnel. Integration with existing payment gateways, banking systems, and legacy ERP platforms can be technically complex and time-consuming. Small and medium enterprises struggle to justify costs when immediate ROI is unclear. Data normalization across multiple payment providers further increases deployment challenges. Ongoing maintenance, customization, and model updates add to operational expenses. These financial and technical barriers slow adoption, particularly in cost-sensitive markets and organizations with fragmented IT ecosystems, restricting broader market penetration despite strong demand drivers.

Payment Analytics Software Market Opportunities:

-

AI-driven predictive analytics enabling proactive payment optimization, fraud prevention, and personalized customer payment experiences

Advancements in artificial intelligence and machine learning are transforming payment analytics from reactive reporting to predictive intelligence. Businesses can forecast transaction failures, fraud risks, and customer payment preferences before issues arise. This enables proactive optimization of routing, pricing, and authorization strategies. Personalized payment experiences improve conversion rates and customer loyalty. Vendors offering AI-powered insights, automation, and self-learning models gain competitive advantage. As enterprises seek intelligent decision-making tools rather than static dashboards, demand for advanced, AI-driven payment analytics solutions presents strong growth opportunities across global digital commerce ecosystems.

Payment Analytics Software Market Segment Highlights

-

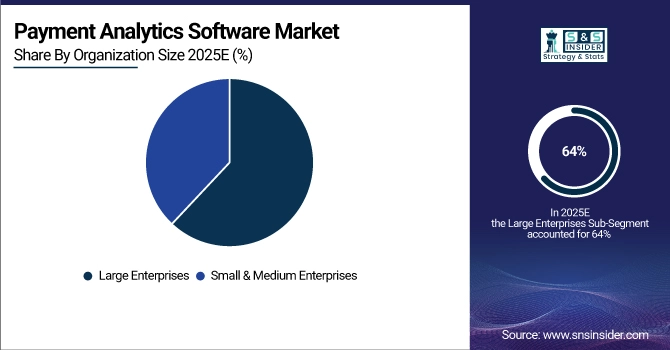

By Organization Size, Large Enterprises dominated with ~64% share in 2025; Small & Medium Enterprises fastest growing (CAGR).

-

By Analytics Type, Predictive Analytics dominated with ~34% share in 2025; Prescriptive Analytics fastest growing (CAGR).

-

By End-Use Industry, BFSI dominated with ~35% share in 2025; Retail & E-commerce fastest growing (CAGR).

-

By Deployment Mode, Cloud-Based dominated with ~70% share in 2025; Cloud-Based fastest growing (CAGR).

Payment Analytics Software Market Segment Analysis

By Organization Size

Large Enterprises segment dominated the Payment Analytics Software Market in 2025 due to their extensive transaction volumes, complex payment ecosystems, and significant investments in advanced analytics solutions to optimize revenue, ensure compliance, and enhance operational efficiency. Their ability to adopt and integrate sophisticated platforms drives higher market revenue.

Small & Medium Enterprises segment is expected to grow at the fastest CAGR from 2026-2033 because cloud-based and subscription models lower entry barriers. Increasing digital payment adoption among SMEs and rising awareness of fraud prevention and payment optimization solutions are fueling rapid adoption of analytics platforms in this segment.

By Analytics Type

Predictive Analytics segment dominated the Payment Analytics Software Market in 2025 as it enables organizations to forecast transaction failures, detect fraud patterns, and optimize payment processes proactively. Businesses leverage predictive insights to improve operational efficiency, reduce financial losses, and enhance customer experience, driving higher adoption and revenue generation.

Prescriptive Analytics segment is expected to grow at the fastest CAGR from 2026-2033 due to its ability to provide actionable recommendations, automate payment routing, optimize authorization rates, and support strategic decision-making. The increasing demand for AI-driven decision-making in complex payment ecosystems accelerates its adoption across industries.

By End-Use Industry

BFSI segment dominated the Payment Analytics Software Market in 2025 owing to its high transaction volumes, strict regulatory requirements, and focus on fraud prevention. Banks, financial institutions, and payment processors invest heavily in analytics solutions to manage risk, optimize payment performance, and maintain compliance, driving market revenue.

Retail & E-commerce segment is expected to grow at the fastest CAGR from 2026-2033 because digital commerce expansion and multi-channel payments create complex transaction data. Analytics platforms help merchants optimize checkout, reduce declines, detect fraud, and enhance customer experience, leading to accelerated adoption and strong market growth in this segment.

By Deployment Mode

Cloud-Based segment dominated the Payment Analytics Software Market in 2025 and is expected to grow at the fastest CAGR from 2026-2033 due to its scalability, flexibility, and cost-efficiency. Organizations prefer cloud deployment for seamless integration with multiple payment gateways, real-time data processing, and reduced IT infrastructure costs. Cloud solutions enable rapid implementation, remote access, and automatic updates, making them ideal for businesses of all sizes. Growing digital payments and the need for agile analytics further accelerate adoption in this segment.

Payment Analytics Software Market Regional Analysis

North America Payment Analytics Software Market Insights

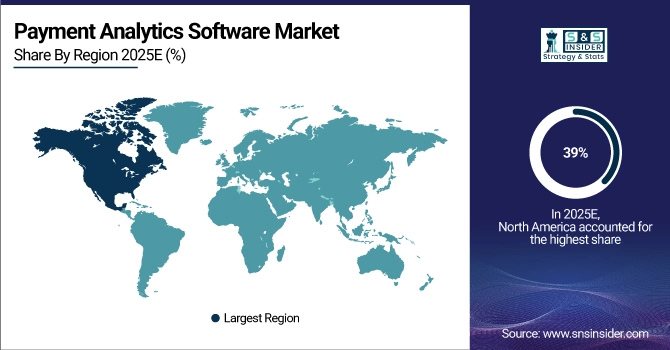

North America dominated the Payment Analytics Software Market with the highest revenue share of about 39% in 2025 due to its advanced digital payment infrastructure, high adoption of AI-driven analytics solutions, and presence of major global payment solution providers. Businesses prioritize fraud prevention, real-time transaction monitoring, and regulatory compliance, driving significant investments. Strong financial services, e-commerce growth, and technological innovation further contribute to the region’s leading market revenue and sustained dominance.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Payment Analytics Software Market Insights

Asia Pacific segment is expected to grow at the fastest CAGR of about 6.78% from 2026-2033 due to rapid digital payment adoption, increasing smartphone and internet penetration, and expanding e-commerce activities. Government initiatives promoting cashless transactions and fintech innovations are boosting analytics solution adoption. Growing SMEs and rising awareness of fraud prevention and operational optimization accelerate demand, positioning the region as the fastest-growing market for payment analytics software.

Europe Payment Analytics Software Market Insights

Europe in the Payment Analytics Software Market is witnessing steady growth due to strong regulatory frameworks, widespread adoption of digital payments, and increasing focus on fraud prevention. Banks, financial institutions, and e-commerce players invest in analytics platforms to ensure compliance, optimize transaction performance, and enhance customer experience. Technological advancements, coupled with growing awareness of AI-driven payment insights, are driving adoption, making Europe a significant contributor to the global market revenue.

Middle East & Africa and Latin America Payment Analytics Software Market Insights

Middle East & Africa and Latin America in the Payment Analytics Software Market are experiencing growth driven by increasing digital payment adoption, rising fintech investments, and supportive government initiatives promoting cashless economies. Businesses are deploying analytics solutions to optimize transactions, prevent fraud, and enhance customer experience. Expanding e-commerce, improving infrastructure, and growing fintech ecosystems further accelerate market demand and attract investments from global analytics solution providers across both regions.

Payment Analytics Software Market Competitive Landscape:

Stripe

Stripe is a leading global payments technology company enabling businesses to accept online and in-person payments. It emphasizes developer-friendly APIs, seamless payment processing, and advanced analytics. By integrating AI and machine-learning tools, Stripe enhances fraud detection, revenue forecasting, and operational efficiency. Its solutions support e-commerce, marketplaces, and enterprise-scale operations, driving growth in global payment volumes while continuously innovating checkout optimization, orchestration, and analytics-driven insights.

-

2025: Stripe’s total payment volume hit $1.4 trillion in 2024, driven by AI-enhanced payments analytics and fraud tools.

-

2024: At Stripe Sessions 2024, 50+ new features were introduced, including enhanced analytics, fraud insights, and billing improvements for revenue analysis and forecasting.

-

2025: Stripe Sessions 2025 revealed Stripe Orchestration, AI-based analytics in Radar fraud scoring, and checkout optimization tools for improved transaction understanding.

Adyen

Adyen is a global payments platform providing end-to-end solutions for online, in-store, and mobile payments. The company focuses on data-driven insights, real-time analytics, and AI-enabled optimization to improve conversion rates, reduce fraud, and enhance merchant operations. Adyen serves enterprises across retail, F&B, and e-commerce sectors, offering innovative point-of-sale (POS) hardware, AI-powered analytics suites, and scalable payment solutions that streamline global commerce.

-

2025: Adyen released two new POS terminals (S1E4 Pro and S1F4 Pro), improving in-person payment analytics and operational insights for merchants.

-

2025: Adyen launched Adyen Uplift, an AI-powered analytics suite optimizing payment funnels, boosting conversions, and controlling fraud through data-driven insights.

PayPal

PayPal, including its Braintree division, is a global leader in digital payments, offering secure, scalable, and AI-enhanced solutions for merchants and consumers. The company integrates analytics and machine-learning capabilities into checkout, fraud detection, and transaction management. PayPal focuses on enabling international commerce, optimizing conversion rates, and delivering seamless payment experiences while expanding digital-payment access in emerging markets through strategic partnerships and localized solutions.

-

2025: PayPal announced Commerce BigCommerce Payments powered by PayPal, delivering advanced checkout analytics and merchant insights for U.S. sellers.

-

2025: Committed $100 million to accelerate digital growth in Middle East & Africa, offering localized payments and analytics support for merchants.

-

2025: Partnered with OpenAI to integrate PayPal payments into ChatGPT, enabling AI-powered transaction experiences and UX/analytics enhancements.

Key Players

Some of the Payment Analytics Software Market Companies

-

Stripe

-

Adyen

-

PayPal (Braintree)

-

ACI Worldwide

-

FIS

-

Fiserv

-

Global Payments

-

Worldline

-

Visa

-

Mastercard

-

Oracle (Payments/Analytics)

-

SAS

-

NICE Actimize

-

Forter

-

Riskified

-

Signifyd

-

Featurespace

-

Sift

-

Corefy

-

Chargebee

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 3.91 Billion |

| Market Size by 2033 | USD 5.83 Billion |

| CAGR | CAGR of 5.18% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment Mode (Cloud-Based, On-Premise) • By Organization Size (Large Enterprises, Small & Medium Enterprises) • By Analytics Type (Descriptive Analytics, Diagnostic Analytics, Predictive Analytics, Prescriptive Analytics) • By End-Use Industry (BFSI, Retail & E-commerce, Hospitality & Travel, Healthcare, Media & Entertainment, IT & Telecommunication) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Stripe, Adyen, PayPal (Braintree), ACI Worldwide, FIS, Fiserv, Global Payments, Worldline, Visa, Mastercard, Oracle (Payments/Analytics), SAS, NICE Actimize, Forter, Riskified, Signifyd, Featurespace, Sift, Corefy, Chargebee |