Peanut Oil Market Report Scope & Overview:

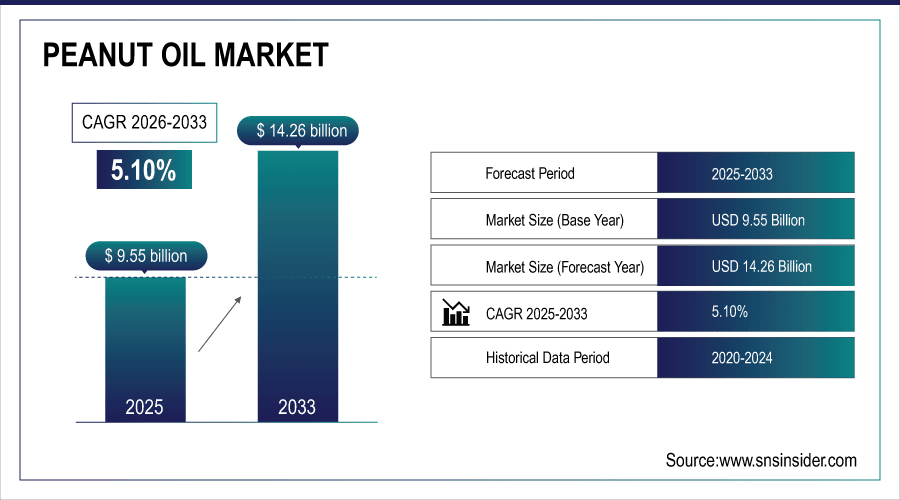

The Peanut Oil Market size was valued at USD 9.55 Billion in 2025E and is projected to reach USD 14.26 Billion by 2033, growing at a CAGR of 5.10% during 2026-2033.

The global peanut oil market is gaining steady momentum owing to its rising prominence as a healthy edible oil, growing edible oil consumption trends coupled with the hovering demand for peanut oil application in food, personal care, and pharmaceuticals. As demand will further be backed by strong adoption across Asia Pacific households where peanut oil is still culturally important. Moreover, the increase in prevalence of natural and organic products worldwide is contributing to market growth, positioning peanut oil as a healthy and versatile option for a variety of consumers, as well as a sustainable option.

Over 50% of consumers globally prefer oils with high monounsaturated fat content, supporting heart-healthy diets.

To Get More Information On Peanut Oil Market - Request Free Sample Report

Peanut Oil Market Trends

-

Rapid growth of the food processing industry is significantly increasing demand for peanut oil in snacks, confectionery, and packaged foods.

-

Peanut oil’s longer shelf life, neutral taste, and high smoke point make it ideal for processed and convenience food applications.

-

Rising urbanization and working populations are driving higher consumption of processed foods, boosting peanut oil’s use in cooking and manufacturing.

-

Food chains and packaged product companies are increasingly incorporating peanut oil into formulations to meet demand for reliable cooking media.

-

Growing consumer preference for natural and organic oils is creating strong opportunities for organic peanut oil in food and personal care.

-

Expanding e-commerce platforms and specialty retail channels are enhancing accessibility, fueling premiumization and high-value growth for organic peanut oil.

U.S. Peanut Oil Market Insights

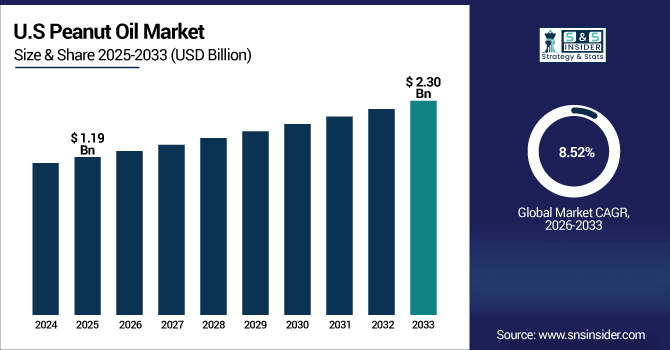

The U.S. Peanut Oil Market size was valued at USD 1.19 Billion in 2025E and is projected to reach USD 2.30 Billion by 2033, growing at a CAGR of 8.52% during 2026-2033.

The U.S. peanut oil market is boosted by rising consumer demand for heart healthy oil, high adoption of peanut oil in processed food, and increasing use from foodservice outlets. Peanut oil is also used in personal care and cosmetics sector due to its moisturizing and antioxidant properties, which further proven growth for the economic sector. Increasing interest in premium organic peanut oil types, growing retail penetration, and exploratory movements of culinary players, thereby paving the way for the U.S. peanut oil market to emerge as potential buoyant growth region in the upcoming years.

Peanut Oil Market Growth Drivers:

-

Expanding Food Processing Industry and Increasing Utilization of Peanut Oil Across Snacks, Confectionery, And Packaged Food Products Globally

Rapid growth in food processing industry plays a key role in increasing the requirement for peanut oil. Peanut oil is finding application in food manufacturing for snacks, confectionery and food packaged product as it has a longer shelf life, neutral taste and high smoke point. Higher processed food consumption, particularly among the urban and working population, reinforces peanut oil as a good cooking media. The increasing need for convenience food products are instigating food chains and packaged product corporations to comprise peanut oil into formulations, providing a sustainable opportunity for market growth globally.

Over 35% of buyers globally opted for organic or plant-based oils in 2025, emphasizing sustainability and clean-label preferences.

Peanut Oil Market Restraints:

-

High Prevalence of Peanut Allergies Among Consumers Leading to Safety Concerns and Limited Use in Packaged and Retail Food Products

The hurdle preventing people consuming peanut oil on a more widespread basis is peanut allergies. Despite the fact that most refined peanut oil is regarded allergenic-free, concerns on the part of consumers and warnings from regulatory agencies result in reluctance on the part of foodservice and retail to use peanut oil. The growth of peanut oil in the common applications has been restricted as it is often avoided by packaged products manufacturers to minimize allergic reactions. Additionally, a rise in campaigns highlighting food allergies and safety labeling adds even more roadblocks. Thus, allergen-related limitations weaken peanut oil in its competition with other vegetable oils such as soybean and sunflower oil.

Peanut Oil Market Opportunities:

-

Rising Demand for Natural and Organic Oils in Food and Personal Care Applications Across Developed and Emerging Economies Globally

The increasing trend towards natural and organic products offers a lucrative opportunity for peanut oil. Market Drivers Consumers are opting for the rise in consumer consumption for pesticides-free, high-end oils in the formulations of food and personal care to drive the market. The broad skin nurturing and anti-oxidant property of organic peanut oil has made it gaining a great traction among market players seeking to leverage consumer preference of organic and natural base related products. Consumers in developed economies are willing to pay more for organic variants in food applications owing to health conscious attitude. The growing accessibility due to the increasing penetration of e-commerce platforms and specialty retail channels captures the high-value growth potential of organic peanut oil.

Over 55% of consumers globally in 2025 reported preferring organic oils due to health and wellness benefits.

Peanut Oil Market Segment Analysis

-

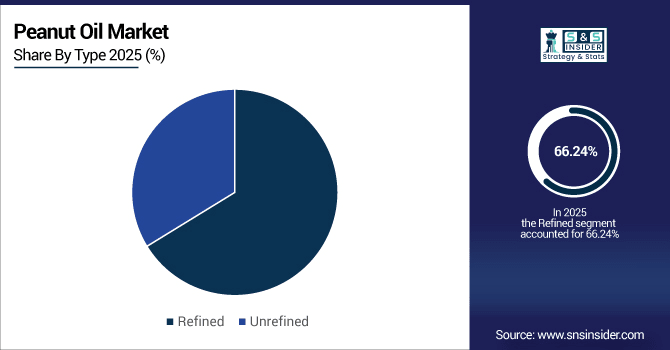

By Type, Refined led the Peanut Oil Market with a 66.24% share in 2025E, while Unrefined is the fastest-growing segment with a CAGR of 6.65%.

-

By Product, the Hot Pressed sector dominated the market with 71.25% share in 2025E, whereas the Cold Pressed segment is expected to grow fastest with a CAGR of 6.26%.

-

By Application, Food led the market with 61.38% share in 2025E, while Personal Care is registering the fastest growth with a CAGR of 14.61%.

-

By Distribution Channel, B2B held 74.83% share in 2025E, while B2C is growing the fastest with a CAGR of 8.71%.

By Type, Refined Leads Market While Unrefined Registers Fastest Growth

Refined segment had a major revenue share of around 32.84% in 2025E within the Peanut Oil Market due to longer shelf life, one of the neutral edible oils, higher stability during cooking and for foodservice purposes. The unrefined segment is anticipated to register the highest CAGR of approximately 17.33% during 2026-2033, as the demand for least processed oils is gaining traction amongst consumers. An increase in demand for consumption of products due to the growing trend of cold-pressed and natural peanut oil portfolios among companies such as ADM which will enhance fuel growth in specialty cooking and personal care application segments.

By Product, Hot Pressed Dominate While Cold Pressed Shows Rapid Growth

In 2025E, the Peanut Oil Market accounted for the largest revenue share of approximately 41.62% in the Hot Pressed segment, as Hot Pressed methods are more yield efficient and cost-efficient at an industrial scale. The Cold Pressed segment is also projected to register the fastest growth over the forecast period, at a CAGR of approximately 16.38% from 2026-2033, owing to the growing demand for nutrient-rich and chemicals-free oils. Taking advantage of this trend, Wilmar International is ramping-up its cold-pressed peanut oil sales in Asia-Pacific markets.

By Application, Food Lead While Personal Care Registers Fastest Growth

Food segment led the Peanut Oil Market segment in terms of share approximately of 72.52% in 2025E owing to usage in cooking, frying and packaged food. The Personal Care segment is expected to be the fastest growing with a CAGR of 14.61% during 2026-2033 in peanut oil at the penetration of peanut oil as a moisturizer and antioxidant in cosmetics. Capitalizing on this trend, Cargill is launching peanut oil-based ingredients for skin and hair care applications.

By Distribution Channel, B2B Lead While B2C Grow Fastest

B2B segment captured highest share with 48.36% in 2025E due to food manufactures, restaurants and other industrial users who demand bulk supply of peanut oil for consistent quality. Nonetheless, due to increasing retail and e-commerce penetration, the B2C segment is anticipated to cement the fastest CAGR of 17.10% throughout the forecasted period 2026-2033. Olam International is investing in consumer-facing brands and digital channels to benefit from this new consumer demand direct to consumer.

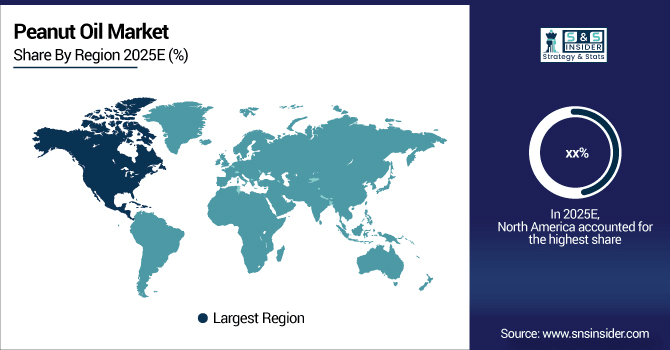

Peanut Oil Market Regional Analysis:

North America Peanut Oil Market Insights

North America is estimated to grow at the fastest CAGR of approximately 9.12% over 2026-2033 prompted by the growing health-conscious population, where the consumers choose heart-healthy & organic oils. This is further boosted by the increasing demand for clean-label products, in addition to the adoption of peanut oil in natural cosmetics and personal care. This further solidifies its adoption throughout the U.S. and Canada against deepening retail penetration and product innovations.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Peanut Oil Market Insights

U.S. leads North America peanut oil market owing to high consumer preferences for heart healthy oils and developing food processing industry, and growing personal care applications. With a high percentage of retail penetration complemented by growing consumer base for the organic types, U.S. maintains the zenith.

Asia-Pacific Peanut Oil Market Insights

The Asia Pacific region held the highest revenue share of approximately 38.62% in 2025E, driven by significant production of peanuts and higher per-capita consumption of peanut oil in China and India, where cultural preferences for peanut oil are established owing to its importance in traditional cooking. It also enjoys developed processing industries and export growth, making it the biggest and most important market globally.

China Peanut Oil Market Insights

China accounts for most of the Asia pacific peanut oil and is also the largest peanut growing country in the world and due to cultural factors, a lot of food is cooking with peanut oil, and the domestic consumption is also the largest among Asia pacific countries. Familiar processing capabilities and expanding outbound shipments bolster China's role as the key regional market.

Europe Peanut Oil Market Insights

Europe accounts for a large portion of the Peanut Oil Market, backed by high preference towards sustainable seafood alternatives backed by friendly government regulations and the growing flexitarin population. Germany, the U.K., and the Netherlands are some leading adopters, driven by retail expansions and foodservice innovations. As a result, growing investments toward R&D and clean-label products will further contribute to the regional market growth.

Germany Peanut Oil Market Insights

Germany is the largest peanut oil market, where the demand for high quality edible oils, especially organic and cold-pressed, is on the rise. With an advanced food processing industry, an increasing health-conscious consumer base, and increasing utility in the cosmetics and pharmaceutical sector, Germany cements its place as a market leader.

Latin America (LATAM) and Middle East & Africa (MEA) Peanut Oil Market Insights

The Middle East & Africa Peanut Oil Market and the Latin America Peanut Oil Market are also expanding on the back of growing awareness pertaining to health and rise in foodservice as well as retail penetrations. Large-scale cultivation has triggered in the geography to drive the Saudi Arabia, UAE, and South Africa, lead MEA, Brazil in Latin America, motivates the large-scale cultivation, supported by demand from Argentina and growing preference for organic oils.

Peanut Oil Market Competitive Landscape:

ADM is a global leader in agricultural processing and food ingredients and a major player in edible oils in North America, Europe, and South America. They specialize in sustainable sourcing, refining and distribution of food and industrial oils. Through its Refined Peanut Oil, the company caters to a wide array of frying and processed foods which utilize the oil due to its stability, while its Cold-Pressed Organic Peanut Oil targets health conscious consumers and the premium segment in search for natural and minimum processed oil solutions.

-

In June 2025, ADM adjusted its soybean purchase bids ahead of anticipated changes in U.S. biofuel blending requirements. This move, which included lowering local cash prices by about 6.5%, reflects ADM's proactive approach to market dynamics and its impact on oilseed processing.

Cargill, an American multinational, is a key player in edible oils and agribusiness services around the globe. Its vast distribution network enhances its participation in the peanut oil market. Refined Peanut Cooking Oil finds widespread application in foodservice and packaged products bought primarily because of its high smoke point and neutral flavour combined with Peanut Oil for Cosmetics offers moisturizing and antioxidant properties addressing trends regarding natural personal care and skin care industries.

-

In April 2024, Cargill's 2024 TrendTracker report highlights the "EXPERIENCE it" macro trend, emphasizing consumer desire for indulgent yet affordable food experiences. This trend influences Cargill's innovation in premium and sustainable ingredients, including specialty oils.

Wilmar International, based in Singapore, is one of the largest integrated agribusiness groups in Asia with operations that range from cultivation and refining to distribution. The company has a big presence on the global peanut oil market. The companies Hot-Pressed Peanut Oil yields better and costs lower than other oils for food manufacturers, while its Organic Cold-Pressed Peanut Oil is sold at a premium for health-conscious consumers as a nutritionally beneficial ingredient that complements fits in this trend for organic and clean-label edible oils.

-

In October 2024, Wilmar International reported an 8% increase in overall sales volume, driven by stronger sales across most product categories. This growth is attributed to improved raw material prices and consumer demand for higher quality, safer, and more nutritious products.

Peanut Oil Market Key Players:

Some of the Peanut Oil Market Companies are:

-

Archer Daniels Midland Company (ADM)

-

Cargill

-

Olam International

-

Wilmar International

-

CHS Inc.

-

Bunge Limited

-

AAK AB

-

Shandong Luhua Group Co., Ltd

-

COFCO Corporation

-

Hain Celestial Group, Inc.

-

Liberty Oil Mills Limited

-

Sahaj Oil & Food Private Limited

-

Agrocrops

-

Shree Uday Oil & Foods Industries

-

Qingdao Changsheng Group

-

3F Industries Ltd.

-

ATC Group India

-

Marico Limited

-

Mother Dairy Fruit & Vegetable Pvt Ltd

-

Henry Lamotte Oils GmbH

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 9.55 Billion |

| Market Size by 2033 | USD 14.26 Billion |

| CAGR | CAGR of 5.1% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Refined, Unrefined) • By Product (Cold Pressed, Hot Pressed) • By Application (Food, Personal Care, Pharmaceuticals, Others) • By Distribution Channel (B2B, B2C [Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Others]) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Archer Daniels Midland Company (ADM), Cargill, Olam International, Wilmar International, CHS Inc., Bunge Limited, AAK AB, Shandong Luhua Group Co., Ltd, COFCO Corporation, Hain Celestial Group, Inc., Liberty Oil Mills Limited, Sahaj Oil & Food Private Limited, Agrocrops, Shree Uday Oil & Foods Industries, Qingdao Changsheng Group, 3F Industries Ltd., ATC Group India, Marico Limited, Mother Dairy Fruit & Vegetable Pvt Ltd, Henry Lamotte Oils GmbH, and Other. |