Personal Loans Market Report Scope & Overview:

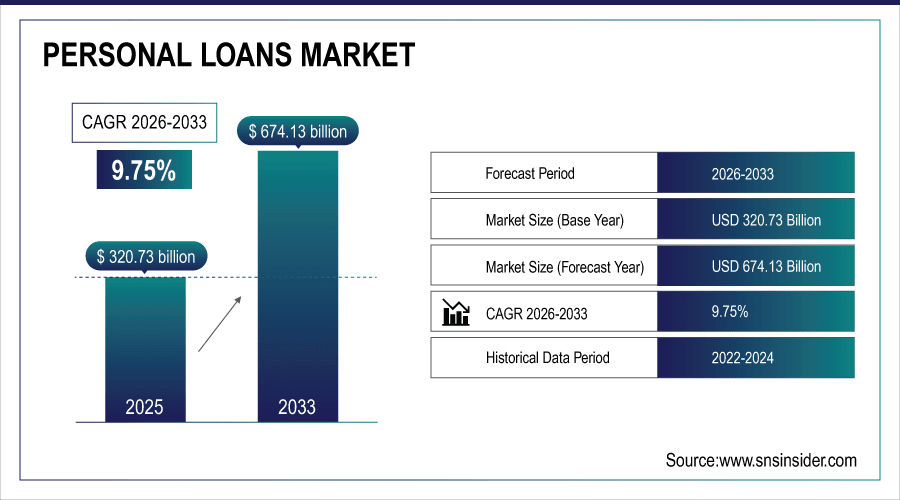

The Personal Loans Market Size was valued at USD 320.73 Billion in 2025E and is expected to reach USD 674.13 Billion by 2033 and grow at a CAGR of 9.75% over the forecast period 2026-2033.

The Personal Loans Market growth is primarily driven by the increasing demand for flexible borrowing solutions among consumers. Unlike traditional loans, PLOC allows borrowers to access funds up to a pre-approved limit, providing financial flexibility for emergencies, large purchases, or ongoing expenses. The rising awareness of personal financial management, coupled with the proliferation of digital banking platforms, has made it easier for consumers to apply for and manage PLOC accounts online. Additionally, the growing middle-class population and increasing disposable income, particularly in urban regions, have fueled the adoption of credit products that offer convenience and immediate access to funds. According to study, over 60% of consumers prefer loans that offer flexible credit access rather than fixed-term loans.

To Get More Information On Personal Loans Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 320.73 Billion

-

Market Size by 2033: USD 674.13 Billion

-

CAGR: 9.75% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Personal Loans Market Trends

-

Increasing consumer preference for unsecured loans drives faster market adoption globally.

-

Growth fueled by higher disposable incomes and financial literacy among borrowers.

-

Digital lending platforms reduce documentation, enabling quicker personal loan approvals.

-

Mobile banking and internet penetration expand personal loans in emerging markets.

-

Integration of automated repayment and financial planning tools enhances borrower engagement.

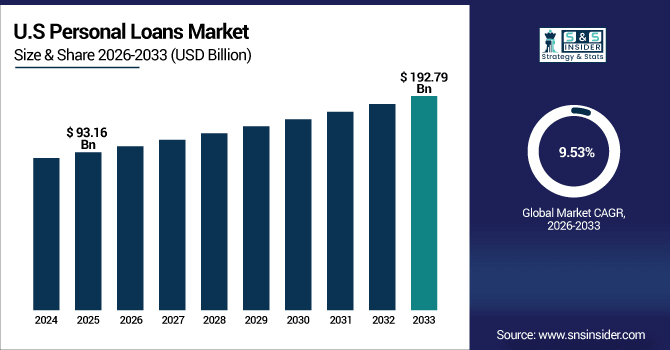

The U.S. Personal Loans Market size was USD 93.16 Billion in 2025E and is expected to reach USD 192.79 Billion by 2033, growing at a CAGR of 9.53% over the forecast period of 2026-2033, driven by high consumer adoption of unsecured loans, advanced digital lending platforms, AI-driven credit assessments, and growing demand for debt consolidation, home improvement, medical, and education financing.

Personal Loans Market Growth Drivers:

-

Rising Demand for Flexible Unsecured Loans Boosts Market Growth Rapidly

The primary driver of the personal loans market is the rising consumer preference for unsecured loans, which do not require collateral. This trend is fueled by growing financial literacy, higher disposable incomes, and the increasing awareness of credit products that provide quick access to funds. Consumers increasingly prefer personal loans for purposes such as debt consolidation, medical expenses, education, and home improvements due to their flexibility and ease of approval. Moreover, the rapid expansion of digital lending platforms and fintech solutions has streamlined the application process, reduced documentation requirements, and shortened approval times, making unsecured personal loans more accessible to a wider audience.

Over 65% of personal loan consumers prefer unsecured loans for faster access.

Personal Loans Market Restraints:

-

High Default Risk and NPAs Challenge Personal Loan Market Expansion

A significant challenge restraining the growth of the personal loans market is the high default risk associated with unsecured lending. Since personal loans do not require collateral, lenders face higher exposure to credit risk, especially among borrowers with poor or unstable credit histories. Rising Non-Performing Assets (NPAs) can affect lender profitability and tighten lending standards. Economic uncertainties, such as rising inflation or unemployment, can also lead to increased loan defaults, making financial institutions cautious. This restraint limits the expansion of personal loans in certain segments and regions, especially among first-time borrowers or in emerging markets with less mature credit assessment infrastructure.

Personal Loans Market Opportunities:

-

Digital Lending and Fintech Integration Open Vast Market Opportunities Globally

The growing adoption of digital banking and fintech technologies presents a major opportunity for the personal loans market. Innovative platforms enable faster loan disbursement, personalized credit offers, and AI-driven risk assessment, attracting tech-savvy millennials and younger borrowers. Additionally, fintech integration allows lenders to leverage alternative data, such as utility payments and e-commerce behavior, to evaluate creditworthiness, thereby expanding access to underserved segments. The increasing penetration of smartphones, internet connectivity, and mobile wallets in emerging markets further enhances the potential for growth.

Nearly 45% of lenders now incorporate utility payments and e-commerce data for credit scoring.

Personal Loans Market Segmentation Analysis:

-

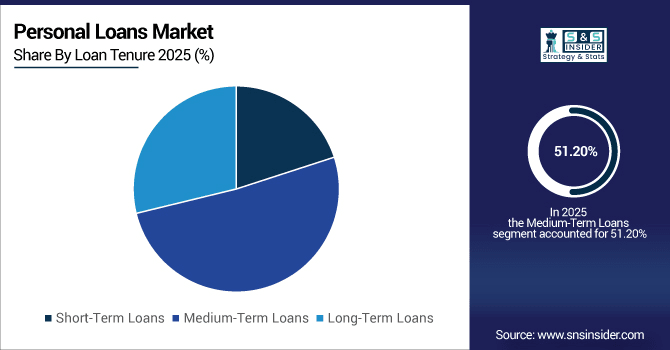

By Loan Tenure: In 2025, Medium-Term Loans led the market with a share of 51.20%, while Short-Term Loans is the fastest-growing segment with a CAGR of 11.04%.

-

By Loan Type: In 2025, Unsecured Loans led the market with a share of 44.80%, while Debt Consolidation Loans is the fastest-growing segment with a CAGR of 10.40%.

-

By Lender Type: In 2025, Banks led the market with a share of 50.24%, while Online Lenders is the fastest-growing segment with a CAGR of 11.20%.

-

By Loan Purpose: In 2025, Debt Consolidation led the market with a share of 35.32%, while Home Improvement is the fastest-growing segment with a CAGR of 10.30%.

By Loan Tenure, Medium-Term Loans Lead Market and Short-Term Loans Fastest Growth

In the Personal Loans Market, Medium-Term Loans lead the market as they offer a balanced repayment period and manageable EMIs, appealing to a wide range of borrowers seeking financial flexibility. These loans are commonly used for debt consolidation, home improvements, medical expenses, and education, providing stability without overburdening borrowers. Meanwhile, Short-Term Loans are the fastest-growing segment, driven by the increasing need for quick liquidity and emergency funding. Digital lending platforms and fintech innovations enable rapid approval, minimal documentation, and instant disbursement, making short-term loans more accessible. Rising awareness of flexible credit solutions further fuels the segment’s growth across urban and semi-urban regions.

By Loan Type, Unsecured Loans Lead Market and Debt Consolidation Loans Fastest Growth

In the Personal Loans Market, Unsecured Loans lead the market due to their ease of access, absence of collateral requirements, and growing consumer preference for flexible borrowing. They are widely used for purposes such as debt consolidation, medical expenses, education, and home improvements, attracting urban and middle-class borrowers. Meanwhile, Debt Consolidation Loans are the fastest-growing segment, driven by increasing household debt levels and the need for efficient debt management solutions. The rapid adoption of digital lending platforms and fintech innovations further supports growth by offering quick approvals, AI-driven credit assessment, and seamless online disbursement.

By Lender Type, Banks Lead Market and Online Lenders Fastest Growth

In the Personal Loans Market, Banks lead the market due to their well-established infrastructure, wide branch network, and trusted reputation among consumers. They dominate loan disbursement, particularly in urban and semi-urban areas, offering competitive interest rates and diverse product offerings. Simultaneously, Online Lenders are the fastest-growing segment, driven by the increasing adoption of digital platforms and fintech solutions. These lenders provide instant approvals, minimal documentation, and AI-driven credit assessments, attracting tech-savvy millennials and younger borrowers. The convenience of online applications and rapid disbursement, combined with expanding internet and smartphone penetration, is accelerating the growth of online lending in personal loans.

By Loan Purpose, Debt Consolidation Leads Market and Home Improvement Fastest Growth

In the Personal Loans Market, Debt Consolidation leads the market as borrowers increasingly seek to manage multiple debts efficiently, reduce interest burdens, and simplify repayments. This segment is particularly popular among urban and middle-class households, as it provides financial relief and structured repayment plans. Meanwhile, Home Improvement Loans are the fastest-growing segment, fueled by rising real estate investments, renovations, and increasing consumer interest in enhancing living spaces. The growth is further supported by digital lending platforms and fintech innovations, which offer quick approvals, flexible repayment options, and easy access to funds, making home improvement financing more convenient and attractive for borrowers.

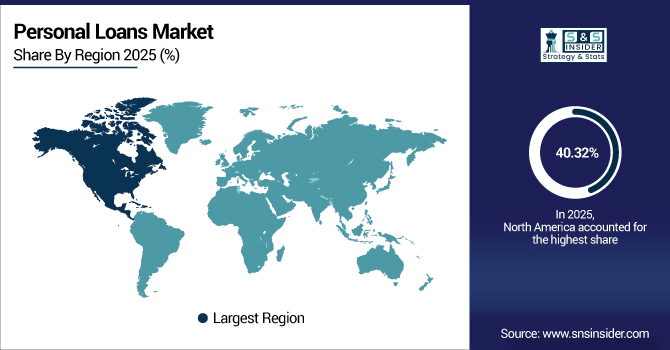

Personal Loans Market Regional Analysis:

North America Personal Loans Market Insights:

The Personal Loans Market in North America held the largest share 40.32% in 2025, driven by high consumer awareness, widespread financial literacy, and a mature banking infrastructure. The region benefits from a strong preference for unsecured loans, particularly for debt consolidation, medical expenses, education, and home improvements. Advanced digital banking platforms and fintech innovations have streamlined loan applications, offering faster approvals, AI-driven credit assessments, and seamless online disbursement. High disposable incomes and growing urbanization further support market growth. Additionally, regulatory frameworks promoting responsible lending and financial inclusion encourage adoption across diverse borrower segments. North America’s established market presence makes it the dominant region in global personal loans.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates Personal Loans Market with Advanced Technological Adoption

U.S. Dominates Personal Loans Market with Advanced Technological Adoption: The U.S. leads the personal loans market due to widespread fintech integration, digital lending platforms, AI-driven credit assessments, and high consumer adoption of unsecured loans for debt consolidation, home improvement, and emergency funding.

Asia-Pacific Personal Loans Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the Personal Loans Market, projected to expand at a CAGR of 10.87%, driven by rising disposable incomes, rapid urbanization, and increasing financial awareness among consumers. The region benefits from expanding digital banking and fintech adoption, enabling faster loan approvals, AI-driven credit scoring, and seamless online disbursement. Demand is particularly strong for unsecured loans used for debt consolidation, medical expenses, education, and home improvements. The growing penetration of smartphones, internet connectivity, and mobile wallets supports digital lending and enhances accessibility for a wider population. Supportive regulatory frameworks and initiatives promoting financial inclusion further accelerate market growth, making Asia-Pacific a key region for personal loans globally.

China and India Propel Rapid Growth in Personal Loans Market

China and India drive rapid growth in the Personal Loans Market due to Rising digital lending adoption, increasing disposable incomes, and growing demand for unsecured loans.

Europe Personal Loans Market Insights

Europe holds a significant share in the Personal Loans Market, driven by strong consumer awareness, established banking infrastructure, and high adoption of unsecured loans. Borrowers increasingly utilize personal loans for debt consolidation, home improvements, medical expenses, and education, seeking flexible repayment options and quick access to funds. The region benefits from advanced digital banking platforms and fintech solutions, which streamline applications, enable AI-driven credit assessments, and provide faster disbursement. Supportive regulatory frameworks ensure responsible lending and consumer protection, further encouraging market growth. Mature financial markets and increasing integration of technology make Europe a stable and influential region in the global personal loans market.

Germany and U.K. Lead Personal Loans Market Expansion Across Europe

Strong consumer demand for unsecured loans, advanced digital banking platforms, and fintech adoption drive rapid growth and expansion of personal loans across the region.

Latin America (LATAM) and Middle East & Africa (MEA) Personal Loans Market Insights

Latin America (LATAM) and Middle East & Africa (MEA) represent emerging growth regions in the Personal Loans Market, driven by increasing financial inclusion, rising disposable incomes, and growing awareness of credit products. In these regions, consumers are increasingly adopting unsecured loans for debt consolidation, education, medical expenses, and home improvements. The expansion of digital banking platforms and fintech solutions enables faster loan approvals, AI-driven credit assessments, and seamless online disbursement, making personal loans more accessible to urban and semi-urban populations. Supportive regulatory frameworks and initiatives promoting responsible lending further accelerate adoption. As financial literacy improves and smartphone penetration rises, LATAM and MEA present significant growth potential for personal loans globally.

Personal Loans Market Competitive Landscape

Kotak Mahindra Bank has strengthened its personal loans segment through competitive interest rates and strategic acquisitions, including Standard Chartered Bank’s loan portfolio. Focused on unsecured lending, digital applications, and AI-driven credit assessment, the bank caters to urban and semi-urban borrowers seeking flexible repayment options, enhancing its market presence and customer base.

-

In January 2025, Kotak Mahindra Bank launched personal loans starting at 9.98% interest and expanded offerings by acquiring Standard Chartered Bank’s loan portfolio.

Bajaj Finserv drives personal loans growth through quick approvals, minimal documentation, and flexible EMIs. The company’s strong fintech integration and innovative loan products attract millennials and urban consumers. With consistent market performance and growing assets under management, Bajaj Finserv continues expanding its personal loans footprint across unsecured lending segments in India.

-

In August 2025, Bajaj Finserv enhanced personal loan accessibility with rates starting at 10% and quick approvals, while shares rose 0.70% indicating strong market performance.

HDFC Bank dominates the personal loans market with attractive interest rates, zero-foreclosure options, and flexible tenures. Leveraging digital platforms, the bank simplifies applications, ensures rapid disbursement, and targets urban and tech-savvy consumers. Its focus on customer convenience, festive offers, and risk-managed lending positions it strongly in India’s competitive personal loans landscape.

-

In August 2025, HDFC Bank offered competitive personal loan rates with discounts for existing customers, while addressing branch security concerns in Deoghar.

Personal Loans Market Key Players:

Some of the Personal Loans Market Companies are:

-

State Bank of India (SBI)

-

Punjab National Bank (PNB)

-

Bank of India (BOI)

-

Indian Overseas Bank (IOB)

-

HDFC Bank

-

ICICI Bank

-

Axis Bank

-

Kotak Mahindra Bank

-

IndusInd Bank

-

Yes Bank

-

Bajaj Finserv

-

Cholamandalam Investment & Finance Company

-

Muthoot Finance

-

IDFC First Bank

-

Aditya Birla Capital

-

Moneyview

-

CASHe

-

BankBazaar

-

Perfios

-

Jupiter

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 320.73 Billion |

| Market Size by 2033 | USD 674.13 Billion |

| CAGR | CAGR of 9.75 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Loan Type (Secured Loans, Unsecured Loans, Debt Consolidation Loans, Personal Lines of Credit) • By Lender Type (Banks, Credit Unions, Online Lenders, Peer-to-Peer Lenders) • By Loan Tenure (Short-Term Loans, Medium-Term Loans, Long-Term Loans) • By Loan Purpose (Debt Consolidation, Home Improvement, Medical, Education, Emergency, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |