Digital Diabetes Management Market Overview

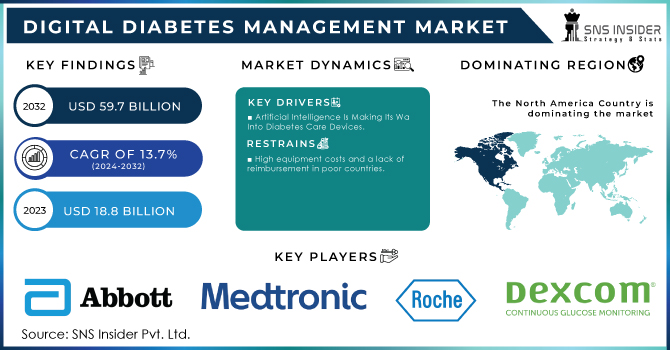

The Digital Diabetes Management Market size was valued at USD 13.45 billion in 2024 and is expected to reach USD 26.29 billion by 2032, growing at a CAGR of 8.75% over 2025-2032.

Get more information on Digital Diabetes Management Market - Request Free Sample Report

The digital diabetes management market is experiencing substantial growth due to the growing global prevalence of diabetes, adoption of digital health, and increased availability of continuous glucose monitoring devices. Highly advanced tools such as continuous glucose monitoring (CGM) systems, smart insulin pens, and mobile health apps that improve glucose tracking and insulin delivery are on the rise. Effort is being put into supercharging innovation– for instance, developing AI-based insulin dosing and cloud-based platforms -with heavy investment in R&D and strategic partnerships.

For instance, Omada Health held its IPO in June 2025 at a USD 1.1 billion valuation, indicating an increasing amount of investor support for digital chronic care solutions, including diabetes and prediabetes management.

Regulatory and payer support, like over-the-counter CGM approval and longer sensor wear, are supporting broad adoption. In addition, higher reimbursement rates for remote patient monitoring and data-informed care models are driving demand. On the supply side, suppliers are concentrating on small, convenient devices and closed-loop insulin systems. Investment is piling into digital diabetes startups and therapeutic platforms, and multi-million-dollar funding rounds are being raised to boost telehealth integration, predictive analytics, and patient engagement. These are the factors contributing to continued digital diabetes management market growth.

In March 2025, Dexcom finally revealed its launch plans for its over-the-counter 15-day CGM (Stelo) focused on Type 2 diabetes patients and diabetes drug users, marking a significant leap into the outside-the-insulin realm of users.

Digital Diabetes Management Market Dynamics

Drivers:

-

Technological Innovations, Digital Integration, and Regulatory Support are Driving Adoption of Digital Diabetes Tools

The digital diabetes management market is primarily driven by the increasing prevalence of diabetes, increasing penetration of digital platforms, parallelly followed by the rapid advancement in technology in the end-user market has a high demand for real-time glucose management and monitoring devices.

More than 75% of Type 1 diabetes patients in the developed globally are expected to be on CGM or smart insulin delivery implementations by the early-year 2025, suggesting strong demand. Companies like Biocorp have partnered with Novo Nordisk in 2024 Q2 to incorporate smart caps on insulin pens, which monitor the dosage and timing of doses in real time. AI-driven diabetes coaching, along with remote monitoring platforms, is becoming increasingly popular, with Virta Health seeing a 60% uptick in 2024 patient enrollment for its reversal-based Type 2 diabetes program. As we increasingly witness regulatory bodies foster innovation (such as European CE approval for the automated insulin delivery system by Ypsomed in August 2024, real-time mobile insulin dose titration tools (which are not for insulin users) cleared in the U.S.

By 2024, R&D investments exceeded USD 2.1 billion globally as startups like GlucoMe, Glooko, and DarioHealth raised funds for AI-based decision support tools and cross-platform integration. Increasing application of CPT billing codes for remote care is also driving greater provider use. These forces, as well as better patient experience and outcome monitoring, are helping to drive the market.

Restraints:

-

Cost Barriers, Data Security, and Device Interoperability Challenges are Slowing Wider Adoption

The digital diabetes management market is limited by the high cost and lower level of digital literacy among the general population, despite technological advancements. Many of the state-of-the-art CGM systems and insulin delivery systems are beyond the reach of the average uninsured patient or in low-income environments.

In 2024, more than 40% of patients in emerging markets attributed cessation to ongoing sensor expenses and restricted insurance coverage. Also, device integration is fragmented; smart pens from one vendor usually do not communicate with pumps or CGMs from others, which impacts clinical work. In addition, data privacy and security still inhibit adoption, with more than 1.6 million compromised health records for digital diabetes systems globally in 2023, alarming health systems and patients. Another challenge is limited awareness and adoption among older patient groups; Q3 2024 research indicates seniors with diabetes used digital tools at a rate of less than 25%.

Regulatory challenges to the adoption of AI-based decision-making software are too disparate across regions to allow for a synchronized global ‘unlocking’. In addition, they have funding issues as the clinical validation process is long, and compliance issues are also there at every stage of development. These barriers collectively limit widespread digital adoption and may limit the growth of the market until mitigation through focused policymaking, wider insurance mandates, and more efficient platform interoperability standards.

Digital Diabetes Management Market Segmentation Analysis

By Product

Continuous glucose monitoring (CGM) systems held the largest market share of 39.29% in the year 2024, due to their capabilities to provide real-time glucose readings that can result in minimal hypoglycemic incidents as well as improved glycemic control than traditional finger-stick therapy. CGMs continued to be the dominant mode due to growing uptake among people with Type 1 and insulin-dependent Type 2 diabetes, and increasing physicians’ recommendation rates also underpin the expansion. Mobile app and insulin delivery system connection, along with regulatory authorization for extended-wear sensors, has bolstered the CGM market position.

However, smart insulin pens are estimated to be the most lucrative product type. Their steep growth is driven by growing patient preference for price-competitive, non-invasive insulin administration methods. These include dose-tracking and Bluetooth-enabled pens that promote improved compliance and insulin dosing in non-intensive insulin users.

By Type

Wearable devices held the largest market share in 2024, as sensor-based technologies, including CGMs and wearable insulin pumps, are increasingly being adopted. Their ease of use and seamless, user-friendly operations, along with their smartphone and health platform connectivities, make them the choice for patients and clinicians dealing with chronic disease conditions. Their small design and remote monitoring make them conducive to user compliance and comfort.

Furthermore, wearable devices are also the sector with the highest growth in this area. The growing consumer health self-awareness and the increasing need for remote monitoring and telehealth incorporation drive their increasing usage. Younger, techie patients with diabetes in particular are driving this trend; many of them have come to expect digital companionship, immediacy, and snazzy, intuitive feedback.

By End Use

Hospitals dominated the market with a share of 39.9% in 2024 in the digital diabetes management market. This is attributed to the increasing demand for inpatient glycemic monitoring practices, diabetes professional education, and integration of hospital-grade digital tools with EHRs. Hospitals are now using CGMs, smart insulin pumps, and AI-enabled monitoring platforms to help ensure that patients have better outcomes during intensive care or after surgery while managing diabetes.

The home settings segment, on the other hand, is expected to expand at the highest CAGR during the projected period. The move toward people managing their diabetes, supported by easy-to-use apps, connected insulin pens, and remote monitoring services, has also made home care more feasible and attractive. The growing adoption of digital diabetes tools, along with enhanced reimbursement for remote patient monitoring, is expediting the shift from facility to home-based diabetes care.

Global Digital Diabetes Management Market Regional Outlook

In 2024, North America accounted for the largest market share of 38.24%, owing to early adoption of digital health technologies, a well-established reimbursement framework, and regular developments & innovations in connected diabetes care.

The digital diabetes management market size was valued at USD 3.89 billion in 2024 and is expected to reach USD 6.87 billion by 2032, growing at a CAGR of 7.42% over 2025-2032. The U.S. led the regional market on account of high adoption of CGM and smart insulin pumps, well-established healthcare IT infrastructure, and favourable government support. More than 65% of insulin-dependent diabetics in the U.S. had been using some type of digital management device by 2024. This dominance is further supported by the presence of key players like Medtronic, Dexcom, and Insulet, and functioning telehealth programs. Canada had the second-highest penetration, driven by the national healthcare efforts to drive remote patient monitoring. Mexico is still developing the digital health infrastructure, but is experiencing increasing public-private partnerships to enhance access to diabetes care, and it is this that underpins its future potential.

Europe held a considerable share in 2024 and is characterized by escalating burden of diabetes, robust government-driven digitalization efforts, and growing patient awareness.

Germany is the region’s leader, in part due to strong uptake of wearable CGM as well as of integrated diabetes apps covered by its digital health app (DiGA) policy. Strong R&D performance and organised diabetes care programmes are also advantageous for the country. France and the UK are also big players, using AI and digital therapeutics for chronic care management. The area has seen a growing number of rollouts of mobile insulin management solutions and digital coaching supported by public health systems. Italy and Spain are trending up economically, due to increased investment in their telemedicine capacities, as well as chronic care pathways. Europe’s legislative alignment with data privacy laws, including GDPR, means digital health tools can be safely embraced, enhancing user confidence.

The growth in the Asia Pacific region during the forecast period is likely to be the highest due to the rising diabetes prevalence, rising smartphone users, and funding from the government for digital health ecosystems.

China is the largest and most powerful market, propelled by urbanization, an increasing number of diabetic patients (more than 140 million adults), and telemedicine in the country, among the provinces. The government’s “Healthy China 2030” plan also encourages the integration of AI and digital therapeutics into primary care to enable uptake. India is also catching up with a boom in app-based glucose tracking tools and startups selling cheap wearable monitors to serve its huge diabetic population. Japan and South Korea are also investing in these advanced digital tools and AI for diabetes care via national health insurance programs. Rising smartphone penetration and accessibility of digital services are making this region a market hotspot for future growth.

Digital Diabetes Management Market Key Players

Leading digital diabetes management companies operating in the market include Abbott, Medtronic, Roche, Bayer, Sanofi, Dexcom, LifeScan, Insulet, Ascensia Diabetes Care, B. Braun Melsungen and Others

Recent Developments in Digital Diabetes Management Technology

In July 2025, Health2Sync and Novo Nordisk Korea launched the Smart‑Cap Mallya for FlexTouch insulin pens, enabling automatic recording of insulin injection data directly into the SugarGenie app. This real-time syncing with healthcare providers enhances remote diabetes management and supports improved dosing accuracy.

In April 2025, the FDA approved a 15-day wear extension for Dexcom’s G7 CGM, up from the original 10 days. This extended lifespan enhances convenience, reduces sensor replacements, and strengthens Dexcom’s competitive position against rivals like Abbott and Medtronic.

| Report Attributes | Details |

| Market Size in 2024 | USD 13.45 billion |

| Market Size by 2032 | USD 26.29 billion |

| CAGR | CAGR of 8.75% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Smart Glucose Meters, Continuous Glucose Monitoring Systems, Smart Insulin Pens, Smart Insulin Pumps/Closed Loop Systems, and Apps (Digital Diabetes Management Apps, Weight & Diet Management Apps) • By Type (Wearable Devices, Handheld Devices) • By End Use (Hospitals, Home Settings, and Diagnostic Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Abbott, Medtronic, Roche, Bayer, Sanofi, Dexcom, LifeScan, Insulet, Ascensia Diabetes Care, B. Braun Melsungen and Others |