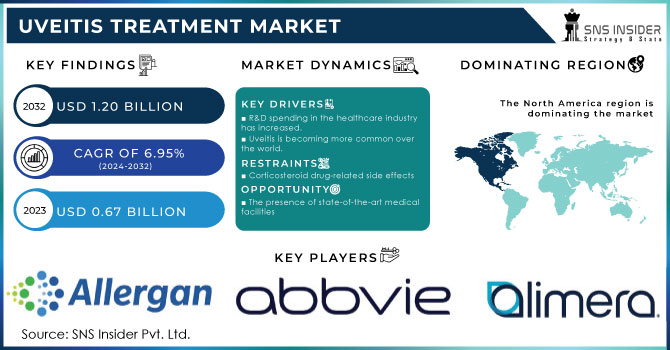

Uveitis Treatment Market Size Analysis:

The Uveitis Treatment Market Size was valued at USD 2.26 Billion in 2023 and is expected to reach USD 4.69 Billion by 2032 and grow at a CAGR of 8.47% over the forecast period 2024-2032.

Get more information on Uveitis Treatment Market - Request Sample Report

This report points out the increasing cases and prevalence of uveitis, fueling demand for successful therapy, and analyzes prescription patterns geographically, which vary according to drug accessibility and physician choice. The research studies the uptake of biologic and non-biologic medication, highlighting the move towards newer therapies to enhance patient outcomes. In addition, it evaluates healthcare expenditure on uveitis treatment among government, commercial, private, and out-of-pocket channels, reflecting the investment and cost of disease management. The report further explores trends in clinical trials and the pipeline for drug development, highlighting ongoing research, innovation, and the prospect of new treatment in the marketplace.

Global Uveitis Treatment Market Dynamics

Drivers

-

The increasing prevalence of uveitis, particularly non-infectious uveitis (NIU), is a major driver for market growth.

Uveitis is responsible for 10-15% of blindness in developed nations, with close to 200,000 new cases each year in the U.S. alone. The increase in autoimmune diseases, including Behçet's disease, sarcoidosis, and ankylosing spondylitis, is also contributing to uveitis incidence. Furthermore, advances in biologic therapies, such as monoclonal antibodies and JAK inhibitors, are revolutionizing treatment by providing long-term disease control and less steroid reliance. For instance, AbbVie's Humira (adalimumab) is FDA-approved for NIU and has substantially enhanced patient outcomes. The increasing use of long-acting intravitreal implants, like Yutiq (fluocinolone acetonide), is also enhancing demand. In addition, increased awareness and advanced diagnostic methods, such as optical coherence tomography (OCT) and fluorescein angiography, are allowing early detection and improved treatment of uveitis, favoring overall market growth.

Restraints

-

The high cost of biologic and immunosuppressive therapies remains a major barrier to market growth.

High-cost biologics such as adalimumab and tocilizumab may cost more than USD 40,000 per year, which precludes many patients without good insurance. Furthermore, the chronic administration of corticosteroids, the usual management of uveitis, carries with it terrible side effects such as cataracts, glaucoma, and osteoporosis, so their long-term use is generally restricted. Even more recent therapies such as fluocinolone acetonide intravitreal implants have risks of increased intraocular pressure and the requirement for further surgeries, limiting their widespread use. Furthermore, the unavailability of biologics in developing countries because of high importation costs and poor reimbursement frameworks further limits market penetration. The lengthy regulatory approval process for new therapies also hinders the entry of innovative treatments. These factors combined deter market growth despite increasing demand for successful uveitis treatment solutions.

Opportunities

-

The uveitis treatment market is witnessing significant opportunities with ongoing clinical research in novel biologics, gene therapy, and small molecule inhibitors.

Companies such as Priovant Therapeutics and Novartis are placing significant investments in next-generation JAK inhibitors and monoclonal antibodies in non-infectious uveitis, which has the potential to transform treatment strategies. FDA Fast Track and Orphan Drug designations of experimental uveitis drugs further speed up product development. Digital health technologies, including AI-powered diagnostic tools and teleophthalmology, are another promising avenue with improved early detection and individualized treatment strategies. AI-driven deep learning algorithms have demonstrated 90% accuracy in identifying uveitis-related complications, improving patient outcomes. Further, the expansion of e-pharmacies and telemedicine platforms is enhancing the availability of uveitis medications, especially in underserved areas. The rising partnerships among pharma companies and research centers for new drug development also contribute to long-term market growth prospects.

Challenges

-

low awareness among general practitioners and misdiagnosis of uveitis pose significant challenges.

Research shows that more than 30% of uveitis are initially misdiagnosed, resulting in delayed treatment and disease progression. Most symptoms of early uveitis, including redness, photophobia, and blurred vision, have overlapping similarities with prevalent ocular diseases, presenting challenges during diagnosis. In most countries, the absence of harmonized diagnostic procedures also adds to the difficulties encountered during disease identification. Moreover, the scarcity of specialized ophthalmologists, especially in developing nations, restricts timely interventions. The untimely treatment enhances the likelihood of serious complications like macular edema, glaucoma, and irreversible loss of vision, eventually driving up healthcare expenditures. Patient compliance with long-term therapy is another challenge, with many patients dropping out of treatment due to side effects, exorbitant prices, or absence of symptom alleviation, leading to relapse of the disease. Overcoming these challenges demands increased physician training, enhanced diagnostic technology, and enhanced patient education campaigns.

Uveitis Treatment Market Segmentation Analysis

By Treatment

The corticosteroids segment held the largest share in the uveitis treatment market in 2023, with a revenue share of 26.6%. Corticosteroids are the drug of choice for uveitis because of their strong anti-inflammatory activity, which is effective in suppressing ocular inflammation and avoiding complications. Their existence in different forms, such as eye drops, oral tablets, intravenous injections, and sustained-release implants, provides flexibility in treatment depending on the severity of the disease. Moreover, corticosteroids find extensive usage for both infectious and non-infectious uveitis, the most commonly prescribed therapeutic choice. Notwithstanding their fears about long-term adverse effects such as increased intraocular pressure and cataract formation, their instantaneous efficacy has ensured them a place at the forefront of the market.

The antibiotics segment is anticipated to witness the fastest growth, driven by the surging incidence of bacterial uveitis cases. The growth of tuberculosis-associated uveitis, syphilitic uveitis, and other bacterial diseases has fueled the demand for targeted antibiotic treatments. The presence of sophisticated antimicrobial treatments and enhanced awareness among medical professionals are propelling market growth.

By Disease

The anterior uveitis segment accounted for the highest market share in 2023, generating 47.8% of the revenue. Anterior uveitis is the most frequently diagnosed type of uveitis, usually associated with autoimmune diseases like ankylosing spondylitis and juvenile idiopathic arthritis. Its greater prevalence than intermediate, posterior, and panuveitis renders it the leading disease type. In addition, anterior uveitis is comparatively easier to diagnose and treat, often responding favorably to corticosteroid eye drops and cycloplegic drugs. The very high success rate of treatment and easy availability of potent drugs make it a market leader. Growing awareness, better diagnostic methods, and the increased number of ophthalmic clinics also add strength to its leadership.

The posterior uveitis segment will experience the most rapid growth as a result of increasing cases of infectious and autoimmune-related uveitis. Its complicated nature typically demands prolonged therapy with systemic corticosteroids, immunosuppressants, and biologics, demanding more sophisticated therapeutic interventions.

By Cause

The infectious uveitis category generated 83.4% of revenue in 2023, and it is the market-leading category. Infectious uveitis is most prevalent in developing countries and regions, where bacterial, viral, fungal, and parasitic diseases drive disease rates. Commonly, infectious agents that drive disease rates include tuberculosis, toxoplasmosis, herpes viruses, and cytomegalovirus, which all require targeted antimicrobial therapies. The presence of antibiotics, antivirals, and antifungal drugs specific to the infection has bolstered the market position of this segment. Additionally, enhanced government efforts toward controlling infectious diseases and better diagnostic capacity have helped drive the segment's growth.

The non-infectious uveitis segment is expected to experience the most rapid growth as a result of the increasing number of cases of autoimmune-related uveitis. The development of biologics, including monoclonal antibodies and JAK inhibitors, is greatly enhancing treatment outcomes, resulting in higher adoption of therapies for non-infectious uveitis.

By Distribution Channel

The retail pharmacies segment dominated the market in 2023 with a revenue share of 42.4%. Retail pharmacies are still the most sought-after distribution channel for uveitis drugs because they are convenient and easily accessible to patients. Most corticosteroids, cycloplegic drugs, and antibiotics employed in uveitis management are easily accessible through retail pharmacies, hence becoming the point of purchase. Retail pharmacies are frequently the sources that patients turn to to have direct access to prescription and over-the-counter medication, particularly during flare-ups of acute uveitis. Moreover, the availability of competent pharmacists who offer drug counseling and assistance makes the retail pharmacies, especially within urban and suburban locations, more attractive. The extensive network of physical pharmacies and the sense of security related to in-store shopping further consolidate the dominance of the segment.

The segment of online pharmacies is expected to see the highest growth, stimulated by the rising adoption of digital and customers' desire for doorstep delivery of medicines. Discounts, convenience, and model-based medication offerings on subscriptions are powering swift expansion in this segment.

Regional Insights

North America dominated the uveitis treatment market in 2023 due to superior healthcare infrastructure, superior disease awareness, and heavy pharmaceutical R&D investments. Favorable reimbursement policies, the presence of key industry players like AbbVie, Pfizer, and Regeneron, and the presence of superior support systems have all contributed to the dominance of this region. Greater use of biologics and immunosuppressants for the treatment of non-infectious uveitis and elevated prevalence of autoimmune diseases further boost the U.S. and Canadian markets.

Europe shares a major marketplace as a result of public healthcare programs, sophisticated diagnostic facilities, and rising clinical trials for new uveitis drugs. Germany, the U.K., and France are top market leaders because of robust regulatory systems and high patient exposure to biologic and monoclonal antibody therapy treatments.

The Asia-Pacific area is likely to see the fastest growth, being driven by a rise in the incidence of infectious uveitis, growing healthcare infrastructure, and heightened awareness. China, India, and Japan are experiencing growing adoption of emerging treatment methods, propelled by escalating government expenditure on healthcare and increased access to corticosteroids and biologics.

Need any custom research on Uveitis Treatment Market - Enquiry Now

Uveitis Treatment Market Key Players

-

AbbVie Inc. – Humira (adalimumab), Rinvoq (upadacitinib)

-

Santen Pharmaceutical Co., Ltd. – Tapros (tafluprost), Eylea (aflibercept)

-

Bausch Health Companies Inc. – Lotemax (loteprednol etabonate), Alrex (loteprednol etabonate)

-

Regeneron Pharmaceuticals Inc. – Eylea (aflibercept)

-

EyePoint Pharmaceuticals, Inc. – Yutiq (fluocinolone acetonide intravitreal implant), Durasert (fluocinolone acetonide)

-

Novartis AG – Cosentyx (secukinumab), Beovu (brolucizumab)

-

Ocular Therapeutix, Inc. – Dextenza (dexamethasone ophthalmic insert)

-

Ophthotech Corporation – Zimura (avacincaptad pegol)

-

Pfizer Inc. – Xeljanz (tofacitinib), Rapamune (sirolimus)

-

Merck – Pred Forte (prednisolone acetate ophthalmic suspension)

-

Horizon Therapeutics – Tepezza (teprotumumab-trbw)

-

Otsuka Pharmaceutical – Samsca (tolvaptan)

-

Aerie Pharmaceuticals – Rocklatan (netarsudil/latanoprost)

-

Amgen – Enbrel (etanercept)

-

Roche – Actemra (tocilizumab), Lucentis (ranibizumab)

-

Alcon – Durezol (difluprednate ophthalmic emulsion)

-

Johnson & Johnson – Simponi (golimumab), Remicade (infliximab)

-

UCB – Cimzia (certolizumab pegol)

-

Bristol Myers Squibb – Orencia (abatacept), Otezla (apremilast)

Recent Developments in the Uveitis Treatment Market

In Nov 2024, Clearside Biomedical’s partner, Arctic Vision, entered a commercial collaboration with Santen Pharmaceutical for ARVN001, a suprachoroidal space injection therapy for uveitic macular edema. This partnership aims to expand access to innovative uveitis treatments in key markets.

In Sept 2024, Priovant Therapeutics received Fast Track Designation from the FDA for Brepocitinib in treating non-anterior non-infectious uveitis (NIU) and has initiated patient enrollment for its Phase 3 NIU clinical program, marking a significant advancement in uveitis treatment development.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.26 billion |

| Market Size by 2032 | USD 4.69 billion |

| CAGR | CAGR of 8.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Treatment [Corticosteroids, Immunosuppressant, Monoclonal Antibodies, Cycloplegic Agents, Antibiotics, Antivirals, Antifungal, Analgesics] • By Disease [Anterior Uveitis, Posterior Uveitis, Intermediate Uveitis, Panuveitis] • By Cause [Infectious, Non-infectious] • By Distribution Channel [Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AbbVie Inc., Santen Pharmaceutical Co., Ltd., Bausch Health Companies Inc., Regeneron Pharmaceuticals Inc., EyePoint Pharmaceuticals, Inc., Novartis AG, Ocular Therapeutix, Inc., Ophthotech Corporation, Pfizer Inc., Merck, Horizon Therapeutics, Otsuka Pharmaceutical, Aerie Pharmaceuticals, Amgen, Roche, Alcon, Johnson & Johnson, UCB, Bristol Myers Squibb. |