Pharmaceutical HDPE Bottles Market scope & overview:

Get More Information on Pharmaceutical HDPE Bottles Market - Request Sample Report

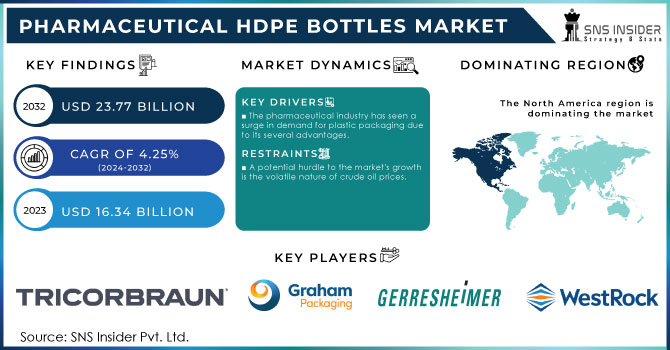

Pharmaceutical HDPE Bottles Market Size was valued at USD 16.34 billion in 2023 and is expected to reach USD 23.77 billion by 2032 and grow at a CAGR of 4.25% over the forecast period 2024-2032.

The market for pharmaceutical plastic bottles is driven by several factors: the growing demand for packaging to store and deliver medicine, the unmatched properties of plastic for this application barrier against moisture, high durability, transparency etc., and the increasing use of aseptic filling and packaging techniques.

While sustainability concerns are pushing the industry towards solutions like higher recycling rates and bio-based plastics, plastic bottles remain the dominant choice due to their functionality and established supply chains. Asia-Pacific being a major PET resin producer with a production capacity of 123.9 billion pounds in the US. HDPE is expected to see the highest growth rate within this market segment due to its versatility, durability, chemical resistance, and suitability for larger containers. However, rising plastic prices due to crude oil fluctuations and stricter regulations might affect consumption in the future.

MARKET DYNAMICS:

KEY DRIVERS:

-

The pharmaceutical industry has seen a surge in demand for plastic packaging due to its several advantages.

The pharmaceutical industry has heavily embraced plastic packaging due to its unbeatable functionalities. Plastic offers a winning combination of features such as it acts as a barrier against moisture, maintains its shape, withstands impact and stress, absorbs minimal water, and often provides clarity. Furthermore, plastic packaging can resist heat and flames, potentially extending the shelf life of medications. These advantages have cemented plastic as the dominant material choice in pharmaceutical packaging.

-

Pharmaceutical plastic bottles remain popular despite sustainability concerns, with the industry prioritizing recycling and environmental impact reduction.

RESTRAINTS:

-

A potential hurdle to the market's growth is the volatile nature of crude oil prices.

Rising crude oil prices can lead to increased plastic costs. This could translate to higher prices for pharmaceutical plastic bottles, potentially impacting consumption and hindering overall market expansion.

-

Advancements in materials science and packaging technology could lead to the emergence of more competitive alternatives to HDPE bottles.

OPPORTUNITIES:

-

The pharmaceutical industry's growing use of plastic bottles and advancements in technology are fueling the market's expansion.

Improvements in plastic materials science are leading to the development of stronger, lighter, and more versatile plastic bottles. This allows for the safe and effective packaging of a wider range of medications, including both solid and liquid oral drugs.

-

HDPE bottles are a top choice for pharmaceuticals because they don't react with the medication, keeping it safe.

CHALLENGES:

-

Tighter plastic regulations could drive up production costs for packaging.

This increase in production costs could translate to higher prices for pharmaceutical plastic bottles. As a result, consumers, healthcare institutions, and pharmaceutical companies might be incentivized to seek alternative packaging solutions, potentially hindering the growth of the plastic bottle segment within the market. Additionally, stricter regulations might focus on aspects like minimum recycled content requirements or mandated use of specific, potentially more expensive, bio-based plastics.

-

The growing focus on environmental responsibility is challenging HDPE's dominance, as the industry explores more sustainable packaging options.

IMPACT OF RUSSIA-UKRAINE WAR

The Russia-Ukraine war further exacerbated existing challenges in the pharmaceutical HDPE bottles market. Following disruptions caused by the 2021 Texas winter storm that resulted in a 30% production capacity decrease, the war triggered another round of price hikes for key raw materials like polypropylene (PP) and polyethylene (PE). PE suppliers raised prices by 4 cents per pound in March 2022 and anticipated another 6-cent increase in Q2, while PP saw similar increases of 8-10 cents with potential additional hikes. This volatility and rising costs could potentially hinder the growth of the pharmaceutical HDPE bottles market.

IMPACT OF ECONOMIC SLOWDOWN

Economic slowdowns can negatively impact the Pharmaceutical HDPE Bottles Market. In past economic crises, countries like those in the Baltic region implemented austerity measures that restricted spending on pharmaceuticals. These measures included price cuts, reduced reimbursement rates, and additional taxes on medications. This can lead to decreased demand for pharmaceuticals, and consequently, a lower need for packaging like HDPE bottles. Pharmaceutical companies facing economic pressures might also focus resources on core operations and shelve innovation in packaging solutions, further impacting the market.

KEY MARKET SEGMENTS:

By Capacity

-

Less than 30 ml

-

31 ml – 100 ml

-

101 ml – 500 ml

-

501 ml – 1Lt

-

Above 1Lt

The market for pharmaceutical HDPE bottles is divided by size, with the 101ml to 500ml segment leading the market. This mid-range size is popular because it's versatile and can hold various medications while remaining convenient for storage and transport. It's a good fit for different dosages and treatment lengths, making it widely used across many pharmaceutical products. Interestingly, the largest bottles are showing the fastest growth.

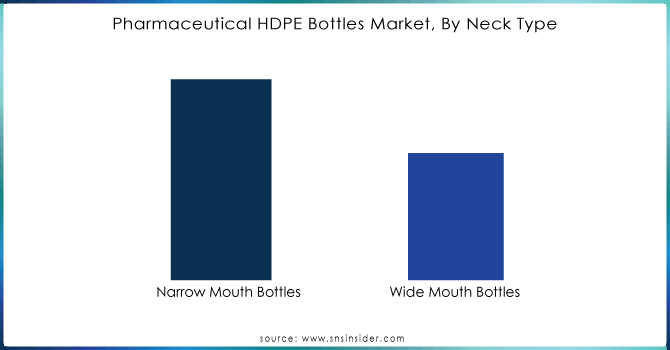

By Neck Type

-

Narrow Mouth Bottles

-

Wide Mouth Bottles

Narrow-mouth bottles are dominant in the pharmaceutical HDPE bottle market with 65% of share. Their design prioritizes patient safety by allowing for controlled dispensing, minimizing spills and contamination, and safeguarding medication integrity. This perfect fit for strict regulations makes them the number one choice. Additionally, their user-friendly design and compatibility with various closures solidify their dominance in the pharmaceutical packaging world.

Need any customization research on Pharmaceutical HDPE Bottles Market - Enquiry Now

By End User

-

Domestic Use

-

Chemical Industries

-

Cosmetic Industries

-

Pharmaceutical Industries

Pharmaceutical HDPE bottles leading in the market, driven by the industry's strict regulations for safe and stable drugs. Their ever-expanding production fuels the need for reliable packaging. Pharmaceutical companies call the shots, influencing trends with innovations like tamper-proof closures and user-friendly designs. Their focus on sustainability aligns perfectly with HDPE's eco-friendly nature. Interestingly, the cosmetics industry is the fastest-growing user of these bottles, fueled by the booming personal care market, especially in emerging regions.

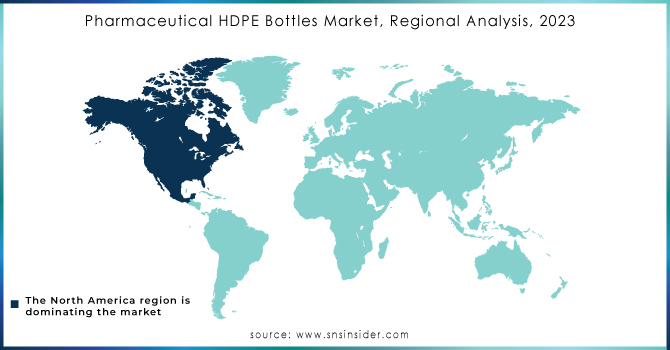

REGIONAL ANALYSES

North America, particularly the United States, is a major player in the pharmaceutical and plastic bottle markets. The rise in pharmaceutical use creates a corresponding demand for functional packaging solutions. This trend is supported by the robust plastics industry in North America, which employs thousands of people and caters to various sectors, with packaging being a significant portion of plastic end use.

Europe is a strong contender for pharmaceutical HDPE bottles, ranking second behind North America. Strict regulations, booming pharmaceutical production, and a growing emphasis on sustainable packaging solutions are driving this market. Notably, Germany leads Europe in revenue for these bottles, while the UK market is experiencing the fastest growth within the region. The Asia-Pacific region is poised for the fastest growth in pharmaceutical HDPE bottles. This surge is fueled by a booming pharmaceutical manufacturing industry and stricter regulations demanding secure and eco-friendly packaging. China is currently the leader in this market, but India is experiencing the most rapid growth within the region.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Gerresheimer, Berry Global, Graham Packaging Company, Canyon Plastics Inc., Alpack Plastics, TricorBraun, Amcor Plc, Alpla, WestRock Company, Apex Plastics, O.Berk Company LLC, Aptar Pharma, Santen Pharmaceutical Co. Ltd. other key players.

RECENT DEVELOPMENT

-

Gerresheimer, a leader in pharmaceutical, healthcare, and beauty packaging, acquired Centripack in October 2023. Centripack, a US-based leader in high-performance plastic packaging for pharmaceuticals.

-

In September 2023, a packaging company Alpla teamed up with Aptar Pharma, a big company that makes drug delivery systems and packaging. This partnership aims to create new and improved packaging solutions for medications, including fresh designs for bottles made of a kind of plastic called HDPE.

-

In August 2023, a big North American packaging company named TricorBraun bought Plastipak Packaging. Plastipak makes a lot of plastic bottles and containers, which will give TricorBraun more options to sell and new ways to make things, including bottles for medicine made from a kind of plastic called HDPE.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 16.34 Bn |

| Market Size by 2032 | US$ 23.77 Bn |

| CAGR | CAGR of 4.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Capacity (Less Than 30 Ml, 31 Ml – 100 Ml, 101 Ml – 500 Ml, 501 Ml – 1Lt, Above 1Lt) • By Neck Type (Narrow Mouth Bottles, Wide Mouth Bottles) • By End User (Domestic Use, Chemical Industries, Cosmetic Industries, Pharmaceutical Industries) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Gerresheimer, Berry Global, Graham Packaging Company, Canyon Plastics Inc., Alpack Plastics, TricorBraun, Amcor Plc, Alpla, WestRock Company, Apex Plastics, O.Berk Company LLC, Aptar Pharma, Santen Pharmaceutical Co. Ltd. |

| Key Drivers | • The pharmaceutical industry has seen a surge in demand for plastic packaging due to its several advantages. • Pharmaceutical plastic bottles remain popular despite sustainability concerns, with the industry prioritizing recycling and environmental impact reduction. |

| Key Restraints | • A potential hurdle to the market's growth is the volatile nature of crude oil prices. • Advancements in materials science and packaging technology could lead to the emergence of more competitive alternatives to HDPE bottles. |