Pharmaceutical Plastic Bottles Market Report Scope & Overview:

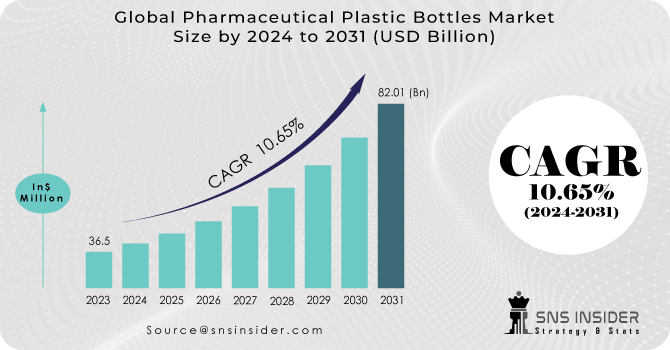

The Pharmaceutical Plastic Bottles Market Size was valued at USD 36.5 billion in 2023 and is expected to reach USD 82.01 billion by 2031 and grow at a CAGR of 10.65 % over the forecast period 2024-2031.

Pharmaceutical plastic bottles have become integral in packaging both solid and liquid formulations within the industry. The global healthcare infrastructure's expansion is expected to drive a surge in demand for these plastic bottles in the coming years. While pharmaceutical glass bottles were traditionally prevalent, the market has undergone a significant shift with the introduction of plastic alternatives, offering cost and weight benefits. Manufacturers and consumers alike prefer pharmaceutical plastic bottles over glass due to their affordability, lightweight nature, and ease of transportation.

Technological advancements in plastic bottle parameters, including plastic types, closure varieties, and size ranges, have positively impacted sales. The versatility of plastic packaging has fuelled its substantial growth in the pharmaceutical sector, offering features such as moisture barrier, dimensional stability, impact strength, strain resistance, low water absorption, transparency, heat and flame resistance, and extended expiration dates. Pharmaceutical plastic bottles are popular due to their affordability and ease of transport. Sustainability efforts and new technology for oral medications are driving further market growth.

MARKET DYNAMICS

KEY DRIVERS:

-

The market is primarily driven by the growing need for lightweight and convenient pharmaceutical packaging solutions.

Plastic bottles offer significant advantages in terms of weight, durability, and cost-effectiveness, which makes them a preferred choice over traditional glass packaging. Additionally, the increasing healthcare expenditure globally is contributing to the growth of this market.

-

Rising expenditures in healthcare and the pharmaceutical sector are expected to further stimulate market growth.

RESTRAIN:

-

Market faces challenges due to rising raw material costs and environmental concerns associated with plastic usage.

The growing scrutiny and regulatory pressures regarding the use of plastics and the demand for sustainable packaging solutions are significant restraints for the market growth.

-

Increasing environmental apprehensions regarding plastic usage are expected to once again impede market growth.

OPPORTUNITY:

-

Opportunities in the market are abundant, particularly in the area of sustainable and recyclable plastic materials.

The shift towards eco-friendly materials like Polyethylene Terephthalate (PET) offers a significant opportunity for market growth. Technological advancements and innovations in plastic bottle manufacturing, such as aseptic filling and packaging techniques, also present substantial opportunities.

-

The robust expansion of the e-commerce sector is expected to present significant growth opportunities in the coming years.

CHALLENGES:

-

Addressing the environmental impact of plastic waste and complying with the stringent regulatory standards for pharmaceutical packaging

Ensuring the compatibility of plastic materials with various pharmaceutical products to maintain the efficacy and safety of the drugs also remains a challenge.

Impact of Russia Ukraine War

The Russia-Ukraine crisis has significantly disrupted the pharmaceutical plastic bottle market, causing challenges in manufacturing and supply chains. Shutdowns of key facilities, including Ukraine's main petrochemical plant and Vetropack's largest glass factory, have led to material shortages and price increases. The conflict has caused significant price increases and decreased production capacity in the plastics industry. Sanctions on Russia, coupled with rising crude oil prices, have elevated resin costs, affecting vital materials such as polyethylene and polypropylene used in pharmaceutical plastic bottles. Additionally, logistical hurdles, like the cessation of pallet production in Ukraine necessary for shipping, have further complicated resin supply delivery, leading to increased expenses. Major players in the chemicals and plastics industries, such as Clariant, LyondellBasell, DuPont, and Solvay, have either suspended or reconsidered their business operations in Russia and Ukraine. This has prompted a reassessment of sourcing strategies, potentially leading to shortages or increased costs for raw materials crucial in pharmaceutical plastic bottle manufacturing.

The broader consequences include possible prolonged disruptions in the global healthcare product supply chain, particularly those packaged in plastic bottles. While direct production impacts in Ukraine may not heavily affect the U.S. medical supply chain, indirect factors such as airspace closures, increased fuel expenses, and dependence on regional raw materials could lead to delays and higher costs for medical supplies, including pharmaceutical packaging.

Impact of Economic Slowdown

Economic slowdowns wield a multifaceted impact on industries, and the pharmaceutical plastic bottle market is no exception. The repercussions are diverse, spanning from reduced consumer spending to intricate supply chain disruptions and alterations in manufacturing output. Specifically, the pharmaceutical plastic bottle market may witness fluctuations in demand for pharmaceutical products as consumers potentially curtail spending on non-essential healthcare items during economic downturns. Changes in healthcare spending patterns, influenced by economic uncertainties, can directly affect the market dynamics, with potential shifts in the types and volumes of pharmaceutical products demanded.

Moreover, supply chain challenges become pronounced, impacting production schedules and logistics within the pharmaceutical plastic bottle market. These disruptions may arise from both global and regional economic contractions, leading to procurement difficulties and potential shortages. Adjustments in production strategies become imperative to navigate supply chain complexities and maintain operational efficiency.

KEY MARKET SEGMENTS

By Material

-

Polyethylene

-

High-density polyethylene (HDPE)

-

Low-density polyethylene (LDPE)

-

-

Polyethylene Terephthalate

-

Polypropylene

-

Polyvinyl Chloride

Polyethylene Terephthalate is expected to lead the global market, particularly in the pharmaceutical industry, as it offers weight reduction of up to 90% compared to glass, leading to more economical transportation. The High Density Polyethylene (HDPE) segment is poised for notable growth due to its outstanding stiffness and barrier characteristics. Its pigmented variant is primarily utilized for packaging light-sensitive drugs.

By Capacity

-

Below 100 ml

-

100-250 ml

-

Above 250 ml

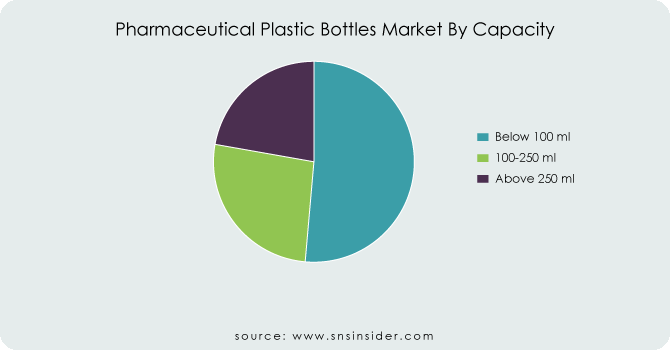

Bottles with capacities below 100 ml are projected to lead the market, comprising a significant share exceeding 50%. The growing preference for smaller packaging is fuelling an upward surge in demand for bottles in this capacity range.

By Bottle Type

-

Plastic Bottles for Opthalmic/Nasal formulations

-

Plastic Bottles for Solid Formulations

-

Plastic Bottles for Liquid

Plastic bottles designed for ophthalmic and nasal formulations are driving the growth of the global pharmaceutical plastic bottles market, leading the bottle types segment. The rising utilization of corticosteroid medications in nasal formulations for diverse treatments is fuelling consumption. Additionally, the escalating prevalence of pollution-induced eye allergies is a key factor boosting demand.

By Closure Type

-

Screw Cap

-

Crown Cap

-

Friction Fit

-

Other Closures

By Application

-

Pharmaceutical Companies

-

Compounding Pharmacies

REGIONAL ANALYSIS

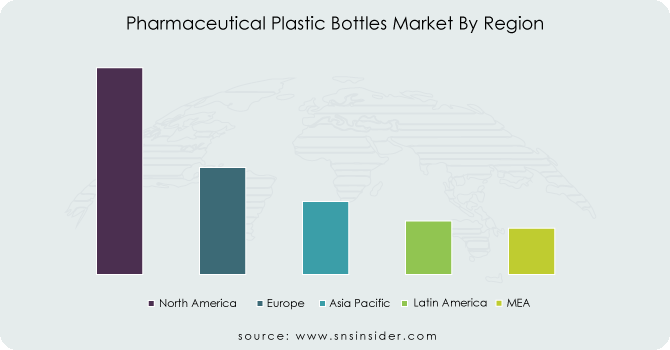

North America is expected to maintain its status as a highly attractive market throughout the forecast period. The United States, in particular, is anticipated to dominate the North American market, constituting over 80% of the region's share until 2032. The USA is poised to be a significant driver of demand for pharmaceutical plastic bottles in the next decade, fuelled by a strong desire for an exceptional healthcare system among the population and supportive state policies that contribute to the growth of the healthcare industry. In the UK, the demand for pharmaceutical plastic bottles is projected to rise, supported by the country's developed and advanced healthcare system resulting from government efforts. The UK is foreseen as the second-largest market shareholder in Europe, covering approximately 21% market share.

Furthermore, Asia Pacific is forecasted to experience swift growth in the global pharmaceutical plastic bottles market due to the region's robust manufacturing sector. Additionally, the availability of inexpensive labour and convenient access to raw materials are anticipated to fuel market growth. China, being one of Asia's major pharmaceutical markets, presents lucrative opportunities for manufacturers of pharmaceutical plastic bottles.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players:

Some of the major players in the Pharmaceutical Plastic Bottles Market are Berry Global Inc., AptarGroup Inc., Amcor Plc, C.L.Smith Company, Gerresheimer AG, Pro-Pac Packaging Group Pty Ltd, United States of America Plastic Corporation, Alpack Inc, Comar LLC, O. Berk Company, LLC and other players.

Berry Global Inc-Company Financial Analysis

RECENT DEVELOPMENTS

-

In December 2021, Comar, a healthcare packaging company, acquired Omega Packaging to strengthen its offerings. Omega Packaging's expertise in child-resistant closures and mold-building expands Comar's capabilities for custom healthcare packaging.

-

Two packaging companies, Pretium Packaging and Alpha Packaging, merged in September 2021. This deal, backed by investment firm Clearlake Capital Group, expands their product offerings and customer reach in the advanced packaging solutions market.

-

Alpha Packaging expanded its reach in the Irish market by acquiring Boxmore Plastics in April 2021. Boxmore manufactures HDPE plastic packaging for various industries, including beverage, industrial, and healthcare.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 36.5 Billion |

| Market Size by 2031 | US$ 82.01 Billion |

| CAGR | CAGR of 10.65 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Polyethylene, Polyethylene Terephthalate, Polypropylene, Polyvinyl Chloride) • By Capacity (Below 100 Ml, 100-250 Ml, Above 250 Ml) • By Bottle Type (Plastic Bottles For Opthalmic/Nasal Formulations, Plastic Bottles For Solid Formulations, Plastic Bottles For Liquid) • By Closure Type (Screw Cap, Crown Cap, Friction Fit, Other Closures) • By Application (Pharmaceutical Companies, Compounding Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Berry Global Inc., AptarGroup Inc., Amcor Plc, C.L.Smith Company, Gerresheimer AG, Pro-Pac Packaging Group Pty Ltd, United States of America Plastic Corporation, Alpack Inc, Comar LLC, O. Berk Company, LLC |

| Key Drivers | • The market is primarily driven by the growing need for lightweight and convenient pharmaceutical packaging solutions. • Rising expenditures in healthcare and the pharmaceutical sector are expected to further stimulate market growth. |

| Restraints | • Market faces challenges due to rising raw material costs and environmental concerns associated with plastic usage. • Increasing environmental apprehensions regarding plastic usage are expected to once again impede market growth. |