Photocoupler Market Size Analysis:

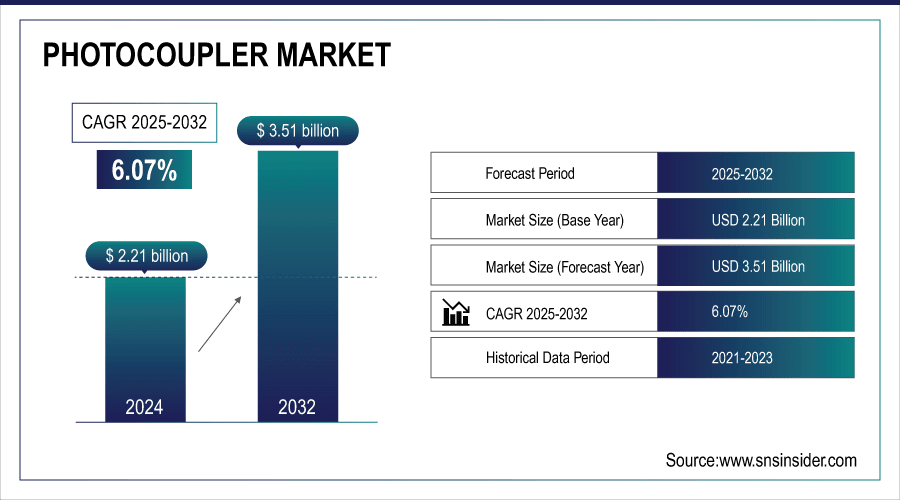

The Photocoupler Market Size was valued at USD 2.21 billion in 2024 and is expected to reach USD 3.51 billion by 2032 and grow at a CAGR of 6.07 % over the forecast period 2025-2032.

The global market is is growing, because of growing demand of reliable electrical isolation devices in different electronic application. Growth in end-use industries such as consumer electronics, automotive, and industrial automation, increased penetration of smart devices, and advancement in semiconductor technology are some of the factors contributing to the strong growth of the market across the globe.

To Get More Information On Photocoupler Market - Request Free Sample Report

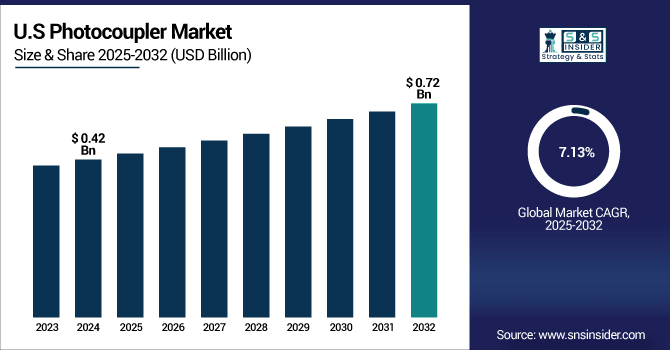

The U.S. Photocoupler Market size was USD 0.42 billion in 2024 and is expected to reach USD 0.72 billion by 2032, growing at a CAGR of 7.13 % over the forecast period of 2025–2032.

US Photocoupler Market growth can be attributed to the growing use of innovative technologies across automotive, consumer electronics, and industrial automation. The increasing production of electric vehicles and use of energy-efficient systems has intensified the requirement for robust signal isolation offerings such as photocouplers. Moreover, the demand in the U.S. is led by focus on technology innovation and the presence of major market players, leading to the market growth.

According to research, U.S.-based companies account for over 70% of patents filed globally in electrical isolation technologies, underscoring the country’s leadership in innovation.

Photocoupler Market Dynamics

Key Drivers:

-

Increasing demand for electrical isolation in growing automotive and consumer electronics markets fueling photocoupler use

Increasing demand for electrical isolation to safeguard vulnerable parts in automotive and consumer electronics is driving demand for photocouplers. Electric vehicles and smart devices Photocouplers contribute to the safety and reliability of systems by preventing electrical noise and surges from causing damage to circuits. They are also small and efficient, making them perfect for today's applications, and hence have become very popular. Such a tendency is more enhanced with multi-function and sophistication of electronics, and photocouplers are indispensable in some respects for devices which need to be electrically insulated.

According to research, Photocouplers help reduce electrical noise by up to 30%, enhancing device performance while fitting into smaller, more efficient designs.

Restrain:

-

Lack of standardized regulations and certification processes affects market confidence and adoption

The lack of a universally accepted standard or certification in the field of photocouplers has led to concerns for end-users, especially in areas where failure could have catastrophic consequences, such as in the medical and aerospace industries. Without it, product approvals can be delayed and trust eroded, constraining market penetration and overall expansion. In addition, local regulations are different in various countries, thereby increasing the compliance burden of companies operating regionally in different geographies. Impeding Expansion. Furthermore, the changing face of safety and environmental legislation requires constant updating and editing, adding cost and serving as a barrier to entry and growth for those smaller companies wishing to penetrate the market.

Opportunities:

-

Rising demand for photocouplers in emerging applications such as renewable energy and smart grids

Growing renewable energy and smart grid systems need trusty electrical isolation components. Photocouplers are the most appropriate devices in terms of performance, and thus represent a promising area of development. The efficiency and safety of signal isolation for these isolators make them suitable for the technology of contemporary energy systems. Moreover, growing government initiatives towards green energy solutions also encourage the use of these components in sustainable projects across the globe.

According to research, Solar and wind energy installations are projected to increase by more than 12% annually, driving demand for reliable electrical isolation components.

Challenges:

-

Rapid technological changes requiring frequent product updates increase development costs and risks

The rapid development of electronic technology requires continuous improvement of the photocoupler. Rapid changes in product design result in expensive R&D costs and the market risk of obsolescence. Smaller, less capitalized companies might have a hard time keeping up, which would damage the overall market’s growth. Moreover, the ever-increasing demand to meet environmental and regulatory specifications adds to the complexity of the product development cycle. This constant pressure to innovate leads to shorter product lifecycles, ever more testing investment, and supply chain lurches that make it difficult to maintain profitability within the industry.

Photocoupler Market Segment Analysis:

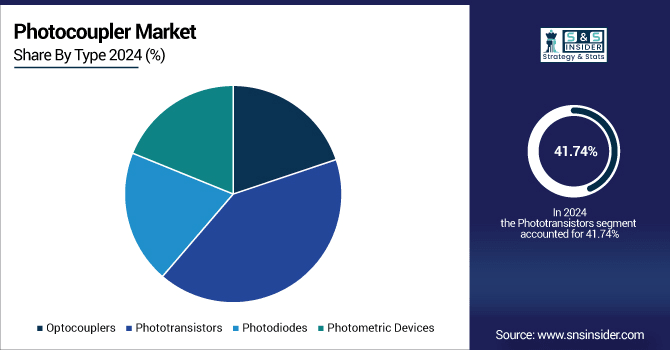

By Type

The Phototransistors segment dominated the Photocoupler Market Share in 2024 with about 41.74% due to higher sensitivity and switching speed than other devices. One well known manufacturer of high performance phototransistors is Vishay Intertechnology. They are suitable for exact signal transmission and for reducing the noise in all electronic applications. They are also cost-effective and reliable in separating electrical signals, and so widely used, which helps maintaining the top position of the Tri-morph in the market.

The Optocouplers segment is expected to grow at the fastest CAGR of about 7.32% from 2025 to 2032 due to the rising need of high isolation components in high speed communication and industrial automation applications. Broadcom, a leading supplier of this technology, provides advanced optocoupler solutions that provide superior electrical isolation and signal integrity. Rising adoption in IoT devices, renewable energy systems and consumer electronics is accelerating demand, as optocouplers provide enhanced performance in new technology-led solutions.

By Application

The Consumer Electronics segment held the largest revenue share of about 34.26% in 2024, because to the wide adoption of photocouplers in smartphones, tablet PCs, and smart clothes. Such photocouplers have been, for example, provided by Sharp Corporation as photocouplers for isolation of different parts of a circuit for the purpose of safety and achieving electrical noise. Rising need for performance-oriented, long life, smart devices is contributing to the dominance of this segment in the photocoupler market.The increasing requirement of smart devices with advanced performance and longer life is also responsible for this segment's high market share in the photocoupler market.

The Automotive segment is projected to grow at the fastest CAGR of about 7.55% from 2025 to 2032 due to the higher utilization of photocouplers in the advanced driver assistance systems (ADAS), electric vehicle (EV) and in-vehicle networking. Photocouplers Companies like Texas Instruments enables this growth with battle-proven photocoupler solutions for electrical isolation in automotive systems. Increasing investments in the autonomous driving and smart mobility industry drives the demand for automotive applications.

By End-Use Industry

The Manufacturing segment dominated the Photocoupler Market with a revenue share of about 37.91% in 2024, because photocouplers are essential for employees who work on industrial automation systems. Manufacturers such as Omron Corporation have been at the forefront, developing photocouplers that have been used to isolate equipment from high voltages and electrical noise in order to provide operational safety. Stable demand prevents the use of Smart Factory technology and Industry 4.0 projects from accelerating, continuing to position the manufacturing industry as the flagship industry in the photocoupler market.

The Aerospace segment is expected to grow at the fastest CAGR of about 7.74% from 2025 to 2032 because of the growing use of photocouplers in safety-and reliability-critical avionics and spacecraft applications. Honeywell is a leader in the field with its photocoupler components that are built for use under harsh environment and can securely transmit signals. Increasing investments in satellite technology, defense, and space exploration fuel the rapid growth of this growing end-use industry.

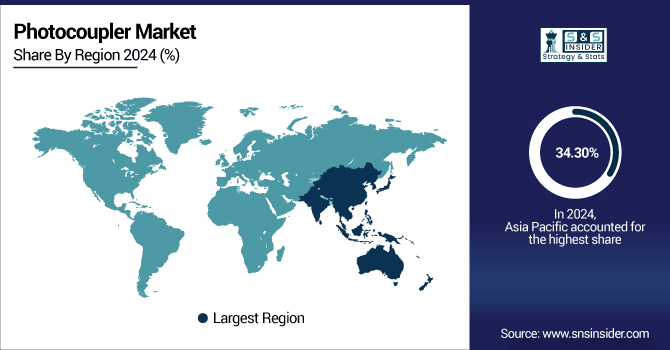

Photocoupler Market Regional Outlook:

Asia Pacific dominated the Photocoupler Market in 2024 with the highest revenue share of about 34.30% because of the region's heavy concentration of electronics manufacturing hot spots such as China, Japan, South Korea and Taiwan. The increasing use of consumer electronics, industrial automation, and automobile-related equipment has increased the demand for photocouplers in high volumes. Moreover, the likes of Toshiba Corporation are at forerunners of the production methods and innovation technologies in local production and develop apheresis systems at a lower cost and quicker pace, which enhances the dominance of the APAC region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China leads the Asia Pacific photocoupler market on account of its large electronics production base, strong domestic need, and extensive supply chain. Government backing, low-cost manufacturing, and firms like Toshiba and Panasonic with local operations add to China’s already strong position.

North America is expected to experience the fastest growth in the Photocoupler Market, with a CAGR of about 7.65% from 2025 to 2032, driven by the fast development of industries such as electric vehicle, industrial automation, and so on. A high concentration of safety standards and energy-saving applications have accelerated the incorporation of photocouplers in mission-critical applications in the region. Note that (high-performance) industry leaders like Broadcom Inc. drive innovation, so that an increasing R&D commitment and governmental support fuel market penetration in North America.

The U.S. Photocoupler Market will be led by superior technology environment, penetration of major participants such as Broadcom and ON Semiconductor along with increasing demand across automotive, aerospace, and industrial automation industry and supported by strong R&D and innovation.

Europe has emerged as a popular region for the Photocoupler Market fueled by the increased demand for automotive electronics, industrial automation, and renewable energy systems. The area’s focus on safety, sustainability, and high-performance technologies drives demand for quality isolation components. Key manufacturers and country wise participants production association ensures that the industry is competitive by innovating and adopting such trends as optimal products or creative production technologies.

Germany is the major country of Photocoupler Market in Europe. The mechanical and automotive industries are quite powerful, an automation generalization is available and it is the base for large automotive, photonics and semiconductor organizations. The focus of Germany on innovation, precision engineering, and incorporation of Industry 4.0 has established it as a major consumer and producer of photocouplers in Europe.

In the Middle East & Africa, the UAE accounts for the maximum share of Photocoupler Market owing to the priority being given to a smart infrastructure, industrial automation and renewable energy projects. In Latin America, Brazil is the leading automotive adhesive market as the country has grown as a manufacturing base for electronics, has a growing automotive industry, and increased demand for energy-efficient technologies.

Photocoupler Companies are:

Major Key Players in Photocoupler Market are Broadcom Inc., Texas Instruments Inc., Toshiba Corporation, ON Semiconductor (onsemi), Vishay Intertechnology, Inc., Renesas Electronics Corporation, Lite-On Technology Corporation, Everlight Electronics Co., Ltd., Panasonic Corporation, IXYS Corporation (Littelfuse, Inc.) and others.

Recent Development:

-

In April 2023, Broadcom showcased the world's first Tomahawk 5-based 51.2T Bailly CPO prototype system at OFC 2023. This innovation emphasizes the company's commitment to advancing optical connectivity and photonic integrated circuits.

-

In December 2023, Texas Instruments' ISO77x series digital isolators with optical coupling technology continue to be integral in high-speed communication systems, reflecting the company's ongoing development in isolation solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.21 Billion |

| Market Size by 2032 | USD 3.51 Billion |

| CAGR | CAGR of 6.07% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Optocouplers, Phototransistors, Photodiodes, Photometric Devices) • By Application (Consumer Electronics, Automotive, Industrial, Healthcare, Telecommunications) • By End-Use Industry (Aerospace, Energy and Power, Manufacturing, Food and Beverage, Pharmaceuticals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Broadcom Inc., Texas Instruments Inc., Toshiba Corporation, ON Semiconductor (onsemi), Vishay Intertechnology, Inc., Renesas Electronics Corporation, Lite-On Technology Corporation, Everlight Electronics Co., Ltd., Panasonic Corporation, IXYS Corporation (Littelfuse, Inc.) |