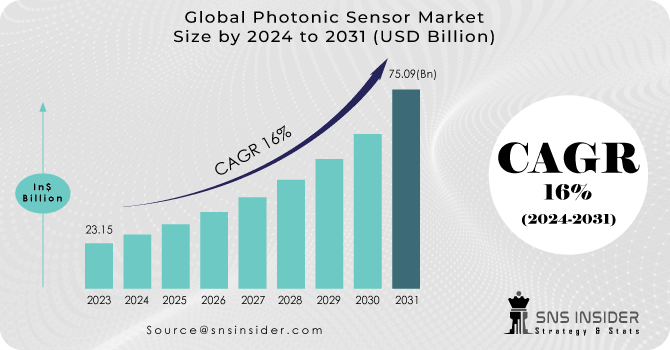

The Photonic Sensor Market will be valued at 75.09 billion by 2031, and Market Size was valued at USD 23.15 billion in 2023. It will grow at a CAGR of 16% over the forecast period 2024-2031.

Photonic sensors are quietly transforming consumer electronics. From touchscreens on smartphones and tablets to high-resolution imaging in cameras and drones, these sensors enhance user experience and device functionality. They enable features like auto-brightness based on ambient light and secure user authentication through fingerprint or iris scanning. The rising global smartphone user base, predicted to exceed 8.5 billion by 2031, fuels this market growth.

Beyond smartphones, wearables like fitness trackers and smartwatches leverage photonic sensors for health tracking features like heart rate monitoring and blood oxygen measurement. Growing health awareness and rising disposable income further propel the wearable device market.

Photonic sensors are also the secret sauce behind smart home devices. They enable features like adjusting display brightness based on light and smart climate control. Additionally, they power touchless gesture recognition in gaming consoles and smart TVs, creating a seamless user experience in our increasingly connected homes.

Get more information on Photonic Sensor Market - Request Sample Report

KEY DRIVERS:

Increasing demand for automation in the manufacturing industry

The demand for automation in the manufacturing sector is rising Increasing adoption of photonics is one of the key factors that has helped to drive growth in this market. Automation in the manufacturing sector, as well as an increasing number of Iot enabled devices for monitoring applications. Industry is now aware of the reliability and long-term financial success created by automated systems based on photonics.

RESTRAIN:

Lack of Industry Standards to hamper market growth.

The market for photonic sensors is becoming more and more widespread in the retail sector. However, there are few recognised standards related to their functioning. In addition, photonic sensors use a variety of technologies such as lasers, fibre optic and bio photonics. Only when they differ from one another do these technologies work together. Market expansion could be further hampered by the low image quality provided by the sensors and the lack of awareness.

Technical difficulties in installing and maintaining equipment

OPPORTUNITY:

Growing demand for photonic transducers

Increasing the use of photonic sensors in consumer electronics,

The use of photonic sensors in industrial processes for temperature sensing and control

CHALLENGES:

Security and safety Concerns

Increased security and safety solution needs to be developed Increased safety and security measures are offered by photonic sensors, which are of major concern to end users. In the past, manual security and safety systems required continuous physical monitoring; however, these sensors allow the system to operate autonomously and provide the end user with a sense of security. By collecting and keeping data on a centralised server, the automatic system works very effectively.

The cost of photonic sensors and detectors is high

IMPACT OF RUSSIAN UKRAINE WAR

Russia and Ukraine accounted for about 30 % of global neon supply, on a regular basis. Other projections based on values from market research firm TECHCET place this figure between 40% and 50%. According to Trend Force, Ukraine supplied almost 70% of the world's neon gas capacity before the war broke out. However, the estimated that 90% of the global supply of high purity neonates is consumed by the production of semiconductors. And it as much as possible The US semiconductor industry imports 90% of its high purity neon’s from Ukraine. 'The impact of this conflict on China's photonic and laser industries is limited in terms of scope,' 'The reason's simple.' With Ukraine, China does not do a great deal to import or export. In addition, China's rise as a domestic producer of photonics has allowed the country to support its own development. reliance insofar as it relates to its photonics ecosystem. China's rapid growth in domestic production of lasers and particularly fibre lasers has been a contributory factor.

Impact of Economic Downturn:

The vast diversity of applications allowed by photonics is a double eco, The promise of nomics and the policy challenges. Technical progress, on the one hand, In the basic principles of photonics, it may have a broad impact in many ways Application and economic sectors. This diversity, on the other hand, means that monitoring of public and private investment, employment, output, and it is difficult to deal with other economic aspects of photonics. Photonics is a wide area of technology Rather than an industry. 'The economic impact of photonics'. There's not a single North American in there, of course. Industry Classification System (NAICS) codes that enable the tracking of Revenue, employment and industry R&D Spending on photonics related fields, and we do not have enough data about government research and development spending in photonics. The lack of this information reduces the chances’ ability of photonics in the industrial community and hinder its use, opment of more coherent.

KEY MARKET SEGMENTATION:

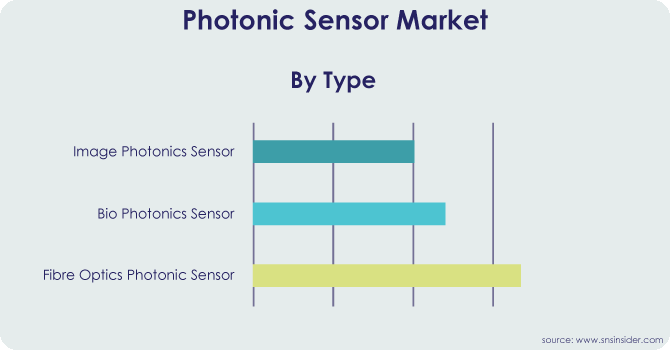

By Type

Fibre optics photonic sensor

Biphotonic sensor

Image photonics sensor

The largest contributor to the market is the image photonic sensor segment, which is expected to grow at a compound annual growth rate of 16.8% over the forecast period. There is a strong correlation between image resolution, the level of illumination and speed. The development of photonics, which allows users to stop time, is shown in the examination of new uses for high-speed imaging cameras. Charge-coupled devices (CCDs) and complementary metal-oxide semiconductors are the two main categories of image sensors (CMOS).

Get Customized Report as per your Business Requirement - Request For Customized Report

By Audience

Research Consultancy

Technology Investor

Sensor Manufacturer

Government Organisations

System Integrators

By End-Users

Oiland Gas

Automotive

Healthcare

Transport

Consumer Electronics

Energy

Industrial Sector

The sensors photonics market is divided into aerospace and defense, on the basis of end user industries. transportation, manufacturing, healthcare, energy and power, and other end-user industries. The largest market is held by the transport sector, which is expected to grow at a compound annual growth rate of 18.46% during the forecast period. period. The transport sector has been rapidly adopting LIDAR technology over the last few years. LiDAR is primarily used in advanced driver assistance systems for vehicles, such asADAS. The convenience of the driver, with a human machine interface for safe navigation and efficient operation. In addition, Governments worldwide are promoting the installation of ADAS features that will help to expand the market.

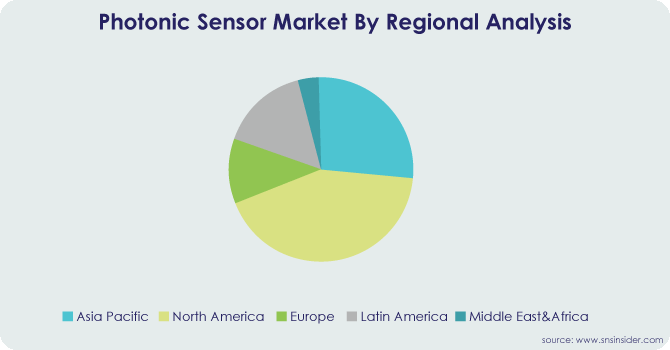

The Asia Pacific region is the largest contributor to revenue and is expected to grow at a compound annual growth rate of 17.48% during the forecast period. period. China is expected to grow as a result of its expanding economy and considerable market share in global electronics. Among the Asia Pacific countries, there is a significant difference. China is a large producer and consumer of electronics. The region's The industrial sector is rapidly expanding, and different technologies for manufacturing and telecommunications are still being developed implemented.

In the forecast period, North America is projected to increase by a compounded annual growth rate of 16.93%. In the course of the forecast period, North the US is expected to be the dominant market for laser sensors. In particular, this is because of optics and photonics Over the last ten years, sensing, imaging and metrology have become even more important in the United States. Due to the growing need for precision sensing, optical measurements are becoming more common.

The development of fibre optic and photonic technologies has made it possible to manufacture precision in the European region, which has led to the development of even more efficient sensors. The market demand is expected to be driven by the impact of Optical Imaging on In the European region, biomolecular sciences and medical diagnostics. There's a lot of photonics on the European continent. Use in a wide variety of areas.

The full use of optics and photonics as an enabling technology is needed in order for Latin America to remain competitive in the global economy. Mexico has begun to take steps to position itself as a leader after realizing this vast market opportunity. Latin America. To make Mexico the leader in Latin America's optical and photonics sector, the first study of the industry in Mexico asks for coordinated and strategic activities and investments from the government, academia, and business.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The Key players in Photonic Sensor Market are BK Technologies Corporation, Hytera Communications Corporation Ltd, Toshiba Corporation, Prime Photonics, Banpil Photonics, Inc , L3 Harris, Motorola Solutions, omnisys - thales group, General Electric Company , NP Photonics, Oxsensis, BAE Systems plc, General Dynamics Corporation, ICOM Incorporation, Samsung Electronics, Leonardo S.R.L., MCS Digital, Intevac, Inc., Mitsubishi Electric Corporation and Other.

Hytera Communications Corporation Ltd-Company Financial Analysis

Photonic sensing is a method of detecting and measuring changes in the environment using light, or identifying a particular target. It This involves the use of imaging systems, such as lasers, fibers, detectors and photodetectors, to determine changes in electrical intensity, Changes in the environment or presence of a target may lead to wavelengths, phases, polarizations and time delays.

A variety of applications, e.g. chemical and biological sensing, temperature or pressure measurements, can be carried out with photonic sensors Sensors, structural health monitoring, environmental monitoring and security and surveillance. They offer several advantages in comparison with traditional sensors, such as strong sensitivity, quick response time, immunity to EM interference and ability. to monitor remote or inaccessible areas.

October 2023: The acquisition of eMagin by Samsung Display Co., Ltd., a subsidiary of samsung electronics was completed Corporation, the leader in U.S. based OLED microdisplays. This has given eMagin the scale and technology to do so for customers, the acceleration of growth and greater value has been achieved.

May-2023: Fujifilm Holdings Corporation acquired Entegris, Inc., an American provider of products and systems to purify, protect and transport critical materials used in the production of semiconductor devices As a result of this acquisition, the range of electronic chemicals available to customers will be expanded by Fujifilm, including KMG's High Performance Process ChemicalsHPPCs, which play an important role in Etching and Oxidation During the manufacturing of semiconductors, silicon wafers shall be cleaned.

In September 2022, A new Transparent 3D Formable Touch Sensor is now being manufactured by Canatu, a Carbon Nanomaterial Development Company. In the automotive sector and in the semiconductor sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 23.15 Billion |

| Market Size by 2030 | US$ 75.90 Billion |

| CAGR | CAGR of 16% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Fibre Optics Photonic Sensor, Biophotonic Sensor, Image Photonics Sensor) • By End-User (Oil And Gas, Automotive, Healthcare, Transport, Consumer Electronics, Energy, Industrial Sector) • By Audience (Research Consultancy, Technology Investor, Sensor Manufacturer, Government Organizations, System Integrators) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BK Technologies Corporation, Hytera Communications Corporation Ltd, Toshiba Corporation, Prime Photonics, Banpil Photonics, Inc , L3 Harris, Motorola Solutions, omnisys - thales group, General Electric Company , NP Photonics, Oxsensis, BAE Systems plc, General Dynamics Corporation, ICOM Incorporation, Samsung Electronics, Leonardo S.R.L., MCS Digital, Intevac, Inc., Mitsubishi Electric Corporation |

| Key Drivers | • Increasing demand for automation in the manufacturing industry |

| RESTRAINTS | • Lack of Industry Standards to hamper market growth. • Technical difficulties in installing and maintaining equipment |

The Photonic Sensor Market size was valued at 23.15 billion in 2023 at a CAGR of 16% till 2031

North American region is dominating the Photonic Sensor Market.

The Key players in Global Photonic Sensor Market are BK Technologies Corporation, Hytera Communications Corporation Ltd, Toshiba Corporation, Prime Photonics, Banpil Photonics, Inc , L3 Harris, Motorola Solutions, omnisys - thales group, General Electric Company , NP Photonics, Oxsensis, BAE Systems plc, General Dynamics Corporation, ICOM Incorporation, Samsung Electronics, Leonardo S.R.L., MCS Digital, Intevac, Inc. , Mitsubishi Electric Corporation and Other.

Top-down research, bottom-up research, qualitative research, quantitative research, and Fundamental research.

Manufacturers, Consultants, Association, Research Institutes, private and university libraries, suppliers, and distributors of the product.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Photonic Sensor Market Segmentation, By Type

9.1 Introduction

9.2 Trend Analysis

9.3 Fibre optics photonic sensor

9.4 Biphotonic sensor

9.5 Image photonics sensor

10. Photonic Sensor Market Segmentation, By Audience

10.1 Introduction

10.2 Trend Analysis

10.3 Research Consultancy

10.4 Technology Investor

10.5 Sensor Manufacturer

10.6 Government Organisations

10.7 System Integrators

11. Photonic Sensor Market Segmentation, By End Users

11.1 Introduction

11.2 Trend Analysis

11.3 Oil and Gas

11.4 Automotive

11.5 Healthcare

11.6 Transport

11.7 Consumer Electronics

11.8 Energy

11.9 Industrial Sector

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Photonic Sensor Market by Country

12.2.3 North America Photonic Sensor Market By Type

12.2.4 North America Photonic Sensor Market By Audience

12.2.5 North America Photonic Sensor Market By End Users

12.2.6 USA

12.2.6.1 USA Photonic Sensor Market By Type

12.2.6.2 USA Photonic Sensor Market By Audience

12.2.6.3 USA Photonic Sensor Market By End Users

12.2.7 Canada

12.2.7.1 Canada Photonic Sensor Market By Type

12.2.7.2 Canada Photonic Sensor Market By Audience

12.2.7.3 Canada Photonic Sensor Market By End Users

12.2.8 Mexico

12.2.8.1 Mexico Photonic Sensor Market By Type

12.2.8.2 Mexico Photonic Sensor Market By Audience

12.2.8.3 Mexico Photonic Sensor Market By End Users

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Photonic Sensor Market by Country

12.3.2.2 Eastern Europe Photonic Sensor Market By Type

12.3.2.3 Eastern Europe Photonic Sensor Market By Audience

12.3.2.4 Eastern Europe Photonic Sensor Market By End Users

12.3.2.5 Poland

12.3.2.5.1 Poland Photonic Sensor Market By Type

12.3.2.5.2 Poland Photonic Sensor Market By Audience

12.3.2.5.3 Poland Photonic Sensor Market By End Users

12.3.2.6 Romania

12.3.2.6.1 Romania Photonic Sensor Market By Type

12.3.2.6.2 Romania Photonic Sensor Market By Audience

12.3.2.6.4 Romania Photonic Sensor Market By End Users

12.3.2.7 Hungary

12.3.2.7.1 Hungary Photonic Sensor Market By Type

12.3.2.7.2 Hungary Photonic Sensor Market By Audience

12.3.2.7.3 Hungary Photonic Sensor Market By End Users

12.3.2.8 Turkey

12.3.2.8.1 Turkey Photonic Sensor Market By Type

12.3.2.8.2 Turkey Photonic Sensor Market By Audience

12.3.2.8.3 Turkey Photonic Sensor Market By End Users

12.3.2.9 Rest of Eastern Europe

12.3.2.9.1 Rest of Eastern Europe Photonic Sensor Market By Type

12.3.2.9.2 Rest of Eastern Europe Photonic Sensor Market By Audience

12.3.2.9.3 Rest of Eastern Europe Photonic Sensor Market By End Users

12.3.3 Western Europe

12.3.3.1 Western Europe Photonic Sensor Market by Country

12.3.3.2 Western Europe Photonic Sensor Market By Type

12.3.3.3 Western Europe Photonic Sensor Market By Audience

12.3.3.4 Western Europe Photonic Sensor Market By End Users

12.3.3.5 Germany

12.3.3.5.1 Germany Photonic Sensor Market By Type

12.3.3.5.2 Germany Photonic Sensor Market By Audience

12.3.3.5.3 Germany Photonic Sensor Market By End Users

12.3.3.6 France

12.3.3.6.1 France Photonic Sensor Market By Type

12.3.3.6.2 France Photonic Sensor Market By Audience

12.3.3.6.3 France Photonic Sensor Market By End Users

12.3.3.7 UK

12.3.3.7.1 UK Photonic Sensor Market By Type

12.3.3.7.2 UK Photonic Sensor Market By Audience

12.3.3.7.3 UK Photonic Sensor Market By End Users

12.3.3.8 Italy

12.3.3.8.1 Italy Photonic Sensor Market By Type

12.3.3.8.2 Italy Photonic Sensor Market By Audience

12.3.3.8.3 Italy Photonic Sensor Market By End Users

12.3.3.9 Spain

12.3.3.9.1 Spain Photonic Sensor Market By Type

12.3.3.9.2 Spain Photonic Sensor Market By Audience

12.3.3.9.3 Spain Photonic Sensor Market By End Users

12.3.3.10 Netherlands

12.3.3.10.1 Netherlands Photonic Sensor Market By Type

12.3.3.10.2 Netherlands Photonic Sensor Market By Audience

12.3.3.10.3 Netherlands Photonic Sensor Market By End Users

12.3.3.11 Switzerland

12.3.3.11.1 Switzerland Photonic Sensor Market By Type

12.3.3.11.2 Switzerland Photonic Sensor Market By Audience

12.3.3.11.3 Switzerland Photonic Sensor Market By End Users

12.3.3.1.12 Austria

12.3.3.12.1 Austria Photonic Sensor Market By Type

12.3.3.12.2 Austria Photonic Sensor Market By Audience

12.3.3.12.3 Austria Photonic Sensor Market By End Users

12.3.3.13 Rest of Western Europe

12.3.3.13.1 Rest of Western Europe Photonic Sensor Market By Type

12.3.3.13.2 Rest of Western Europe Photonic Sensor Market By Audience

12.3.3.13.3 Rest of Western Europe Photonic Sensor Market By End Users

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific Photonic Sensor Market by Country

12.4.3 Asia-Pacific Photonic Sensor Market By Type

12.4.4 Asia-Pacific Photonic Sensor Market By Audience

12.4.5 Asia-Pacific Photonic Sensor Market By End Users

12.4.6 China

12.4.6.1 China Photonic Sensor Market By Type

12.4.6.2 China Photonic Sensor Market By Audience

12.4.6.3 China Photonic Sensor Market By End Users

12.4.7 India

12.4.7.1 India Photonic Sensor Market By Type

12.4.7.2 India Photonic Sensor Market By Audience

12.4.7.3 India Photonic Sensor Market By End Users

12.4.8 Japan

12.4.8.1 Japan Photonic Sensor Market By Type

12.4.8.2 Japan Photonic Sensor Market By Audience

12.4.8.3 Japan Photonic Sensor Market By End Users

12.4.9 South Korea

12.4.9.1 South Korea Photonic Sensor Market By Type

12.4.9.2 South Korea Photonic Sensor Market By Audience

12.4.9.3 South Korea Photonic Sensor Market By End Users

12.4.10 Vietnam

12.4.10.1 Vietnam Photonic Sensor Market By Type

12.4.10.2 Vietnam Photonic Sensor Market By Audience

12.4.10.3 Vietnam Photonic Sensor Market By End Users

12.4.11 Singapore

12.4.11.1 Singapore Photonic Sensor Market By Type

12.4.11.2 Singapore Photonic Sensor Market By Audience

12.4.11.3 Singapore Photonic Sensor Market By End Users

12.4.12 Australia

12.4.12.1 Australia Photonic Sensor Market By Type

12.4.12.2 Australia Photonic Sensor Market By Audience

12.4.12.3 Australia Photonic Sensor Market By End Users

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Photonic Sensor Market By Type

12.4.13.2 Rest of Asia-Pacific Photonic Sensor Market By Audience

12.4.13.3 Rest of Asia-Pacific Photonic Sensor Market By End Users

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Photonic Sensor Market by Country

12.5.2.2 Middle East Photonic Sensor Market By Type

12.5.2.3 Middle East Photonic Sensor Market By Audience

12.5.2.4 Middle East Photonic Sensor Market By End Users

12.5.2.5 UAE

12.5.2.5.1 UAE Photonic Sensor Market By Type

12.5.2.5.2 UAE Photonic Sensor Market By Audience

12.5.2.5.3 UAE Photonic Sensor Market By End Users

12.5.2.6 Egypt

12.5.2.6.1 Egypt Photonic Sensor Market By Type

12.5.2.6.2 Egypt Photonic Sensor Market By Audience

12.5.2.6.3 Egypt Photonic Sensor Market By End Users

12.5.2.7 Saudi Arabia

12.5.2.7.1 Saudi Arabia Photonic Sensor Market By Type

12.5.2.7.2 Saudi Arabia Photonic Sensor Market By Audience

12.5.2.7.3 Saudi Arabia Photonic Sensor Market By End Users

12.5.2.8 Qatar

12.5.2.8.1 Qatar Photonic Sensor Market By Type

12.5.2.8.2 Qatar Photonic Sensor Market By Audience

12.5.2.8.3 Qatar Photonic Sensor Market By End Users

12.5.2.9 Rest of Middle East

12.5.2.9.1 Rest of Middle East Photonic Sensor Market By Type

12.5.2.9.2 Rest of Middle East Photonic Sensor Market By Audience

12.5.2.9.3 Rest of Middle East Photonic Sensor Market By End Users

12.5.3 Africa

12.5.3.1 Africa Photonic Sensor Market by Country

12.5.3.2 Africa Photonic Sensor Market By Type

12.5.3.3 Africa Photonic Sensor Market By Audience

12.5.3.4 Africa Photonic Sensor Market By End Users

12.5.3.5 Nigeria

12.5.3.5.1 Nigeria Photonic Sensor Market By Type

12.5.3.5.2 Nigeria Photonic Sensor Market By Audience

12.5.3.5.3 Nigeria Photonic Sensor Market By End Users

12.5.3.6 South Africa

12.5.3.6.1 South Africa Photonic Sensor Market By Type

12.5.3.6.2 South Africa Photonic Sensor Market By Audience

12.5.3.6.3 South Africa Photonic Sensor Market By End Users

12.5.3.7 Rest of Africa

12.5.3.7.1 Rest of Africa Photonic Sensor Market By Type

12.5.3.7.2 Rest of Africa Photonic Sensor Market By Audience

12.5.3.7.3 Rest of Africa Photonic Sensor Market By End Users

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Photonic Sensor Market by country

12.6.3 Latin America Photonic Sensor Market By Type

12.6.4 Latin America Photonic Sensor Market By Audience

12.6.5 Latin America Photonic Sensor Market By End Users

12.6.6 Brazil

12.6.6.1 Brazil Photonic Sensor Market By Type

12.6.6.2 Brazil Photonic Sensor Market By Audience

12.6.6.3 Brazil Photonic Sensor Market By End Users

12.6.7 Argentina

12.6.7.1 Argentina Photonic Sensor Market By Type

12.6.7.2 Argentina Photonic Sensor Market By Audience

12.6.7.3 Argentina Photonic Sensor Market By End Users

12.6.8 Colombia

12.6.8.1 Colombia Photonic Sensor Market By Type

12.6.8.2 Colombia Photonic Sensor Market By Audience

12.6.8.3 Colombia Photonic Sensor Market By End Users

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Photonic Sensor Market By Type

12.6.9.2 Rest of Latin America Photonic Sensor Market By Audience

12.6.9.3 Rest of Latin America Photonic Sensor Market By End Users

13. Company Profiles

13.1 BK Technologies Corporation

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Hytera Communications Corporation Ltd

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Toshiba Corporation

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Prime Photonics

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Banpil Photonics, Inc

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 L3 Harris

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Motorola Solutions

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 omnisys - thales group

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 General Electric Company

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 NP Photonics

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

13.11 Oxsensis

13.11.1 Company Overview

13.11.2 Financial

13.11.3 Products/ Services Offered

13.11.4 SWOT Analysis

13.11.5 The SNS View

13.12 BAE Systems plc

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

13.12.5 The SNS View

13.13 General Dynamics Corporation

13.13.1 Company Overview

13.13.2 Financial

13.13.3 Products/ Services Offered

13.13.4 SWOT Analysis

13.13.5 The SNS View

13.14 ICOM Incorporation

13.14.1 Company Overview

13.14.2 Financial

13.14.3 Products/ Services Offered

13.14.4 SWOT Analysis

13.14.5 The SNS View

13.15 Samsung Electronics

13.15.1 Company Overview

13.15.2 Financial

13.15.3 Products/ Services Offered

13.15.4 SWOT Analysis

13.15.5 The SNS View

13.16 Leonardo S.R.L.

13.16.1 Company Overview

13.16.2 Financial

13.16.3 Products/ Services Offered

13.16.4 SWOT Analysis

13.16.5 The SNS View

13.17 MCS Digital

13.17.1 Company Overview

13.17.2 Financial

13.17.3 Products/ Services Offered

13.17.4 SWOT Analysis

13.17.5 The SNS View

13.18 Intevac

13.18.1 Company Overview

13.18.2 Financial

13.18.3 Products/ Services Offered

13.18.4 SWOT Analysis

13.18.5 The SNS View

13.19 Mitsubishi Electric Corporation

13.19.1 Company Overview

13.19.2 Financial

13.19.3 Products/ Services Offered

13.19.4 SWOT Analysis

13.19.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Optical Transceiver market size was valued at USD 8.75 Billion in 2022 and is expected to grow to USD 27.33 Billion by 2030 and grow at a CAGR Of 15.3% over the forecast period of 2023-2030.

The Smart Display Market Size will be valued at USD 30.53 billion by 2031, and it was valued at USD 3.09 billion in 2023, and grow at a CAGR of 33.1% over the forecast period 2024-2031.

The Fault Detection and Classification Market size was valued at USD 4.5 billion in 2022 and is expected to grow to USD 9.03 billion by 2030 and grow at a CAGR of 9.1% over the forecast period of 2023-2030.

The Speech and Voice Recognition Market Size was valued at USD 12.63 billion in 2023, and expected to reach USD 73.84 billion by 2031 and grow at a CAGR of 24.7% over the forecast period 2024-2031.

The Display Technology Market size was valued at USD 125.5 Billion in 2022 and is expected to grow to USD 212.42897 Billion by 2030 and grow at a CAGR Of 6.8 % over the forecast period of 2023-2030.

The Virtual Sensors Market size was valued at USD 0.79 Billion in 2023 and is expected to grow to USD 7.1 Billion by 2031 and grow at a CAGR of 31.25 % over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone