Physical Therapy Software Market Report Scope & Overview:

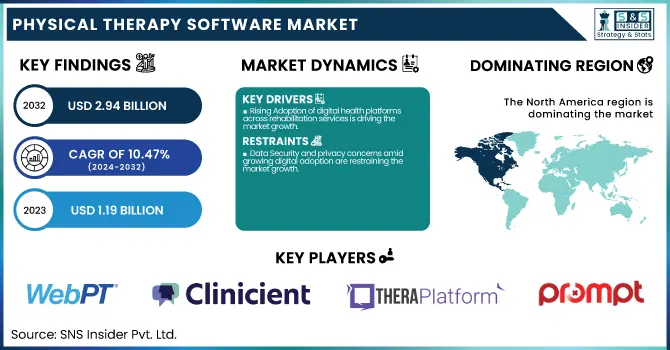

The Physical Therapy Software Market was valued at USD 1.19 billion in 2023 and is expected to reach USD 2.94 billion by 2032, growing at a CAGR of 10.47% from 2024-2032.

To Get more information on Physical Therapy Software Market - Request Free Sample Report

This report provides exclusive value by providing detailed, data-driven insights specific to the digitalization of physical therapy services. It provides the adoption rate of physical therapy software, broken down by hospitals, clinics, private practices, and telehealth providers, with usage trends in various care settings. The report also presents module-wise software usage, including EMR, billing, scheduling, and patient engagement tools. In addition, it compares the share of deployment mode—server-based versus cloud-based—by key regions, providing insight into infrastructure preference. It also gives average software expense per facility by region, providing a balanced understanding of spending trends by financial investment in healthcare environments.

The U.S. Physical Therapy Software Market was valued at USD 0.44 billion in 2023 and is expected to reach USD 1.05 billion by 2032, growing at a CAGR of 10.23% from 2024-2032. The United States leads the North American Physical Therapy Software Market based on its well-developed healthcare IT infrastructure, high adoption of EMR systems, and high presence of major players such as WebPT and Net Health. This supremacy is also sustained by the high demand for outpatient rehabilitation solutions and electronic practice management tools throughout healthcare organizations.

Physical Therapy Software Market Dynamics

Drivers

-

Rising Adoption of digital health platforms across rehabilitation services is driving the market growth.

The growing digitalization of healthcare systems worldwide has greatly fueled the need for software solutions in physical therapy. As more and more clinics and hospitals look for effective means to manage patient records, treatment plans, and scheduling, physical therapy software is increasingly becoming part of day-to-day operations. Based on a 2023 HIMSS survey, more than 80% of North American outpatient care providers currently use some kind of digital health platform. In addition, the combination of AI-based motion-tracking technologies and automated documentation software is decreasing administrative workloads for therapists. Another development worth mentioning is the collaboration between WebPT and Intel RealSense Technology (September 2024) to improve therapy using AI-based motion capture. The growing trend towards automation and real-time tracking of data is spurring adoption, particularly among practices with a focus on enhancing patient outcomes and optimizing workflows.

-

The growing need for remote patient monitoring and telehealth capabilities is propelling the growth of the market.

The move towards virtual rehabilitation and remote care has established a high demand for physical therapy software with telehealth capabilities built in. The pandemic caused by COVID-19 fast-tracked the use of virtual care, and this trend has persisted as providers and patients alike appreciate the convenience and flexibility that it provides. Firms such as Net Health have broadened their services with acquisitions such as Alinea Engage (January 2025), which deals with rehabilitation provider automation and patient engagement technology. The trend is particularly dominant in rural and underserved areas where physical therapy access is scarce. The further growth of secure, HIPAA-compliant telehealth platforms is allowing therapists to provide real-time care, remotely monitor exercises, and enhance long-term patient adherence and recovery rates.

Restraint

-

Data Security and privacy concerns amid growing digital adoption are restraining the market growth.

While physical therapy clinics continue to shift to online platforms, issues related to data security and patient confidentiality have become the biggest hindrance in the market. The confidential nature of medical records, such as patient and treatment information, requires very strict adherence to data protection rules such as HIPAA in the U.S. and GDPR in the E.U. Nevertheless, most of the smaller rehabilitation centers and clinics do not possess the technical support and infrastructure to implement strong cybersecurity measures. Such a weakness makes them vulnerable to attacks like data breaches, ransomware, and unauthorized access, which can damage patient trust and lead to regulatory fines. Additionally, the regular changes in compliance requirements place another kind of burden on software vendors as well as end users. Such obstacles could discourage adoption, especially from institutions with negligible IT support or where there is limited budget. This would prevent market penetration in some areas.

Opportunities

-

Integration of AI and Wearable Devices in Physical Therapy Software presents a significant opportunity.

The growing use of Artificial Intelligence (AI) and wearable health monitors in physical therapy software is an exciting opportunity for market expansion. AI-based analytics provide real-time monitoring of progress, customized exercise routines, and predictive analytics to anticipate recovery trends. Combined with wearable devices such as motion detectors and fitness tracking devices, software programs can quantify the range of motion, posture, and therapy adherence. This convergence provides therapists with a broader understanding of patient performance beyond clinical environments, enabling better remote care and improved outcomes. As tele-rehabilitation and hybrid models of care continue to gain traction worldwide, especially in the aftermath of COVID-19, innovators who advance AI and IoT-enabled platforms will be well-positioned to unlock emerging revenue streams, enhance patient satisfaction, and attract technology-savvy healthcare providers seeking enhanced digital solutions.

Challenges

-

Limited Digital Literacy Among Small and Mid-sized Practices is challenging the market growth.

Even with the increased advantages of physical therapy software, low digital literacy among small and mid-sized physical therapy clinics is a significant obstacle. Most independent or rural clinics lack in-house IT assistance or training to properly implement and leverage sophisticated software platforms. These clinics might find it difficult to navigate complicated interfaces, modify modules, or integrate the software with current systems such as billing or EHR systems. Additionally, reluctance to modify entrenched manual workflows again hinders digital transformation. Such a knowledge deficit usually results in under-leverage of the software's functionality, diminished return on investment, and user discontent. Vendors need to then spend on onboarding, training, and ease of use to overcome the digital literacy deficit and stimulate mass adoption, particularly in lower-digitized markets.

Physical Therapy Software Market Segmentation Analysis

By Interface

Mobile & Tablet segment dominated the physical therapy software market with a 64.18% market share in 2023 because of increasing demand for flexible, on-the-go access to clinic and administrative tools. Physical therapists increasingly turned to mobile and tablet devices to handle patient records, appointments, and virtual care, particularly in home-based and remote therapy environments. The convenience of mobile interfaces enabled therapists to document sessions in real time, enhancing workflow efficiency and lowering administrative burden. The increasing demand for tele-rehabilitation and patient engagement tools based on apps further spurred extensive mobile adoption. The simplicity of use, mobility, and connectivity possibilities with wearable devices additionally drove the stronghold of this segment in contemporary physical therapy practices.

By Deployment Mode

Cloud-based segment dominated the physical therapy software market with a 65.13% market share in 2023 as a result of its scalability, cost-effectiveness, and ease of accessibility. The cloud-based applications became the favorite of clinics and therapy centers owing to their ability to provide safe, remote access to patient documentation, records, and billing without on-premises servers. The model cut down on initial IT expenditure while guaranteeing automatic software updates and backup data. Further, cloud platforms facilitated seamless integration with telehealth, patient portals, and mobile devices—capabilities that became critical in post-pandemic models of care. The increasing multi-location practice trend also gained advantage through centralized cloud systems for real-time data exchange and team collaboration among facilities, solidifying the acceptability and ascendancy of cloud-based deployment in physical therapy software

By End-Use

The Hospitals segment dominated the physical therapy software market with a 42.15% market share in 2023 due to their large-scale operations, greater patient volumes, and higher financial ability to invest in full-fledged software solutions. Hospitals need sophisticated physical therapy software that can easily integrate with current electronic health records (EHRs), handle multidisciplinary teams, and accommodate inpatient as well as outpatient rehabilitation services. The requirement for strong documentation, regulatory compliance, and insurance billing also compels hospitals to implement full-featured software systems. Moreover, hospitals tend to have specialized physical therapy and rehabilitation departments, which require centralized software for better coordination and performance tracking, cementing their leadership in this market segment.

The Others segment, which consists of home healthcare providers, sports and fitness centers, and long-term care facilities, is expected to see the fastest growth in the forecast period with 10.74% CAGR, as there is growing demand for remote and customized therapy services. Tele-rehabilitation, mobile health applications, and integration with wearables have enabled non-traditional locations to use physical therapy software to improve service delivery. As chronic diseases and aging populations rise around the world, home-based rehabilitation and long-term care are becoming increasingly crucial, spurring digital adoption. The scalability, affordability, and flexibility of physical therapy software make it an effective option for these alternative providers, which are enjoying fast growth in the market.

Regional Insights

North America dominated the physical therapy software market with a 52.06% market share in 2023 because it has a well-developed healthcare system, embraced electronic medical records (EMR) earlier than other regions, and is far-reaching with digital health solution implementations. Major companies like WebPT, Net Health, and Clinicient call the region home, and these organizations keep improving to serve the high demand for optimized physical therapy processes. Furthermore, favorable government policies, comprehensive insurance coverage for outpatient care, and high awareness of rehabilitation services have significantly contributed to the wide adoption of software among clinics and hospitals in the U.S. and Canada. The convergence of AI and motion-capture technologies is further improving outcomes of therapy. Additionally, heavy patient volumes and administrative complexities make digital tools necessary for enhancing operational efficiency.

Asia Pacific is witnessing the fastest growth in the physical therapy software market with 11.11% CAGR throughout the forecast period, driven by growing healthcare infrastructure, increasing investments in digital health technologies, and an aging population with rising rehabilitation requirements. India, China, and Japan are seeing a boost in demand for outpatient therapy services and telehealth platforms. The region's burgeoning smartphone penetration as well as its enhanced internet coverage also augur well for cloud-based and mobile-optimized therapy software uptake. With healthcare payers seeking the efficiency of processes and the enabling of remote care, Asia Pacific is also positioned to become an important growth driver for the overall global market. Government drives pushing digital health conversion and enhanced emphasis on physical rehabilitation further aid in the momentum build-up of the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Physical Therapy Software Market

-

WebPT (WebPT EMR, WebPT Reach)

-

Clinicient Inc. (Insight EMR, Insight Billing)

-

TheraPlatform (TheraPlatform Telehealth, TheraPlatform EHR)

-

PromptEMR (Prompt Scheduling, Prompt Documentation)

-

BMS Practice Solutions (RevFlow EMR, RevFlow Billing)

-

Net Health (TherapyRehab Plus, ReDoc)

-

MWTherapy (MWTherapy EMR, MWTherapy Telehealth)

-

Fusion Web Clinic (Fusion EMR, Fusion Scheduling)

-

Raintree Systems (TherapyRehab Suite, Raintree Billing)

-

PT PracticePro (PT PracticePro EMR, PT PracticePro Scheduler)

-

Kareo (Kareo Clinical, Kareo Billing)

-

AdvancedMD, Inc. (AdvancedMD EHR, AdvancedMD Practice Management)

-

SimplePractice (SimplePractice Telehealth, SimplePractice EMR)

-

Therasoft Online (Therasoft EHR, Therasoft Client Portal)

-

ChartPerfect (ChartPerfect Scheduler, ChartPerfect Billing)

-

CareCloud (CareCloud Charts, CareCloud Central)

-

Jane Software Inc. (Jane App Scheduling, Jane App Billing)

-

Power Diary (Power Diary Practice Management, Power Diary Telehealth)

-

Practice Perfect EMR (Practice Perfect Scheduler, Practice Perfect Documentation)

-

ReDoc by Net Health (ReDoc Suite, ReDoc Outcomes)

Suppliers (These suppliers provide essential cloud computing infrastructure, secure data storage, telehealth APIs, communication tools, and payment processing services that enable physical therapy software platforms to operate securely, reliably, and at scale.) in Physical Therapy Software Market

-

Amazon Web Services (AWS)

-

Microsoft Azure

-

Google Cloud Platform (GCP)

-

Twilio Inc.

-

Stripe

-

Zoom Video Communications, Inc.

-

Vonage

-

Salesforce (Heroku)

-

MongoDB, Inc.

-

Cloudflare, Inc.

Recent Developments

-

September 2024 – WebPT has partnered with Intel RealSense Technology on a strategic initiative to bring AI-enabled motion-capture technology to the physical therapy industry. This partnership will make clinical workflows easier by using artificial intelligence to eliminate manual motion analysis and greatly reduce administrative tasks for therapists.

-

January 8, 2025 – Net Health, a premier distributor of specialized care software for providers of restorative care, announced the acquisition of Alinea Engage. Alinea, which excels at providing enterprise-level automation and patient engagement solutions to private and senior rehabilitation therapy providers, will now operate under the guidance of Net Health. The merger will help create better patient outcomes through enhanced engagement and increase revenue for providers through optimized reimbursement strategies and reduced denials.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.19 Billion |

| Market Size by 2032 | US$ 2.94 Billion |

| CAGR | CAGR of 10.47 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Interface (Desktop & Laptop, Mobile & Tablet) • By Deployment Mode (Cloud-Based, Server-Based) • By End-Use (Hospitals, Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | WebPT, Clinicient Inc., TheraPlatform, PromptEMR, BMS Practice Solutions, Net Health, MWTherapy, Fusion Web Clinic, Raintree Systems, PT PracticePro, Kareo, AdvancedMD, Inc., SimplePractice, Therasoft Online, ChartPerfect, CareCloud, Jane Software Inc., Power Diary, Practice Perfect EMR, ReDoc by Net Health, and other players. |