Pickup Trucks Market Size & Overview:

Get More Information on Pickup Trucks Market - Request Sample Report

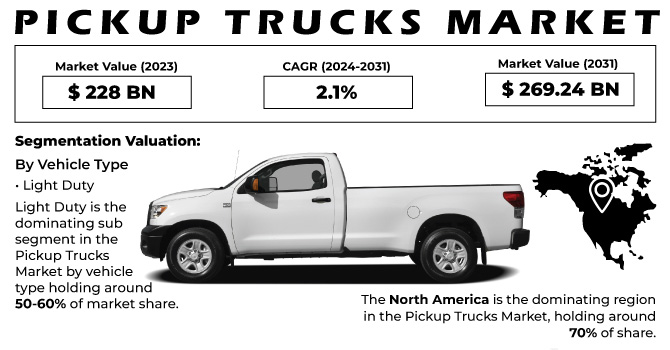

The Pickup Trucks Market Size was valued at USD 228 billion in 2023 and is expected to reach USD 269.24 billion by 2031 and grow at a CAGR of 2.1% over the forecast period 2024-2031.

The rise of pickup trucks can be attributed to their versatility. They offer ample cargo space for both business and personal use, making them ideal for work and hobbies alike. Thus, the advancements in fuel efficiency are fueling the industry's growth. Manufacturers are constantly striving to create lighter trucks through innovative materials and replacing steel parts. This not only improves fuel efficiency but also enhances overall performance. The increasing demand for transporting goods is another key driver of the pickup truck market's expansion. The combination of functionality, improved fuel efficiency, and a growing need for hauling capabilities is propelling the pickup truck market forward.

MARKET DYNAMICS:

KEY DRIVERS:

-

E-commerce and technological advancements are fueling the rise of pickup trucks, especially for deliveries and in remote areas.

The growth in online shopping has led to a global rise in home deliveries. These deliveries often rely on mid-sized and full-sized pickup trucks. In remote areas, where infrastructure might be limited, pickup trucks' technological advancements make them ideal choices for navigating diverse terrains and ensuring deliveries reach their destinations. So, the rise of e-commerce has not only boosted home deliveries but has also contributed to the popularity of technologically advanced pickup trucks, particularly in remote regions.

-

Rising consumer preference for outdoor activities like camping and boating is increasing the demand for capable pickup trucks.

RESTRAINTS:

-

Rising environmental awareness and stricter emission regulations threaten the pickup truck market.

As environmental concerns rise and governments enact stricter regulations to limit carbon emissions, the pickup truck market faces the problems. These regulations often target vehicles with lower fuel efficiency, a category that traditionally includes many pickup trucks. This puts pressure on manufacturers to develop cleaner technologies or risk a decline in sales. The industry is responding by implementing advancements like lighter materials and hybrid engines, but the success of these efforts will determine how effectively the pickup truck market adapts to this evolving landscape.

-

High fuel costs due to lower fuel efficiency compared to other vehicles can be a turn-off for some buyers.

OPPORTUNITIES:

-

Advancements in electrification and hybrid technology offer eco-friendly options for pickup truck buyers.

-

Rising disposable income allows consumers to invest in feature-rich and technologically advanced pickups.

CHALLENGES:

-

Rising production costs due to technological advancements can lead to expensive pickup trucks.

-

Limited parking availability in urban areas discourages ownership of large vehicles like pickups.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has disrupted the pickup truck market in several ways. The global supply chains have been significantly impacted. Both Russia and Ukraine play important roles in the production of vehicle parts, and the conflict has caused shortages and delays. This has limited the overall production of pickup trucks and slowed down deliveries to customers. The war has driven up the prices of raw materials like steel and aluminium, which are essential components of pickups. This increase in production costs has translated to higher pickup truck prices for consumers. Due to ongoing fluctuations, there is a decline in the global pickup truck market share by around 5% to 10%. This can be attributed to the combined effect of production slowdowns and rising costs.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can significantly impact the pickup truck market. These trucks are often considered discretionary purchases, meaning they are not essential for everyday life. During economic downturns, consumers tend to limit their budgets and prioritize spending on necessities like groceries and housing. This can lead to a decline in sales for pickup trucks, especially for high-end, feature-loaded models. The pickup truck market share decreased from around 20% to closer to 15%. Businesses that rely on trucks for deliveries may also cut back on purchases during an economic downturn. Trucks can be seen as an investment, lasting for many years and offering utility for both work and personal use.

KEY MARKET SEGMENTS:

By Fuel Type

-

Diesel

-

Petrol

-

Electric

Petrol is the dominating sub-segment in the Pickup Trucks Market by fuel type holding around 65-75% of market share. Petrol pickup trucks remain the most popular segment due to their established infrastructure, lower upfront costs compared to electric and diesel options, and wider availability of Petrol stations. While diesel offers superior towing capacity and fuel efficiency in specific situations, its higher price tag and maintenance needs limit its appeal to a broader audience.

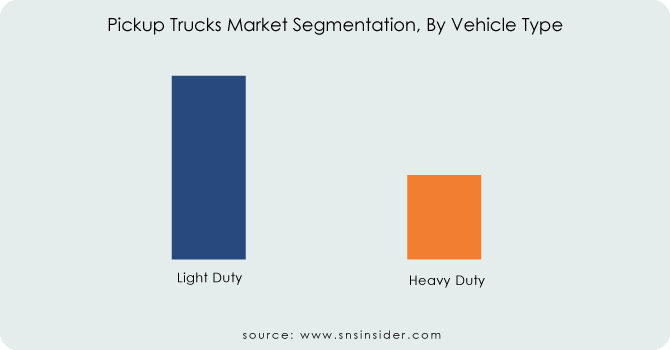

By Vehicle Type

-

Light Duty

-

Heavy Duty

Light Duty is the dominating sub-segment in the Pickup Trucks Market by vehicle type holding around 50-60% of market share due to their versatility. They cater to a wider range of uses, from personal transportation and recreation to light-duty commercial applications. Their smaller size makes them more mobility, fuel-efficient for everyday use compared to heavy-duty trucks, and easier to park in urban areas.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL ANALYSES

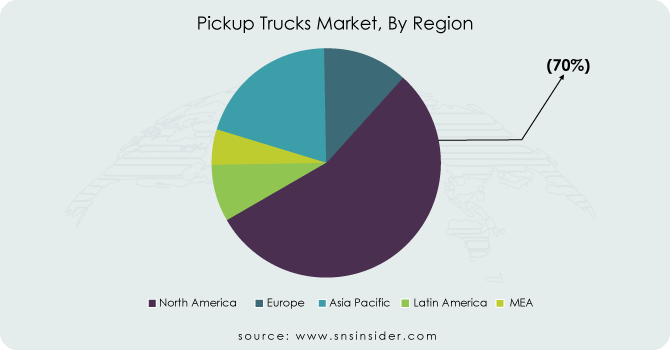

The North America is the dominating region in the Pickup Trucks Market, holding around 70% of share. Factors like a strong work ethic, emphasis on outdoor activities, and vast open spaces contribute to their popularity. Additionally, lower fuel prices historically compared to other regions made larger, less fuel-efficient vehicles more appealing.

The Asia Pacific region is the second highest region in this market with 15-20% of share. This is driven by factors like increasing disposable income, growing urbanization leading to a rise in construction needs, and a developing culture of outdoor recreation.

Europe is experiencing the fastest growth holding around 5-10% of share. The growth can be attributed to factors like an increasing preference for adventure travel, growing demand for lifestyle vehicles, and the introduction of more fuel-efficient and user-friendly pickup truck models by manufacturers.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Stellaris N.V., Ford Motor Company, Suzuki Motor Corp, Toyota Motor Corp., Nissan Motor Co. Ltd., Mercedes Benz, Volkswagen Group, Ashok Leyland Ltd., General Motors Company, Tata Motors Ltd., Hyundai Motor Company, Kia Corporation, Isuzu Motors, Mahindra & Mahindra Ltd and other key players.

Ford Motor Company-Company Financial Analysis

RECENT DEVELOPMENT

-

In June 2023: GM is investing heavily in Flint, Michigan, pouring over $1 billion into its plants to increase heavy-duty pickup truck production. This includes a new V-8 engine development and upgrades for a supporting facility.

-

In April 2023: Reading Truck Group expands its national presence by acquiring Mastercraft Truck Equipment, a Colorado-based truck and van solutions provider. This adds two new locations, bringing Reading Truck's total to 24 nationwide.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 228 Billion |

| Market Size by 2031 | US$ 269.24 Billion |

| CAGR | CAGR of 2.1% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Fuel Type (Diesel, Petrol, Electric) • By Vehicle Type (Light Duty, Heavy Duty) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Stellaris N.V., Ford Motor Company, Suzuki Motor Corp, Toyota Motor Corp., Nissan Motor Co. Ltd., Mercedes Benz, Volkswagen Group, Ashok Leyland Ltd., General Motors Company, Tata Motors Ltd., Hyundai Motor Company, Kia Corporation, Isuzu Motors, Mahindra & Mahindra Ltd |

| Key Drivers | • E-commerce and technological advancements are fueling the rise of pickup trucks, especially for deliveries and in remote areas. • Rising consumer preference for outdoor activities like camping and boating is increasing the demand for capable pickup trucks. |

| Restraints | • Rising environmental awareness and stricter emission regulations threaten the pickup truck market. • High fuel costs due to lower fuel efficiency compared to other vehicles can be a turn-off for some buyers. |