Automotive Sensors Market Report Scope & Overview:

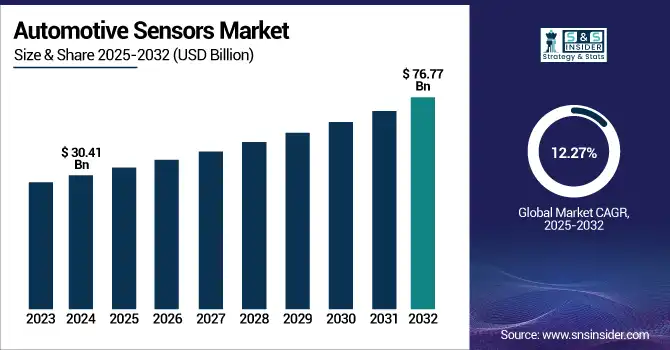

The Automotive Sensors Market was valued at USD 30.41 billion in 2024 and is expected to reach USD 76.77 billion by 2032, growing at a CAGR of 12.27% over the forecast period 2025-2032.

Get More Information on Automotive Sensors Market - Request Sample Report

The automotive sensors market is witnessing growth due to the rising interest in technology that improves safety, efficiency, and driving experience. With changes in consumer preferences in favor of smart and connected vehicles, the deployment of sensors in powertrain systems, safety systems, and telematics is accelerating. Increasing adoption of Advanced Driver-Assistance Systems (ADAS), autonomous driving technologies, and emission regulations have led to the demand for position, pressure, and NOx sensors. These sensors are vital for optimal vehicle performance, increased fuel economy, and compliance with increasingly stringent emissions standards. Moreover, the increasing adoption of electric vehicles (EVs) and hybrid vehicles also drives up the demand for battery management sensors, energy efficient sensors, and regenerative braking sensors, thus creating a better market opportunity for sensors. ADAS technologies used in over 85% of new vehicles in developed markets by 2024, while 50 million EVs are predicted to hit the road by 2025. Battery management sensors will reach 4.2 billion units, and 90% of new vehicles in the EU and U.S. worldwide will be using sensors for emission compliance.

Moreover, device and software penetration into vehicles with the rapid expansion of the Internet of Things (IoT) will drive demand for connected vehicle technologies and telematics systems, thus boosting market growth. With the Wide adoption of vehicles integrated with smart infrastructure and smart communication/interaction networks, the need for sensors in automotive, especially in the department of vehicle body electronics and telematics, is needed. Investment in sensor technologies, driven by the automotive industry's needs for an increasingly secure driving and traveling experience for drivers and their passengers whilst also reducing environmental impact and improving the overall driving experience, is likely to see the automotive sensors market continue to expand in the coming years. Sensor-based safety technologies like collision Avoidance, Parking Assist, and Adaptive Cruise Control will be available in 60% of new Vehicles by 2024. The transition to electric and hybrid cars, along with the emanation of IoT and sensor boosting, will lower the emissions from vehicles by 30% below ICE vehicles by 2025. For navigation and safety, autonomous vehicles will have 20-30 sensors. Also, 40% of vehicles will use telematics for processing real-time data for navigation, traffic management, and emergencies.

Market Dynamics

Key Drivers:

-

Predictive Maintenance and Real-Time Monitoring Driving Growth of Automotive Sensors in Smart Fleets

The growing attention towards predictive maintenance and real-time monitoring in vehicles is one of the major factors driving the growth of the automotive sensors market. As sensor technology improves, car manufacturers are installing smart sensors in vehicles that track wear and tear on important parts like brakes, tires, and engines. The use of these sensors delivers data in real-time used for assessing the potential failure which can be prevented through timely maintenance thereby minimizing downtime or expensive repairs. This trend is especially powerful in the commercial vehicles segment, where predictive maintenance can maximize efficiency and minimize downtime. With fleet operators increasingly embracing connected tech for optimized logistics, the need for scalable durable automotive sensors is seen to grow. In 2024, 70% of fleet operators will be using GPS tracking solutions, while 95% of fleet managers recognize how much they benefit from connected technologies for more efficient fleets. Smart Fleets technology can reduce maintenance costs by up to 25% and unplanned downtime by up to 70% for commercial vehicles, through predictive maintenance technologies. Further, by 2025, more than 50% of commercial vehicles are projected to be equipped with predictive maintenance sensors covering critical components such as brakes, tires, and engines for real-time data collection.

-

Smart Cities and V2X Communication Driving Automotive Sensor Growth and Enhancing Traffic Safety Worldwide

The rapid growth of smart cities and V2X (Vehicle-to-Everything) communication is among the more significant market drivers. As governments and city planners promote smart infrastructure, vehicles are being built to interact with their environment, including traffic lights, pedestrian crossings, and other vehicles. This trend is powered by advanced sensors including radar, lidar, and camera sensors which enable the vehicle to sense and respond to its surroundings almost instantly. V2X communication not only facilitates improved traffic management with reduced congestion but it also increases safety by avoiding crashes and enabling optimised navigation. With the proliferation of these sensors that are quickly starting to act as enabling elements for smart city projects around the globe, their adoption is expected to be a key enabler for the automotive sensors market over the upcoming years. Arizona, Texas, and Utah will receive a combined USD 60 million from the U.S. Department of Transportation to spur V2X deployment. More than 60% of vehicles will include V2X technologies, and radar, LiDAR, and camera sensors are expected to expand 10 to 15% annually. V2X communication is expected to help reduce 30% of traffic accidents, increasing safety while also optimizing navigation.

Restrain:

-

Challenges in Integrating Diverse Automotive Sensors and Ensuring Secure Data Transmission in Modern Vehicles

The complexity involved in the integration of diverse sensor types into a single system is one of the key restraints in the automotive sensors market. Modern vehicles include many different types of sensors (image, position, inertial sensors, etc.) that must operate consistently to ensure maximum performance. The largest automakers have gone to get two or three sensor technologies, software, and vehicle platforms, to be compatible with each other which is hard. This results in slow product development and higher technical barriers to achieving stability of the system. As modern cars are increasingly connected, telematics proliferate, and the sharing of vehicular data is the norm, they risk more than the exfiltration of these swathes of data. For manufacturers, the collection of generated data by their sensors comes at a cost because now they have to ensure that this data is transmitted and stored securely. Although regulatory compliance and the creation of layered cybersecurity are necessary, it complicates sensor design and deployment.

Segment Analysis

By Sensor Type

In 2024, Temperature sensors are dominating the automotive sensors market due to their critical role in ensuring vehicle safety, performance, and efficiency. These sensors are essential in monitoring engine temperature, battery systems in electric vehicles, and HVAC operations, helping prevent overheating and optimizing energy use. With the rise of electric and hybrid vehicles, the demand for precise thermal management has surged. Additionally, regulatory pressure for emission control and fuel efficiency further drives the widespread integration of temperature sensors in modern automobiles.

The Pressure Sensors category is anticipated to develop at the highest CAGR from 2025 to 2032, as it has a growing number of applications on contemporary automobiles. They are essential for monitoring tire pressure, fuel systems, braking systems, and HVAC systems that aid in vehicle safety, efficiency, and performance. The increasing adoption of electric and hybrid cars has also boosted the need for pressure sensors, which are essential for the battery management system (BMS) and thermal management system (TMS). Moreover, the growing requirement for stringent emission regulation across the globe is preparing pressure sensors to be used in exhaust and fuel systems to be considered a high-growth segment shortly.

By Application

In 2024, Powertrain systems dominate the automotive sensors market due to their vital role in enhancing engine performance, fuel efficiency, and emissions control. These systems rely heavily on various sensors including temperature, pressure, and position sensors to monitor and regulate key functions such as fuel injection, ignition timing, and transmission operations. With the rise of electric and hybrid vehicles, the demand for advanced powertrain sensors has surged to ensure optimal energy management. Additionally, stricter global emission norms are driving greater sensor integration in modern powertrain architectures.

The safety and control systems segment are likely to expand at the highest CAGR during the period from 2025 to 2032 due to the increasing penetration of Advanced Driver Assistance Systems (ADAS) and autonomous driving technologies. These systems are dependent on numerous sensors like radar, lidar, image sensors inertial sensors, etc. necessary to support automotive abilities such as collision avoidance, lane-keeping assist, adaptive cruise control, etc. As governments and regulatory authorities enforce advanced safety features in vehicles and consumers push for even higher safety standards, it has become important for automotive manufacturers to integrate sensors inside safety and control systems. In addition, the roll-out of autonomous vehicles is likely to propel further growth as the complexity of sensor networks, and the need for real-time decision-making and increased situational awareness, are set to rise significantly.

By Vehicle Type

In 2024, Passenger cars dominate the automotive sensors market due to their massive global production volume and increasing integration of advanced technologies. Modern passenger vehicles are equipped with numerous sensors for safety, performance, comfort, and connectivity driven by rising consumer demand for ADAS features, infotainment, and emission control systems. Additionally, the surge in electric and hybrid passenger cars further boosts the need for specialized sensors. With governments enforcing strict safety and environmental regulations, automakers are embedding more sensors in passenger cars, reinforcing their dominant market position.

Light Commercial Vehicles (LCVs) have been growing at the fastest CAGR during 2025 and 2032, supported by the widening spectrum of applications in last-mile delivery along with logistics Strong growth of e-commerce and urbanization is pushing for higher demand for LCVs that need advanced sensor technologies for better driver safety, load handling, and for an improved fuel efficiency Moreover, the shift towards electric LCVs is also driving sensors for battery systems, regenerative braking, and telematics for fleet monitoring. Increasing focus on emissions reduction and operational optimization in commercial fleets is accelerating the adoption of advanced safety systems such as ADAS and V2X with heavy reliance on sensors. Altogether, these components have set the anatomy LCV marketplace segment among the fastest developing segments in the automotive sensors marketplace.

Regional Analysis

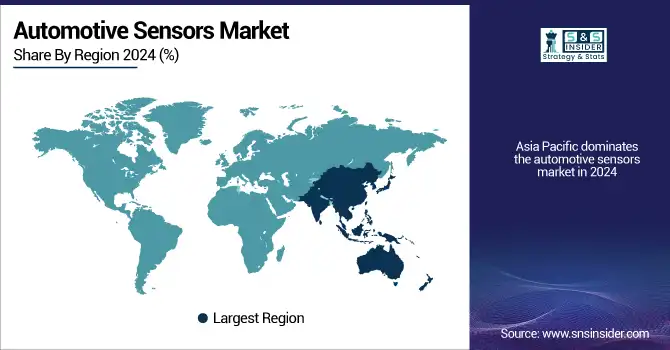

Asia Pacific dominates the automotive sensors market in 2024, driven by massive vehicle production in countries such as China, Japan, South Korea, and India. These nations serve as global automotive hubs and are making significant strides in electric vehicle (EV) and advanced driver-assistance system (ADAS) development. Companies like BYD and NIO in China, Toyota in Japan, and Hyundai in South Korea are integrating cutting-edge sensors for battery management and safety. In India, initiatives like FAME are encouraging automakers such as Tata Motors and Mahindra & Mahindra to adopt sensor-based systems that support electrification and ensure regulatory compliance on emissions.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key players

Some of the major players in the Automotive Sensors Market are:

-

Aeva (Aeries II, Atlas)

-

Kistler Group (High-temperature Pressure Sensors, Ballistic Pressure Sensors)

-

Luminar Technologies (Hydra, Iris+)

-

Denso Corporation (Engine Control Modules, Fuel Pumps)

-

Bosch (MEMS Accelerometers, Oxygen Sensors)

-

Continental AG (Radar Sensors, Lidar Sensors)

-

Delphi Technologies (Fuel Injection Systems, Engine Control Units)

-

Infineon Technologies AG (Magnetic Sensors, Pressure Sensors)

-

NXP Semiconductors (Inertial Measurement Units, Tire Pressure Monitoring Sensors)

-

Sensata Technologies (Speed Sensors, Position Sensors)

-

TE Connectivity (Temperature Sensors, Humidity Sensors)

-

Valeo (Ultrasonic Parking Sensors, Rain-Light Sensors)

-

ZF Friedrichshafen AG (Airbag Sensors, Steering Angle Sensors)

-

Aptiv PLC (Occupant Detection Sensors, Active Safety Sensors)

-

Analog Devices (Gyroscope Sensors, Accelerometers)

-

Honeywell International Inc. (Mass Airflow Sensors, Knock Sensors)

-

Mitsubishi Electric Corporation (Automotive Cameras, Millimeter-Wave Radars)

-

OmniVision Technologies (Image Sensors, Camera Modules)

-

ON Semiconductor (Image Sensors, Proximity Sensors)

-

Texas Instruments (LiDAR Sensors, Ultrasonic Sensors)

Some of the Raw Material Suppliers for companies:

-

TDK Corporation

-

CoorsTek

-

Amphenol Advanced Sensors

-

Goodfellow

-

Ceradex

-

Hitachi High-Tech Corporation

-

Novonix

-

ON Semiconductor

-

Infineon Technologies

-

NXP Semiconductors

Recent Trends

-

In December 2024, Aeva unveiled its new 4D LiDAR sensor, Atlas Ultra, and showcased partnerships with Torc Robotics and Wideye by AGC at CES 2025, highlighting innovations for autonomous driving and seamless in-cabin integration.

-

In December 2024, DENSO and Onsemi strengthened their long-term collaboration to enhance autonomous driving and ADAS technologies, with DENSO acquiring Onsemi shares to deepen their partnership.

-

In July 2024, Infineon and Swoboda partnered to develop high-performance current sensor modules for electromobility, enhancing electric vehicle traction inverters and battery management systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 30.41 Billion |

| Market Size by 2032 | USD 76.77 Billion |

| CAGR | CAGR of 12.27% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor Type (Temperature Sensors, Pressure Sensors, Oxygen Sensors, NOx Sensors, Position Sensors, Speed Sensors, Inertial Sensors, Image Sensors, Others) • By Application (Powertrain Systems, Chassis, Exhaust Systems, Safety & Control Systems, Vehicle Body Electronics, Telematics Systems, Others) • By Vehicle Type (Passenger cars, LCV, HCV) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aeva, Kistler Group, Luminar Technologies, Denso Corporation, Bosch, Continental AG, Delphi Technologies, Infineon Technologies, NXP Semiconductors, Sensata Technologies, TE Connectivity, Valeo, ZF Friedrichshafen AG, Aptiv PLC, Analog Devices, Honeywell International Inc., Mitsubishi Electric Corporation, OmniVision Technologies, ON Semiconductor, Texas Instruments. |

| Key Drivers | • Predictive Maintenance and Real-Time Monitoring Driving Growth of Automotive Sensors in Smart Fleets • Smart Cities and V2X Communication Driving Automotive Sensor Growth and Enhancing Traffic Safety Worldwide |

| RESTRAINTS | • Challenges in Integrating Diverse Automotive Sensors and Ensuring Secure Data Transmission in Modern Vehicles |