Tubeless Tire Market Report Scope & Overview:

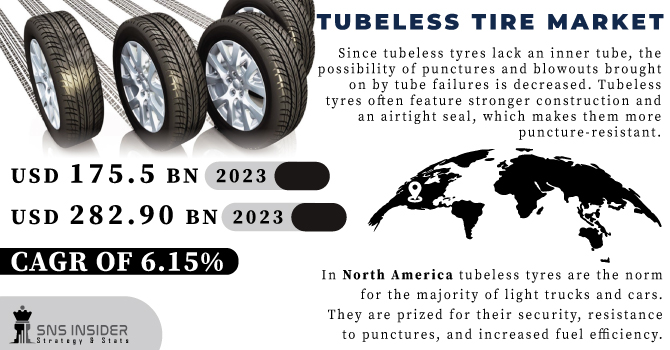

The Tubeless Tire Market size is expected to reach USD 282.90 Bn by 2031, the market was valued at USD 175.5 Bn in 2023 and will grow at a CAGR of 6.15% over the forecast period of 2024-2031.

Since tubeless tyres lack an inner tube, the possibility of punctures and blowouts brought on by tube failures is decreased. Tubeless tyres often feature stronger construction and an airtight seal, which makes them more puncture-resistant. Because of this, they are appropriate for off-road and rugged terrain applications. Many tubeless tyres can seal themselves. The sealant inside the tyre can frequently immediately close the hole if a small puncture develops, such as from a nail or screw, avoiding air loss. When compared to tubed tyres, tubeless tyres can be operated at lower air pressures, which can improve traction, particularly in off-road or high-performance circumstances.

Get More Information on Tubeless Tire Market - Request Sample Report

Due to its superior capacity to absorb shocks and vibrations compared to tubed tyres, tubeless tyres can provide a more comfortable and smoother ride. Without an inner tube, the tyre is lighter overall, which can result in better fuel economy and less rolling resistance. Tubeless tyres dissipate heat more quickly than tubed tyres, which can assist prolong tyre life, particularly in conditions of high-speed driving.

The rising road fatalities because of puncture tyres is the driving factor. For instance, 25% of road fatalities are caused because of default tyres.

Tyres with tubes are typically more prone to punctures because the inner tube is vulnerable to damage from sharp items like nails or screws. The tyre might quickly lose air if the inner tube were to puncture. Due to their strengthened design and lack of an inner tube, tubeless tyres are intended to be more puncture-resistant. Additionally, a lot of tubeless tyres have self-sealing features that may frequently seal minor punctures without causing an instant air loss. The inner tube is necessary for tyred tyres to sustain air pressure. The tyre will deflate if the inner tube loses pressure or suffers damage. Tyres without tubes: In some circumstances, tubeless tyres can be operated at lower air pressures than tubed tyres, offering traction and comfort benefits. Due to their airtight seal, they also tend to hold air pressure better. Tubed tyre installation and upkeep are simple tasks that do not need for specialised tools. An inner tube replacement is a typical repair. Installing tubeless tyres necessitates the use of rims and frequently necessitates the use of sealant to ensure an airtight seal. Tubeless tyre maintenance may be more difficult, and plugging or sealing punctures is frequently required for tubeless tyre repair.

Market Dynamics:

Driver:

-

The benefits associated with the tubeless tires mainly the safety element.

Driver safety is improved by the decreased possibility of a sudden deflation caused by punctures. Drivers can maintain greater control of their cars because tubeless tyres are less prone to blow out or rapidly lose air when punctured. Tubeless tyres can be operated at lower air pressures than tubed tyres, which may result in superior traction in muddy, snowy, or off-road conditions. They become popular as a result in uses like off-road vehicles and particular kinds of motorcyclists. A smoother, more comfortable ride is frequently offered by tubeless tyres. They increase ride quality, particularly on bumpy or uneven road surfaces, by being better at absorbing shocks and vibrations.

Restrain

-

Constrains related to limited availability of parts.

-

Compatibility issues with older vehicles.

Opportunity

-

The rising initiatives towards environment sustainability and the urge of improving the performance.

In high-performance and racing settings, when precise control, traction, and lighter tyres are essential, tubeless tyres are preferred. Off-road vehicles, sports cars, and motorcycles utilised for racing all frequently use them. Tubeless tyres are a good option for manufacturers and customers that care about the environment because of their lighter weight and increased fuel efficiency, which can help to reduce carbon emissions. Tubeless tyre technology is increasingly being used as manufacturing techniques and technology develop. This implies that many new cars come standard with tubeless tyres. Tubeless tyres can result in cost savings over time by lowering the frequency of tyre repairs, even though they may have a higher upfront cost due to the specialised rims and sealant needed.

Challenges

-

Lack of skilled professionals for initial maintenance and repairing of the tyres.

Impact of Recession:

During a recession, tyre producers can see a drop in sales and production. For instance, most of the major players have observed a drop of 6-10% in their sales volume since the economic constrains began. This may limit their capacity to spend money on developing new tyre technology, such as materials that are impermeable to punctures. Tyre manufacturers may engage in price wars or give discounts in order to retain sales volumes and market share, which could have an impact on the premium pricing generally associated with puncture-resistant tyres. Economic downturns can disrupt supply chains, which can impair the availability of the raw materials and components required for tyre production. Production delays and potential shortages could result from this.

Impact of Russia Ukraine War:

Regional instability may result in fluctuating prices for raw materials and transportation expenses (rise of 7% in operating costs have been recorded), which may have an impact on the total cost of making tyres. Price increases for tyres could result from this cost rise being passed on to customers. Due to the conflict, tyre manufacturers with production facilities in Russia or Ukraine may experience difficulties, such as supply disruptions, labour shortages, and safety issues. Manufacturers may think about moving production to different areas, which could affect supply and availability. The movement of tyres and products connected to tyres across borders can be impacted by trade disruptions, such as export and import restrictions put in place by countries in response to the conflict. Delays and higher expenses may result from these restrictions.

Market Segmentation

By Type

-

Radial

-

Bias

By Vehicle Type

-

Two Wheelers

-

Passenger Cars

-

Commercial Vehicles

By Distribution Channel

-

OEM

-

Aftermarket

Regional Analysis

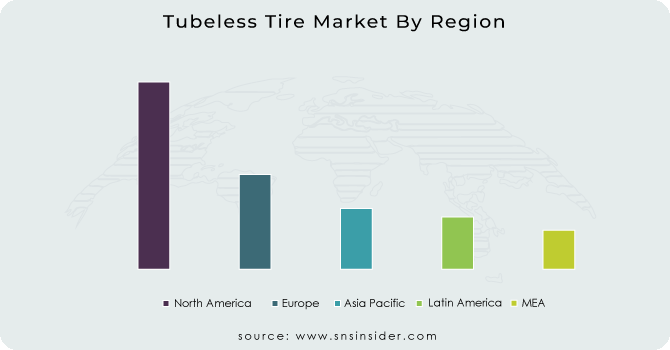

In North America, tubeless tyres are the norm for the majority of light trucks and cars. They are prized for their security, resistance to punctures, and increased fuel efficiency. The market is also seeing an increase in demand for tubeless tyres for bicycles and motorbikes.

For both commercial and passenger vehicles, tubeless tyres are frequently utilised. Their performance and safety qualities are valued by European consumers. The market for high-performance tubeless tyres is also very healthy. As a result of economic expansion and a rise in the adoption of contemporary automobiles, tubeless tyres have recently gained popularity in Eastern Europe.

Due to the country's expanding vehicle sector and rising consumer preference for tubeless tyres because of their advantages in terms of performance and safety, China has a sizable tubeless tyre market. Tubeless tyres are becoming more common there, especially in urban areas and on more expensive cars. Tubed tyres are nevertheless very widely used, particularly in rural regions. Due to its superior performance and safety attributes, tubeless tyres are widely used in nations like Malaysia, Thailand, and Indonesia.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major key players are Michelin, Pirelli, Bridgestone, Continental AG, Toyo Tyre, Sumitomo Rubber Industries, Yokohama Tire Corporation, CST, The Goodyear Tyre & Rubber Company, and others.

Michelin-Company Financial Analysis

Recent Development

-

Continental AG: Company has stated using the recovered carbon black in solid tires.

-

Bridgestone: The company has implemented the transition of 100% usage of renewable energy sources at their six plants in Japan. This will contribute to their sustainability factor in terms of business and meeting the climate sustainability goals.

| Report Attributes | Details |

| Market Size in 2023 | US$ 175.5 Billion |

| Market Size by 2031 | US$ 282.90 Billion |

| CAGR | CAGR of 6.15 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Radial, Bias) • By Vehicle Type (Two Wheelers, Passenger Cars, Commercial Vehicles) • By Distribution Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Michelin, Pirelli, Bridgestone, Continental AG, Toyo Tyre, Sumitomo Rubber Industries, Yokohama Tire Corporation, CST, The Goodyear Tyre & Rubber Company |

| Key Drivers | • The benefits associated with the tubeless tires mainly the safety element. |

| Market Opportunity | • The rising initiatives towards environment sustainability and the urge of improving the performance. |