Piling Machine Market Report Scope & Overview:

To Get More Information on Piling Machine Market - Request Sample Report

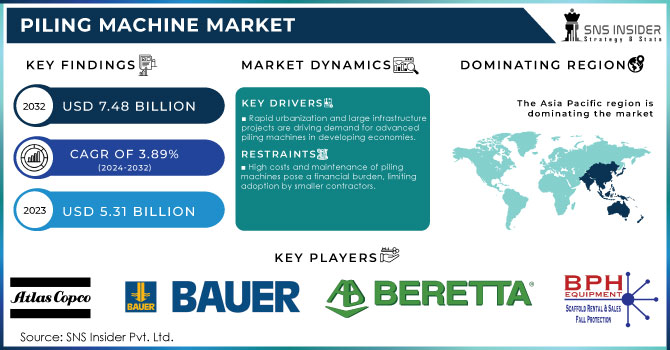

The Piling Machine Market size was valued at USD 5.31 Billion in 2023. It is expected to grow to USD 7.48 Billion by 2032 and grow at a CAGR of 3.89% over the forecast period of 2024-2032.

The piling machines market is experiencing significant growth, driven by the rapid expansion of infrastructure projects, renewable energy installations, and industrial construction worldwide. One of the primary drivers is the surge in renewable energy projects, particularly in wind energy. According to the International Trade Administration (ITA), global renewable capacity is expected to increase by 107 gigawatts (GW) in 2023, supported by policies promoting clean energy and rising energy security concerns. The demand for piling machines in renewable projects, especially offshore wind farms, is rising as these machines are essential for building the robust foundations required for turbines.

In the U.S., the construction industry plays a crucial role in the demand for piling machines. Construction spending, both residential and non-residential, grew by 3.5% year-on-year in June 2023, according to the U.S. Census Bureau. This growth is further accelerated by government initiatives like the USD 1.20 billion Bipartisan Infrastructure Bill, which allocates USD 550 billion for infrastructure spending, bolstering construction output. This surge in infrastructure development, along with efforts to revitalize semiconductor production by building new factories, is creating substantial demand for piling machines to support the foundational work in these projects. Additionally, the U.S. economy, representing around 20% of global output, continues to see growth in its technologically advanced construction sector. With over 919,000 construction establishments reported in early 2023 by Oxford Economics Analytics, the country’s construction activities are integral to the piling machine market. Residential construction, particularly single-family dwellings, has witnessed a significant boom, contributing to the growing need for piling machines to support expanding urban and suburban infrastructure.

MARKET DYNAMICS

DRIVERS

- Rapid urbanization and large-scale infrastructure projects worldwide, especially in developing economies, are driving increased demand for advanced piling machines to support complex construction needs.

Rapid urbanization and the surge in large-scale infrastructure projects across the globe, particularly in developing economies, are significantly driving the demand for advanced piling machines. As countries like India, China, and Brazil experience rapid urban growth, there is a pressing need for robust infrastructure, including residential complexes, commercial buildings, highways, bridges, and railways. Piling machines play a crucial role in laying the foundation for these structures, making them essential for the construction of high-rise buildings and other complex infrastructure that require deep foundations. Governments in developing nations are increasingly investing in infrastructure development to support their growing urban populations. For instance, initiatives such as India’s Smart City Mission and China's Belt and Road Initiative are examples of large-scale projects that require sophisticated piling machines capable of handling diverse terrains and ensuring structural stability. These projects often span across sectors like transportation, energy, and public utilities, further boosting the demand for specialized piling equipment that can meet the complexity and scale of such construction needs.

Moreover, as urban areas become denser, construction companies are seeking more efficient, faster, and environmentally-friendly piling solutions. This has led to a shift towards advanced piling machines equipped with automation, precision technology, and reduced noise and vibration features. These innovations allow construction firms to complete projects with greater efficiency and minimal disruption, making piling machines an indispensable part of modern infrastructure development efforts. This trend is expected to continue as urbanization accelerates globally.

- Technological advancements like automation, GPS tracking, and noise reduction in piling machines are increasing their adoption by improving efficiency, precision, and compliance with environmental regulations.

Technological advancements in piling machines, such as automation, GPS tracking, and noise reduction, are driving their increased adoption across the construction industry. Automation has enhanced operational efficiency by allowing machines to perform tasks faster and with greater precision, reducing the need for manual labor and minimizing errors. GPS tracking technology improves accuracy in positioning and monitoring, ensuring that piling operations are completed with high precision, especially in complex construction sites. Additionally, noise and vibration reduction technologies help piling machines comply with stringent environmental regulations, particularly in urban areas where construction activities often face restrictions due to noise pollution and ground disturbances. These advancements not only improve productivity but also help companies adhere to regulatory standards, reduce operational costs, and enhance safety. As a result, the demand for technologically advanced piling machines is increasing, making them a preferred choice for modern infrastructure and industrial projects.

RESTRAIN

- The high initial cost, ongoing maintenance, and operational expenses of piling machines make them a significant financial burden, especially for smaller contractors, limiting their widespread adoption.

The high initial cost, along with ongoing maintenance and operational expenses, makes piling machines a substantial financial burden for many construction companies, particularly smaller contractors. Large-scale piling machines often require significant capital investment, which can be challenging for businesses with limited resources. Beyond the purchase cost, these machines demand regular maintenance, including servicing, part replacements, and occasional repairs, all of which contribute to increased operating costs. Additionally, downtime due to repairs or maintenance can further disrupt project timelines and lead to financial losses. For small to mid-sized companies, these financial demands limit their ability to invest in or adopt advanced piling technologies. This, in turn, restricts the accessibility of piling machines to larger, well-funded enterprises, creating a gap in the market. Consequently, many contractors may opt for renting equipment or using less efficient alternatives, slowing the overall adoption of modern piling machines in construction projects.

KEY MARKET SEGMENTATION

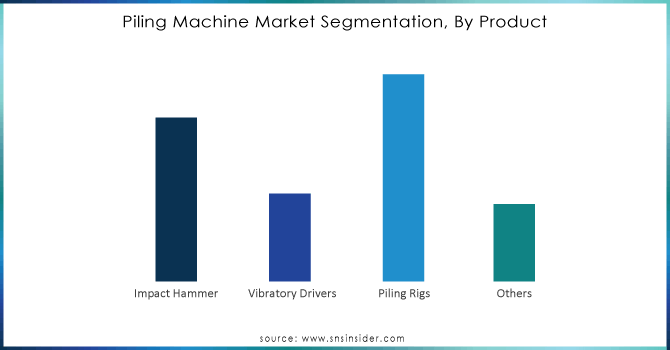

By Product

Piling rigs segment led the market and accounted for 41.1% of the global piling machine market in 2023, and expected to grow at a significant CAGR over the forecast period. Piling rigs are specialized machines designed specifically for the purpose of driving piles into the ground. These rigs are equipped with the necessary machinery and mechanisms for drilling, driving, or boring piles into the ground, playing a crucial role in enhancing the load-bearing capacity of structures such as buildings, marine and offshore constructions, and other infrastructure projects.

Do You Need any Customization Research on Piling Machine Market - Enquire Now

By Method

The impact-driven piling segment held the predominant revenue share of 30.2% in 2023. This approach employs impact force to achieve piling at varying depths, and the requisite impact force can be generated using a hydraulic hammer. Additionally, the piles employed in this method are composed of materials such as steel, precast concrete, and timber, with the option for them to be deployed as single lengths or spliced for exceptionally deep piles. Typically powered by hydraulic energy, the impact-driven piling method excels in transferring greater compressive forces. The stroke and blow rate of the piles can be easily adjusted to optimize pile driving under diverse conditions.

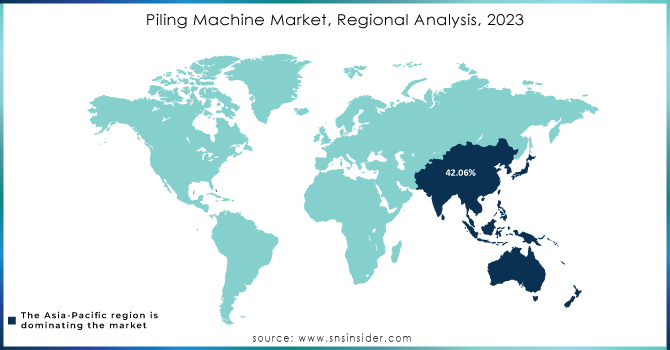

REGIONAL ANALYSIS

Asia Pacific region dominated the market share over 42.06% in 2023. The economies in the region are anticipated to flourish over the forecast period on account of the massive investments by governments for the development of public infrastructure and the expansion of the residential construction industry, which is expected to benefit the market in Asia Pacific.

The Europe market accounted for the second largest market share in 2023. The growth of the market in Europe is expected to be significantly driven in the coming years by its flourishing residential sector owing to the increasing immigration rate in the region. In addition, surging investments in the development of civil engineering structures are expected to increase the demand for piling machines in Europe over the forecast period.

KEY PLAYERS

Some of the major key players of Piling Machine Market

- Atlas Copco: (Hydraulic piling hammers, Pneumatic piling systems)

- Bauer AG: (BG Series rotary drilling rigs, KLEMM drilling rigs)

- BAUER-Pileco: (Diesel hammers, Hydraulic hammers)

- Beretta Alfredo SRL: (Beretta T46 hydraulic rig, Compact drilling machines)

- Bermingham Foundation Solutions: (Berminghammer pile driving equipment, Lead systems)

- BPH Equipment, Ltd.: (Hydraulic impact hammers, Vibro hammers)

- BSP International Foundations, Ltd.: (Hydraulic piling hammers, Rapid impact compaction machines)

- Casagrande Group: (B-series hydraulic piling rigs, Diaphragm wall equipment)

- Davey Kent, Inc.: (DK Series pile drivers, Drill rigs)

- Dawson Construction Plant, Ltd.: (Hydraulic pile pressing machines, Silent piler)

- Delmag GmbH & Co. KG: (Diesel pile hammers, Piling rigs)

- Geoprobe Systems: (Geoprobe 6712DT direct push rig, Rotary sonic drill rigs)

- Junttan Oy: (Hydraulic pile driving rigs, Pile driving accessories)

- Liebherr Group: (LRH 100 piling rig, LB series drilling rigs)

- Soilmec S.p.A.: (SR drilling rigs, Piling machines for deep foundations)

- Comacchio Srl: (MC Line hydraulic drilling rigs, Piling equipment for micro piles)

- Hitachi Construction Machinery Co., Ltd.: (Piling rigs, Rotary drilling machines)

- Sany Group Co., Ltd.: (SR series rotary drilling rigs, STH pile driving machines)

- XCMG Group: (XR series rotary drilling rigs, Hydraulic pile drivers)

- Fayat Group: (PilingTech) (Vibrodrivers, Drilling rigs for foundation piles)

RECENT DEVELOPMENTS

In January 2023: Junttan Oy has acquired Junttan UK. Junttan UK is based in Newark, UK, and has been Junttan’s authorized distributor since 1996. By combining the resources and expertise of the two companies, the company will have a strong team with high expertise and will further develop our local operations to meet Junttan customers’ needs.

In June 2023: Epiroc AB introduced its flagship construction drill rig SmartROC T25 R in June 2023, a smart rig for smarter operations. Moreover, the rig has various significant characteristics, such as a large coverage area, great trainability, application diversity, and a smart Rig Control System that reduces the rig's environmental impact.

In September 2022: the company launched the Hydrohammer IQ Series. The IQ Series can drive piles constantly with a 100% energy capacity, or it can be enhanced to produce a maximum power of 120% over a set length of time, depending on soil conditions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.31 Billion |

| Market Size by 2032 | USD 7.48 Billion |

| CAGR | CAGR of 3.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product(Impact Hammer, Vibratory Drivers, Piling Rigs, Others) • By Method(Impact Driven, Drilled Percussive, Rotary Bored, Air-lift RCD Rig, Auger Boring, Continuous Flight Auger, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Atlas Copco, Bauer AG, BAUER-Pileco, Beretta Alfredo SRL, Bermingham Foundation Solutions, BPH Equipment, Ltd. , BSP International Foundations, Ltd. ,Casagrande Group, Davey Kent, Inc., Dawson Construction Plant, Ltd, Delmag GmbH & Co. KG , Geoprobe Systems, Junttan Oy, Liebherr Group, Soilmec S.p.A, Comacchio Srl, Hitachi Construction Machinery Co., Ltd., Sany Group Co., Ltd. , XCMG Group, Fayat Group |

| Key Drivers | • Rapid urbanization and large-scale infrastructure projects worldwide, especially in developing economies, are driving increased demand for advanced piling machines to support complex construction needs. • Technological advancements like automation, GPS tracking, and noise reduction in piling machines are increasing their adoption by improving efficiency, precision, and compliance with environmental regulations. |

| RESTRAINTS | • The high initial cost, ongoing maintenance, and operational expenses of piling machines make them a significant financial burden, especially for smaller contractors, limiting their widespread adoption. |