Mining Equipment Market Report Scope & Overview:

To get more information on Mining Equipment Market - Request Free Sample Report

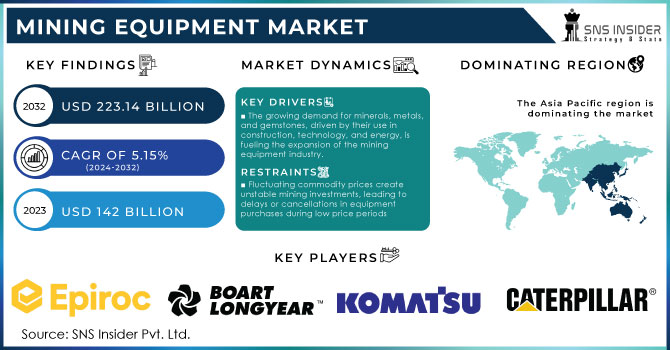

The Mining Equipment Market size was estimated at USD 142 Billion in 2023 and is expected to reach USD 223.14 Billion by 2032 at a CAGR of 5.15% during the forecast period of 2024-2032.

A combination of rising safety regulations in mining areas has led to a demand for self-driving mining equipment. Furthermore, the need to reduce emissions in enclosed mines with insufficient ventilation leading to the risk of miners developing respiratory problems has been driving the growing demand for electric and hybrid mining equipment. Mining machinery manufacturers are working to create more convenient interfaces for operating huge mining machines from a distance and monitoring them. Mining machinery meets the changing needs of mining operations while also focusing on safety and convenience through an emphasis on user experience. The advent of safer mining procedures with minimal emissions ensures less pollution, ensuring high demand for advanced mining machinery.

Majority of mining companies in the modern world are eager to adopt electrification other than traditional fuel sources such as diesel. Different types of minerals are mined in the U.S. including crushed rock, cement, gold, industrial sand, gravel and iron ore, copper and potash. Demand for coal, gas and oil sands and technological development are expected to drive the U.S. industry. The mining industry extracts and protects various materials and necessitates a large quantity of energy. Additionally, numerous refining, smelting, and concentration processes will demand a great deal of electricity. Energy usage is on the rise as a result of the deterioration of the average copper ore quality, and the total volume of mineral output is also expanding. As a result, demand is expected to rise for more advanced mining machinery.

Artificial intelligence increases the effectiveness of mining machines and assists in improving mineral mine production and ensuring miners’ health. Intelligent data and artificial intelligence are widely employed in mining industries across the world. Demand is predicted to rise as a result of technical improvements during the forecast period.

Sandvik will showcase its latest innovations, including a new diesel-electric truck and battery-electric drill rig, at MINExpo 2024 in Las Vegas, highlighting its focus on sustainable mining technologies.

Market Dynamics

Drivers

The increase in need for minerals, metals, and gemstones is driving the expansion of the mining equipment industry. An important factor is the increasing usage of these resources in sectors like building, technology, and power.

The increasing need for minerals, metals, and precious stones is a major factor fueling the growth of the mining equipment industry. The rise is mainly a result of the growing demand for these materials in multiple sectors, especially in building, technology, and power. Metals such as steel and aluminum play a crucial role in infrastructure projects in the construction sector, while rare earth metals are vital for manufacturing advanced electronics like smartphones, batteries, and renewable energy systems. The move of the energy industry towards renewable energy sources such as wind and solar heavily depends on minerals and metals for making turbines, solar panels, and other essential parts. Moreover, the increasing urbanization and industrialization worldwide have heightened the request for these resources, strengthening the necessity for more advanced mining gear. This has resulted in technological progress in mining equipment, improving efficiency, safety, and productivity.

Continual growth in mining activities, especially in developing countries, is leading to a substantial need for improved and more effective mining machinery. Governments' supportive policies towards mining activities are also a factor in the growth of the market.

The continued growth of mining activities, particularly in developing countries, is fueling a significant need for advanced and more productive mining machinery. With these nations looking to make the most of their natural resources, there is an increasing demand for equipment that can boost efficiency and guarantee safety in mining environments that are becoming more intricate. Governments are also contributing to the increasing demand by offering support through policies that encourage mining, such as incentives for foreign investments, simplified regulations, and infrastructure development projects. These regulations not just draw in big mining firms but also motivate local businesses to enhance their equipment and technology, nurturing a competitive market environment. Furthermore, the drive towards sustainable and eco-friendly mining methods is leading to the use of energy-saving and automated mining machinery. The move towards advanced, efficient equipment is projected to support market expansion by helping mining operations meet the increasing worldwide need for minerals and other resources. The mining equipment market in developing countries is constantly growing due to the increase in mining activities and supportive government policies.

Restraints

Fluctuating commodity prices can lead to unstable mining investments, causing companies to delay or cancel mining equipment purchases when prices are low.

Fluctuations in worldwide commodity prices have a substantial effect on mining investments, resulting in a lack of predictability within the sector. Companies encounter difficulties in forecasting future revenues and are reluctant to make significant capital investments when commodity prices vary. This lack of certainty frequently leads to mining projects being postponed or abandoned, impacting the need for mining equipment. Mining companies may choose to save money and delay or decrease their equipment acquisitions when commodity prices are low. This careful strategy allows them to control risks, but hinders the growth of the mining equipment industry. The industry's cyclical pattern results in equipment demand bouncing back when prices recover, but periods of volatility can cause disruptions for manufacturers and suppliers.

Market Segmentation

By Equipment Type

In 2023, surface mining equipment had the highest revenue share of over 40.2% in the mining equipment market, making it the dominant segment. In the upcoming period, there is an expectation for a growth in the need for surface mining equipment due to an increased demand for iron ore, coal, diamonds, and chromium in developing countries. As this equipment is adopted more widely, it allows for specific mining operations to be carried out, such as scouting for valuable resources and building sturdy embankments and surfaces. Underground mining has updated its operational procedures with advancements in equipment technology. The mine transport system plays a vital role in underground mining. The strong production and significant impact strength of underground mining equipment make it a highly effective piece of machinery for operations beneath the surface, driving the need for such equipment in the forecast period.

By Application

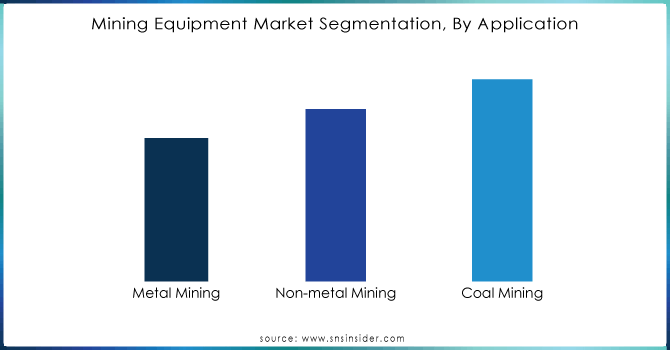

Coal mining was the dominating segment in the mining equipment market in 2023, contributing over 39.4% of the total revenue. It is anticipated that there will be a substantial increase in the use of mining equipment for coal mining purposes. The increase is due to its rising need for generating electricity. Coal mining equipment has diversified its functions and usage due to the increase in coal excavation.

Need any customization research on Mining Equipment Market - Enquiry Now

Regional Analysis

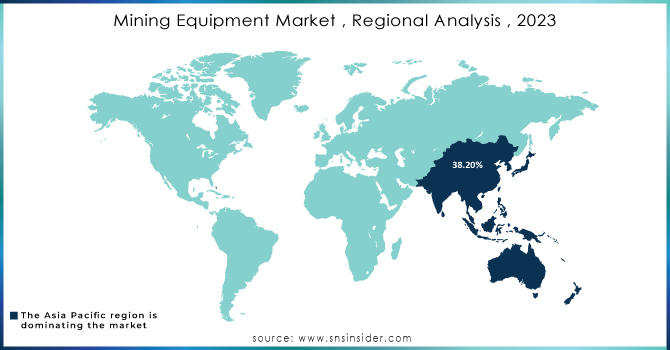

In 2023, Asia Pacific has emerged as the dominant region, representing more than 38.2% of the total revenue. Market growth is anticipated to be driven in the future by the rising use of clean energy sources and the increase in electric vehicle adoption in developing nations like China and India.

North America region will experience growth at a compound annual growth rate of 4.1%. Increased mining activity for minerals, utilization of advanced mining equipment, and government efforts in North America are the primary factors driving market expansion. Furthermore, the transition from conventional underground mining to advanced, efficient open-pit mining is expected to increase the need for these items in the upcoming period.

Key Players

The major Key players are Epiroc, Boart Long year Ltd, Caterpillar Inc, China Coal Energy Group Co. Ltd, Vipeak Mining Machinery Co. Ltd, Guangdong Leimeng Intelligent Equipment Group Co. Ltd, Henan Baichy Machinery Equipment Co. Ltd, Komatsu Ltd, Liebherr, Metso Qutotec and others.

Recent Development

In July 2023: Liebherr joined forces with Leica Geosystems to provide an extensive range of machine control systems tailored for hydraulic excavators. These systems serve as driver assistance tools, enhancing the efficiency, safety, and productivity of construction projects.

In July 2023:Metso Corporation entered into an agreement to acquire Brouwer Engineering, an Australian company. The diverse bulk material handling equipment of Mesto lineup aligns well with Brouwer Engineering's expertise in electrical and control systems. The collaboration aimed to provide customers with a holistic range of solutions by combining their respective capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 142 Billion |

| Market Size by 2032 | US$ 223.14 Billion |

| CAGR | CAGR of 5.15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Equipment Type (Underground Mining Equipment, Surface Mining Equipment, Crushing, Pulverizing & Screening Equipment, Drills & Breakers, Others) • By Application (Metal Mining, Non-metal Mining, Coal Mining) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Epiroc, Boart Long year Ltd, Caterpillar Inc, China Coal Energy Group Co. Ltd, Vipeak Mining Machinery Co. Ltd, Guangdong Leimeng Intelligent Equipment Group Co. Ltd, Henan Baichy Machinery Equipment Co. Ltd, Komatsu Ltd, Liebherr, Metso Qutotec |

| Key Drivers | • The increase in need for minerals, metals, and gemstones is driving the expansion of the mining equipment industry. An important factor is the increasing usage of these resources in sectors like building, technology, and power. • Continual growth in mining activities, especially in developing countries, is leading to a substantial need for improved and more effective mining machinery. Governments' supportive policies towards mining activities are also a factor in the growth of the market. |

| RESTRAINTS | • Fluctuating commodity prices can lead to unstable mining investments, causing companies to delay or cancel mining equipment purchases when prices are low. |