Plant-based Milk Market Report Scope & Overview:

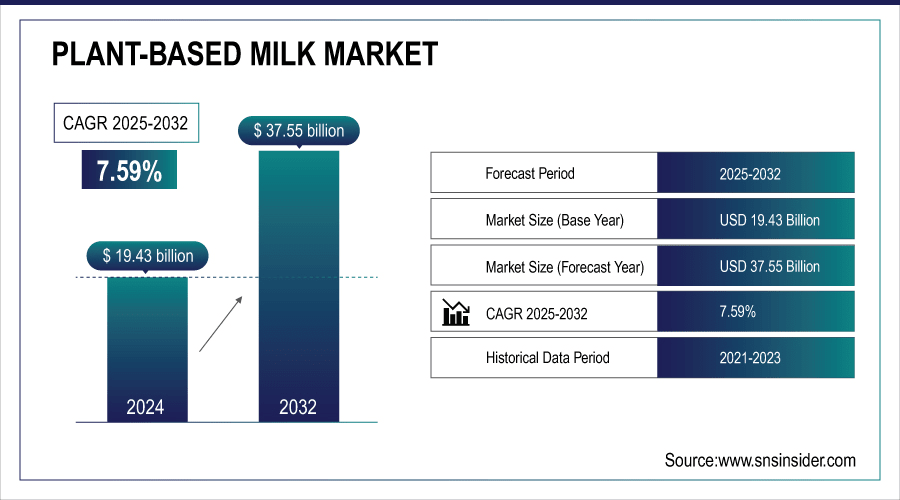

The Plant-based Milk Market Size was valued at USD 19.43 billion in 2024 and is expected to reach USD 37.55 billion by 2032, growing at a CAGR of 7.59% over the forecast period of 2025-2032.

Change in consumer consumption is evident from plant-based milk market analysis, with health and dietary considerations gaining traction. Given that lactose intolerance and digestive sensitivities mean more people are opting for lactose-free milk, plant-based milk alternatives are an enticing option.

According to the National Institutes of Health (NIH), up to 65% of the global population and approximately 36% of American adults experience some degree of lactose intolerance, highlighting the sizable portion of consumers actively seeking dairy substitutes.

To Get More Information On Plant-based Milk Market - Request Free Sample Report

Key Plant-based Milk Market Trends

-

Rising consumer preference for lactose-free and dairy-alternative products.

-

Growing demand for vegan and environmentally sustainable beverages.

-

Expansion of fortified and functional plant-based milk variants with added nutrients.

-

Increased product availability through supermarkets, online platforms, and specialty stores.

-

Innovation in flavors and blends (e.g., almond-oat, soy-coconut) to cater to diverse tastes.

-

Rising awareness of health benefits, such as lower cholesterol and calorie content.

-

Strategic partnerships and mergers among major plant-based milk manufacturers.

Plant-based Milk Market Growth Drivers

-

Growing Consumer Shift Toward Healthier, Lactose-Free Alternatives Drive the Market Growth

The rising awareness of lactose intolerance and the desire for healthier dietary choices are driving consumers toward plant-based milk products. Many consumers prefer plant-based milk due to its lower cholesterol, absence of hormones, and perceived natural health benefits. Additionally, increasing vegan and flexitarian lifestyles contribute to this growing demand. This shift is encouraging manufacturers to expand their product portfolios, innovate with new flavours and formulations, and improve nutritional content to cater to diverse consumer preferences.

For instance, in 2023, Danone invested $150 million to expand its plant-based milk production capacity in North America to meet the surging demand driven by health-conscious consumers.

Plant-based Milk Market Restrain

-

High Production Costs and Supply Chain Challenges, Which May Hamper the Market Growth

Despite growing demand, the plant-based milk market faces challenges related to high production costs, primarily due to the sourcing of raw materials like almonds, oats, and peas, which can be subject to weather-related yield fluctuations. Supply chain disruptions and price volatility also affect product pricing, making it difficult to compete with conventional dairy on cost. These factors can limit market penetration, especially in price-sensitive regions.

According to a USDA report in 2022, drought conditions in key almond-producing states led to a 15% increase in almond prices, impacting production costs and retail prices of almond-based milk products.

Plant-based Milk Market Growth Opportunities

-

Expansion of E-commerce and Direct-to-Consumer Channels Creates an Opportunity for the Market

The rapid growth of online shopping presents a significant opportunity for plant-based milk brands to reach broader audiences. E-commerce platforms allow for direct engagement with consumers, personalized marketing, and subscription-based sales models, which enhance customer loyalty and recurring revenue. Moreover, digital sales channels help brands quickly adapt to consumer trends and preferences.

For instance, in 2024, Califia Farms launched a nationwide direct-to-consumer subscription service in the U.S., resulting in a 30% increase in online sales within six months, signaling strong consumer acceptance and growth potential through digital channels.

Plant-based Milk Market Segment Highlights

-

By Product: Almond milk led the market with a 35% share in 2024, driven by high consumer preference for low-calorie and nutrient-rich alternatives; Oat milk is the fastest-growing segment, fueled by its creamy texture, sustainability, and popularity in cafés and households.

-

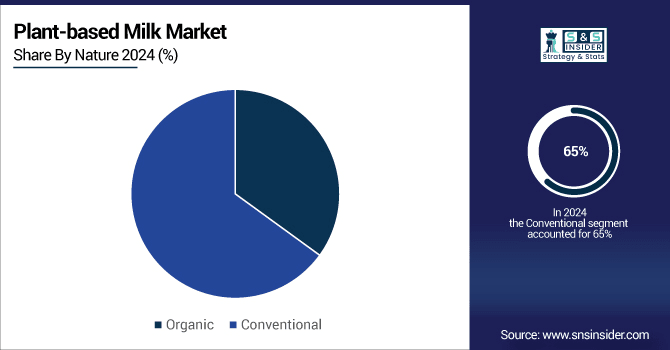

By Nature: Conventional plant-based milk dominated with a 65% share in 2024 due to mass production and widespread availability; Organic milk is the fastest-growing segment, benefiting from rising health awareness and demand for clean-label, chemical-free products.

-

By Flavors: Non-flavored milk held a 55% share in 2024 as consumers prefer versatile options for cooking and beverages; Flavored milk is the fastest-growing segment, supported by innovative flavors like chocolate, vanilla, and matcha that appeal to younger demographics.

-

By Distribution Channel: Hypermarkets & supermarkets accounted for a 50% share in 2024 due to extensive shelf presence and brand visibility; Online sales are the fastest-growing channel, driven by e-commerce convenience, subscription models, and increasing digital penetration.

Plant-based Milk Market Segment Analysis

-

By Nature

Conventional plant-based milk dominates with roughly 65% market share, supported by mass-market availability and competitive pricing. Organic varieties are the fastest-growing segment, driven by consumers seeking chemical-free, non-GMO options that align with clean-label trends. Increasing demand for transparency and sustainability has propelled organic milk growth, especially among younger demographics and premium shoppers willing to pay a higher price for perceived quality and health benefits.

-

By Product

Almond milk holds the largest market share, accounting for around 35% of the segment, due to its well-established consumer base and favourable taste profile. However, oat milk is the fastest-growing product, with a surge in popularity driven by its creamy texture and sustainability advantages compared to almond milk. Soy milk remains a steady player but has seen slower growth due to allergen concerns. The rise in health-conscious and environmentally aware consumers is fuelling the diversification of plant-based milk varieties.

-

By Flavors

Non-flavored or plain plant-based milk accounts for the majority of sales, holding about 55% of the segment, largely because of its versatility in cooking and beverage applications. Flavored milk is the fastest-growing sub-segment, boosted by innovation in vanilla, chocolate, and seasonal flavors catering to younger consumers and families. The surge in flavored options enhances appeal and helps brands attract new customers seeking variety beyond traditional tastes.

-

By Application

Packaging is the largest application area for PET films, accounting for more than 38% of the bio-PET film market in 2023. This is predominantly due to increasing global demand for eco-friendly packaging solutions, such as those recycled materials, and clear packaging options, especially within the food and beverage industry and pharmaceutical sector.

The rate of growth in electrical and electronics is skyrocketing on the backs of the growing prevalence of PET films for capacitor insulation purposes, flexible printed circuitry elements, and display protection. With dielectric strength, thermal stability, and mechanical robustness, the material is an excellent candidate for many next-generation devices in the electric vehicle and wearable electronics markets.

-

By Distribution Channel

Hypermarkets and supermarkets currently dominate with a 50% share of plant-based milk sales, driven by extensive shelf space and consumer trust in brick-and-mortar retailers. However, the online channel is the fastest-growing distribution segment, benefiting from increased e-commerce penetration, direct-to-consumer subscription models, and convenience-focused shopping habits. Specialty stores maintain steady growth by targeting niche, health-conscious buyers with premium and organic options.

Plant-based Milk Market Regional Analysis:

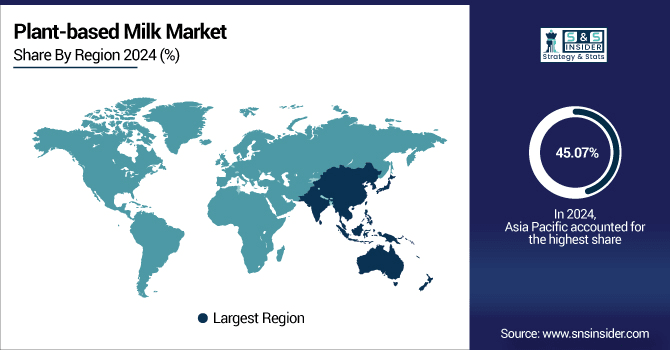

Asia Pacific Plant-based Milk Market Insights

Asia Pacific held the largest Plant-based Milk Market Share in 2024, around 45.07% 2024. due to the region’s vast population and increasing health awareness. Traditional dietary habits in many Asian countries already favor plant-based diets, which creates a natural consumer base for plant-based milk products. Rapid urbanization, rising disposable incomes, and increasing lactose intolerance awareness further fuel demand. Additionally, the growing middle class is becoming more conscious about environmental sustainability and animal welfare, which supports market growth.

A recent development in the region is the expansion of a major local player, Vitasoy, which invested in new production facilities in China in 2024 to increase capacity and meet rising consumer demand for plant-based alternatives.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Plant-based Milk Market

The North America region is the fastest-growing market. The market is due to widespread health-conscious behaviours and an active lifestyle culture. Consumers are increasingly avoiding dairy for digestive and ethical reasons, seeking alternatives perceived as healthier and more sustainable. E-commerce growth and wide availability through major supermarkets support market penetration. A key recent development includes Califia Farms launching a direct-to-consumer subscription service in 2024, significantly boosting its sales and customer engagement in the U.S. market.

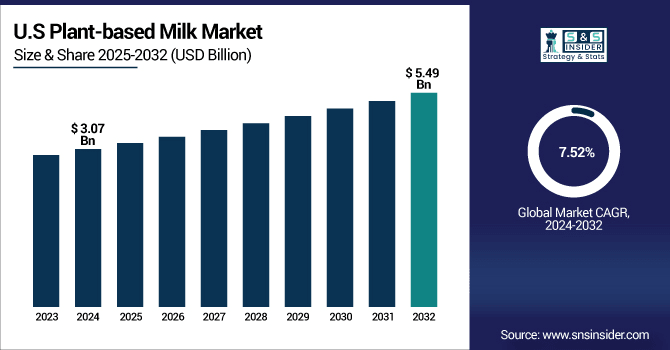

U.S. Plant-based Milk Market

The U.S. Plant-based Milk market size was USD 3.07 billion in 2024 and is expected to reach USD 5.49 billion by 2032 and grow at a CAGR of 7.52% over the forecast period of 2025-2032.

Due to widespread health-conscious behaviours and an active lifestyle culture. Consumers are increasingly avoiding dairy for digestive and ethical reasons, seeking alternatives perceived as healthier and more sustainable. E-commerce growth and wide availability through major supermarkets support market penetration. A key recent development includes Califia Farms launching a direct-to-consumer subscription service in 2024, significantly boosting its sales and customer engagement in the U.S. market.

Europe Plant-based Milk Market

Europe maintains a significant share of the Plant-based Milk market. It is due to widespread health-conscious behaviors and an active lifestyle culture. Consumers are increasingly avoiding dairy for digestive and ethical reasons, seeking alternatives perceived as healthier and more sustainable. E-commerce growth and wide availability through major supermarkets support market penetration. A key recent development includes Califia Farms launching a direct-to-consumer subscription service in 2024, significantly boosting its sales and customer engagement in the U.S. market.

Competitive Landscape for Plant-based Milk Market

DuPont

DuPont is a global leader in specialty materials and chemical solutions, focusing on innovation and sustainability across multiple industries.

-

In March 2024, DuPont, in collaboration with Teijin Films, introduced a recyclable PET film to enhance sustainability within its product portfolio, aligning with the growing industry emphasis on eco-friendly material solutions.

Toray Plastics

Toray Plastics specializes in high-performance plastic and film solutions for packaging, electronics, and industrial applications.

-

In April 2024, Toray Plastics increased its production capacity in Japan to address rising demand for PET films, particularly for high-performance applications in electronics and packaging sectors.

Plant-based Milk Market Key Players:

Some of the Plant-based Milk Companies

-

Danone

-

Blue Diamond Growers

-

Califia Farms

-

Ripple Foods

-

Elmhurst 1925

-

SunOpta

-

Vitasoy International Holdings

-

Earth's Own Food Company

-

Pacific Foods of Oregon

-

Pureharvest

-

Alpro

-

Kite Hill

-

Rude Health

-

MALK Organics

-

Plenish

-

Forager Project

-

Good Karma Foods

-

Sproud

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 19.43 Billion |

| Market Size by 2032 | USD 37.55Billion |

| CAGR | CAGR of7.59% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type: Almond Milk, Oat Milk, Soy Milk, Coconut Milk, Rice Milk, Pea Milk, Others • By Nature: Organic, Conventional • By Flavors: Flavored Milk, Non-Flavored Milk • By Distribution Channel: Hypermarkets & Supermarkets, Specialty Stores, Online, Others |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Danone, Blue Diamond Growers, Califia Farms, Oatly, Ripple Foods, Elmhurst 1925, SunOpta, Vitasoy International Holdings, Earth's Own Food Company, Dream Plant Based, Pacific Foods of Oregon, Pureharvest, Alpro, Kite Hill, Rude Health, MALK Organics, Plenish, Forager Project, Good Karma Foods, Sproud |