Cholesterol Test Market Size & Overview:

Get more information on Cholesterol Test Market - Request Free Sample Report

The Cholesterol Test Market was valued at USD 8.3 billion in 2023 and is expected to reach USD 16.8 billion in 2032 and grow at a CAGR of 8.17% over the forecast period of 2024-2032.

High cholesterol levels are fast becoming an increasingly common problem, and increasing awareness of the need to check cholesterol levels periodically also forms a significant driver for market growth. However, innovations in the pharmaceutical industry to develop advanced cholesterol testing kits are also of utmost importance, especially because a growing pool of conscious health consumers seek solutions that help them achieve accessible health monitoring. The emerging market is huge and holds much potential due to better health infrastructure, growing unmet healthcare needs, and an increase in the incidence of cardiovascular diseases, which further augment the demand for cholesterol-testing products.

Health sectors in emerging economies are developing rapidly, characterized by a high demand for improved healthcare services and enormous government investment directed at healthcare infrastructure improvement. This trend is accompanied by the developing medical tourism industry, thus making the environment quite welcoming for market growth. Besides this, the rise of the e-commerce sector has transformed the manner of purchasing healthcare products. Thus, online shopping has become a boon because it provides many benefits over the traditional mode of retailing. It has opened its doors to cholesterol testing products among many in these developed regions, as well as in developing countries such as China, Brazil, and India.

Factors such as unhealthy eating patterns and the intake of carbohydrate-rich and packaged foods are contributing to this market dynamics. Strongly evident among young people and adults, it's also fostering high cholesterol levels, resulting in increased requirements for cholesterol testing. Greater consumer awareness about preventive healthcare and higher availability of testing products also drive adoption. Further support for the cholesterol testing market will come from an aging population and healthy living will become more of a focus for the mainstream in the near term.

Additionally, issues in this market include silent high cholesterol, which is directly associated with an estimated 2.6 million deaths around the world annually. This can be attributed to the interference caused by medication, improper fasting, and human mistakes, among others. Testing services and laboratory activities have also been worst affected during the pandemic period. However, the market is expected to recover as well as stabilize due to the ever-growing prevalence of cardiovascular diseases and obesity, which enhances the call for an effective solution to cholesterol monitoring.

Cholesterol Test Market Dynamics

Drivers

-

Rising Cardiovascular Diseases and Obesity Rates Propel Demand for Regular Cholesterol Screening

The primary drivers of the growth of the cholesterol testing market are rising cardiovascular diseases and obesity rates. Patients with cardiovascular diseases need to undergo regular cholesterol tests for proper therapeutic management, and hence demand will be relatively inelastic. Health agencies worldwide recommend that children between 9 and 11 years, and young adults between 17 to 21 years, be tested for cholesterol regularly since high cholesterol is asymptomatic, and with silent causes. A Full Cholesterol Test will result in the measurement of triglycerides, HDL, LDL, and total blood cholesterol. As long as it is taken with appropriate care and precautions, heart attacks, peripheral arterial disease, and many other heart conditions linked with it can be considered close to none.

Millions have been affected by the global increase in heart attacks, diabetes, and kidney failure, whereas significant investments in research and development along with the introduction of advanced testing methodologies have increased the demand for cholesterol testing. A remarkable improvement in the healthcare infrastructure, especially in developing nations, has streamlined diagnostic as well as cholesterol management procedures and, hence, increased efficiency. The integration of artificial intelligence and the Internet of Things into practices also boosts healthcare, thereby fueling the growth of the market. All of these factors will drive revenue in the global cholesterol testing market as more and more individuals seek preventive healthcare measures as well as effective monitoring solutions.

Restraints

-

The growth of the cholesterol testing market is hindered by a shortage of diagnostic laboratories and stringent regulatory requirements, particularly in developing regions.

-

A limited availability of skilled professionals in these areas poses an additional challenge to the market's expansion.

Cholesterol Test Market - Key Segmentation

By Product Type

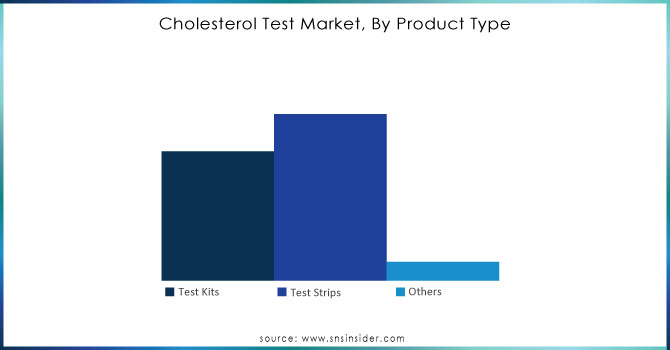

In 2023, the leading product in the cholesterol testing market was test kits which comprised about 45.0% of the total market share. Their popularity is due to their convenience and ease of use for both professionals and patients. Test kits ensure full cholesterol screening in a kit. While offering multiple tests in one package, they cater to various forms of preferential demand in the healthcare sector. The Test Strips segment is expected to grow the fastest, at a CAGR of 8% over the next five years. This growth is fueled mainly by the increasing demand for at-home testing solutions, with patients demanding greater control over their health and monitoring routines. Test strips are convenient and easy to carry around, making them more and more popular among consumers who like to monitor their cholesterol levels at home.

Need any customization research on Cholesterol Test Market - Enquiry Now

By Test Type

In 2023, the Total Cholesterol Test dominated the market with a 40.0% share in the total test type market share. It has been the preferred choice because of its ability to give an overview of a patient's cholesterol, including his HDL, LDL, and triglycerides. The high demand in clinical practice and routine check-ups has made it the leader in the test type. The LDL Cholesterol Test is most likely to be the most rapidly growing segment, growing at a 7% CAGR. Increasing health awareness relating to very high levels of LDL cholesterol, specifically in the context of cardiovascular diseases, drives demand for this particular test. As more patients as well as healthcare providers monitor LDL, this is likely to be a very fast-growing segment.

By End User

Diagnostic laboratories held the largest share of the cholesterol testing market in 2023, accounting for over 40.0% of the market. This dominance is attributed to the wide availability of advanced testing equipment and specialized professionals, ensuring accurate and efficient cholesterol testing. Diagnostic laboratories also play a crucial role in conducting a high volume of cholesterol tests, as they are often the preferred choice for physicians and patients due to their ability to handle complex diagnostics with precision. The growing prevalence of cardiovascular diseases and the increasing demand for regular cholesterol monitoring have further bolstered the position of diagnostic laboratories as a key player in this market. Hospitals emerged as the fastest-growing segment in the cholesterol testing market, with an impressive growth rate projected over the forecast period. This growth is driven by the increasing number of in-patient admissions due to cardiovascular conditions, obesity-related complications, and the rising focus on preventive care. Hospitals are increasingly adopting advanced diagnostic technologies and integrating cholesterol testing as part of routine check-ups, ensuring early detection and management of cholesterol-related disorders.

Cholesterol Test Market Regional Analysis

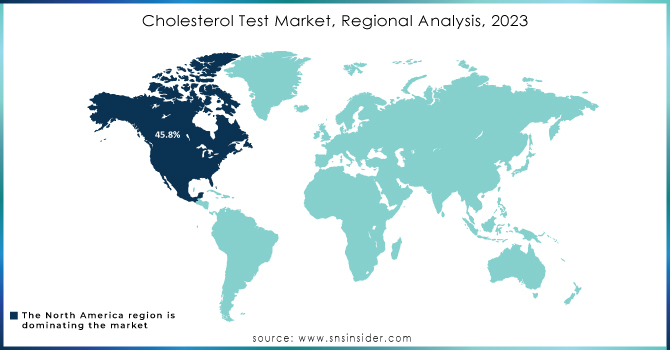

North America Cholesterol Testing Market accounted for USD 2.8 billion in 2023, capturing about 45.8% of the overall market share, and is expected to see massive CAGR growth over the forecast period. The region is a significant market due to well-developed healthcare systems, primarily within the United States. A key driver for the cholesterol testing market in this country for the forecast years is the rapid rise in the occurrence of strokes.

Europe is the second-largest market share for cholesterol testing. The awareness about preventive care among patients raises the usage of cholesterol testing products and services. The advancements in the efficiency and production of these kits and devices by market players have led to an increasing volume of market opportunities. The UK is also the largest market share in Europe. Germany has been identified as the fastest-growing market in the continent.

The Asia Pacific market is expected to grow at the highest CAGR from 2024 to 2032. This region is becoming more attractive due to an increase in population. Increased investment and spending in healthcare infrastructure have easily facilitated the development of diagnostic centers and pathology laboratories, hence improving diagnostic capabilities. China holds the largest market share in this region, followed by India, which has been declared a rapidly growing market for cholesterol testing.

Key Players in the Cholesterol Testing Market and Their Offerings

-

Quest Diagnostics Incorporated: Cardio IQ Cholesterol Test

-

Clinical Reference Laboratory Inc.: Lipid Panel Test

-

Randox Laboratories Ltd.: RX series Cholesterol Kit

-

PTS Diagnostics: CardioChek Cholesterol Testing System

-

Hoffmann-La Roche AG: Cobas Cholesterol Test

-

Cell Biolabs Inc.: Cholesterol/Cholesteryl Ester Quantitation Kit

-

Laboratory Corporation of America Holdings (LabCorp): Lipid Panel with Cholesterol Test

-

Thermo Fisher Scientific: Infinity Cholesterol Reagent

-

Eurofins Scientific: Cholesterol/Lipid Profile Testing Kit

Recent Developments

In January 2024, Abbott's Proclaim DRG Neurostimulation System received expanded MRI access for individuals suffering from chronic pain. Additionally, Abbott announced the initiation of its first global procedures in a clinical trial for its volt-pulsed field ablation system, designed to treat patients with abnormal heart rhythms.

In February 2024, Quest Diagnostics launched the MelaNodal Predict Test, a personalized melanoma risk prediction tool aimed at helping patients avoid invasive surgery.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.3 Billion |

| Market Size by 2032 | USD 16.8 Billion |

| CAGR | CAGR of 8.17% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Test Kits, Test Strips, Others) • By Test Type (Total Cholesterol Test, High-density lipoprotein (HDL) Cholesterol, Low-density lipoprotein (LDL) Cholesterol, Triglycerides/VLDL Cholesterol Test) • By End User (Hospitals, Diagnostic Laboratories, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Quest Diagnostics Incorporated, Clinical Reference Laboratory Inc., Randox Laboratories Ltd., PTS Diagnostics, Hoffmann-La Roche AG, Cell Biolabs Inc., Laboratory Corporation of America Holdings (LabCorp), Thermo Fisher Scientific, Eurofins Scientific, and Others |

| Key Drivers | • Rising Cardiovascular Diseases and Obesity Rates Propel Demand for Regular Cholesterol Screening |

| Restraints | • Shortage of diagnostic laboratories and stringent regulatory requirements, particularly in developing regions. |