Plant Growth Regulators Market Report Scope & Overview

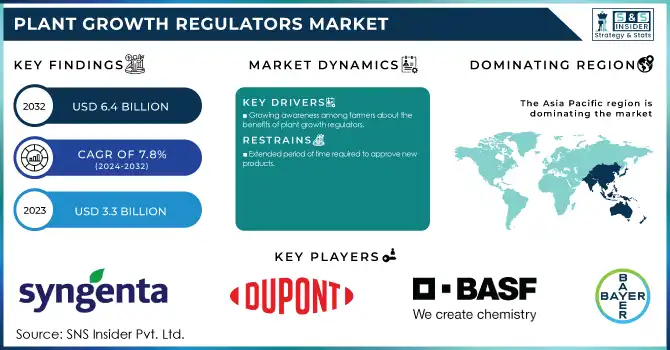

The plant growth regulators market size was valued at USD 3.29 billion in 2023 and is expected to reach USD 6.45 billion by 2032, growing at a CAGR of 7.77% over the forecast period of 2024-2032. The report provides a comprehensive analysis of production capacity and utilization by country, highlighting key manufacturing hubs and efficiency levels. It examines feedstock price trends across major regions, assessing cost fluctuations in raw materials. The report explores regulatory impacts on synthetic and bio-based plant growth regulators, focusing on policies from agencies like the EPA, EFSA, and ICAR. Additionally, it presents environmental metrics, including emissions data and sustainability initiatives in the industry. Innovation trends, particularly in bio-based formulations and nano-regulators, are analyzed alongside adoption rates in agriculture and horticulture, with a special focus on controlled environment agriculture.

Get E-PDF Sample Report on Plant Growth Regulators Market - Request Sample Report

Market Dynamics:

Drivers

-

Increasing demand for high-quality crops drives market growth.

As consumers increasingly demand produce that is rich in nutrients, aesthetically pleasing, and free of pesticide residue, the use of plant growth regulators (PGRs) is gaining momentum, especially in high-value crops like fruits, vegetables, and cereals. These PGRs are very essential for getting better flowering, fruit set, root growth, and plant health, leading to better marketability and exportable quality. Moreover, amid rising challenges to global food security, growth regulators are also advocated by governments and agronomic institutions to enhance productivity with sustainable crop practices. Further, rising demand for bio-based and residue-free PGRs due to the increasing replacement of controlled environment agriculture, hydroponics, and organic will boost the industry trend.

Restraint

-

High costs associated with plant growth regulators may hamper the market growth.

The high costs of plant growth regulators (PGRs) are one of the major hindrances to the market growth of PGRs; however, it has a considerable impact on small and medium-scale farmers aiming to operate on a very low budget. High costs associated with PGRs can make them inaccessible for some farmers, resulting in low adoption rates and consequently market demand. Also, the stringent regulatory frameworks surrounding PGR approval and use also lead to higher costs and longer timelines for new products. In such cases, it has been observed that these factors inhibit the wider adoption of PGRs, despite enhancing crop yield and quality potential.

Opportunities

-

Increasing adoption of precision agriculture techniques creates an opportunity for the market.

Agriculture is gaining importance as it benefits growers by reducing costs, enhancing efficiency, maximizing yield, saving time, and minimizing chemicals and resource consumption. Technologies such as GPS, remote sensing, and data analytics advance precision agriculture, which allows for the application of inputs such as PGRs more efficiently. According to the time when the plants need the treatment with plant growth regulators (PGRs); this method optimizes crop yield and quality, minimizes wastage, and reduces the environmental burden. High-growth rates of organic and bulk agricultural input sales in Asia have increased the dependence of farmers on the usage of precision farming techniques to farm crops with higher efficiency and sustainability and hence maintain the growth stimulation for specialized PGRs implementing precision farming technologies more appealing to farmers, which, directly or indirectly, will expand the market development for these products.

Challenges

-

Presence of low-quality and counterfeit products in the market.

The prevalence of adulterated and duplicative plant growth regulators (PGRs) is one of the widespread problems faced by the agriculture fraternity. Farmers using these polluted products often suffer from reduced crop yield, diseases in plants, and soil depletion issues. Such consequences not only result in monetary loss to Punjab farmers but also destroy their confidence in agricultural inputs further growing reluctance to pay for true PGRs in the future. Additionally, counterfeit PGRs can also be found with untested or dangerous contents, which can threaten both human and environmental health. The entry of these false products into the market also affects genuine manufacturers' credibility as well as the supply chain and eventually impedes the growth and sustainability of the PGR market as a whole.

Market segmentation:

By Material Type

Cytokinin held the largest market share around 42% in 2023. They are widely favorable among the farmers due to their important role in increasing the crop yield, and quality of fruits and vegetables and improving the plant resistance against environmental stress. The increased adoption of high-yield crops and the high need for better seed germination and root growth have provided an additional boost to the market with the use of cytokinins (particularly in cereals, pulses, and fruits). Moreover, innovations in biotechnological compositions and the growing transition to bio-based plant growth regulators have swayed the power in favor of cytokinin in the market. Another reason that has been responsible for their significant market share is the widespread use of these products in tissue culture applications and controlled environment agriculture which includes hydroponics and vertical farming.

By Crop Type

The Cereals & Grains segment held the largest market share around 34% in 2023. With population pressing and the food security quest becoming more pivotal, plant growth regulators (PGRs) are being widely utilized by farmers to increase crop yield, better stress toleration, and finally germination and maturation cycles. To obtain high productivity, cereals and grains need optimal conditions of growth; and PGRs (plant growth regulators), especially cytokinins and gibberellins, are vital for grain quality, seed development, and well-being of plants. Moreover, the use of PGRs in this segment has been further boosted by government initiatives and agricultural subsidies that are promoting sustainable farming. Cereals & grains also continue to lead the way in the market with the rising popularity of precision farming techniques and controlled environment agriculture.

Regional Analysis:

Asia Pacific held the largest market share around 42% in 2023. The region has been witnessing expansion in the agricultural sector over the last few years along with adoption of crop production on a large scale and the local population, adopting modern agriculture techniques. Plant Growth Regulators Market Research Report is a professional and in-depth study on the existing state of the Plant Growth Regulators Market Plant Growth Regulators market in the Asia-Pacific region is growing at a rapid pace driven by countries such as China, India in addition to Indonesia, which are amongst the major growers of rice, wheat, and other staple crops, which subsequently is generating huge demand for increase yield & quality of yield boosting the consumption of PGRs. Moreover, increasing worries about food security, a robust population, and government support for sustainable agriculture have further expedited the implementation of PGR. Apart from this, the region is undergoing developmental initiatives towards bio-based plant growth regulators, which is mainly fueled by supportive environmental regulations and growing consciousness over organic farming.

North America region is projected to witness the fastest growth rate in forecast period 2024- 2032. Federal policies in the United States have created a conducive climate for innovation and investment in the agricultural sector and stimulated plant growth regulator development and adoption. In addition to this, few key vendors of plant growth regulators exist in the U.S. This has resulted in these companies making significant investments in the development of innovative products and technologies. The powerful protection of intellectual property rights and well-established distribution networks that exist in the United States has also bolstered US dominance in this sector, as domestic films get the greatest support from these conditions. A crucial issue is the sustainable agriculture practices of the US. The nation has taken the lead in sustainable farming methods, including environmental protection agents, and plant growth regulator agrochemicals. These inputs help farmers to rely less on harmful chemical inputs, reduce environmental footprints, and improve resource use efficiency.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players:

-

Bayer AG (ProGibb, Ethrel)

-

BASF SE (Regalis Plus, Smartblock)

-

DuPont (Agris-Fos, Fontelis)

-

DSM (Maxi-Grow, Ripener)

-

Nestlé (Nutrigrow, BioStim)

-

Biosynth Carbosynth (Gibberellin A3, Zeatin)

-

Syngenta AG (Primo Maxx, Moddus)

-

Nufarm Ltd. (B-Nine, Cytoplex)

-

Corteva, Inc. (RyzUp, N-Large)

-

UPL Limited (Surplus, Stomp)

-

Tata Chemicals Ltd. (Grow-One, StimRich)

-

Sumitomo Chemical Co. Ltd. (Promalin, SumiGro)

-

FMC Corporation (Accede, Pix)

-

Sichuan Guoguang Agrochemical Co., Ltd. (Guoguang GA3, Green-Up)

-

Dextra Laboratories (Indole-3-Butyric Acid, 6-Benzylaminopurine)

-

Arysta LifeScience (Apogee, Regulex)

-

Fine Americas, Inc. (Perlan, Novagib)

-

Valent BioSciences (ProTone, ReTain)

-

Xinyi Industrial Co., Ltd. (Xinyi GA4, Xinyi KT-30)

-

Redox Industries Limited (BioGro, StimPlus)

Recent Development:

In August 2023, Bayer invested USD 238.1 million in a new R&D facility at its Monheim site. The facility aims to develop the next generation of crop protection chemicals. This initiative enhances Bayer’s innovation in sustainable agriculture solutions.

In March 2023, Sumitomo Chemical India Ltd. launched Promalin, a plant growth regulator, in India. The product aims to enhance fruit quality, size, and yield in orchards. This launch strengthens Sumitomo’s presence in the Indian agricultural market.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 3.29 Billion |

|

Market Size by 2032 |

USD 6.45 Billion |

|

CAGR |

CAGR of 7.77% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Cytokinin, Gibberellins, Auxins, Ethylene, and Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

|