Plastic Caps & Closures Market Report Scope & Overview:

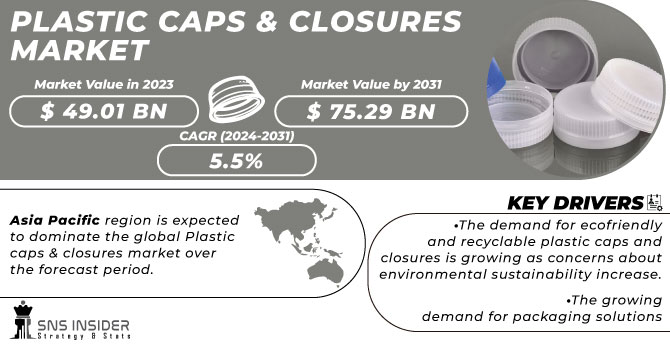

The Plastic Caps & Closures Market size was USD 49.01 billion in 2023 and is expected to Reach USD 75.29 billion by 2031 and grow at a CAGR of 5.5 % over the forecast period of 2024-2031.

The plastic bottle caps and closures market is driven by increased demand for water from customers around the world. In order to avoid spills, simplify transport and improve shelf life, plastic caps and closures are used to seal water bottles. Demand for bottles of water is increasing as more people are becoming aware of contamination and safety problems in drinking water.

Get More Information on Plastic Caps & Closures Market - Request Sample Report

Additionally, 15.5 billion gallons of bottled water were consumed worldwide, an increase of 4.4% over the previous year, according to Beverage Marketing Corporation (BMC). During the forecast period, the demand for plastic caps and lids will continue to increase.

The Qorpak HDPE F422 foamlined polypropylene caps are acid resistant. The.38"LDPE core is sandwiched in the same layers of.002"HDPE and.003"Ranisole, which makes it an F422 liner. The polypropylene closures, polyethylene foam lines, are particularly suitable for sealed applications due to their excellent chemical resistance. The product must be resistant to acids, alcohols, alkalis, water products, cosmetics, household oils and so on.

MARKET DYNAMICS

KEY DRIVERS:

-

The growing demand for packaging solutions

The necessity of effective and secured packaging solutions, where plastic caps and closures play a major role, is driven by the growing demand for packing foodstuff, beverages, pharmaceutical products, consumer goods or household products.

-

The demand for ecofriendly and recyclable plastic caps and closures is growing as concerns about environmental sustainability increase.

RESTRAIN:

-

Environmental issues and plastic pollution

Regulations on single use plastics, as well as an increased focus on recycling and sustainability, have resulted from growing environmental awareness and concern over plastic pollution. This will directly affect the plastics packaging and closures market.

OPPORTUNITY:

-

Expanding markets in emerging economies

This opportunity can be harnessed if market presence is expanded in emerging economies and regions that are experiencing a growing demand for disposable income, living patterns have changed or urbanization has taken place. With growing demand for packaging products, as well as associated caps and closures, the consumer base is expanding.

CHALLENGES:

-

The general public's perception and opinion

A significant obstacle is to overcome the negative perception of plastics as a result of media coverage of environmental issues and waste. In order to correct misunderstandings, the public needs to be informed of the benefits of recycling plastics and made aware of sustainable practices.

IMPACT OF RUSSIAN UKRAINE WAR

As a result of the war, the cost of raw materials, such as oil and gas, increased. It has led to an increase in the price of polyethylene and polypropylene caps and closures. Due to the decline in economic activity, there is a decrease in demand for plastic closures and caps. It is because of this war that the world economy has been rocked by uncertainty and instability. In plastics, caps and closures there was a disruption of trade due to the war. It has resulted in difficulties for companies to obtain the raw materials they need and export their products.

In March, the suppliers of PE increased their prices by 4 cents per pound, and expect further increases of 6 cents per pound in the second quarter of 2022. Similarly, suppliers of PP increased the price per pound by between 8 and 10 cents with another 4 cent increase possible in Q2 2022. Russia and Ukraine together make up the world's second-largest steel exporter (China is first) and both countries suspended steel exports after the invasion. The manufacturing of molds used in injection moulding will be hampered by the lack of steel.

IMPACT OF ONGOING RECESSION

As a result of the recession, demand for consumer products that use plastic closures or caps such as food and beverage products, personal hygiene products etc. is also expected to decrease. Increased competition with alternatives, such as metals and glass, is foreseen due to high plastic costs. Demand for plastic caps and closures is expected to decrease as a result. New investment in the plastic cap and closure sector is likely to be held back by uncertainty around the world economy. In the medium term, this could have a negative impact on market growth.

In 2023, as a result of the recession, the US market for plastic caps and closures is projected to decline by 2%. This is also due to increased cost of petroleum and energy and gas. In 2023, the market for plastics caps and closures in Europe is projected to decrease by 2.5% due to a recession. Since the prices of energy has increased in this region this will rise the production cost.

KEY MARKET SEGMENTS

By Material

-

PP

-

LDPE

-

Others

By Product Type

-

Screw on Caps

-

Dispensing Caps

-

Others

Screw on caps will account for the major market share of around 70% over the forecast period. This is due to the increase in beverages consumption.

By Packaging Technology

-

Post Mold TE Band

-

Injection Molding

-

Compression Molding

By Container Type

-

Glass

-

Plastic

By End Use

-

Beverages

-

Food

-

Pharmaceuticals

-

Personal & Homecare

-

Others

Food & Beverage segment will dominate the end use industry. The food & beverage segment accounted for the 49.5% market share in the year 2022. The increasing demand for the ready to drink beverages, will give rise to the market growth.

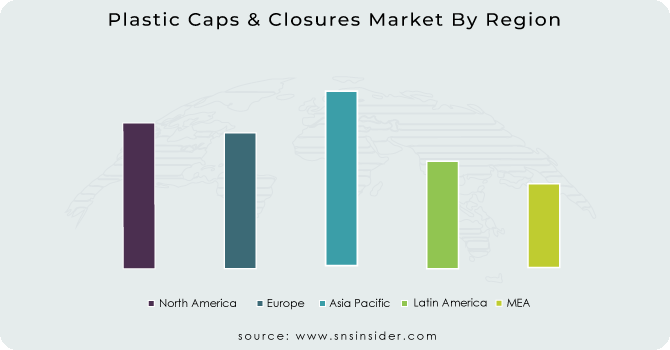

REGIONAL ANALYSIS

Asia Pacific region is expected to dominate the global Plastic caps & closures market over the forecast period. Improving consumer lifestyles, increased disposable income, and increasing economy is expected to drive the market growth over the coming years.

North America is second largest dominating region. United states held the major market share and will dominate the region followed by Canada.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Plastic Caps & Closures market are Amcor Plc, United Caps, Guala Closures SPA, Aptar Inc, Silgan Plastics, Berry Global Inc, Closure Systems International Inc, MJS Packaging, Crown Holding, O.Berk Company and other players.

United Caps-Company Financial Analysis

RECENT DEVELOPMENT

-

United Caps, the world's largest cap and closures manufacturer, has started producing an effective and sustainable plastic tie closure for carton packaging in 23 HPAK.

-

Amcor has introduced IMPRESSIONS, a technology developed in cooperation with MGJ that will allow brands to modify closure liners like the underside of bottle caps.

| Report Attributes | Details |

| Market Size in 2023 | US$ 49.01 Bn |

| Market Size by 2031 | US$ 75.29 Bn |

| CAGR | CAGR of 5.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (HDPE, PP, LDPE, Others) • by Product Type (Screw on Caps, Dispensing Caps, Others) • by Packaging Technology (Post Mold TE Band, Injection Molding, Compression Molding) • by Container Type (Glass, Plastic), by End Use (Beverages, Food, Pharmaceuticals, Personal & Homecare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Amcor Plc, United Caps, Guala Closures SPA, Aptar Inc, Silgan Plastics, Berry Global Inc, Closure Systems International Inc, MJS Packaging, Crown Holding, O.Berk Company |

| Key Drivers | • The growing demand for packaging solutions • The demand for ecofriendly and recyclable plastic caps and closures is growing as concerns about environmental sustainability increase. |

| Key Restraints | • Environmental issues and plastic pollution |