Toys Market Report Scope & Overview:

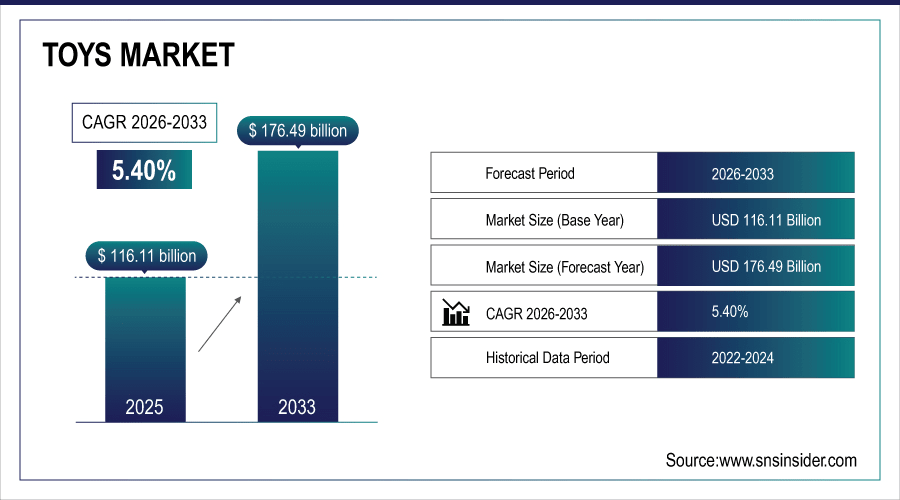

The Toys Market Size was valued at USD 116.11 Billion in 2025E and is projected to reach USD 176.49 Billion by 2033, growing at a CAGR of 5.40% during the forecast period 2026–2033.

Toys market analysis provides a comprehensive overview of performance trends and developments in the category, as well as volume, value and growth at a national level. The market has been divided based on age group, end user (residential, commercial, educational, industrial), material, price range and distribution channel including online retail, specialty stores/supermarkets & hypermarkets/departmental stores. Global market growth is being driven by a growing consumer expenditure, expansion in the demand of educational and interactive toys, and digital incorporation.

Building sets accounted for around 28% of the Toys Market in 2025, driven by growing demand for educational and STEM-focused toys.

To Get More Information On Toys Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 116.11 Billion

-

Market Size by 2033: USD 176.40 Billion

-

CAGR: 5.40% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Toys Market Trends:

-

Growing preference for learning and skill development among children, has complemented sale of building sets along with puzzles.

-

Digital/interactive toys are playing into technology integration and hot app-enabled/smart play experiences.

-

High-end and sustainable toys are on the rise, driven by increased consumer knowledge about safety and environmental standards.

-

E-commerce and specialty shops are increasing availability of niche collectible and quality toys for hobbyists and collectors.

-

Swelling disposable incomes, urbanization and more spending on children’s entertainment and educational products are fueling growth in emerging markets.

U.S. Toys Market Insights:

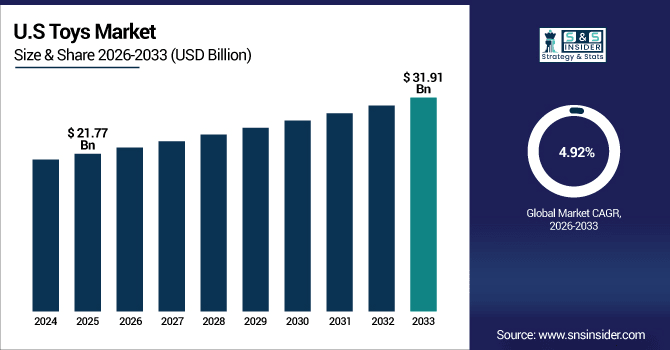

The U.S. Toys Market is projected to grow from USD 21.77 Billion in 2025E to USD 31.91 Billion by 2033, at a CAGR of 4.92%, driven by rising consumer spending, demand for educational and interactive toys, and growing popularity of premium and collectible products. E-commerce and specialty retail enhance accessibility.

Toys Market Growth Drivers:

-

Increasing demand for educational and interactive toys is driving global market growth across age groups and segments.

The Toys Market is growing due to increasing demand for educational and interactive toys across emerging and developed economies. Annual worldwide sales of toys are expected to exceed 3 billion pieces in 2033, compared with roughly 2 billion in 2025, supported by higher consumer spending, urbanization and a trend toward skill-building play. High demand of digitally integrated smart and premium toys, coupled with e-commerce is driving innovation and market growth throughout the globe.

Rising demand for educational and interactive toys drove nearly 35% of global toy sales in 2025, led by building sets and puzzles.

Toys Market Restraints:

-

Safety concerns and strict toy regulations limit production and slow market growth across global segments.

Concern about the safety and heavy regulation toys must meet, which mounts up to around 30% of production and compliance costs is one area governing the Toys industry. Testing requirements, particularly in North America and Europe limit the availability of certain materials and designs. These regulations are hard for small, local producers to comply with and therefore hamper their ability to compete. Moreover, mounting recalls, material shortages and compliance delays continue to restrict market growth at large, stimulated by the intriguing and interactive counterpart of toys globally.

Toys Market Opportunities:

-

Rising demand for STEM-focused, educational, and interactive toys presents significant global market expansion opportunities.

Emerging opportunities in the Toys Market will lead to the growth of STEM based, educational and interactive Toys. Thirty percent of new toy launches will have a skill-building, learning or digital integration component by 2025 that both children and parents find appealing. The proliferation of e-commerce, specialty retail outlets and subscription-based toy services continue to make toys accessible while premium, educational and tech-enhanced toys should support further world-wide market expansion through 2033.

Launches of STEM-focused, educational, and interactive toys accounted for nearly 32% of global toy product introductions in 2025.

Toys Market Segmentation Analysis:

-

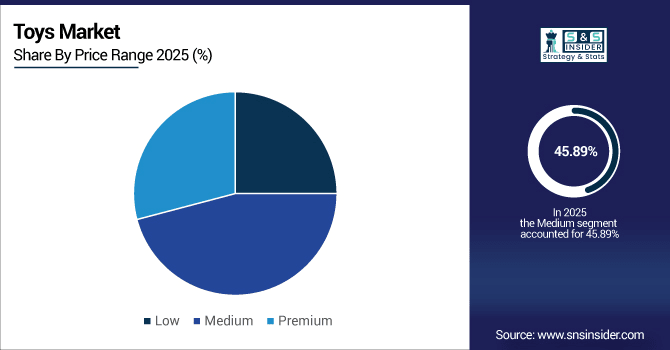

By Price Range, Medium dominated with a 45.89% share in 2025, and Premium is projected to record the fastest CAGR of 6.34%.

-

By Product Type, Building Sets held the largest market share of 28.45% in 2025, while Puzzles are expected to grow at the fastest CAGR of 6.12%.

-

By Age Group, 3–5 Years dominated with a 25.88% share in 2025, while 6–8 Years is projected to expand at the fastest CAGR of 6.05%.

-

By End User, Residential / Household accounted for the highest market share of 61.32% in 2025, and Educational / Institutional is projected to record the fastest CAGR of 6.15%.

-

By Material, Plastic held the largest share of 54.76% in 2025, while Fabric is expected to grow at the fastest CAGR of 5.88%.

-

By Distribution Channel, Supermarkets & Hypermarkets held the largest share of 36.12% in 2025, while Online Retail is expected to grow at the fastest CAGR of 7.03%.

By Price Range, Medium Lead While Premium Expand Rapidly:

Medium-priced toys segment dominated and accounted for nearly 840 million units in 2025, favored for affordability and accessibility. Balance of quality and price appeals to most households globally. Premium toys (350 million) are fast-growing due to rising disposable income, demand for branded and innovative toys. Growth of niche collector editions, interactive digital toys, and educational products in urban and online markets.

By Product Type, Building Sets Lead While Puzzles Expand Rapidly:

The building sets in 2025 dominated at around 520 million units, driven by rising demand for STEM-focused and educational play. High adoption of skill-based, educational, and STEM toys among children. While puzzles were 320 million units, as they are a fast-growing category with more attention being drawn to interactive and family-type games. Increasing popularity of family-oriented, interactive, and cognitive development toys in urban and semi-urban markets.

By Age Group, 3–5 Years Lead While 6–8 Years Expand Rapidly:

Toys for children aged 3–5 years dominated and accounted for 610 million units in 2025, reflecting high demand for early learning and developmental play. Strong preference for early childhood educational and developmental toys. The 6–8 years age group, at nearly 460 million units, is the fastest growing as more parents buy educational and interactive toys for school-age children. Rising adoption of STEM kits, puzzles, and interactive toys for school-going children.

By End User, Residential / Household Lead While Educational / Institutional Expand Rapidly:

Residential and household dominated with about 1.1 billion units in 2025, driven by traditional family purchases and home-based play. Large volume of household toy consumption and home-based play routines. Educational and institutional use, about 240 million units, is fast-growing as schools, daycare centers, and learning programs adopt technology. Integration of STEM and interactive toys into curricula and government initiatives promoting educational play.

By Material, Plastic Lead While Fabric Expand Rapidly:

Plastic toys dominated in 2025 at 950 million units due to affordability, durability, and versatility across product types. Cost-effectiveness and suitability across a wide range of toy types. Fabric toys, around 180 million units, are fast-growing with rising popularity of plush toys and soft educational toys. Increased consumer preference for tactile, safe, and eco-friendly soft toys, especially for younger children.

By Distribution Channel, Supermarkets & Hypermarkets Lead While Online Retail Expand Rapidly:

The supermarkets and hypermarkets dominated the market (680 million units) in 2025, owing to convenience, availability and customer's trust. Well-established physical retail networks that are easily accessible. Online retail (520 million units) is the fastest-growing sector, driven by growth of e-commerce, direct-to-consumer sales and subscription toy services. Greater digital adoption, quicker logistics and targeted online marketing helping to drive access to niche and international brands.

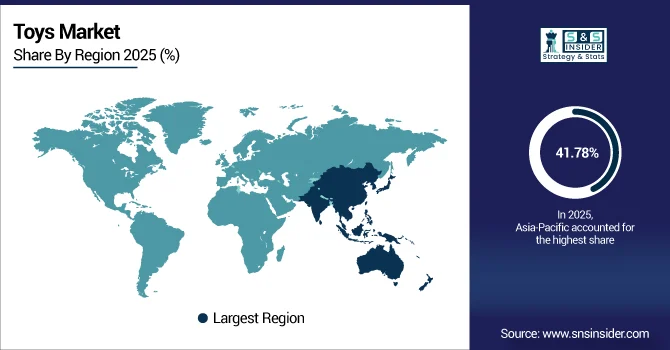

Toys Market Regional Analysis:

Asia-Pacific Toys Market Insights:

The Asia-Pacific Toys Market accounted for 41.78% of global consumption in 2025, supplying around 1.05 billion units, led by China (480 million) and India (220 million). Building sets and action figures took prominent market share, there was also acceleration in puzzles for this part of the year. Growing disposable incomes, urbanization, and rising emphasis on educational and interactive toys in megacities are driving market growth, positioning Asia-Pacific as the largest region globally and the most influential.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China Toys Market Insights:

In 2025, China was consuming some 480 million toy units dominated by building sets and action figures. 280 million units were sold in Supermarkets & Hypermarkets and the rest through online retail and specialty stores. Growth has been fuelled by increasing disposable incomes, urbanisation and growing demand for educational, interactive toys across the country.

North America Toys Market Insights:

The North America Toys Market demand was around 610 million units in 2025, supported by action figures, building sets & board games. Distribution is almost exclusively through supermarkets & hypermarkets, with online retail and specialist stores rising. Growth is being fueled by growing disposable income, the growing appeal of educational and interactive playthings, and robust uptake of premium and collectable goods throughout the US and Canada.

U.S. Toys Market Insights:

The U.S. consumed about 610 million toy units under over 1,200 brands in 2025 alone. About 380 million units were sold in supermarkets and specialty stores, while some 230 million units were bought online. Growth is being propelled by increasing demand for educational, interactive and premium toys across the country.

Europe Toys Market Insights:

The European Toys Market in 2025 was assumed to be 450 million units with Germany representing some 120 million units, UK (95 million) and France (80 million). The volume share for supermarkets and multiples was 260 million units, and the specialty trade weighted in with 190 million. Market growth in the region is propelled by growing demand for educational and interactive toys, surging disposable incomes, rapid urbanization and a shift towards premium as well as eco-friendly products in the region.

Germany Toys Market Insights:

In 2025, Germany has used some 120 million toy units; of those, 70 million were sold in supermarkets and specialized shops while the other 50 million were distributed by online retail. Building sets and action figures dominated. The market is mainly stimulated by growing disposable incomes, demand for educational and interactive toys, and surging popularity of premium and eco-friendly products.

Middle East and Africa Toys Market Insights:

The Middle East & Africa Toys Market is expected to grow at a CAGR of 6.82% during the forecast period, driven by rising disposable incomes and urbanization. In 2025, the area had consumed about 130 million toy units 80 through traditional brick-and-mortar stores and 50 online. Demand for educational, interactive and premium toys drives growth.

Latin America Toys Market Insights:

In 2025, toy consumption in Latin America amounted to some 130 million units, with Brazil (60 million), Argentina (35 million) and Chile (20 million) being the most important markets. Around 85 million units were sold in retail and 45 million via e-commerce, spurred by increasing urbanization and growing demand for educational / interactive toys.

Toys Market Competitive Landscape:

The LEGO Group is a world leader in the toy industry and distributes more than 600 million sets of its toys into over 140 countries. Its product offerings include LEGO Classic, LEGO Technic and LEGO Friends products that offer creative and educational play experiences. LEGO invests in STEM and digitalized toys. With a strong retail and online footprint, it maintains its leadership position as well as an innovative streak to be a lighthouse in the global industry of toys arena.

-

In March 2025, LEGO released the LEGO Technic Mars Rover set that included interactive robotics capabilities and integrated augmented reality. New packaging brought a focus on STEM learning to the forefront, enriching play for kids everywhere.

Mattel, Inc. is one of the worldwide leaders in the design, manufacture and marketing of toys industry. Sold across 150 countries worldwide. Its brands, which range from Barbie to Hot Wheels to Fisher-Price, cut across action figures, dolls and educational toys. Operating in 150 countries, Mattel’s global notability for creativity, innovation and branding serves as the transformative catalyst that supports our strategic approach to portfolio management.

-

In June 2025, Mattel introduced a reboot of the Barbie Dreamhouse with smart technology like voice activation and app connections. Changes in packaging that emphasized ethical and shelf appeal that would be likely to draw both children and collectors.

Hasbro, Inc., a worldwide leader in children’s and family leisure time products and services industry with 900 million toys sold every year in more than 120 countries. It is home to Monopoly, Nerf, My Little Pony and Transformers, which cater for different age groups and markets. With retail, online, and licensing channels integrated to deliver the best customer experience in the industry, Hasbro is well positioned to achieve significant scale in multiple categories and markets worldwide.

-

In September 2025, The Nerf HyperStrike Blaster by Hasbro with increased distance and the bait digital scoring. The new packaging showcased competitive game play features targeting both casual and serious E-sports users in the international market.

Toys Market Key Players:

Some of the Toys Market Companies are:

-

LEGO Group

-

Mattel, Inc.

-

Hasbro, Inc.

-

Bandai Namco Holdings, Inc.

-

Spin Master Corp.

-

VTech Holdings Limited

-

MGA Entertainment, Inc.

-

Jakks Pacific, Inc.

-

Tomy Company, Ltd.

-

Ravensburger AG

-

Funko, Inc.

-

LeapFrog Enterprises, Inc.

-

Playmobil (Brandstätter Group)

-

Fisher-Price, Inc.

-

Crayola, LLC

-

Schleich GmbH

-

Playmates Toys Limited

-

Bruder Spielwaren GmbH

-

Giochi Preziosi S.p.A.

-

WOW! Stuff Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 116.11 Billion |

| Market Size by 2033 | USD 176.49 Billion |

| CAGR | CAGR of 5.40% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Action Figures, Dolls, Puzzles, Board Games, Building Sets, Vehicles, Plush Toys, Others) • By Age Group (0–3 Years, 3–5 Years, 6–8 Years, 9–12 Years, Teenagers, Adults) • By End User (Residential/Household, Commercial, Educational/Institutional, Industrial) • By Material (Plastic, Wood, Metal, Fabric, Others) • By Price Range (Low, Medium, Premium) • By Distribution Channel (Online Retail, Specialty Stores, Supermarkets & Hypermarkets, Department Stores, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | LEGO Group, Mattel, Inc., Hasbro, Inc., Bandai Namco Holdings, Inc., Spin Master Corp., VTech Holdings Limited, MGA Entertainment, Inc., Jakks Pacific, Inc., Tomy Company, Ltd., Ravensburger AG, Funko, Inc., LeapFrog Enterprises, Inc., Playmobil (Brandstätter Group), Fisher-Price, Inc., Crayola, LLC, Schleich GmbH, Playmates Toys Limited, Bruder Spielwaren GmbH, Giochi Preziosi S.p.A., WOW! Stuff Ltd. |