Thermoform Packaging Market Thermoform Packaging Market Report Scope & Overview:

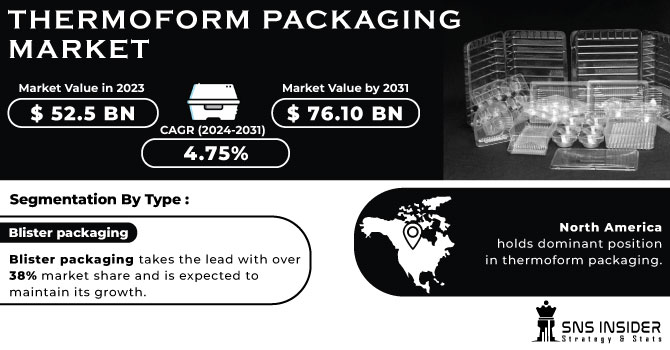

The Thermoform Packaging Market Size was valued at USD 52.5 billion in 2023 and is projected to reach USD 76.10 billion by 2031 and grow at a CAGR of 4.75% over the forecast periods 2024 -2031.

The thermoform packaging market flourishes due to its versatility and affordability. This forming process offers tamper-resistant, durable packages that extend shelf life and simplify product access. It's a cost-effective alternative to injection molding, making it attractive for various industries.

Get More Information on Thermoform Packaging Market - Request Sample Report

For instance, ProAmpac to launch a 90% fiber-based thermoforming solution in Europe February 2024 targeting improved recyclability, efficiency, and consumer appeal for food packaging. From blister packs in pharmaceuticals to food trays, thermoforming caters to diverse applications. The market is expected to grow due to its ability to reduce plastic waste and meet single-use plastic regulations.

The convenience, extended shelf life, and lower packaging costs it offers for food products further drive market growth. Additionally, the pharmaceutical industry's expansion, particularly in emerging regions, fuels demand for thermoformed packaging as a sustainable and affordable option. With continued innovation in thermoformed tubs and containers, the future looks bright for this adaptable packaging solution across various sectors.

MARKET DYNAMICS

KEY DRIVERS:

-

Food companies are increasingly turning to thermoformed packaging solutions due to their advantages.

Driven by consumer demand for convenient food and stricter safety regulations, the food industry's preference for thermoform packaging is surging. These lightweight, cost-effective solutions offer extended shelf life, contamination protection, and customizable designs, making them ideal for a variety of food products. This trend is expected to propel the thermoform packaging market forward.

-

Sustainability-conscious consumers and cost-driven manufacturers are increasingly demanding lightweight and affordable packaging solutions.

RESTRAINTS:

-

Limited plastic recycling facilities hinder the thermoform packaging market's sustainability edge.

Thermoform packaging's sustainability suffers due to limited recycling facilities. While versatile and cost-effective, these packages often end up in landfills due to inadequate infrastructure. Investment in recycling technology and promoting eco-friendly thermoform materials are crucial to address this challenge.

-

Unstable raw material costs pose a challenge for the thermoform packaging market.

OPPORTUNITY:

-

Thermoform packaging's versatility, functionality, and adaptability make it a perfect fit for diverse food products and packaging needs.

-

The development and adoption of sustainable packaging solutions.

Environmental concerns are driving demand for sustainable packaging. Thermoform's versatility can meet this need by offering eco-friendly options like recycled materials and bioplastics, making it a key player in the sustainable packaging market.

CHALLENGES:

-

Standing out in the crowded thermoform packaging market is a significant challenge for businesses.

The thermoform packaging market is a tough competition for manufacturers. Numerous players vie for market share, demanding constant innovation and differentiation. Pricing pressures, shifting consumer preferences, and rapid technological advancements all contribute to this intense landscape. Globalization further intensifies competition, requiring manufacturers to prioritize quality, efficiency, and continuous innovation for survival.

-

The initial investment required for thermoforming machinery can be substantial, posing a financial challenge for some companies.

IMPACT OF RUSSIA UKRAINE WAR

The war in Ukraine has thrown another problem into the already strained thermoform packaging supply chain. Rising oil prices due to sanctions on Russia are expected to push up resin costs, a key raw material for thermoforming. Steel shortages are also a concern, as Russia and Ukraine are major exporters, and steel is typically used for the molds in injection molding, a competitor to thermoforming. While thermoforming uses aluminum tooling, disruptions in the steel supply chain could still cause problems and potentially increase costs.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown triggered by the war in Ukraine, inflation, and potential recession is expected to slow down the growth of the thermoform packaging market. As inflation erodes disposable incomes, consumers are likely to tighten their belts and prioritize essential goods over discretionary spending. This could lead to a decrease in demand for packaged goods, which in turn would reduce the need for thermoform packaging. Businesses may become more cautious about investing in new packaging solutions during an economic downturn. This could slow down the adoption of innovative thermoform packaging options, hindering market growth. The volatile global economic climate could lead to disruptions in the supply chain for raw materials and components used in thermoform packaging production. This could cause delays, shortages, and price increases, further impacting the market.

KEY MARKET SEGMENTS

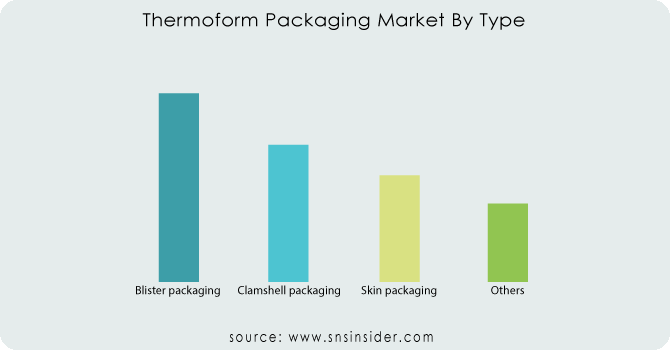

By Type

-

Blister packaging

-

Clamshell packaging

-

Skin packaging

-

Others

The thermoform packaging market offers various options, including blister packs dominant for pharmaceuticals and retail due to security and visibility, clamshell packaging is popular for electronics, cosmetics, and food due to its hinged design and protection, skin packaging, trays & lids, containers, and others. Blister packaging takes the lead with over 38% market share and is expected to maintain its growth.

Need any customization research on Thermoform Packaging Market - Enquiry Now

By Material

-

Plastic

-

Polyvinyl Chloride

-

Polyethylene Terephthalate

-

Polyethylene

-

Polypropylene

-

Polystyrene

-

Others

-

-

Aluminum

-

Paper & Paperboard

In Thermoform packaging market plastic is dominating. It can be molded into any shape or size, perfectly matching branding needs. Additionally, plastic offers excellent protection against external elements, keeping products safe. Additionally, its lightweight nature lowers transportation costs and emissions. Looking ahead, advancements in technology and a growing focus on sustainable options like recycled and biodegradable plastics are propelling further market growth. With its unmatched adaptability, protection, and increasing eco-friendly options, plastic seems likely to maintain its leadership role in thermoform packaging.

By End-Use Industry

-

Food & Beverages

-

Pharmaceuticals

-

Electronics

-

Home & Personal care goods

-

Others

The pharmaceutical industry is the leader of thermoform packaging growth. An aging global population and rising healthcare awareness fuel demand for packaged medicines, perfectly addressed by thermoform packaging. Blister packs, a thermoforming star, offer unmatched protection, tamper-evident seals, and clear visibility, making them ideal for pharmaceuticals. Clamshell trays join the game by providing secure, sterile packaging for medical devices.

By Heat-seal coating

-

Solvent-based heat seal coating

-

Water-based heat seal coating

-

Hot-melt-based heat seal coating

Solvent-based heat seal coatings dominates in the thermoform packaging market with share of 40% due to their unbeatable strengths. As they offer exceptional water and grease resistance, forming an essential protective layer for food and beverages. Second, their unmatched bond strength creates secure seals that can handle even demanding situations. These combined advantages make solvent-based coatings the go-to choice for thermoform packaging.

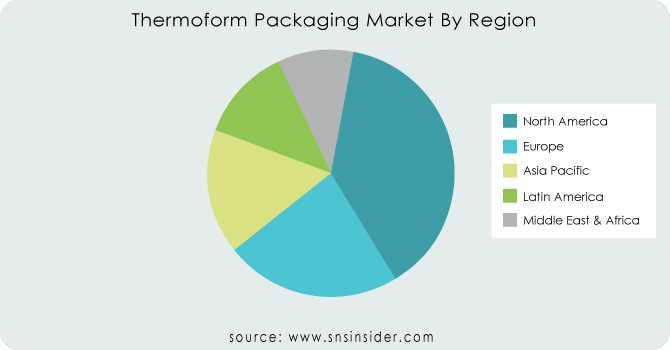

REGIONAL ANALYSIS

North America holds dominant position in thermoform packaging. This dominance stems from a well-developed packaging industry with cutting-edge technology. Strong demand from food & beverage, pharmaceuticals, and electronics further fuels growth. The booming e-commerce market, requiring secure and efficient packaging, also bolsters North America's leadership. As a hotbed of innovation, North America is poised to stay at the forefront of thermoform packaging advancement.

Meanwhile, Asia-Pacific is projected for significant growth. Their growing industries are driving the demand for sustainable packaging like thermoform containers and trays. Food and beverage companies are also turning to thermoform solutions to attract consumers and preserve food quality. Features like good barriers, durability, and easy access are making thermoform packaging increasingly popular in India. Rising disposable incomes in Latin America are fueling the market's growth, as consumers have more money to spend on packaged food and beverages. The Middle East and Africa are emerging as the fastest-growing regions due to two key factors such as a large population of working migrants in GCC (Gulf Cooperation Council) countries creates a higher demand for packaged goods. Rapid economic growth in Africa is leading to increased consumer spending and a growing market for packaged food and beverages.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some the major players in Thermoform Packaging Market are WestRock Company, Anchor Packaging, Inc., Display Pack Inc., Dart Container Corp., Constantia, Sonoco Products Company, RPC Group Plc, Lacerta Group Inc., DS Smith Plc, Placon Corp, Amcor Plc, Pactiv LLC, D&W Fine Pack And Others Players.

WestRock Company-Company Financial Analysis

RECENT DEVELOPMENT

-

In April 2024, Plastic Ingenuity, a Wisconsin-based provider of eco-friendly thermoform solutions, launched a free online course titled "Thermoform Circularity" as part of their Good Information series. This comprehensive course delves into thermoforming basics, polymer varieties, recycling methods , and the ongoing journey towards a circular economy in the industry.

-

Amcor Plc boosted its North American thermoforming capacity in January 2024 to serve the expanding healthcare market. This expansion offers greater flexibility for companies partnering with Amcor on development projects.

-

Coveris (UK) made a big impact in the packaging industry in November 2023 with MonoFlex Thermoform. This groundbreaking mono-material thermoforming solution tackles the issue of non-recyclable food packaging. MonoFlex Thermoform not only minimizes carbon footprint but also enhances product quality.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 52.5 Bn |

| Market Size by 2031 | US$ 76.10 Bn |

| CAGR | CAGR of 4.75% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Blister Packaging, Clamshell Packaging, Skin Packaging, Others) • By Material [Plastic (Polyvinyl Chloride, Polyethylene Terephthalate, Polyethylene, Polypropylene, Polystyrene, Others), Aluminum, Paper & Paperboard) • By End-Use Industry (Food & Beverages, Pharmaceuticals, Electronics, Home & Personal Care Goods, Others), By Heat-Seal Coating (Solvent-Based Heat Seal Coating, Water-Based Heat Seal Coating, Hot-Melt-Based Heat Seal Coating) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Crown Holdings, Amcor, Berry Group, DuPont, Genpak, LINPAC, Mondi Group, Sealed Air, Ardagh Group, DS Smith, Bemis, Sonoco Products Company, ProAmpac LLC, Cascades Inc., American Packaging Corporation |

| Key Drivers | • Food companies are increasingly turning to thermoformed packaging solutions due to their advantages. • Sustainability-conscious consumers and cost-driven manufacturers are increasingly demanding lightweight and affordable packaging solutions. |

| Key Restraints | • Limited plastic recycling facilities hinder the thermoform packaging market's sustainability edge. • Unstable raw material costs pose a challenge for the thermoform packaging market. |