Plastic Contract Manufacturing Market Report Scope & Overview

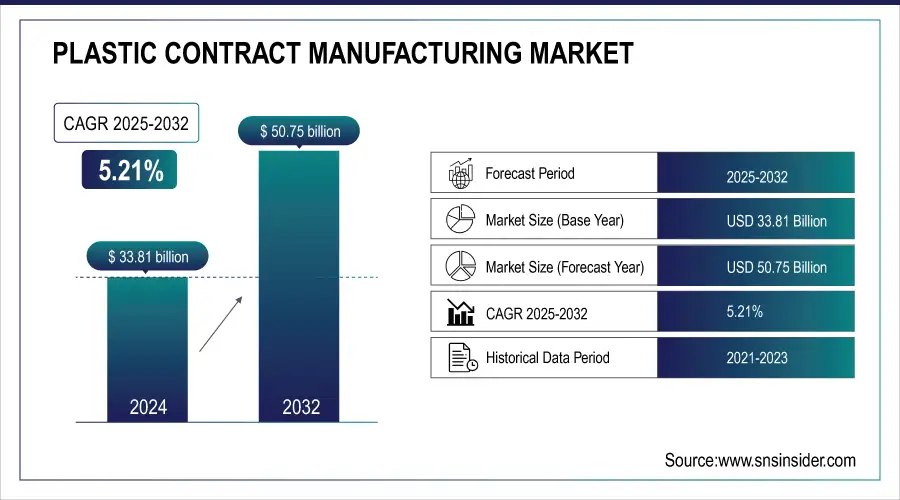

The Plastic Contract Manufacturing Market size was valued at USD 33.81 billion in 2024 and is expected to reach USD 50.75 billion by 2032, growing at a CAGR of 5.21% over the forecast period of 2025-2032.

The growing consumer electronics and IoT industry is one of the major factors driving the growth of the Plastic Contract Manufacturing Market Analysis. With growing numbers of smart devices, wearables, and connected home products, the demand for affordable, scalable precision plastic component manufacturing is greater than ever. With increasing length reduction and faster innovation cycles, OEMs are increasingly relying on contract manufacturers to ensure production simplicity and quality. These collaborations allow a quicker go-to-market approach and design and volume flexibility, in particular within the migraine fast-moving consumer electronics space, which drive the plastic contract manufacturing market growth.

To Get more information on Plastic Contract Manufacturing Market - Request Free Sample Report

According to the US Census Bureau's 2023 Annual Survey of Manufacturers, the value of shipments for electronic instruments and appliances was USD 110.2 billion in 2023, up from USD 102.8 billion in 2021. This surge is representative of increased order quantum, which is driving demand for contract manufacturing in plastic components in the U.S. electronics/IoT industry.

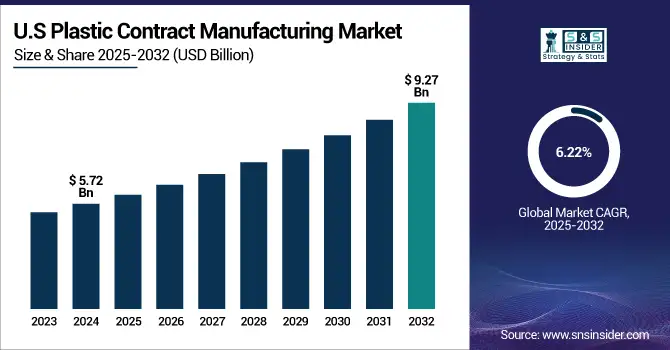

The U.S Plastic Contract Manufacturing market size was USD 5.72 billion in 2024 and is expected to reach USD 9.27 billion by 2032 and grow at a CAGR of 6.22% over the forecast period of 2025-2032. It is due to its innovation-driven economy and high-volume production of medical devices, consumer goods, and automotive components. U.S. firms prioritize precision, regulatory compliance, and sustainability, making contract manufacturing a preferred solution for fast, high-quality production. The growing emphasis on reshoring and local sourcing is also encouraging OEMs to partner with domestic contract manufacturers.

Plastic Contract Manufacturing Market Drivers

-

Expansion of the Medical Devices Sector Propelling Market Growth

Plastic Contract Manufacturing is playing a vital role in meeting the complex needs of the healthcare industry, especially in the production of disposable and precision medical devices. The increased adoption of plastic components due to their lightweight nature, design flexibility, injection molding plastic contract and compliance with hygiene standards is supporting market growth. The rising aging population and chronic illnesses are further increasing the demand for diagnostic devices, surgical instruments, and IV components all areas heavily dependent on outsourced plastic manufacturing.

For instance, in 2023, Medline Industries announced a $500 million expansion of its U.S.-based healthcare manufacturing and distribution operations, which included increased partnerships with contract manufacturers to produce plastic-based medical components more efficiently.

Plastic Contract Manufacturing Market Restrain

-

High Volatility in Raw Material Prices Hampers Consistent Cost Planning, May Hamper the Market Growth

The market relies significantly on petroleum-based resins such as polypropylene, polyethylene, and polystyrene. Any fluctuation in crude oil prices directly impacts the cost of these materials, affecting contract manufacturing agreements and margins. Additionally, supply chain disruptions or geopolitical issues can increase lead times and material costs, particularly when sourcing is global. This creates uncertainty in pricing strategies for manufacturers and may deter OEMs from outsourcing if costs become unmanageable.

Plastic Contract Manufacturing Market Opportunities

-

Increased Adoption of Bioplastics and Sustainable Materials Creates Lucrative Avenues, Create an Opportunity in the Market

The rising focus on sustainability and circular economy practices is encouraging OEMs and brands to opt for eco-friendly and biodegradable plastic components. Contract manufacturers capable of processing bioplastics and advanced polymers are seeing increased partnerships and long-term agreements, especially in the packaging, consumer goods, and medical sectors. Integration of sustainability into production workflows is becoming a major selection criterion for clients which drive the plastic contract manufacturing market trends.

For instance, in 2023, Nature Works (a bioplastics leader) announced a USD 600 million investment in a new polylactic acid (PLA) manufacturing facility in Georgia, USA, to expand partnerships with plastic contract manufacturers to serve the growing demand for compostable packaging and medical plastics.

Plastic Contract Manufacturing Market Segmentation Analysis

By Product Type

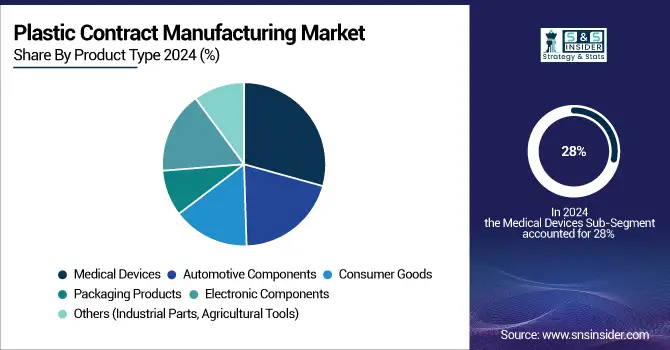

Medical Devices held the largest plastic contract manufacturing market share, around 28% in 2024. It is due to the strict regulatory standards and the critical need for precision-molded parts in the healthcare industry. With growing demand for disposable products like IV sets, catheters, diagnostic devices, and surgical instruments, manufacturers are increasingly outsourcing to specialized contract firms to ensure quality and compliance.

Packaging Products are the fastest-growing sub-segment. The surge in e-commerce, increasing demand for sustainable packaging, and the shift toward lightweight and customized plastic packaging across the food & beverage and personal care sectors are propelling this segment’s rapid expansion.

By Process

Injection Molding is the most dominant process used in plastic contract manufacturing due to its scalability, cost-efficiency, and ability to produce complex geometries with high repeatability. It is heavily utilized across medical devices, automotive components, and electronics, where dimensional accuracy is critical.

Blow Molding is experiencing the fastest growth, particularly in producing bottles, containers, and packaging products. The increasing demand for consumer packaging, combined with innovation in material usage and sustainability (such as PET recycling and bioplastics), is accelerating the adoption of blow molding processes.

By Service Type

Production services hold the largest market share as OEMs across various industries seek to outsource bulk manufacturing to third-party specialists for cost reduction, operational efficiency, and scalability. Contract manufacturers often handle the full-scale production process, including quality control and compliance assurance.

Meanwhile, Prototype Development is the fastest-growing service type. The rise of startups, rapid product iteration cycles, and the need to test and validate designs before full-scale production are fueling demand. In sectors like consumer electronics and medical devices, prototyping enables faster innovation and regulatory approvals.

By End-Use Industry

Healthcare & Medical is the leading end-use industry, accounting for a significant share of the plastic contract manufacturing market. Rising global healthcare expenditure, growing demand for disposable and minimally invasive devices, and stringent quality standards drive outsourcing among medical OEMs.

Consumer Electronics is the fastest-growing end-use segment. The expanding demand for smart devices, wearables, and connected home products necessitates precise, compact plastic components. The industry’s push for lightweight designs and improved durability is creating new opportunities for plastic manufacturing partners.

Plastic Contract Manufacturing Market Regional Outlook

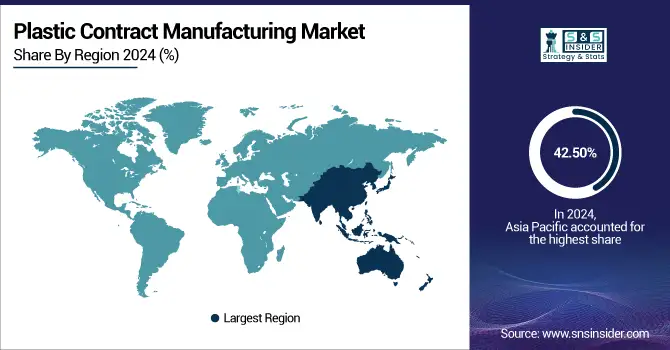

Asia Pacific Plastic Contract Manufacturing market held the largest market share, around 42.50%, in 2024. It is due to its expanding industrial base, low-cost manufacturing, and rising domestic demand from sectors like electronics, automotive, and packaging. Countries like China, India, and Vietnam have become global outsourcing hubs to favorable labor costs, improving infrastructure, and government incentives. Additionally, global OEMs are increasingly shifting operations to Asia to reduce costs and ensure supply chain resilience.

Get Customized Report as per Your Business Requirement - Enquiry Now

In 2024, Flex Ltd., a leading contract manufacturer, announced the expansion of its plastic molding capabilities in Malaysia to support rising demand from regional and international clients in consumer electronics and medical devices.

North America is the fastest-growing market in the plastic contract manufacturing market. It is due to its well-established base of OEMs across healthcare, automotive, aerospace, and electronics sectors. The region has a strong outsourcing culture, with major players relying on contract manufacturers for scalable and precision-molded plastic components. The strict FDA compliance requirements in the medical and pharmaceutical sectors further drive demand for specialized plastic manufacturing services. Additionally, technological advancements and early adoption of automation and robotics have boosted production efficiency.

In 2023, major U.S.-based contract manufacturer Westfall Technik expanded its Nevada facility to support medical device molding, driven by increased demand for diagnostic and surgical equipment.

In late 2023, SteriPack Group opened a new facility in Lakeland, Florida, focusing on Class I and II medical device contract manufacturing, supporting U.S. supply chain localization efforts post-pandemic.

Europe is a key player owing to its stringent regulatory landscape as well as sustainable manufacturing practices as well as demand for in high-technology applications including automotive, healthcare and aerospace. Polymers: Bio-based polymers that leverage an emphasis on eco-friendly and recyclable plastics from the region is driving complexity and demand for contract services. And on top of that, European manufacturers have engineering precision and a good labour force.

In 2023, Röchling Medical opened cleanroom plastic injection molding in its Germany facility to support the increasing demand in the European pharmaceutical and medtech industry.

Plastic Contract Manufacturing Market Company are:

The major Plastic Contract Manufacturings companies are Hexcel Corporation, Toray Industries Inc., Teijin Limited, Mitsubishi Chemical Group, SGL Carbon, Zoltek Corporation, Gurit Holding AG, Park Aerospace Corp., Royal DSM, Solvay S.A., Celanese Corporation, Rhein Composite GmbH, TCR Composites, SHD Composite Materials Ltd., North Thin Ply Technology (NTPT), ATC Manufacturing, Cytec Engineered Materials, Cristex Composite Materials, PRF Composite Materials, and TenCate Advanced Composites.

Recent Development:

-

In May 2023, Westfall Technik acquired MHS (Mold Hotrunner Solutions Inc.) to strengthen its micro-molding and hot-runner engineering offerings for ultra-precise medical device components as micro-pipettes and diagnostic parts.

-

In 2024, Flex announced an expansion of its plastic molding operations in Malaysia to serve growing orders from consumer electronics and medical device customers. The move supports Flex’s strategy to leverage low-cost, high-quality Southeast Asian production centers for global OEM supply chains.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 33.81 Billion |

| Market Size by 2032 | USD 50.75 Billion |

| CAGR | CAGR of 5.21% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type: Medical Devices, Automotive Components, Consumer Goods, Packaging Products, Electronic Components, Others (Industrial Parts, Agricultural Tools) • By Process: Injection Molding, Blow Molding, Thermoforming, Extrusion, Compression Molding, Others (Rotational Molding, Transfer Molding) • By Service Type: Design & Engineering, Prototype Development, Assembly & Testing, Production, Logistics & Distribution • By End-Use Industry: Healthcare & Medical, Automotive, Consumer Electronics, Industrial, Food & Beverage, Aerospace & Defense, Others (Construction, Agriculture) Mining, Food & Beverage, Municipal Utilities, Others (Cosmetics, Electronics Manufacturing, Pulp & Paper) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | GW Plastics, EVCO Plastics, C&J Industries, Rosti Group, Tessy Plastics, Natech Plastics, Mack Molding, Plastic Components, Inc., The Rodon Group, Nypro, Technoplast Industries, Seaway Plastics Engineering, Protolabs, Inzign, MME Group Inc., Eastek International, Comar LLC, AMA Plastics, PTI Engineered Plastics, Plastek Industries. |