ETFE Market Report Scope & Overview:

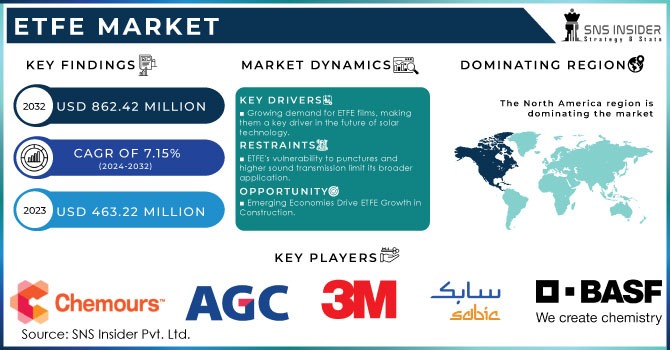

The ETFE Market Size was valued at USD 463.22 million in 2023 and is expected to reach USD 862.42 million by 2032 and grow at a CAGR of 7.15% by 2024-2032.

Get More Information on ETFE Market - Request Sample Report

The Ethylene Tetrafluoroethylene (ETFE) market is experiencing significant growth driven by several key factors. One major contributor is the exceptional performance of ETFE-based coatings. These coatings boast superior durability and weather resistance, lasting up to three times longer than traditional paints.

Their ability to cure at room temperature eliminates the need for high-heat processes, making them ideal for on-site applications and reducing energy consumption. This combination of longevity and ease of use translates to lower maintenance costs and increased efficiency, particularly attractive to the construction and automotive industries. for example "instant glues" achieve a strong bond at room temperature when deprived of oxygen. This makes them ideal for quick repairs, securing tight-fitting parts, and applications where heat exposure is undesirable.

ETFE's versatility fuels its market growth across diverse sectors. In the automotive industry, ETFE finds application in brake systems and sensors due to its ability to withstand harsh conditions. Architects leverage ETFE's unique aesthetic and functionality to create iconic structures like the Beijing National Aquatics Center. Furthermore, the chemical industry and electrical applications benefit from ETFE's radiation resistance, making it a valuable material for wire insulation in demanding environments like aircraft and spacecraft.

ETFE MARKET DYNAMICS

KEY DRIVERS:

-

Growing demand for ETFE films, making them a key driver in the future of solar technology.

The Solar panels are getting a lightweight, heavy glass protected them, but companies are seeking alternatives. ETFE (ethylene tetrafluoroethylene) is a strong contender. This versatile material boasts the chemical and thermal flexibility of fluoropolymers, making it ideal for harsh environments. ETFE films shine as both front and back sheets for solar panels. As a front sheet, it transmits a whopping 90-95% of light, boosting efficiency. As a back sheet, its weather resistance ensures long life, even outdoors. Plus, ETFE's lightweight nature helps reduce the overall weight of solar panels, a major bonus. These films also offer UV protection, flexibility for lighter panels, and even act as a self-cleaning surface thanks to their low friction. With the global push for renewable energy and ambitious goals like Net Zero Emissions by 2050, solar power generation is expected to grow.

RESTRAIN:

-

ETFE's vulnerability to punctures and higher sound transmission limit its broader application.

While ETFE offers exciting possibilities for solar panels, there are some drawbacks to consider. One concern is sound ETFE transmits more noise than glass or other plastics. Imagine all the outside sounds filtering through. Noise and rain suppression systems are being integrated into ETFE structures with success. For rain noise specifically, adding a dampening layer to the ETFE cushions can silence the drumming effect. This adds extra cost to the project. Durability is another area where ETFE requires caution. While strong, a sharp knife can puncture it. This limits its use in windows or low-lying exterior walls. ETFE's vulnerability extends to birds, especially seagulls near shorelines, who can damage the roof with their pecks. So, ETFE might not be ideal for situations where regular maintenance is difficult. These limitations act as a drag on the overall growth of the ETFE market.

OPPORTUNITY:

-

Emerging Economies Drive ETFE Growth in Construction.

The building boom in developing regions like Asia Pacific, the Middle East, and South America is fueling the demand for ETFE tensile structures. These advanced structures offer architects unparalleled design flexibility and can be seamlessly integrated with traditional construction methods. For example, Vector Foiltec's (Germany) design for the FALCON MALL roof in Kunming, China, showcases the versatility of ETFE systems. India, Brazil, China, and countries in the MENA and ASEAN regions are particularly attractive markets for tensile structures. Their cost-effectiveness, aesthetic appeal, and durability are making them a popular choice globally. India, in particular, is embracing ETFE films as a cost-efficient and practical building material, driving growth in the tensile architecture and awning & canopy markets. The growing adoption of PV modules in China, Japan, and India is fueling market growth, further bolstered by government initiatives promoting solar energy in the region.

CHALLENGES:

-

Lack of a readily available skilled workforce in the ETFE market.

Installing these structures in complex construction projects requires extensive training and expertise. Several professionals are crucial throughout the process, from initial design to final construction. This team typically includes contractors, engineers, manufacturers, and installers. ETFE in tensile architecture presents unique design and execution challenges. Similar to any building, the crew needs to meticulously consider every detail, including the structure's purpose, lifespan, environmental factors, and building codes to ensure safety and functionality. This specialized skillset is currently limited, particularly in developing countries, posing a challenge for stakeholders in the ETFE market. Addressing this gap through targeted training programs and fostering collaboration between experienced professionals and new recruits will be essential to fully unlock the potential of ETFE in these regions.

ETFE MARKET SEGMENTS

By Type

The Pellets/Granules segment dominated with a market share of over 67% in 2023. This dominance is largely driven by their extensive application across industries such as construction, automotive, and aerospace. ETFE in the form of pellets or granules is highly sought after due to its exceptional properties, including superior durability, high tensile strength, and excellent resistance to chemicals and extreme weather conditions. In the construction sector, ETFE pellets are widely used in architectural applications, such as roofing and façade systems, owing to their lightweight nature and transparency, which allows for efficient energy utilization.

By Technology

The Extrusion molding segment dominated with the market share over 48% in 2023. This technology is widely preferred due to its efficiency in producing high-quality ETFE films, sheets, and wires, which are extensively used across industries such as construction, automotive, and aerospace. The method’s ability to produce continuous lengths of material with consistent thickness and excellent mechanical properties makes it highly suitable for large-scale applications.

By Application

The Films & Sheets segment dominated with the market share of over 32% in 2023, due to its widespread use in applications such as architectural coverings, greenhouse roofing, and solar panel protection. ETFE films and sheets are preferred for their exceptional durability, UV resistance, and ability to endure extreme weather conditions. Their lightweight nature, coupled with high transparency and corrosion resistance, makes them ideal for use in construction and renewable energy industries.

Get Customized Report as per Your Business Requirement - Request For Customized Report

ETFE MARKET REGIONAL ANALYSIS

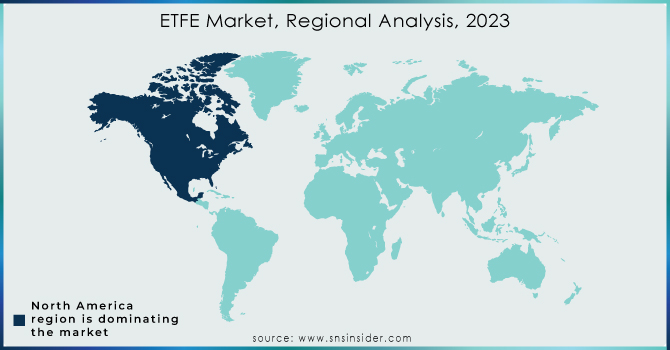

North America segment dominated with a market share of over 38% in 2023, This leadership is driven by strong demand across various industries: construction, automotive, aerospace, electrical, nuclear, and solar energy. The US itself stands out as a regional leader in both ETFE value and volume. Several factors contribute to this dominance: a steady stream of new construction projects leveraging ETFE's architectural appeal, the rise of innovative greenhouses benefiting from its controlled environment properties, and a thriving automotive industry incorporating ETFE components. Furthermore, the burgeoning solar energy sector is a significant driver, with ETFE films demonstrably boosting solar cell efficiency. Solidifying North America's position are major global ETFE manufacturers like AGC Inc. (Japan), The Chemours Company (US), 3M (US), and Daikin Industries, Ltd. (Japan) with established operations in the US, ensuring a readily available supply chain.

Key Players

-

AGC Inc. (Japan) – (ETFE films, ETFE sheets)

-

SABIC (Saudi Arabia) – (High-performance ETFE resins)

-

The Chemours Company (US) – (Tefzel ETFE resins)

-

BASF SE (Germany) – (ETFE coatings, ETFE membranes)

-

3M (US) – (ETFE films for solar panels and architectural applications)

-

Solvay S.A. (Belgium) – (Hyflon ETFE resins and films)

-

Daikin Industries, Ltd. (Japan) – (Neoflon ETFE resins and films)

-

Mitsubishi Chemical Advanced Materials (Switzerland) – (ETFE films for industrial applications)

-

Vector Foiltec (Germany) – (Texlon ETFE architectural membranes)

-

Saint-Gobain S.A. (France) – (ETFE tubing, sheets, and films)

-

HaloPolymer (Russia) – (ETFE resins and coatings)

-

Dongyue Group (China) – (ETFE granules, films, and resins)

-

Guangzhou Li Chang Fluoroplastics Co., Ltd. (China) – (ETFE powders and films)

-

Ensinger Group (Germany) – (ETFE-based semi-finished products)

-

Hubei Everflon Polymer Co., Ltd. (China) – (ETFE resins and coatings)

-

Arkema S.A. (France) – (Kynar ETFE materials)

-

Asahi Glass Co., Ltd. (Japan) – (ETFE membranes for photovoltaic applications)

-

NOWOFOL Kunststoffprodukte GmbH & Co. KG (Germany) – (ETFE films)

-

Honeywell International Inc. (US) – (ETFE laminates for industrial uses)

-

Zhejiang Juhua Co., Ltd. (China) – (ETFE resins and compounds)

Suppliers for (high-quality ETFE resins for industrial applications, including wiring, films, and coatings) of ETFE Market

-

Daikin Industries, Ltd.

-

Chemours Company

-

Asahi Glass Co., Ltd. (AGC)

-

3M Company

-

Arkema Group

-

Solvay S.A.

-

Saint-Gobain S.A.

-

BASF SE

-

Vector Foiltec

-

Nowofol Kunststoffprodukte GmbH & Co. KG

RECENT DEVELOPMENTS

-

In April 2024: Fluon ETFE film, a revolutionary building material by AGC, is shaking up the industry. Lighter and safer than glass, ETFE offers superior energy efficiency, durability, and even cleans itself with rain – making it a perfect choice for modern, sustainable buildings.

-

In January 2024: Saint-Gobain sets its sights on dominating the non-residential flooring market with a double acquisition! The first targets R.SOL, a French resin flooring specialist known for its diverse products and technology. This widens Saint-Gobain's flooring portfolio and strengthens their presence in the construction chemicals sector. Look for the deal to close by mid-2024.

-

In June 2023: Vector Foiltec GmbH, a prominent manufacturer of ETFE films and membranes, revealed plans to expand its production facilities in Germany. The project, set to be completed by late 2024, aims to boost the company’s annual production capacity by 50%.

-

In May 2023: Daikin Industries, Ltd. introduced a newly developed ETFE film with exceptional UV resistance. This innovative film is anticipated to be utilized in various applications, including roofing, greenhouses, and sports stadiums.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 463.22 million |

| Market Size by 2032 | USD 862.42 million |

| CAGR | CAGR of 7.15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Pellet/Granule, Powder) • By Technology (Extrusion Molding, Injection Molding, Others) • By Application (Films & Sheets, Wires & Cables, Tubes, Coatings, Others) • By End-Use Industry (Building & Construction, Automotive, Aerospace & Defense, Nuclear, Solar Energy, Others). |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AGC Inc. (Japan), SABIC (Saudi Arabia), The Chemours Company (US), BASF SE (Germany), 3M (US), Solvay S.A. (Belgium), Daikin Industries, Ltd. (Japan), Mitsubishi Chemical Advanced Materials (Switzerland), Vector Foiltec (Germany), Saint-Gobain S.A. (France), HaloPolymer (Russia), Dongyue Group (China), Guangzhou Li Chang Fluoroplastics Co., Ltd. (China), Ensinger Group (Germany), Hubei Everflon Polymer Co., Ltd. (China), Arkema S.A. (France), Asahi Glass Co., Ltd. (Japan), NOWOFOL Kunststoffprodukte GmbH & Co. KG (Germany), Honeywell International Inc. (US), Zhejiang Juhua Co., Ltd. (China). |

| Key Drivers | • Growing demand for ETFE films, making them a key driver in the future of solar technology. |

| RESTRAINTS | • ETFE's vulnerability to punctures and higher sound transmission limit its broader application. |