Aluminum Nitride Market Analysis And Overview:

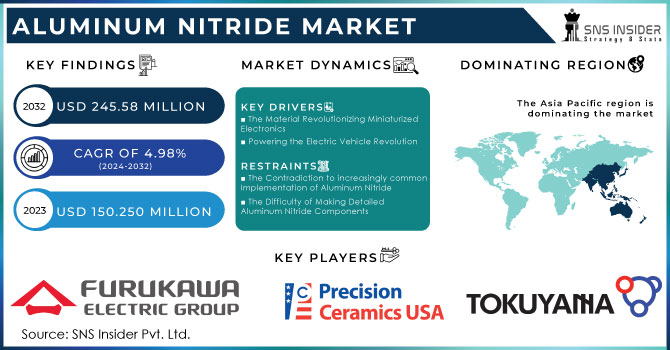

The Aluminum Nitride Market size was valued at USD 154.89 million in 2024 and is expected to reach USD 221.99 million by 2032, growing at a CAGR of 4.61% over the forecast period of 2025-2032.

Get More Information on Aluminium Nitride Market - Request Sample Report

Aluminum nitride market is set to grow as demand for high-performance thermal interface materials in EVs, 5G base stations and power electronics increases. Thin Aluminum Nitride substrates by Aluminum Nitride companies are also driving adoption to achieve higher aluminum nitride market size and efficiency, encouraged by the interest of the U.S. Department of Energy in wide bandgap power electronics. Rising commercialization rate of LED lighting and GaN-based RF devices in the market has propelled trend of aluminum nitride market analysis.

In 2024, Tokuyama Corporation expanded high purity aluminum nitride powder capacity by 40% to solidify aluminum nitride market share, whereas HexaTech won a $10.2million contract from DARPA for developing 100mm substrates to further accelerate aluminum nitride market growth. These partnerships and capacity additions are trends observed in the aluminum nitride industry, encouraged through automotive, electronics sector strategic partnerships. These elements contribute to the favorable outlook in aluminum nitride market analysis, and further reinforce position in the changing competitive marketplace.

Aluminum Nitride Market Dynamics:

Drivers:

-

Expansion of electric vehicle thermal management demands accelerates aluminum nitride market growth

The swift transition towards electric vehicles is driving the aluminum nitride industry on account of the material possessing an extraordinary thermal conductivity and insulating properties. Investment in the development of wide bandgap power electronics has been increasing significantly in recent years, and aluminum nitride substrates are vital for heat dissipation. The aluminum nitride suppliers are ramping up capacities to manufacture high-purity powder for the power modules demand, therefore, influencing the aluminum nitride market size and aluminum nitride market share significantly. Such developments not only enhance the efficiency of their supply chains but also prepare key companies for future growth of the aluminum nitride market. With new generation EV systems requiring reliable heat dissipation, aluminium nitride market trends are expected to witness increased strategic investments, further establishing aluminium nitride market analysis indicating greater acceptance in future automotives.

-

Strategic government research funding supports advanced substrate innovation in aluminum nitride market

Government programs are the major driver for aluminum nitride market as it promotes research and commercial production. Public funding supports companies to invest in additional substrate production technologies such as bigger wafer formats and higher-purity levels. These are projects that drive innovation, bolster supply chain and aid companies in growing market share in aluminum nitride. Recent defense and electronics-related wins reinforce the increasingly vital role aluminum nitride plays in both infrastructure security and secure communications. Such partnerships enhance trends in aluminum nitride market which are focused around the upcoming performance and reliability parameters. Finally, public supported research helps to create a more resilient and competitive aluminium nitride market, leading to a continuous aluminium nitride market size growth through technology leadership.

Restraints:

-

Limited global supply of high-purity raw materials constrains aluminum nitride market share

High-purity aluminas and nitrides are also important for aluminurn nitride powders and substrate components which require a high purity in production. These materials are supplied globally out of a handful of specialty producers and demand spikes can result in bottlenecks. Even small hiccups in mining, refining and logistics can slow deliveries and handcuff the capacity of aluminum nitride companies to increase production rapidly. Such supply challenge is transpiring as a key trend in the aluminum nitride market, especially in booming applications, including power electronics, and telecommunications, in turn impacting the growth of aluminum nitride market. In addition, reliance on specialized raw materials introduces some price volatility to the mix, making long-term aluminum nitride market analysis predictions somewhat unreliable.

Aluminum Nitride Market Segmentation Analysis:

By Grade

Technical grade dominated the aluminum nitride market in 2024 with a market share of 66.20% as it is a key material in high-performance power electronics and microelectronics substrates. Supported by Tokuyama Corporation increasing the high purity powder production capacity by 40% in 2024 and the US Department of Energy laying emphasis on wide bandgap semiconductors, this segment is the largest aluminum nitride market share holder. Aluminum nitride companies prefer technical grade materils for consistent thermal management in EVs, LEDs & 5G to propel the growth of the aluminum nitride market.

Analytical grade is the fastest growing in the aluminum nitride market with a CAGR of 4.69% driven by increasing demand for semiconductor testing and precision electronics. Initiatives taken by the government to promote the research and growing stringency in the purity standard for chip fabrication is anticipated to propel the use in the analytical grade, in turn extends aluminum nitride market share. Aluminum nitride manufacturers are focusing on cutting-edge refining techniques to address the ultra-high purity demands from science and metrology applications, propelling aluminum nitride market share in specialty electronic devices.

By Method

Carbothermal reduction method dominated the aluminum nitride market in 2024 with a market share of 55.30% on account of its scalability and low cost. Leading aluminum nitride suppliers such as Tokuyama Corporation employ this method to produce high-purity powders which are required for EVs and power electronics. The approach is consistent with U.S. Department of Energy (DOE)-CAN supported approach for thermal management materials availability. Its well established efficiency and production quantities make it a pivotal element in the growth of the aluminum nitride market and aluminum nitride market share.

Direct nitridation method is the fastest growing in the aluminum nitride market with a CAGR of 4.84% owing to the increasing demand for fine-grain, high-quality substrates. Defense contracts for the government, such as DARPA funding HexaTech's advanced substrate projects, tend to drive process innovation. More and more companies are using this approach to achieve high standards of performance power electronics and 5G-component, to promote market trends for aluminum nitride and promote the expansion of future markets for aluminum nitride market size, through more stable products and lower defect rates.

By Form

Powder dominated the aluminum nitride market in 2024 with a market share of 68.70% as it plays a vital role in ceramics and thermal interface materials. Tokuyama Corporation’s 40% output expansion in 2024 will meet rising demand from EVs and telecom infrastructure. The powder is still a primary source for producing substrates and composite materials, which is a major factor that drives aluminum nitride market growth. The cold-spray powder’s scalable and flexible nature make it a natural fit for advanced electronics and automotive thermal management volumes for aluminum nitride companies.

Sheet is the fastest growing in the aluminum nitride market with a CAGR of 4.90% due to growing demand in electric vehicles and high-frequency electronics. Rubber Substrate innovation and miniaturization drive requirements for thin sheets of high precision. Aluminum nitride manufacturers focus on introducing new-generation sheet technology to enhance improved thermal performance and a decrease in weight are surging the growth of the aluminum nitride market. Such enhancements benefit the analysis of a market for aluminum nitride, supporting its strategic applicability for future power modules and 5G infrastructure.

By Application

Microelectronics dominated the aluminum nitride market in 2024 with a market share of 48.30% owing to its significance in heat dissipation for smaller devices. Aluminum Nitride (AlN) companies The U.S. Department of Energy has invested in wide bandgap semiconductors and the aluminum nitride provider is providing the substrates needed to support device performance. The demand is across LEDs, RF amplifiers, and small semiconductor packages, thereby guaranteeing continued growth of the aluminum nitride market. Such applications form the core of the aluminum nitride market as they help alleviate thermal stress in high-density electronic circuits.

Power electronics is the fastest growing in the aluminum nitride market with a CAGR of 5.32% due to increasing electric vehicle and renewable energy systems. Efforts from the government and hefty private investment are creating demand for effective thermal substrates for power conversion modules. The demand for the technology require the development of aluminum nitride companies producing custom products or devices, aluminum nitride market’s trend. These trends will bolster the aluminium nitride market analysis and are crucial in new age energy and mobility solutions.

Aluminum Nitride Market Regional Outlook

Asia Pacific dominates the aluminum nitride market in 2024 with a commanding 52.80% market share, due to swift industrialization and growing electronics manufacturing in China, Japan, and South Korea. China’s aggressive move into 5G infrastructure and electric vehicles is further increasing the demand for aluminum nitride substrates, helped by government policies that prioritize semiconductor self-sufficiency. The prominent manufacturers of aluminum nitride are extending their production capacities in the region, thereby contributing to the large size of the aluminum nitride market. This prominence is indicative of the pivotal position of Asia Pacific in world supply chains and transforming trends in aluminum nitride market.

The North America region is the fastest-growing in the aluminum nitride market, with the highest CAGR of 5.09% in the forecast period of 2025 to 2032. The expansion is being driven by its commitment to advanced electronics, renewable energy, and automotive innovations. Funders. The development of materials for lightweight power electronics is similar to the development for light-emitting diodes, with funding programs from regional government initiatives (U.S. DOE, energy efficient power electronics), and Canada's Natural Sciences and Engineering Research Council of Canada on advanced materials research. Further, North American aluminum nitride companies are increasing production capacities to cater to increasing demand for electric vehicles and 5G infrastructure, supporting aluminum nitride market growth outlook across the region.

The U.S. dominates the North American aluminum nitride market with a market size of USD 26.87 million in 2024 and is projected to reach a value of USD 39.85 million by 2032. This domination is attributed to increasing government efforts with extensive collaboration with industry players to encourage adoption of wide bandgap semiconductors and thermal materials. DOE Founded Power Electronics with centered strategy on Aluminum Nitride substrate acceleration introduced to automotive and renewable end markets Official DOE Reports and Tokuyama Corporation’s 2024 Production Expansion Statements In addition to DARPA’s advanced substrate development funding, public-private partnerships build U.S. market share and support innovation and supply chain security within aluminum nitride markets.

Key Players:

The major aluminum nitride market competitors include Tokuyama Corporation, KYOCERA Corporation, Morgan Advanced Materials plc, CeramTec Group, MARUWA Co., Ltd., FURUKAWA CO., LTD., TOSHIBA MATERIALS CO., LTD., CoorsTek Inc., Surmet Corporation, Thrutek Applied Materials Co., Ltd., TOYO ALUMINIUM K.K., Nippon Light Metal Co., Ltd., Merck KGaA, H.C. Starck GmbH, American Elements, Accumet Materials Co., Precision Ceramics USA, Adtech Ceramics Company, Ferro Ceramic-Grinding, and Höganäs AB.

Recent Developments:

-

In July 2025, HexaTech launched an optimized nitrogen-face aluminum nitride substrate, improving thermal conductivity and reliability for power electronics, strengthening its role in electric vehicles and 5G infrastructure markets.

-

In November 2024, Nitride Global Inc. unveiled advanced aluminum oxynitride coatings at PSE 24, boosting durability and thermal management in electronics, reinforcing its technological leadership in high-performance ceramic solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 154.89 million |

| Market Size by 2032 | USD 221.99 million |

| CAGR | CAGR of 4.61% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (Technical Grade, Analytical Grade) •By Method (Carbothermal Reduction Method, Direct Nitridation Method, Nitridation Method) •By Form (Powder, Granules, Sheet) •By Application (Micro Electronics, Naval Radio, Power Electronics, Aeronautical System, Automotive, Emission Control, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Tokuyama Corporation, KYOCERA Corporation, Morgan Advanced Materials plc, CeramTec Group, MARUWA Co., Ltd., FURUKAWA CO., LTD., TOSHIBA MATERIALS CO., LTD., CoorsTek Inc., Surmet Corporation, Thrutek Applied Materials Co., Ltd., TOYO ALUMINIUM K.K., Nippon Light Metal Co., Ltd., Merck KGaA, H.C. Starck GmbH, American Elements, Accumet Materials Co., Precision Ceramics USA, Adtech Ceramics Company, Ferro Ceramic-Grinding, and Höganäs AB |