Plate and Tube Heat Exchanger Market Report Scope & Overview:

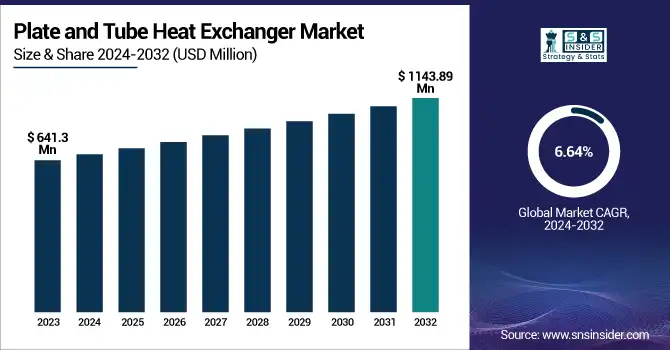

The Plate and Tube Heat Exchanger Market Size was estimated at USD 641.3 Million in 2023 and is expected to arrive at USD 1143.89 Million by 2032 with a growing CAGR of 6.64% over the forecast period 2024-2032. This report offers a unique perspective on the Plate and Tube Heat Exchanger Market by analyzing regional production volumes and capacity utilization rates, highlighting efficiency trends across key manufacturing hubs. It provides insights into operational efficiency and downtime metrics, revealing how automation and predictive maintenance are optimizing performance. The study tracks technological advancements, including next-gen heat transfer materials and compact designs, shaping global adoption trends. Additionally, export/import data uncovers shifting trade patterns and emerging supply chain dynamics. A special focus on sustainability metrics, such as carbon footprint reduction and energy-efficient exchanger designs, adds a cutting-edge dimension to the analysis.

To Get more information on Plate and Tube Heat Exchanger Market - Request Free Sample Report

Plate and Tube Heat Exchanger Market Dynamics

Drivers

-

Rising Demand for Energy-Efficient Heat Exchangers in HVAC and Industrial Sectors Driving Market Growth

The Plate and Tube Heat Exchanger Market is witnessing significant growth due to the rising demand from the HVAC and industrial sectors. Heat exchangers are a critical component in these systems, and can help improve energy efficiency for heating and cooling indoor spaces. Residential, commercial, and industrial buildings are increasingly adopting energy-efficient heating and cooling, and this is expected to boost the demand for next-generation heat exchanger technologies. Moreover, chemical processing, power generation, and food & beverage industries are significantly utilizing heat exchangers to aid in thermal management, increase operational efficiency, and adhere to strict environmental regulations. Major trends in the market include increasing demand for compact, high-performance, and corrosion-resistant heat exchangers, to maximize heat transfer efficiency and minimize the maintenance cost. Moreover, the rise of IoT and automation technologies is allowing for real-time monitoring and predictive maintenance, resulting in systems that last longer and run better. Industrialization is flourishing in emerging economies, especially in Asia-Pacific and Latin America, increasing the production capacities of industries, which is projected to create more demand for heat exchangers. Since there is increasing concern for the environment and increasing energy efficiency policies, it is anticipated the adoption of sustainable and eco-friendly cooling solutions will drive market growth in upcoming years.

Restraint

-

High initial investment and maintenance costs limit the adoption of plate and tube heat exchangers. Material expenses, complex fabrication, and ongoing upkeep pose financial burdens for industries.

The high initial investment and maintenance costs associated with plate and tube heat exchangers can significantly limit market penetration, especially for small and medium-sized enterprises. These systems need to be made from high quality materials like stainless steel, titanium, or copper to ensure durability and corrosion resistance, which increases production costs. Furthermore, both precision engineering and advanced fabrication techniques are used to manufacture these components, raising costs even further. Apart from the initial costs, the maintenance can prove to be a considerable financial liability. Due to their operation at high temperatures and pressures, heat exchangers can suffer from the effects of fouling, scaling, and corrosion over time. Efficiency is maintained and costly downtimes avoided when regular cleaning, inspections, and replacement of parts are done. In sectors including power generation, oil & gas, and chemical processing, any interruption due to heat exchanger failure can lead to significant financial losses. Additionally, their installation, maintenance, and repair often necessitate specialized knowledge, which produces further operational costs. Companies on a budget sometimes refrain from spending on a premium heat exchanger and use a non-optimal device. Even as the technology and advances in design and materials are proving to lead to longer lifespans and lower maintenance frequency, the total cost of ownership (TCO) for new systems has remained a barrier to widespread adoption, especially in emerging markets and cost-conscious verticals.

Opportunities

-

The growing adoption of renewable energy systems, such as solar, geothermal, and waste heat recovery, is driving demand for efficient heat exchangers to optimize energy transfer and sustainability.

The growing demand for renewable energy applications is driving the adoption of plate and tube heat exchangers, as they play a crucial role in enhancing energy efficiency and heat transfer processes. In the context of solar power plants, heat exchangers play a crucial role in optimizing thermal energy storage and distribution, enhancing the overall performance of the system. Geothermal energy systems use heat exchangers to transfer heat from underground sources to power generation units or other heating applications. Heat exchangers can also be used in waste heat recovery systems, where excess heat generated by industrial processes is captured and repurposed for energy savings and operational cost reduction. As the world gradually moves towards a sustainable mode of living and practicing carbon footprint reducing activities, both governments and industries are investing in the development and enhancement of renewable energy projects resulting in the augmentation of demand for efficient heat-exchanger technology. Novel heat exchanger materials and designs make systems more efficient and longer lasting, as well as enabling new applications in clean energy, which merit further research, as the technology is well-poised to provide as the world transitions toward a greener future.

Challenges

-

Meeting diverse international standards and regulatory requirements increases compliance costs, complicates manufacturing, and delays market entry.

Regulatory Compliance and Standardization Issues Hinder Growth of Plate & Tube Heat Exchanger Market Since the industry standards differ in multiple regions, like ASME (American Society of Mechanical Engineers), TEMA (Tubular Exchanger Manufacturers Association), ISO (International Organization for Standardization), it becomes daunting for manufacturers to comply with all the regulatory needs. Environmental and safety regulations that require compliance with emissions control and energy efficiency standards add another layer of complexity to designing and producing a product. The need for regular updates to manufacturing processes due to evolving industry standards, further strains the operations cost. For instance, businesses working with a few regulations must spend huge amounts on certification processes, expensive testing, and documentation, making product cycles longer. Non-compliance with strict regulations could lead to legal fines, product recalls, or market entry barriers. Consequently, manufacturers need to spend considerable time and resources to fulfill these regulatory frameworks, and thus, standardization becomes essential yet complex when it comes to market penetration and competitiveness.

Plate and Tube Heat Exchanger Market Segmentation Analysis

By Material Type

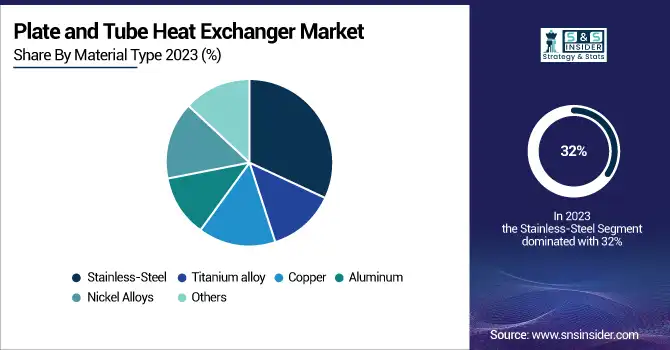

The stainless-steel segment dominated with a market share of over 32% in 2023, due to its exceptional durability, high corrosion resistance, and ability to withstand extreme temperatures and pressures. Because it is non-reactive, it is well suited for chemical processing, food & beverage, pharmaceuticals, and power generation processes that emphasize purity and contamination prevention. Moreover, with good thermal conductivity, stainless steel allows for fast heat transfer, creating cheap maintenance. I also have my doubts about its global availability and low cost compared with exotic metals. Furthermore, increasing environmental regulations of stainless-steel recyclability, and long lifespan, drives its growing preference over other heat exchanger materials across various sectors.

By End-use industry

The chemicals segment dominated with a market share of over 34% in 2023, due to its extensive use in critical processes like cooling, heating, condensation, and energy recovery. These heat exchangers enable stable temperatures in reactions, increase process efficiency, and enhance operational safety. With the industry generally using more energy than it needs to, companies are looking for more sophisticated heat exchange solutions to maximize thermal management and save on energy bills. Moreover, strict environmental regulations force chemical producers to implement energy-saving and environmentally friendly technologies to reduce emissions and waste heat. Rising complexity of chemical processes, requiring corrosion-resistant and durable heat exchangers, also boosts demand significantly. As a result, chemicals are the single largest user of plate and tube heat exchangers worldwide.

Plate and Tube Heat Exchanger Market Regional Outlook

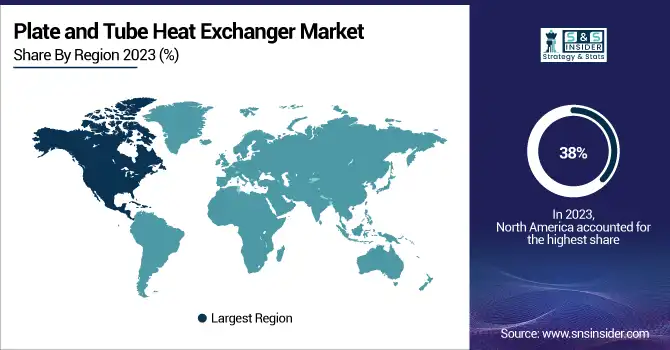

North America region dominated with a market share of over 38% in 2023, due to its well-established industrial infrastructure and strong presence of key market players. Other than that, the region has strict energy efficiency legislation, such as the U.S. Department of Energy (DOE) and the Environmental Protection Agency (EPA), which helps to increase the demand for heat exchanger technologies. In addition, industries such as HVAC, power generation, chemical processing, and oil & gas are also dependent on their efficient heat exchangers for operational optimization and regulatory compliance. The increasing emphasis on lowering the carbon emission levels and energy conservation also fuels the market growth. The major driving factor for North America is advanced technology along with rapid investments in such industrial automation and smart heat exchanger systems in North American regions.

Asia-Pacific is the fastest-growing region in the Plate and Tube Heat Exchanger Market due to rapid industrialization and expanding manufacturing activities across countries like China, India, and Japan. Population growth and urbanization have raised energy demand across the Middle East, resulting in the uptake of energy-efficient technologies in industries like power generation, chemical processing, and HVAC. Government policies promoting sustainability and emission reduction further drive market growth, leading industries to invest in advanced heat exchanger systems. Moreover, the demand is being boosted by infrastructure development and the growth of industries such as food & beverage, pharmaceuticals, and the oil & gas sectors. The Asia-Pacific region is a major growth opportunity for heat exchanger manufacturers, owing to steady technological advancements and inflow of foreign investments.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

-

Alfa Laval (Plate Heat Exchangers, Gasketed Plate Heat Exchangers, Shell & Tube Heat Exchangers)

-

Kelvion Holding GmbH (Brazed Plate Heat Exchangers, Welded Plate Heat Exchangers, Air-cooled Heat Exchangers)

-

API Heat Transfer (Plate & Frame Heat Exchangers, Shell & Tube Heat Exchangers, Air-cooled Heat Exchangers)

-

HRS Heat Exchangers (Corrugated Tube Heat Exchangers, Gasketed Plate Heat Exchangers, Spiral Heat Exchangers)

-

SPX Flow (Plate Heat Exchangers, Air-cooled Heat Exchangers, Shell & Tube Heat Exchangers)

-

Danfoss (Micro Plate Heat Exchangers, Brazed Plate Heat Exchangers, Gasketed Plate Heat Exchangers)

-

HFM Plate Heat Exchanger (Gasketed Plate Heat Exchangers, Brazed Plate Heat Exchangers, Welded Plate Heat Exchangers)

-

Xylem (Brazed Plate Heat Exchangers, Shell & Tube Heat Exchangers, HVAC Heat Exchangers)

-

Wabtec Corporation (Shell & Tube Heat Exchangers, Brazed Plate Heat Exchangers, Air-cooled Heat Exchangers)

-

Thermex (Shell & Tube Heat Exchangers, Plate Heat Exchangers, Marine Heat Exchangers)

-

SWEP International AB (Brazed Plate Heat Exchangers, Gasketed Plate Heat Exchangers)

-

Hisaka Works, Ltd. (Plate & Frame Heat Exchangers, Shell & Tube Heat Exchangers)

-

Tranter, Inc. (Gasketed Plate Heat Exchangers, Welded Plate Heat Exchangers)

-

Güntner GmbH & Co. KG (Air-cooled Heat Exchangers, Brazed Plate Heat Exchangers)

-

Kaori Heat Treatment Co., Ltd. (Brazed Plate Heat Exchangers, Compact Heat Exchangers)

-

Barriquand Technologies Thermiques (Shell & Tube Heat Exchangers, Plate Heat Exchangers)

-

FUNKE Wärmeaustauscher Apparatebau GmbH (Gasketed Plate Heat Exchangers, Shell & Tube Heat Exchangers)

-

Mueller Heat Exchangers (Plate Heat Exchangers, Shell & Tube Heat Exchangers)

-

Secespol Sp. z o.o. (Brazed Plate Heat Exchangers, Shell & Tube Heat Exchangers)

-

Sondex A/S (Danfoss Group) (Gasketed Plate Heat Exchangers, Brazed Plate Heat Exchangers)

Suppliers for the Plate and Tube Heat Exchanger Market

-

Thermax Limited

-

Alfa Laval

-

GEA Group

-

HRS Process Systems Ltd.

-

Kirloskar Brothers Limited

-

Danfoss

-

SWEP

-

Tranter Inc.

-

Sondex

-

Precision Equipment

Recent Development

In September 2023: Kelvion Holding GmbH expanded its production capacity at its Sarstedt facility to meet rising demand across multiple end-use industries. With this enhancement, the plant can now produce an additional 150,000 heat exchangers per year.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 641.30 Million |

| Market Size by 2032 | USD 1143.89 Million |

| CAGR | CAGR of 6.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Material Type (Stainless Steel, Titanium Alloy, Copper, Aluminum, Nickel Alloys, Others) •By End-use Industry (Chemicals, Petrochemicals & Oil & Gas, HVAC & Refrigeration, Food & Beverage, Power Generation, Pulp & Paper) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alfa Laval, Kelvion Holding GmbH, API Heat Transfer, HRS Heat Exchangers, SPX Flow, Danfoss, HFM Plate Heat Exchanger, Xylem, Wabtec Corporation, Thermex, SWEP International AB, Hisaka Works Ltd., Tranter Inc., Güntner GmbH & Co. KG, Kaori Heat Treatment Co. Ltd., Barriquand Technologies Thermiques, FUNKE Wärmeaustauscher Apparatebau GmbH, Mueller Heat Exchangers, Secespol Sp. z o.o., Sondex A/S (Danfoss Group). |