Plastic Welding Equipment Market Report Scope & Overview:

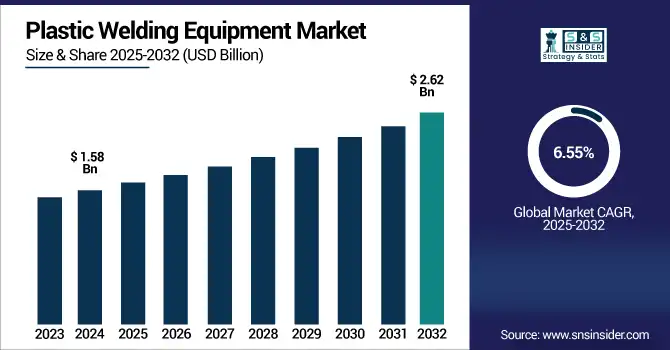

The Plastic Welding Equipment Market size was valued at USD 1.58 billion in 2024 and is expected to reach USD 2.62 billion by 2032, growing at a CAGR of 6.55% over the forecast period of 2025-2032.

To Get more information on Plastic Welding Equipment Market- Request Free Sample Report

The plastic welding equipment market is witnessing robust growth due to increasing demand for strong, reliable, and lightweight plastic components across diverse industries such as automotive, electronics, medical devices, packaging, and consumer goods. There are some varieties of plastic welding machines, like ultrasonic, laser, hot plate, and vibration welding, but they may provide advantages that are specific to the material and application. The laser plastic welding equipment industry is rapidly growing due to high-precision, clean, and contactless welds offered by laser welding equipment, which are specifically applicable for sensitive and complex assemblies.

Key plastic welding equipment market trends include the growing adoption of automated and semi-automated systems, integration of smart sensors for real-time quality control, and increased focus on energy-efficient and sustainable technologies. Such innovations are helping reduce downtimes, increase production consistency, and promote flexible manufacturing. Furthermore, this is enabling the transformation of existing and legacy plastic welding processes to smart systems through the integration of Industry 4.0 technologies, allowing for improved monitoring and process optimization.

Overall, the global plastic welding equipment market is positioned for significant expansion, fueled by technological advancements and rising industrial applications. The industry is undeniably keeping pace with innovation and automation to continue supporting productivity, quality standards, and cost efficiencies over the long term, which is anticipated to be a key factor supporting plastic welding equipment market growth through the coming years.

In January 2025, Laser Photonics Corporation and its subsidiary Control Micro Systems expanded R&D on their Clear-on-Clear Laser Plastic Welding technology. This innovation enables precise welding of transparent plastics without adhesives or fasteners, ideal for medical and high-precision applications. The system uses off-axis machine vision for accurate weld placement and can integrate into SMT production lines. The move supports LPC’s diversification into advanced manufacturing markets.

Plastic Welding Equipment Market Dynamics:

Drivers

-

Surging Automotive and Electronics Demand Sparks Rapid Adoption of Plastic Welding Equipment Technologies

The plastic welding equipment market is significantly driven by the growing demand from the automotive and electronics industries. Plastic welding is applied in automotive manufacturing to meet the need for lightweight and fuel-efficient vehicles by replacing metal components with high-performance plastic parts. The global stock of electric cars exceeded more than 45 million when set in 2023, according to the International Energy Agency (IEA), driving increasingly robust, accurate organization of plastic to provide a safe strain on the outside and inside of EV battery casings. The same trend toward miniaturization and smart devices is leading to greater utilization of micro-welding techniques in electronics. According to IPC (Association Connecting Electronics Industries), worldwide electronics production increased by more than 7% in 2023, primarily driven by Asia-Pacific manufacturers. The aforementioned growth also helps increase the adoption of advanced plastic welding technologies in both.

Restraint

-

High investment cost hinders plastic welding equipment adoption among SMEs

High initial investment cost is one of the major factors restraining the growth of the plastic welding equipment market. These barriers are in front of advanced systems such as ultrasonic and laser welding machines, which require a large up-front investment in purchasing, setting up, and training operators. Such cost can be expensive for a small and medium-sized enterprise (SME), more so if it is operating on a tight budget or lacks access to financing. However, the high operating costs associated with these will also require skilled technicians to operate and maintain these systems. In comparison, plastic welding has a strong demand in the automotive and electronics sectors. As an example, electric car sales reported by the International Energy Agency (IEA) grew to greater than 14 million in 2023, driving demand for lightweight plastic elements.

Plastic Welding Equipment Market Segmentation Outlook:

By Technology

The ultrasonic welding segment dominated the market and accounted for 32% of the plastic welding equipment market share, due to its versatility, speed, and cost-effectiveness. It activates plastic parts quickly and cleanly using high-frequency vibrations applied under pressure, eliminating the need for adhesives or fasteners. Its use across automotive, medical, and consumer electronic sectors stems from the fact that it provides robust welds, with low distortion as it operates without the application of high-pressure and throughout running, as well. Additionally, ultrasonic systems are high-throughput and suited for large-scale production.

Laser welding is the fastest-growing technology in the plastic welding equipment market due to its ability to produce clean, precise, and high-strength welds with minimal heat-affected zones. This process is especially ideal for small, complex components and applications that demand high-end aesthetic appearances, such as electronics, medical, and automotive industries. Laser welding is a non-contact process that can perform high-speed operation, which is a required feature in an automated, accurate manufacturing line. Furthermore, its compatibility with transparent and colored plastics widens its applicability. Laser welding is a high-technology solution, as industries strive for miniaturization and complex assemblies.

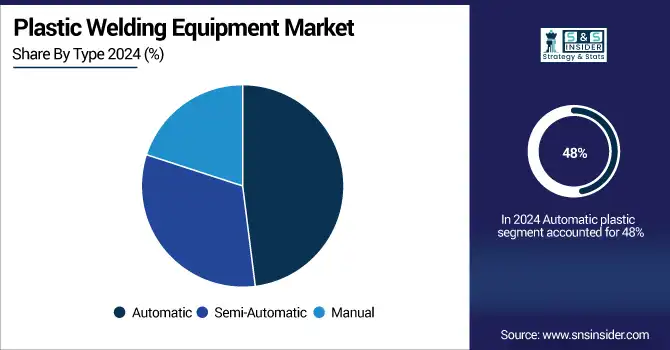

By Type

Automatic plastic welding systems hold the largest market share, accounting for 48% in 2024, owing to their unmatched efficiency and precision. The automotive, electronics, and other industries that experience high-volume production rely on these systems to deliver consistent weld quality while maintaining a high cycle time. Automatic welders are critical in standardized, large-scale production lines as they make the welding tasks less dependent on human work, reduce human error, and ensure repeatability. And they are in perfect harmony with smart factory and ever-so-timely Industry 4.0 trends by implementing robotics, real-time monitoring, data analytics, etc.

Semi-automatic plastic welding machines are the fastest-growing type due to their cost-efficiency and flexibility, particularly for small and medium enterprises (SMEs). They are a compromise between manual and fully automatic, with both flexibility and efficiency. With the requirement of lesser capital investment than fully automatic machines, they are appealing to companies whose budget is limited or production volume is low to medium. They are utilized for various applications and industries such as packaging, electronics, and general manufacturing. But as most manufacturers wish to modernize operations incrementally, leaving full automation aside, the demand for semi-automatic equipment is quickly increasing.

By Application

The automotive sector leads the application segment of the plastic welding equipment market with a 35% share in 2024. This supremacy comes because of the increasing utilization of plastic parts in the automotive industry, as it reduces the weight of vehicles and enhances fuel efficiency without compromising on strength. It is important for the bumper, tank, interior panel, and lighting systems assembly. The sector calls for welding solutions that are high in precision and durability to enable automated and high-speed production lines via technology solutions such as ultrasonic and vibration welding. Additionally, the drive towards electric vehicles (EVs) has created a greater demand for the complex plastic parts and battery enclosures it provides. The strong automotive safety and quality standards ensure that automotive manufacturing will continue to dominate the plastic welding market.

The electronics and electrical segment is the fastest-growing application in the plastic welding equipment market, due to the growing global demand for consumer electronics, EV batteries, sensors, and wearable devices. These products typically consist of delicate, small, and complex assemblies and require precision welding. Technologies such as laser and ultrasonic welding are non-contact, clean, and accurate joining methods that are well-suited for sensitive electronic components in the new generation of plastic wallet batteries. Likewise, as miniaturization is a focus for design, manufacturers will also avoid bonding methods in favor of more reliable welding, since there is less thermal impact with welding.

Plastic Welding Equipment Market Regional Analysis:

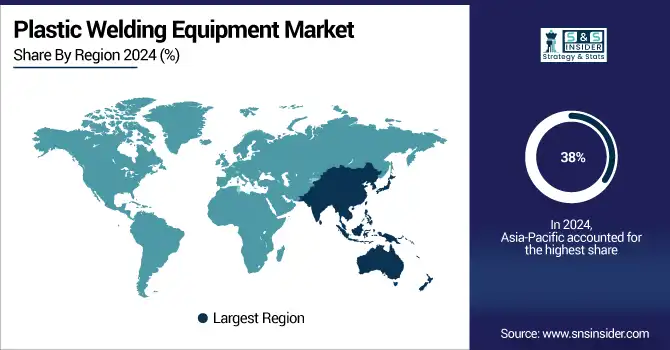

Asia-Pacific leads the plastic welding equipment market, accounting for 38% of global revenue in 2024. The dominance is attributed to high-scale production activity from the automotive, electronics, and packaging industries across China, India, Japan, and South Korea. Demand for plastic welding technologies is expected to rise due to factors such as the availability of cheap labor, immense industrialization, and support from the government with respect to industrial automation. Furthermore, the perk of strong investments in infrastructure and consumer goods production continues to drive the demand for equipment adoption. Key companies have increased the spectrum of presence in the region to harness its potential as a manufacturing region, boosting the leading market position of Asia-Pacific.

China dominates the Asia-Pacific plastic welding equipment market owing to its enormous manufacturing sector, high demand from the automotive and electronics industries, and government support for industrial automation. Add lower-cost labour, large-scale, local, and international manufacturers, and you have a country firmly established as the go-to leader in the region.

North America is the fastest-growing region in the plastic welding equipment market, driven by technological innovation and increasing automation across key industries such as automotive, aerospace, medical devices, and consumer electronics. Advanced welding technologies such as laser and ultrasonic systems are gaining traction for their precise and efficient features, making them ideal for high-performance applications. In addition, the market is growing at a rapid pace due to the presence of key manufacturers as well as continuous investments in Industry 4.0 capabilities. The push for environment-friendly and efficient production across the region, due to regulatory standards in place, is also aiding the region’s growing market for high-end plastic welding equipment.

The U.S. plastic welding equipment market is projected to grow from USD 0.26 billion in 2024 to USD 0.45 billion by 2032, registering a CAGR of 6.98%. Growth is driven by increasing demand from the automotive, packaging, and electronics sectors, along with rising adoption of advanced welding technologies like ultrasonic and laser welding.

Europe holds a significant share of the global plastic welding equipment market, supported by its strong automotive and electronics manufacturing base. Countries like Germany, France, and Italy are countries with a great number of renowned OEMs and automation solution providers who embed plastic welding processes into next-generation production lines. The drive for energy efficiency, sustainability, and quality standards in the European Union pushes the expansion of accurate, non-toxic, and recyclable joining technologies like infrared and hot plate welding. Increased R&D activities and the transition towards light-weight and electric vehicle production in the region further provide a more sustainable market for the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Plastic Welding Equipment Market are:

Plastic welding equipment companies are GEA Group AG, Case IH, Afimilk Ltd, Pearson International LLC, AGCO, Lely Holding S.A.R.L., FarmTek, Real Tuff Livestock Equipment, Murray Farm Care Ltd., Bob-White Systems

Recent Development:

-

In May 2025: Afimilk launched Synergy, a robotic milking system designed for mid-sized dairies. The under-belly robot operates on rails beneath cows in existing parlors, reducing labor needs by up to 75%. It integrates with Afimilk’s monitoring tools for enhanced herd management. Early installations began in Israel, the Czech Republic, and Italy.

-

In May 2025, GEA announced its debut in Farming Simulator 25 with the release of the Plains & Prairies Pack, featuring the GEA STR 447 slurry tanker. This marks GEA’s first entry into the virtual farming world, offering players realistic manure management equipment. The pack includes over 20 new machines and introduces GEA alongside brands like Ford and Trout River.

-

In October 2024, Case IH introduced the 2025 Farmall C tractors with a modern design, improved hydraulics, and enhanced comfort features like cab suspension and LED lighting. The models include a 24-speed transmission, ActiveClutch, and precision farming tools such as telematics and auto-guidance.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.58 Billion |

| Market Size by 2032 | USD 2.62 Billion |

| CAGR | CAGR of 6.55% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Ultrasonic Welding, Vibration Welding, Laser Welding, Infrared Welding, Spin Welding, Hot Plate Welding, Others) • By Type (Automatic, Semi-automatic, Manual) • By Application (Automotive, Electronics & Electrical, Packaging, Medical, Consumer Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | GEA Group AG, Case IH, Afimilk Ltd, Pearson International LLC, AGCO, Lely Holding S.A.R.L., FarmTek, Real Tuff Livestock Equipment, Murray Farm Care Ltd., Bob-White Systems |