Wearable Robotic Exoskeleton Market Size & Overview:

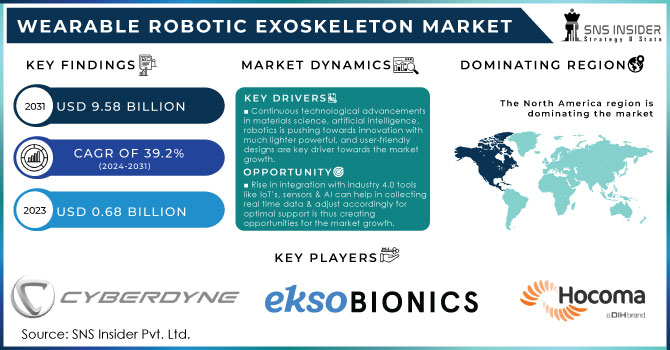

The Wearable Robotic Exoskeleton Market Size was valued at USD 0.68 Billion in 2023 and is now anticipated to grow to USD 9.58 Billion by 2031, displaying a compound annual growth rate (CAGR) of 39.2% during the forecast Period 2024 - 2031.

Get More Information on Wearable Robotic Exoskeleton Market - Request Sample Report

The wearable robotic exoskeleton market is flourishing at a significant rate because of variety of reasons. The current population is aging which is creating demand for devices that assist workers in extending their career lifeline. Whereas in healthcare, exoskeletons are helping in rehabilitation & encouraging individuals with disabilities to regain their abilities. According to the American Heart Association, around 6.5 million Americans suffers a stroke, with around 0.80 million more each year and 60% of the suffers from lower extremity disease which is driving the demand for the market. More industries like manufacturing are impacted with improved worker safety, reduced fatigue, increase in productivity is paving the way for the wearable robotic exoskeleton market. Moreover, advancements in materials science, AI & robotics are helping in creation of more user-friendly, lighter & powerful is another key driver in the growth. The military has also opened the gates for exoskeleton market for much endured & stronger soldiers. Robotic exoskeleton is all set to become an extension of humans blurring the lines between human and machine. All these factors are driving to the growth of the market.

Wearable Robotic Exoskeleton Market Dynamics

Drivers

-

Continuous technological advancements in materials science, artificial intelligence, robotics is pushing towards innovation with much lighter powerful, and user-friendly designs are key driver towards the market growth.

-

Rise in aging population & high demand for workforce is driving towards the market growth.

With rising age of global population which is causing a rise in musculoskeletal disorders and limitations. Hence, exoskeletons can help in assisting old aging workers to extend their career and be productive for a longer period of time. moreover, exoskeletons help in enhancing the productivity of workers at the same time reduces the fatigue. Ford deployed exoskeletons named EksoVest in 15 of their assembly plants throughout the globe & this exoskeleton supports the arms of workers that is performing repeated overhead tasks and This deployment of EksoVests has helped in reduction of workplace injuries by 83% at the trial phase.

Restraints

-

High initial cost, complex & maintenance hurdles can make this device unaffordable for consumers which can be a restraint in the market growth.

-

Lack of standardization in terms of designing, user-interface & functionality can create inconsistencies in terms of comparing different models with the specific needs which could be a restraint in the market growth.

Opportunities

-

Rise in integration with industry 4.0 tools like IoT’s, sensors & AI can help in collecting real time data & adjust accordingly for optimal support is thus creating opportunities for the market growth.

-

Introduction of subscription and rental models for common people is creating growth opportunities.

High cost of wearable exoskeletons can be a barrier for some consumers. So, introducing subscription based or rental models for exoskeletons can help more in penetrating the market technology making it accessible to a wider range of individuals. This can help towards flexibility by providing with temporary needs, like physical therapy patients. Archelis Inc. introduced ArchelisFX exoskeleton which is designed for cases like back pain and recent undergone surgery has announced that it would be available to rent or buy for around USD 5,000.

Challenges

-

The battery life of exoskeletons may not be sufficient for extended use in intense work environments which can be a challenge in the practicality.

-

The high cost of exoskeletons making it unaffordable for small business which might create a challenge in the market growth

Wearable Robotic Exoskeleton Market Impact Analysis

Impact of Russia-Ukraine War

The Russia-Ukraine war has a huge impact on the wearable robotic exoskeleton market. Sanctions & trade restrictions has caused a disruption in the supply chain with Russia as a key supplier of raw material in the manufacturing of exoskeletons. The price of Lithium-ion battery was raised up to 14.95% at the time of war which is hampered the supply for the power source of exoskeletons. This high equipment prices hindered the market growth. The global rise in the energy prices has impacted the production cost for powered exoskeletons making it less profitable for manufacturers. European union was the most affected region because of its proximity with 27% of oil imports and 46% of coal imports are from Russia has raised the energy prices. But on the other side, government might shift their focus towards defense that might require the use of wearable exoskeleton and can encourage exoskeleton manufacturers thereby can drive the growth in the long run by domestic manufacturing and reducing the dependency on international manufacturers. The war might have a high demand in military and defense for enhanced strength, endurance, and load carrying capacity. But in the long run the war may open several opportunities across various industries particularly military & healthcare.

Impact of Economic Slowdown

The economic slowdown has a huge impact on the wearable robotic exoskeleton market.

Budgets of consumers are tighter and companies are facing financial burden and are prioritizing on their core operations rather than adoption of new & advanced technologies. The high cost of exoskeleton makes it hard to sell and thus seen a decrease in the demand. During the slowdown the business becomes more selective towards high ROI providing assets giving away critical like improved productivity rate, decreased injury rates, etc. Also, there will be seen a decrease in R&D fundings which might put a halt in the development of more budget friendly & user-friendly skeleton. But on the other side there are certain industries with specific applications like in physical therapy where prevention of injury is of paramount importance. Also, government can recognize the benefits of exoskeleton in workplace safety by offering subsidies to encourage the adoption of wearable exoskeletons.

Wearable Robotic Exoskeleton Market Segmentation Analysis

by Component

-

Hardware

-

Sensors

-

Gyroscopes

-

Microphones

-

Accelerometers

-

Tilt Sensors

-

Force/Torque Sensors

-

Position Sensors

-

Others

-

-

Actuators

-

Electric

-

Pneumatic

-

Hydraulic

-

Piezoelectric

-

Power Sources

-

Control Systems/Controllers

-

Others

-

Software

by Structure

-

Powered

-

Passive

The powered exoskeleton type is dominating the market with a share of around 63.26% of the total market. The reason being is it provides protection to the user's shoulder, back, hip & thigh from any overloads with stabilizing user movements at the time of handling or carrying heavy objects making it very beneficial in people safety.

by Body Part

-

Lower Extremities

-

Upper Extremities

-

Full Body

by Structure

-

Rigid Exoskeletons

-

Soft Exoskeletons

by End Users

-

Healthcare

-

Defense & Aerospace

-

Manufacturing

-

Commercial

The healthcare segment is dominating the market with a share of around 37.9% of the total market. The increasing rate of the elderly population is giving rise to diseases and rehabilitating & encouraging individuals with disabilities to regain their abilities is making is the reason for being the dominance in this sector. Also, the technological advancements in power, wireless technology are leading to the development of innovative wearable robots and exoskeletons.

Wearable Robotic Exoskeleton Market Regional Analysis

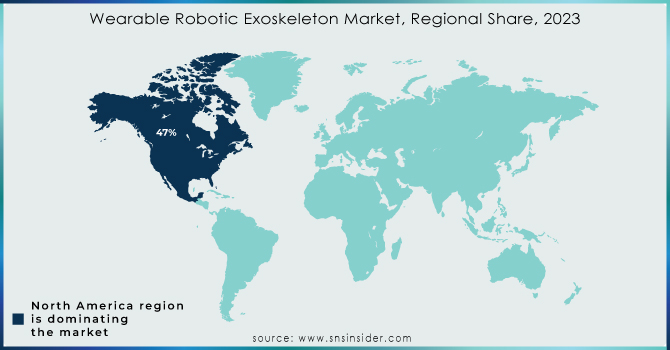

North America is dominating the market with a share of around 47% of the total market.

This dominance is because of large proportion of population is suffering from spine injuries, stroke, sclerosis, brain injuries, Parkinson’s disease & rise in the number of rehabilitation centers across the region. Also, increasing technology adoption across various industries like industrial, healthcare, and military & defense sectors is raising the region share.

Asia-Pacific region is the fastest growing region next to North America because of rising awareness of wearable robotic exoskeleton in manufacturing & defense sector.

Get Customized Report as per your Business Requirement - Request For Customized Report

Regional Outlook

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major key players are CYBERDYNE INC., Ekso Bionics, Hocoma, ReWalk Robotics, Bionik Laboratories Corp., ExoAtlet, Lockheed Martin, Rex Bionics Pty Ltd., Sarcos Corp., Wearable Robotics Srl and others.

Wearable Robotic Exoskeleton Market Recent Development

-

In April 2024, Hyundai announced a partnership with Ekso Bionics to develop and commercialize industrial exoskeletons for the automotive manufacturing sector. This collaboration leverages Ekso's expertise in exoskeleton design with Hyundai's vast experience in robotics and manufacturing, aiming to create industry-specific solutions to reduce worker strain and fatigue on assembly lines.

-

In January 2024, Hypershell announces the launch of GoX, ProX & CarbonX exoskeleton for outdoor enthusiasts and mountain hikers enabling faster treks with less fatigue while carrying heavier packs. These lightweight exoskeletons incorporate AI software to dynamically adjust boost according to changing terrain.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 0.68 Billion |

| Market Size by 2031 | US$ 9.58 Billion |

| CAGR | CAGR of 39.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software) • By Structure (Powered, Passive) • By Body Part (Full Body, Lower & Upper Extremities) • By Structure (Rigid, Soft) • By End user (Healthcare, Defense & Aerospace, Manufacturing, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | CYBERDYNE INC., Ekso Bionics, Hocoma, ReWalk Robotics, Bionik Laboratories Corp., ExoAtlet, Lockheed Martin, Rex Bionics Pty Ltd., Sarcos Corp., Wearable Robotics Srl |

| Key Drivers | • Continuous technological advancements in materials science, artificial intelligence, robotics is pushing towards innovation with much lighter powerful, and user-friendly designs are key driver towards the market growth. • Rise in aging population & high demand for workforce is driving towards the market growth. |

| Restraints | • High initial cost, complex & maintenance hurdles can make this device unaffordable for consumers which can be a restraint in the market growth. • Lack of standardization in terms of designing, user-interface & functionality can create inconsistencies in terms of comparing different models with the specific needs which could be a restraint in the market growth. |