Immersion Cooling Market Report Scope & Overview:

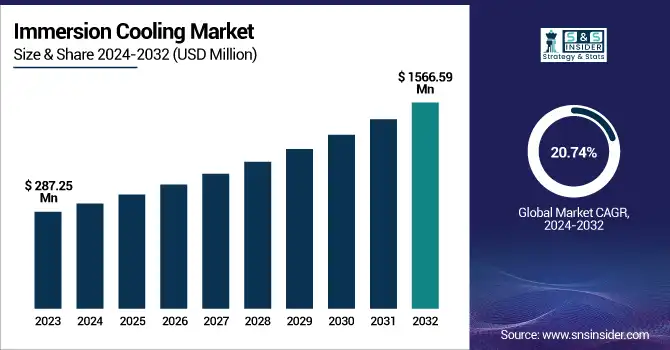

The Immersion Cooling Market was valued at USD 287.25 Million in 2023 and is expected to reach USD 1566.59 Million by 2032, with a growing CAGR of 20.74% over the forecast period 2024-2032. The Immersion Cooling Market is evolving with increasing data center penetration, particularly in hyperscale facilities. Innovations in biodegradable and dielectric coolants are reshaping material and fluid consumption trends, significantly reducing energy usage. Rising server density is driving advanced space optimization strategies. Compliance with ASHRAE TC 9.9 and EU energy efficiency directives is accelerating adoption. Emerging trends like direct-to-chip hybrid cooling and AI-driven thermal management further enhance efficiency and sustainability.

To Get more information on Immersion Cooling Market - Request Free Sample Report

In 2023, U.S. immersion cooling market was valued at USD 80.16 million and is expected to reach USD 422.66 million by 2032 at a CAGR of 20.29% from 2024-2032. With increasing demand for energy-efficient thermal management solutions in data centers and high-performance computing systems, the U.S. immersion cooling market has shown tremendous growth. While advanced processors produce tremendous power consumption and heat, all industries are switching to liquid-based cooling. Another reason for faster adoption across industries is sustainability and lowering carbon footprints.

Immersion Cooling Market Dynamics

Drivers

-

The rising adoption of AI, ML, and big data analytics is driving demand for HPC, making immersion cooling essential for efficient heat dissipation and energy savings.

The growing demand for high-performance computing (HPC) is driving significant advancements in cooling technologies, with immersion cooling emerging as a key solution. AI, ML, and big data analytics have been increasingly adopted by various industries, hence intensifying the need for efficient thermal management. Conventional approaches for cooling, namely air and liquid, typically fail to effectively dissipate the immense heat transferred by the workloads of high-performance computing (HPC), resulting in increased energy consumption and operating expenses. Immersion cooling is a mega-efficient option that leads to a lower power usage effectiveness (PUE) and greater reliability for the system. Immersion cooling is being adopted at a rapid pace by data centers, research institutions, and hyperscale cloud environments, according to market trends. The emergence of edge computing and distributed data management also contributes to this increase, as small-form factor, high-density computer systems need to be cooled more efficiently. As businesses embrace sustainability and adopt energy efficiency regulations, immersion cooling is expected to experience explosive growth, driven further by the performance requirements of AI-driven applications.

Restraint

-

The high upfront costs of immersion cooling, including specialized infrastructure and hardware modifications, pose a significant adoption barrier for SMEs.

The adoption of immersion cooling systems requires a substantial initial investment, primarily due to the cost of specialized infrastructure, dielectric fluids, and modified IT hardware. While immersion cooling offers some unique benefits compared to normal air or liquid cooling, it also requires custom enclosures and very high grade, very nonconductive fluids, which can be rather pricey. Further, existing servers may require replacement or retrofitting, thereby increasing capital expenditure costs. This burden of financial costs is especially painful for SMEs, which work with a limited budget. Although immersion cooling boasts long-term energy efficiency benefits and savings, its initial high costs make it difficult for some businesses to justify smaller gains. Installation and maintenance require skilled professionals, which adds to the cost. As a result, the lack of scalability of immersion cooling performance is a barrier to the adoption of immersion cooling and industry players are investigating cost down methods and leasing models, while governments are creating attractive subsidies to allow access to the technology for all relevant market segments.

Opportunities

-

Hyperscalers and cloud providers are adopting immersion cooling to enhance energy efficiency, reduce costs, and meet sustainability goals.

Hyperscalers and cloud providers are increasingly adopting immersion cooling to enhance energy efficiency and reduce operational costs. As cloud computing, AI, and data-centric workloads scale, it becomes difficult for traditional air-based cooling systems to keep pace with increasing heat loads. Immersion cooling provides a more sustainable option by reducing the PUE and the amount of water used. Top cloud infrastructure owners like Google, Microsoft, and AWS are researching this technology in an attempt to increase sustainability and achieve global carbon neutrality efforts. Moreover, immersion cooling allows for greater server density, ensuring that data center space is used most efficiently. Hyperscalers are pouring money into immersion cooling research and pilot projects to grow the technology, as pressure mounts for more sustainable fleets. As this shift occurs, it creates an ideal opportunity for cooling technology providers to partner with cloud firms earlier in the design stages, compelling innovation and scaling of liquid-based cooling solutions across next-gen data centers.

Challenges

-

The shortage of skilled professionals in immersion cooling limits adoption, as specialized expertise in fluid management, maintenance, and system integration is required.

The adoption of immersion cooling faces a significant challenge due to the limited availability of skilled professionals. Unlike air-based cooling that is merely a subtler approach to the conventional air-conditioning process using more efficient mechanisms, immersion cooling requires specialized expertise in fluid dynamics, thermodynamics and system integration. Dielectric fluids need to be learned to be maintained by data center engineers, careful sealing to avoid leakages, and unique maintenance procedures for liquid-based cooling systems need to be dealt with. But the workforce today is overwhelmingly skilled in traditional cooling techniques, creating a gap that hampers the adoption of those alternatives. Moreover, training programs and certifications surrounding immersion cooling are only beginning, which limits the talent pipeline even more. It leads to a shortage of experts, installation and integration mistakes, operational risk increase, and, as a result, enterprises are less willing to migrate to this technology. Solving this challenge can only be done through targeted training initiatives, but it must be done with close collaboration between industry leaders and education sectors, as well as the creation of industry-standard best practices to reskill workers for the wide-scale adoption of this technology.

Immersion Cooling Market Segmentation Analysis

By Product

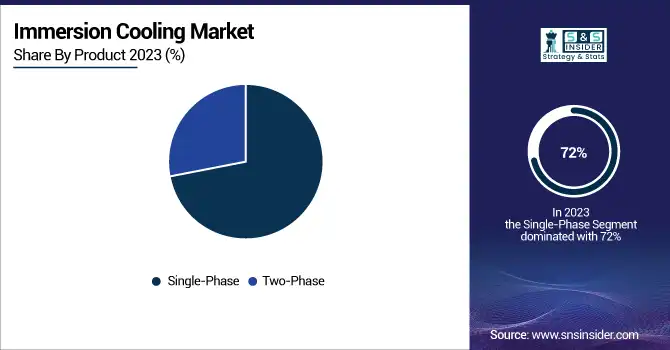

The Single-phase segment dominated with a market share of over 72% in 2023, owing to its cost-benefit, operational simplicity, and less complex maintenance practice compared to the two-phase cooling. This technique draws IT hardware in a liquid (it boils away), the liquid absorbs heat fast; the process is reliable and energy-efficient. This is why it is so popularly used in data servers and crypto miners due to the rising necessity of being able to have more eco-friendly cooling methods, which makes it possible to save energy while taking care of a concrete that serves a longer life. In addition, its simple design and low fluid loss make it a great long-term operational choice for many companies. Accordingly, single-phase immersion cooling remains a key market leader, especially in use cases for high density computing.

By Application

The High-performance Computing (HPC) segment dominated with a market share of over 42% in 2023. Due to the high density of computing power that HPC systems provide, they generate a host of heat, rendering traditional cooling methods ineffective. With immersion cooling, thermal management is much better because hardware is submerged in non-conducting liquid which helps in keeping the temperature low. Some other end-use applications that involve high-speed computing such as scientific research, financial modeling, and complex simulations are also expected to fuel their demand for adoption. Driven by sustainability and cost reduction, the companies are working to integrate immersion cooling to increase their system performance and reliability, reduce downtime, and gain operational efficiency, where HPC is leading in this market.

By Liquid

The Mineral Oil segment dominated with a market share of over 48% in 2023, owing to its wide usage in data center and high-performance computing applications. With great dielectric properties, it can be used to submerge electronic components to avoid short circuits and at the same time be ideal for heat transfer. Also, mineral oil is more economical compared with alternatives such as fluorocarbon-based fluids, which makes it the preferred choice for large-scale implementations. The sheer availability, stability, and like of existing infrastructure around it all lead to its dominance. Given the potency and sustainable, high-thermal management solutions in computing and cloud infrastructure, demand for mineral oil-based immersion cooling will continue to stay robust as data centers continue to search for energy-efficient cooling solutions.

Immersion Cooling Market Regional Outlook

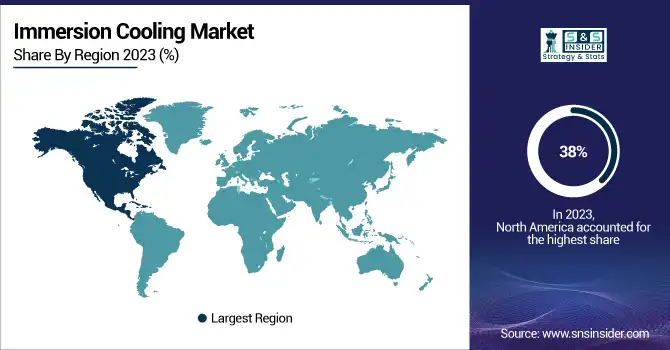

North America region dominated with a market share of over 38% in 2023, attributed to significant data center implementations, frequent technological upgrades, and increased need for high-performance computing. With data infrastructure, AI and cloud computing all receiving significant investment in the region, they all come with high demand for cooling to optimise both server performance and power usage effectiveness. Furthermore, powerful environmental regulations favoring sustainable cooling methods have advanced the above technology of immersion cooling. Prominent U.S. and Canadian players in the field and associated research organizations are also progressing development of novel cooling systems for precision support of next-gen computing. Rising demand for data processing activity drives North America at the forefront with a robust technology ecosystem and growing demand for investments in liquid-based cooling solutions.

Asia-Pacific is the fastest-growing region in the Immersion Cooling Market, fueled by rapid digitalization and the increasing demand for high-performance computing. The continual growth of cloud services, AI solutions, and blockchain technologies is leading to a rapid increase in investment of data centers in the region. China, India, and Japan lead the pack, with increasing demand in energy-efficient cooling solutions to accompany the IT infrastructure growth. Additionally, market expansion is fueled by government programs promoting sustainable technologies and an increase in the demand for cost-effective thermal management solutions. Combined with the rise of 5G networks and edge computing, which is creating opportunities for immersion cooling, Asia-Pacific is becoming a true innovation and adoption center for the global data center industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players in the Immersion Cooling Market

-

LiquidCool Solutions (Liquid Submerged Servers)

-

STULZ GMBH (Micro Data Center Cooling Solutions)

-

DCX POLSKA SP. Z O.O. (Direct Liquid Cooling Systems)

-

Fujitsu (Liquid Immersion Cooling for Servers)

-

Aecorsis BV (High-Density Immersion Cooling Solutions)

-

Green Revolution Cooling, Inc. (ElectroSafe™ Dielectric Fluid & ICEraQ® Systems)

-

Midas Immersion Cooling (Dielectric Fluids & Cooling Tanks)

-

DUG Technology (DUG Cool Immersion System)

-

LiquidStack Holding B.V. (Two-Phase Immersion Cooling Solutions)

-

Submer (SmartPodX & Cooling Dielectric Fluids)

-

Schneider Electric (EcoStruxure Liquid Cooling Solutions)

-

Vertiv (Liquid Cooling Infrastructure & Solutions)

-

Iceotope Technologies (Precision Immersion Cooling Systems)

-

Allied Control (Two-Phase Immersion Cooling Systems)

-

Dell Technologies (Immersion-Cooled Servers & IT Infrastructure)

-

Supermicro (Immersion Cooling-Optimized IT Hardware)

-

ExaScaler Inc. (HPC-Optimized Liquid Immersion Cooling)

-

Bitfury Group (Data Center Immersion Cooling Solutions)

-

Hypertec (Immersion-Ready Servers & Cooling Tanks)

-

Aspen Systems (Turnkey Immersion Cooling Solutions for HPC)

Suppliers for (High-performance immersion cooling solutions for hyperscale and edge data centers) on the Immersion Cooling Market

-

LiquidStack

-

Green Revolution Cooling Inc.

-

Submer

-

Iceotope Technologies Ltd.

-

DCX – The Liquid Cooling Company

-

Engineered Fluids

-

TIEMMERS

-

TMGcore, Inc.

-

GIGA-BYTE Technology Co., Ltd.

-

Wiwynn

Recent Development

In February 2024: Wiwynn, a cloud IT infrastructure provider for data centers, presented its next-generation edge computing solutions and cooling technologies at Mobile World Congress Barcelona 2024.

In October 2023: Submer partnered with Intel to advance single-phase immersion technology using a Forced Convection Heat Sink (FCHS) package. This innovation reduces both the number and cost of components needed for efficient heat capture and dissipation in chips with a Thermal Design Power (TDP) exceeding 1000W.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 287.25 Million |

| Market Size by 2032 | USD 1566.59 Million |

| CAGR | CAGR of 20.74% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Single-phase, Two-phase) •By Application (High-performance Computing, Edge Computing, Cryptocurrency Mining, Artificial Intelligence, Others) •By Liquid (Mineral Oil, Fluorocarbon-based Fluids, Deionized Water, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | LiquidCool Solutions, STULZ GMBH, DCX POLSKA SP. Z O.O., Fujitsu, Aecorsis BV, Green Revolution Cooling, Inc., Midas Immersion Cooling, DUG Technology, LiquidStack Holding B.V., Submer, Schneider Electric, Vertiv, Iceotope Technologies, Allied Control, Dell Technologies, Supermicro, ExaScaler Inc., Bitfury Group, Hypertec, Aspen Systems |