Polyester Straps Market Report Scope And Overview:

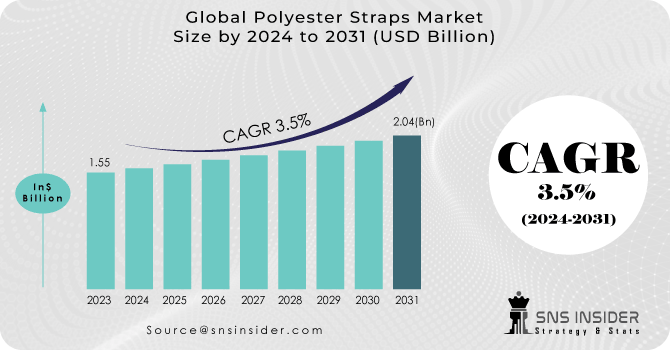

The Polyester Straps Market size was USD 1.55 billion in 2023 and is expected to Reach USD 2.04 billion by 2031 and grow at a CAGR of 3.5% over the forecast period of 2024-2031.

Technological progress in strap manufacturing has been instrumental in driving the growth of the polyester straps market. These advancements have resulted in the creation of high-quality straps with enhanced properties, rendering them more durable, dependable, and effective for a variety of strapping purposes. Progress in polymer chemistry has led to the improvement of polyester resins, offering enhanced properties. Polyester straps commonly utilize polyethylene terephthalate (PET) resin, renowned for its exceptional strength, flexibility, and resistance to abrasion.

Get More Information on Polyester Straps Market - Request Sample Report

The rise of e-commerce, facilitated by the convenience of online shopping, is set to propel the growth of the polyester straps market. E-commerce has streamlined distribution channels, enhanced the precision and efficiency of business transactions, and revolutionized purchases across sectors such as electronics and textiles. The utilization of sustainable polyester straps presents numerous advantages. It diminishes dependence on non-renewable resources and lowers the carbon footprint linked to the manufacturing of new materials. By incorporating recycled or recyclable materials, the environmental impact of polyester straps is notably minimized.

MARKET DYNAMICS

KEY DRIVERS:

-

The automotive sector's increasing demand is anticipated to positively propel market growth.

A significant trend driving growth in the polyester straps market is the adoption of lightweight and high-performance straps. These straps combine strength with lightweight properties, making them ideal for industries focused on weight reduction and operational efficiency. They are particularly valuable in sectors like logistics, shipping, and warehousing, where extensive strapping is common.

-

Polyester straps, prized for their durability, safety, and exceptional UV resistance, offer sustainable packaging solutions.

RESTRAIN:

-

The increasing dependence on conventional and time-honored approaches is likely to impede the growth of the polyester strap market.

OPPORTUNITY:

-

Market growth is anticipated to be driven by opportunities for customization and branding.

-

Increased innovation and heightened product awareness are contributing to the market's growth.

Manufacturers are increasingly focusing on innovation and product development, creating lucrative opportunities for market players. Additionally, the rising consumer awareness regarding sustainable and eco-friendly packaging is anticipated to fuel further growth in the polyester strap market.

CHALLENGES:

-

Disruptions in the supply chain pose a significant threat to the market's stability and growth.

-

Fluctuations in raw material prices are anticipated to pose a challenge for the polyester strap market.

IMPACT OF RUSSIAN UKRAINE WAR

The escalating prices of essential raw materials such as crude oil and food, coupled with increased labor costs, pose significant concerns for the global textile and clothing industry. Many Asian economies heavily depend on imports of Russian coal and oil, as well as Ukrainian food supplies. Turkey has experienced a surge in inflation, reaching approximately 53.5%. Before the crisis, Russia and Ukraine collectively accounted for approximately 10% of the European retail market. However, the depreciation of the Russian currency has led to declining demand for Russian brands. Meanwhile, fashion retailers are compelled to raise prices due to escalating fuel and raw material expenses. For example, the costs of polyester and nylon have surged due to the increase in crude oil prices. This collectively led to hamper the polyester strap market.

IMPACT OF ECONOMIC SLOWDOWN

During economic slowdowns, industries often experience reduced production and lower consumer demand, resulting in decreased manufacturing activities and shipment volumes. This decline in industrial output directly affects the demand for packaging materials like polyester straps, as there are fewer goods to bundle and secure for transportation. As a result, the polyester strap market experiences a decrease in demand, leading to slower growth or even contraction. Companies may implement cost-cutting measures, which could include reducing expenses on packaging materials like polyester straps.

KEY MARKET SEGMENTS

By Packing Grade

-

Hand Grade

-

Machine Grade

By Width

-

5-15 mm

-

15-25 mm

-

25-35 mm

-

Above 35 mm

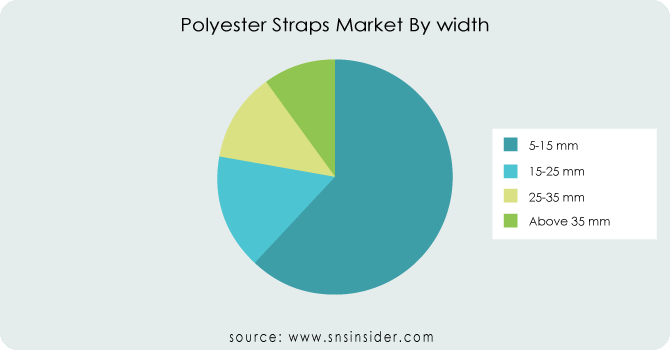

The segment with a width ranging from 5 mm to 15 mm accounted for the largest share, contributing approximately 62% to the revenue of the Polyester Strap for Manual Grade Market. This significant market share can be attributed to the high strength and excellent elongation properties of polyester straps, even with minimal width, making them favorable for various end-user industries and logistical partners.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Thickness

-

Less than 0.50 mm

-

0.50 mm - 0.75 mm

-

0.76 mm - 1.00 mm

-

Above 1.00 mm

The segment with a thickness of 0.5 mm to 0.75 mm held the largest market share and is expected to experience rapid growth during the forecast period. This is attributed to the widespread use of PET straps within this thickness range compared to other strap sizes. These straps are commonly employed in industrial sectors to handle medium to heavy loads during packaging processes. Consequently, the increasing demand for PET straps with a thickness of 0.5 mm to 0.75 mm is driving positive growth in the market.

By Type

-

Polyethylene Terephthalate (PET) Straps

-

Polypropylene (PP) Straps

-

Nylon Straps

-

Paper Straps

-

Composite Straps

-

Woven Straps Others

The Woven Strapping type segment dominated the Polyester Strap for Manual Grade Market, accounting for approximately 59% of the market revenue. Woven polyester strapping offers superior strength and durability due to its cross-woven polyester yarn strands coated with cold glue. This type of strapping is highly resistant to chafing and shearing, making it ideal for use with rough-edged consignments.

By Application

-

Heavy Duty Bailing and Others

-

Bundling

-

Palletizing/ Load Unitizing

Bundling will dominate the market. Ensuring cargo safety throughout the supply chain, from manufacturing to the final consumer, is paramount. Loose goods carry the risk of spillage or damage at any stage, leading to irreparable losses for all involved parties. Bundling has become the go-to method universally adopted to safeguard cargo and enhance its safety during all forms of transportation.

By Breaking Strength

-

Up to 220kg

-

221kg to 300kg

-

301kg to 500kg

-

501kg to 1,000kg

-

Above 1,000kg

The segment with breaking strengths ranging from 301 to 500 kg emerged as the market leader and is anticipated to experience accelerated growth throughout the forecast period. This is essential for shipments with multiple stops, and polyester corded strapping, despite its lack of stretch, offers flexibility. PET straps with breaking strengths of 301 to 500 kg are preferred, driving market growth for Polyester Straps for Manual Grade.

By End-Use Industry

-

Food and Beverage,

-

Pharmaceuticals,

-

Electrical and Electronics, Automotive,

-

Construction and Allied Industries,

-

Paper and Allied Industries,

-

Textiles and Apparels,

-

Chemical and Fertilizers,

-

Others

The Paper & Allied Industries segment led the market and is expected to experience accelerated growth during the forecast period. Paper mills prioritize the selection of strapping materials for bundling and stacking finished paper products. PET strapping for manual grade stands out as a top choice in this industry due to its high strength, non-corrosive nature, and low coefficient of friction.

REGIONAL ANALYSIS

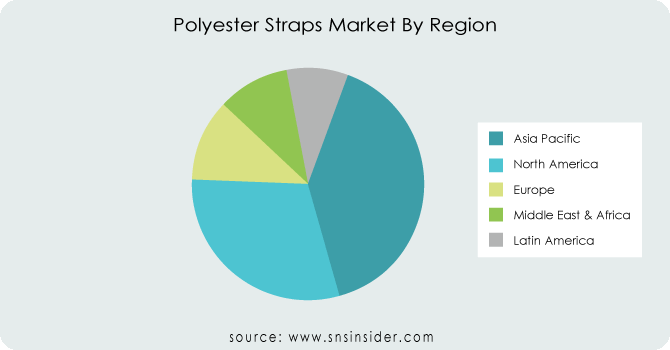

The Asia Pacific region stands as the leading consumer and producer of manual-grade polyester straps, driven by the presence of rapidly expanding economies like China and India. Factors such as population growth contribute significantly to the market's growth in this region. Increased demand from end-user industries in developing nations like India, Indonesia, and Thailand is expected to further propel market growth. The Asia Pacific region dominates the global PET strap market for manual use, particularly due to the rapid expansion of the automobile industry. Additionally, PET straps find extensive application in the logistics sector across Asia Pacific. China and India rank among the largest packaging markets globally.

The North American region is witnessing a surge in demand for polyester straps, particularly within the automobile sector. This industry requires materials characterized by durability, sufficient strength, and lightweight properties. Polyester straps offer a cost-effective alternative to other strapping solutions, notably steel strapping. Consumers are propelling the market for polyester straps due to their high tensile strength, affordability, lightweight nature, and other advantageous properties. Manufacturers in this region prefer polyester straps over alternative strapping solutions due to these favorable attributes.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Major players in Polyester Straps Market are Auto Strap, Linder GmbH, FROMM Packaging, S&K Packaging Inc., TEUFELBERGER, De Webmakers Webdesign Bureau, Dubose Strapping, Greenbridge, North Shore Strapping Inc., Samuel Strapping, and others.

S&K Packaging Inc-Company Financial Analysis

RECENT DEVELOPMENT

-

In June 2022, Samuel Strapping Systems, a division of Samuel, Son & Co., Limited, introduced its latest range of heavy-duty polyester strapping tailored for the lumber industry. This strapping features impressive tensile strength and outstanding resistance to environmental conditions, guaranteeing the secure bundling and protection of lumber products during storage and transportation.

-

In March 2022, FROMM Packaging Systems, a globally acclaimed pioneer in packaging technology, launched its newest advancement in polyester strapping: the FROMM Embosser. This cutting-edge strapping technology merges the advantages of embossed strapping with precise printing capabilities, enabling customized branding and enhanced load security.

-

In March 2021, BONZOBAND Strapping Systems Ltd. introduced a new addition to its product range: a robust 16mm woven polyester strapping solution designed for heavy-duty applications. This innovative strapping solution offers increased strength and durability to meet the demanding requirements of various industries.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.55 Billion |

| Market Size by 2031 | US$ 2.04 Billion |

| CAGR | CAGR of 3.5 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Polyethylene Terephthalate (PET) Straps, Polypropylene (PP) Straps, Nylon Straps, Paper Straps, Composite Straps, Woven Straps Others) • By Application (Heavy Duty Bailing and Others, Bundling, Palletizing/ Load Unitizing) • By Breaking Strength (Up to 220kg, 221kg to 300kg, 301kg to 500kg, 501kg to 1,000kg, Above 1,000kg) • By End-Use Industry (Food and Beverage, Pharmaceuticals, Electrical and Electronics, Automotive, Construction and Allied Industries, Paper and Allied Industries, Textiles and Apparels, Chemical and Fertilizers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Auto Strap, Linder GmbH, FROMM Packaging, S&K Packaging Inc., TEUFELBERGER, De Webmakers Webdesign Bureau, Dubose Strapping, Greenbridge, North Shore Strapping Inc., Samuel Strapping |

| Key Drivers | • The rising demand from the automotive sector is expected to drive market growth positively. • The polyester straps, known for their durability, safety, and high resistance to UV light, serve as sustainable packaging solutions. |

| Challenges | • Disruptions in the supply chain pose a significant threat to the market's stability and growth. • The fluctuations in raw material prices are expected to present a drawback for the polyester strap market. |