Polyurethane Adhesives Market Report Scope & Overview:

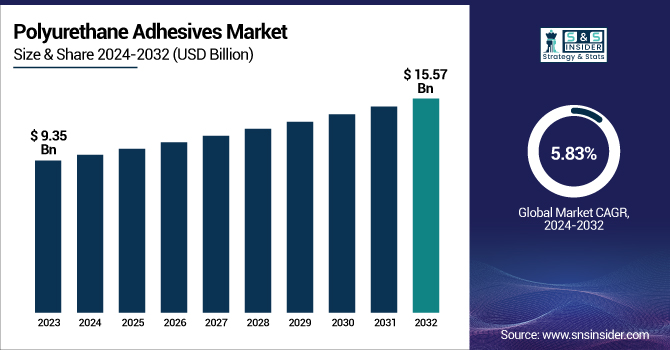

The Polyurethane Adhesives Market Size was valued at USD 9.35 Billion in 2023 and is expected to reach USD 15.57 Billion by 2032, growing at a CAGR of 5.83% over the forecast period of 2024-2032.

To Get more information on Polyurethane Adhesives Market - Request Free Sample Report

The Polyurethane Adhesives Market is evolving with rising demand for sustainable solutions and high-performance bonding technologies. Adoption of bio-based polyurethane adhesives is accelerating as industries embrace eco-friendly alternatives to meet regulatory standards. Consumer preferences and buying behavior trends highlight a shift toward durable and versatile adhesives across applications. The investment landscape and venture capital funding trends reveal strong financial backing for innovation, driving market growth. Meanwhile, export-import duties and their market implications influence global trade, affecting pricing and regional competitiveness. A benchmarking analysis against competing adhesive technologies sheds light on polyurethane adhesives' advantages over epoxy and acrylic counterparts. Our report provides exclusive insights into these key trends, shaping the future of the polyurethane adhesives industry.

The US Polyurethane Adhesives Market Size was valued at USD 2.47 Billion in 2023 and is expected to reach USD 3.88 Billion by 2032, growing at a CAGR of 5.13% over the forecast period of 2024-2032.

The U.S. Polyurethane Adhesives Market is experiencing steady growth, driven by increasing demand across industries such as automotive, construction, and packaging. Advancements in bio-based polyurethane adhesives, supported by organizations like the American Chemical Society (ACS) and the U.S. Environmental Protection Agency (EPA), are fueling sustainability efforts. The automotive sector, with key players like Tesla and Ford, is adopting lightweight, high-strength adhesives to enhance fuel efficiency. Additionally, stringent FDA regulations on food-safe packaging are boosting demand in the packaging industry. Investments in R&D by U.S. companies like Dow Inc. and H.B. Fuller further accelerate market expansion. Our report provides deeper insights into these dynamic growth factors.

Polyurethane Adhesives Market Dynamics

Drivers

-

Surging Investments in Next-Generation Aerospace Adhesives Drive Innovation in the Polyurethane Adhesives Market

The aerospace industry is undergoing rapid transformation with a growing emphasis on lightweight, fuel-efficient materials to enhance aircraft performance and reduce operational costs. Polyurethane adhesives have emerged as a preferred bonding solution, replacing traditional rivets and fasteners in aircraft manufacturing due to their high-strength bonding capabilities, vibration resistance, and durability under extreme environmental conditions. Major aerospace firms such as Boeing and Lockheed Martin are actively investing in next-generation polyurethane adhesive formulations to enhance the structural integrity of commercial and military aircraft. Additionally, fire-resistant and low-VOC polyurethane adhesives are being developed to meet Federal Aviation Administration (FAA) safety regulations, ensuring compliance with stringent environmental and safety standards. The increasing adoption of composite materials in aircraft manufacturing, such as carbon fiber-reinforced polymers (CFRP), further boosts the demand for specialized polyurethane adhesives that provide seamless bonding between lightweight materials. As aerospace manufacturers continue to explore innovative adhesive technologies, polyurethane adhesives will play a crucial role in improving aircraft design efficiency, reducing maintenance costs, and enhancing overall flight performance.

Restraints

-

Limited Long-Term Durability of Polyurethane Adhesives in High-Moisture and Harsh Environments Restrains Market Growth

Despite their strong adhesion properties and flexibility, polyurethane adhesives face performance limitations in extreme environments, particularly in high-moisture and chemical-exposed applications. Over time, prolonged exposure to water, humidity, and aggressive solvents can lead to hydrolysis, weakening the adhesive bonds and reducing structural integrity. This poses significant challenges in industries such as marine, oil & gas, and infrastructure, where long-term durability is critical. Additionally, extreme temperature fluctuations can cause thermal expansion and contraction, leading to adhesive failures in aerospace and automotive applications. While manufacturers are developing moisture-resistant polyurethane formulations, these solutions often come at a higher cost and may not be suitable for all applications. The need for frequent reapplications and maintenance costs further adds to the economic burden on end-users, making alternative adhesive technologies, such as epoxies and silicones, more attractive. These durability challenges hinder market penetration in highly demanding sectors, slowing the overall growth of polyurethane adhesives.

Opportunities

-

Growing Use of Smart Adhesives with Self-Healing and Adaptive Bonding Capabilities Boosts Polyurethane Adhesives Market

The integration of self-healing and adaptive bonding technologies into polyurethane adhesives is opening new growth avenues across multiple industries. These adhesives can automatically repair micro-cracks and bond failures, extending the lifespan of bonded components in automotive, aerospace, and consumer electronics. Research institutions and adhesive manufacturers, such as BASF SE and Henkel AG, are exploring the use of nanoparticles and polymer networks that enable adhesives to re-form chemical bonds when exposed to heat or moisture. Self-healing polyurethane adhesives also improve energy efficiency in battery assembly applications, reducing maintenance costs for electric vehicle manufacturers. Additionally, adaptive adhesives that adjust their viscosity and curing properties based on external conditions are being developed for precision bonding in robotics and medical devices. As smart materials gain traction, self-healing polyurethane adhesives will revolutionize structural bonding technologies, enhancing product reliability and longevity in critical applications.

Challenge

-

Difficulties in Recycling and Environmental Disposal of Polyurethane Adhesives Pose Long-Term Sustainability Concerns

Unlike thermoplastic adhesives, polyurethane adhesives are thermosetting polymers, meaning they do not melt or reshape once cured, making recycling and disposal challenging. This creates significant environmental concerns as industries aim to reduce chemical waste and carbon footprints. Polyurethane adhesives are widely used in packaging, construction, and automotive manufacturing, where disposal regulations are becoming stricter. Organizations such as the Environmental Protection Agency (EPA) and European Environment Agency (EEA) are imposing tighter restrictions on adhesive waste management, forcing manufacturers to develop biodegradable or recyclable alternatives. However, existing recycling methods for polyurethane adhesives remain costly and inefficient, requiring specialized chemical processes such as solvolysis and glycolysis. The industry is investing in bio-based polyurethane adhesives, but achieving commercial scalability remains a major challenge. Without significant advancements in eco-friendly disposal solutions, polyurethane adhesive manufacturers will continue to face regulatory and sustainability hurdles, limiting widespread adoption.

Polyurethane Adhesives Market Segmental Analysis

By Type

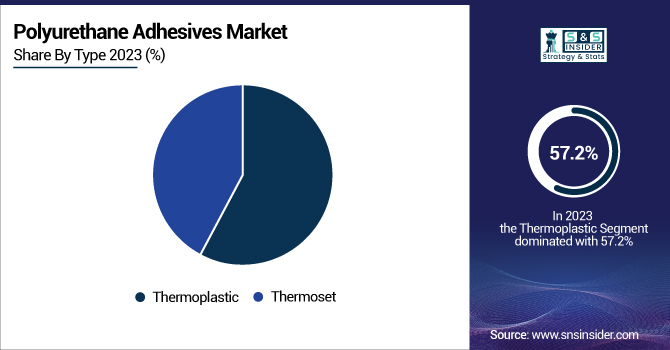

Thermoplastic polyurethane adhesives dominated the Polyurethane Adhesives Market in 2023, accounting for 57.2% of the market share. Their versatility, reusability, and fast-setting properties make them highly preferred in automotive, footwear, and packaging applications. Unlike thermoset adhesives, thermoplastic variants can be remelted and reshaped, making them easier to recycle, aligning with the sustainability goals set by regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Environment Agency (EEA). Moreover, the booming demand for flexible packaging in the food and beverage sector is driving significant adoption, as companies seek strong, yet flexible, bonding solutions that improve sealing performance and durability. Arkema’s Bostik and Henkel AG have actively developed thermoplastic polyurethane adhesives tailored for sustainable and lightweight materials in electric vehicles and consumer electronics, further reinforcing their market dominance.

By Technology

Hot melt polyurethane adhesives dominated the Polyurethane Adhesives Market in 2023 with a 42.8% market share, driven by their rapid bonding, strong adhesion, and solvent-free composition. These adhesives have gained traction in packaging, automotive, and woodworking industries due to their instant curing and high thermal stability. Regulatory authorities like the Food and Drug Administration (FDA) and the Occupational Safety and Health Administration (OSHA) have emphasized reducing volatile organic compound (VOC) emissions, pushing manufacturers to adopt solvent-free bonding solutions. The rise of e-commerce and increased packaging demands have further fueled the adoption of hot melt adhesives in corrugated box sealing and flexible packaging applications. Leading players such as 3M Company, H.B. Fuller, and Dow Inc. have developed high-performance polyurethane hot melt adhesives that cater to automotive interiors, consumer electronics, and hygiene product applications, reinforcing their dominance in the market.

By End-use Industry

The packaging industry dominated the Polyurethane Adhesives Market in 2023, holding a 38.9% market share, primarily due to the surging demand for flexible packaging solutions across food, beverage, pharmaceutical, and e-commerce industries. The U.S. Flexible Packaging Association (FPA) has reported a steady increase in flexible packaging adoption, particularly for sustainability-driven solutions that use polyurethane adhesives for strong, lightweight, and resealable designs. With growing concerns over single-use plastic waste, the demand for recyclable polyurethane-based packaging adhesives has accelerated, with companies like Henkel AG and Bostik (Arkema S.A.) launching solvent-free polyurethane adhesives for flexible laminates and film applications. Furthermore, the rapid growth of online shopping has fueled the need for durable packaging materials, further strengthening the dominance of the packaging segment in the Polyurethane Adhesives Market.

Polyurethane Adhesives Market Regional Outlook

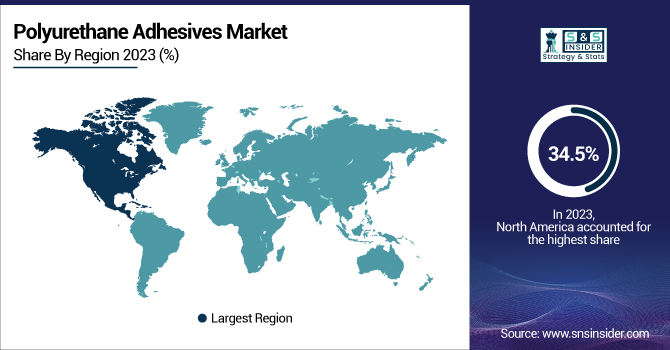

North America dominated the Polyurethane Adhesives Market in 2023, capturing 34.5% of the market share, owing to strong industrial demand, regulatory advancements, and rapid technological innovations. The United States, the leading market in the region, accounted for over a major share of North America’s polyurethane adhesives consumption, driven by the automotive, construction, and packaging sectors. The Biden Administration’s Infrastructure Investment and Jobs Act (IIJA), which allocated $1.2 trillion towards infrastructure development, has significantly boosted the demand for high-performance adhesives in bridge construction, insulation, and road maintenance. Additionally, the automotive sector’s shift towards lightweight and electric vehicles (EVs) has propelled polyurethane adhesives’ usage in bonding composite materials and battery assembly, with companies like Tesla and General Motors integrating polyurethane-based adhesives into their EV production lines. In Canada, the rising emphasis on sustainable packaging solutions has led companies such as 3M and Sika AG to introduce low-VOC and bio-based polyurethane adhesives, further strengthening the region’s dominance. Mexico, the fastest-growing market in North America, is benefiting from increased foreign direct investment (FDI) in manufacturing and automotive sectors, as global companies shift operations due to U.S.-Mexico-Canada Agreement (USMCA) trade incentives. These combined factors have solidified North America’s leadership in the Polyurethane Adhesives Market.

Moreover, Asia Pacific emerged as the fastest-growing region in the Polyurethane Adhesives Market, in 2023 with a significant growth rate, fueled by booming industrialization, increasing urbanization, and expanding automotive production. The region’s manufacturing hubs, including China, India, Japan, and South Korea, have witnessed exponential growth in construction, electronics, and footwear sectors, driving high demand for polyurethane adhesives. China, the largest contributor to the market in Asia Pacific, has seen increased government support for infrastructure projects, with initiatives like China’s Belt and Road Initiative (BRI) propelling construction activities, leading to higher consumption of polyurethane-based bonding solutions. Additionally, China’s rising electric vehicle production, led by companies like BYD and NIO, has increased demand for structural adhesives in battery assembly and lightweight components. India, the fastest-growing country in the region, has seen an 18% annual increase in the footwear and packaging industries, with government-led initiatives such as ‘Make in India’ attracting investments in polyurethane adhesive manufacturing. Japan and South Korea are focusing on high-performance adhesives for electronics and semiconductor manufacturing, aligning with the growing 5G and AI technology sectors. These combined factors position Asia Pacific as the fastest-growing market for polyurethane adhesives, expected to surpass North America’s dominance in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

3M Company (3M Scotch-Weld 2216, 3M Fastbond 2000NF)

-

Arkema S.A. (Bostik) (Bostik XPU 18230, Bostik SAF 30)

-

Ashland Inc. (Pliogrip 7400, Pliogrip 5770)

-

BASF SE (BASF Elastan 6569, BASF Elastocoat C)

-

Beijing Comens New Materials Co., Ltd. (Comensflex 8260, Comensflex 8110)

-

Dow Inc. (BETAMATE 2090, BETAFORCE 2816)

-

H.B. Fuller Company (Swiftbond 2K 1530, Fuller HL 2308)

-

Henkel AG & Co. KGaA (LOCTITE UK 1366 B10, TEROSON PU 8597 HMLC)

-

Hubei Huitian New Materials Co., Ltd. (Huitian 8660, Huitian 9330)

-

Huntsman Corporation (Araldite 2028, Araldite 2047)

-

Illinois Tool Works Inc. (ITW Performix Plastidip PU Adhesive, ITW Devcon Flexane 80)

-

Jowat SE (Jowatherm 261.30, Jowapur 681.10)

-

Kangda New Materials (Group) Co., Ltd. (KD-8223, KD-7600)

-

MAPEI S.p.A. (MapePUR Universal, MapePUR Roof)

-

NANPAO Resins Chemical Group (Nanpao NP-9009, Nanpao NP-8118)

-

Pidilite Industries Ltd. (Fevicol SP 4, Fevicol PU Express)

-

Sika AG (Sikaflex 252, SikaForce 7710)

-

Soudal Holding N.V. (Soudal Soudatherm 270, Soudal Soudaseal 2K PU)

-

Wacker Chemie AG (Wacker GENOMER 3657, Wacker ADH 5200 PU)

-

WEICON GmbH & Co. KG (WEICON Flex 310 PU, WEICON Urethane 45)

Recent Developments

-

September 2024: Bostik, the adhesive solutions segment of Arkema, introduced Kizen LIME, a new range of packaging adhesives. This launch marked a significant step in Bostik's commitment to reducing carbon footprints and enhancing the sustainability of packaging solutions.

-

May 2024: Dow completed its VORATRON adhesive and gap filler production line in Ahlen, Germany, boosting capacity tenfold to meet EV battery assembly demand. The facility operates on renewable energy, supporting sustainability goals.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.35 Billion |

| Market Size by 2032 | USD 15.57 Billion |

| CAGR | CAGR of 5.83% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Thermoset, Thermoplastic) •By Technology (Hot Melt, Reactive, Solvent-borne, UV Cured Adhesives, Water-borne) •By End-use Industry (Footwear, Automotive, Building & Construction, Packaging, Electrical & Electronics, Furniture, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M Company, Dow Inc., BASF SE, Henkel AG & Co. KGaA, H.B. Fuller Company, Sika AG, Huntsman Corporation, Arkema S.A. (Bostik), Illinois Tool Works Inc., Pidilite Industries Ltd. and other key players |