Polyamide 12 Market Report Scope & Overview:

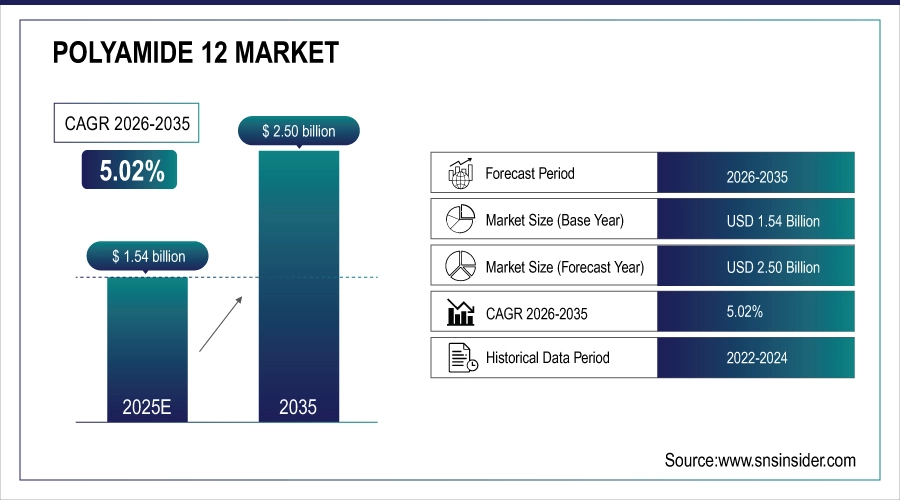

The Polyamide 12 Market size was valued at USD 1.54 Billion in 2025 and is projected to reach USD 2.50 Billion by 2035, growing at a CAGR of 5.02% during 2026-2035.

The Polyamide 12 (PA12) market is growing due to increasing demand for lightweight, high-performance polymers across automotive, aerospace, healthcare, and industrial sectors. Its excellent chemical resistance, durability, and flexibility make it ideal for fuel lines, tubing, connectors, and additive manufacturing applications. The rise of electric vehicles, 3D printing adoption, and advanced manufacturing technologies is accelerating growth. Additionally, stringent environmental regulations and the shift toward bio-based and sustainable polymers are driving investment in PA12 production, expanding its use across emerging applications and global markets.

Market Size and Forecast:

-

Market Size in 2025: USD 1.54 Billion

-

Market Size by 2035: USD 2.50 Billion

-

CAGR: 5.02% From 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026-2035

-

Historical Data: 2022-2024

To Get more information on Polyamide 12 Market - Request Free Sample Report

Key Polyamide 12 Market Trends

-

Increasing adoption of lightweight, high-performance polymers in automotive, aerospace, industrial, and healthcare applications.

-

Growing use of PA12 in additive manufacturing (3D printing) for prototyping and customized end-use parts.

-

Shift toward sustainable and bio-based PA12 solutions, aligning with environmental and regulatory initiatives.

-

Expansion in medical devices, healthcare tubing, and specialized industrial components, offering high-margin opportunities.

-

Rising focus on lightweighting in electric vehicles and development of specialty polymer blends for enhanced performance

The U.S. Polyamide 12 Market size was valued at USD 0.27 Billion in 2025 and is projected to reach USD 0.43Billion by 2035, growing at a CAGR of 4.69% during 2026-2035. The U.S. Polyamide 12 market is growing due to strong demand from automotive, aerospace, and industrial sectors, driven by lightweighting and durability needs. Growth in additive manufacturing, advanced medical devices, and sustainable polymer adoption, combined with regulatory support for high-performance materials, is further accelerating market expansion.

Polyamide 12 Market Growth Drivers:

Growing Demand for Lightweight High Performance Polymers Drives Global Polyamide 12 Market Expansion

The global Polyamide 12 market is primarily driven by the increasing demand for lightweight, high-performance polymers across diverse industries such as automotive, aerospace, industrial manufacturing, and healthcare. PA12’s excellent chemical resistance, dimensional stability, and mechanical strength make it an ideal choice for fuel lines, tubing, connectors, and electrical components. The automotive sector, in particular, is adopting PA12 to achieve vehicle weight reduction and improved fuel efficiency, supporting stricter emission norms. Additionally, the growing adoption of additive manufacturing technologies, including 3D printing, has expanded the application of PA12 powders for prototyping and end-use parts, further fueling market growth. The shift toward sustainable and bio-based polymer alternatives is also increasing demand for eco-friendly PA12 solutions, aligning with global environmental and regulatory initiatives.

PA12 powders used in additive manufacturing (e.g., selective laser sintering) enable reduced part counts by up to 70% and maintain dimensional accuracy (~±0.3%), supporting complex and customized production.

Polyamide 12 Market Restraints:

-

Raw Material Constraints and Processing Challenges Limit Polyamide 12 Market Growth Across Industries

The Polyamide 12 market faces restraints from limited raw material availability, dependency on specific high-quality monomers, and processing complexities requiring specialized equipment. Additionally, technical skill gaps, stringent regulatory compliance for medical and automotive applications, and performance limitations under extreme temperatures can slow adoption in certain industrial and emerging markets.

Polyamide 12 Market Opportunities:

-

Technological Advancements and Emerging Applications Drive Polyamide 12 Market Growth Globally Across Industries

The market also presents significant growth opportunities driven by technological advancements and emerging applications. Expanding use in medical devices, healthcare tubing, and customized industrial components offers high-margin potential. Regions such as Asia Pacific and North America are expected to witness strong growth due to industrial expansion, infrastructure development, and increased manufacturing capabilities. Moreover, the rising focus on lightweighting in electric vehicles and innovative polymer blends creates opportunities for PA12 manufacturers to develop specialty grades with enhanced performance, tapping into both mature and emerging markets globally.

Bio‑circular PA12 powders have been introduced for industrial 3D printing that substitute 100% of fossil feedstock with renewable raw materials, reducing CO₂ emissions by 74% compared with older formulations

Polyamide 12 Market Segment Analysis

-

By Product Type, Standard Polyamide 12 dominated with 58.44% in 2025, and Reinforced / Modified Polyamide 12 is expected to grow at the fastest CAGR of 5.77% from 2026 to 2035.

- By Form, Pellets / Granules dominated with 52.34% in 2025, and Powder (Additive Manufacturing & Coatings) is expected to grow at the fastest CAGR of 5.56% from 2026 to 2035.

- By End-Use Industry, Automotive & Transportation dominated with 38.13% in 2025, and Healthcare & Medical Devices is expected to grow at the fastest CAGR of 5.63% from 2026 to 2035.

- By Application, Automotive Components dominated with 38.45% in 2025, Additive Manufacturing (3D Printing) is expected to grow at the fastest CAGR of 5.66% from 2026 to 2035.

By Product Type, Reinforced And Modified Polyamide 12 Market Growth Fueled By Automotive Aerospace And Industrial Demand

In 2025, Standard Polyamide 12 led the market due to its versatility across automotive, industrial, and aerospace applications. Its excellent chemical resistance, dimensional stability, and mechanical strength make it suitable for tubing, connectors, and fuel systems. From 2026 to 2035, Reinforced / Modified Polyamide 12 is expected to expand rapidly, driven by demand for higher-performance polymers in automotive lightweighting, aerospace components, and industrial applications requiring enhanced durability and thermal stability.

By Form, Powder for Additive Manufacturing Drives Polyamide 12 Market Growth Transforming Automotive Aerospace Medical and Industrial Applications

In 2025, Pellets / Granules were the primary form used in injection molding and extrusion processes. Their adaptability in automotive parts, industrial tubing, and consumer products supports widespread adoption. Between 2026 and 2035, Powder for Additive Manufacturing and Coatings is projected to grow fastest as 3D printing adoption increases, enabling complex, customized designs in aerospace, medical, and industrial sectors, along with expansion into sustainable and high-performance applications.

By End-User Industry, Healthcare and Medical Devices Propel Polyamide 12 Market Growth Transform Automotive Transportation Industrial Applications

In 2025, Automotive & Transportation led adoption due to the need for lightweight, durable components like fuel lines, connectors, and brake systems. From 2026 to 2035, Healthcare & Medical Devices is expected to grow fastest, driven by the use of PA12 in biocompatible medical tubing, surgical instruments, and 3D-printed medical devices, meeting increasing healthcare demand and regulatory requirements.

By Application, Additive Manufacturing Drives Polyamide 12 Market Growth Transforming Automotive Aerospace Medical and Industrial Applications

In 2025, Automotive Components dominated applications, including fuel lines, connectors, and electrical parts, due to durability and weight reduction benefits. From 2026 to 2035, Additive Manufacturing (3D Printing) is expected to grow rapidly, enabling complex, customized parts across aerospace, medical, and industrial applications, supported by innovations in PA12 powders and expanding industrial 3D printing adoption.

Polyamide 12 Market Report Analysis

Asia Pacific Polyamide 12 Market Insights

In 2025, Asia Pacific dominated the global Polyamide 12 market with 34.73% share, driven by rapid industrialization, automotive manufacturing, and electronics production. Strong adoption of lightweight, high-performance polymers in fuel lines, connectors, and industrial components supports widespread PA12 use. From 2026 to 2035, the region is expected to record the fastest CAGR of 5.38%, fueled by growth in electric vehicle production, additive manufacturing, aerospace, and medical applications. Countries such as China, India, and Japan are leading adoption, leveraging advanced manufacturing capabilities and expanding infrastructure to drive PA12 demand.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Polyamide 12 Market Insights

In 2025, North America accounted for 23.35% of the global Polyamide 12 market, driven by strong demand from the automotive, aerospace, and industrial manufacturing sectors. The region’s focus on lightweighting, high-performance components, and advanced polymer applications supports widespread adoption of PA12 in fuel lines, connectors, and electrical parts. Growth in additive manufacturing and 3D printing technologies is further expanding PA12 usage in prototyping and customized industrial components. Additionally, regulatory emphasis on efficiency and sustainability encourages the use of high-performance and eco-friendly PA12 solutions across multiple industries.

U.S. Polyamide 12 Market Insights

In 2025, the United States dominated the North American Polyamide 12 market due to its advanced automotive, aerospace, and industrial manufacturing sectors, strong adoption of additive manufacturing, and regulatory focus on lightweight, high-performance, and sustainable polymer applications.

Europe Polyamide 12 Market Insights

In 2025, Europe accounted for 31.21% of the global Polyamide 12 market, driven by high demand in automotive, aerospace, and industrial sectors. The region emphasizes lightweight, high-performance polymers for fuel lines, connectors, and precision components. Adoption of additive manufacturing and advanced polymer technologies is expanding applications in prototyping, industrial machinery, and medical devices. Strong regulatory frameworks promoting energy efficiency, emissions reduction, and sustainability further boost PA12 usage. Countries like Germany and France lead in industrial production and innovative polymer applications, reinforcing Europe’s position as a key regional market.

Germany Polyamide 12 Market Insights

In 2025, Germany dominated the European Polyamide 12 market due to its strong automotive and industrial manufacturing base, advanced polymer processing capabilities, high adoption of additive manufacturing, and focus on lightweight, high-performance, and sustainable polymer solutions.

China Polyamide 12 Market Insights

In 2025, China dominated the Asia Pacific Polyamide 12 market due to its large automotive and electronics manufacturing base, rapid industrial growth, increasing adoption of additive manufacturing, and strong demand for lightweight, high-performance polymer components across multiple industries.

Latin America (LATAM) and Middle East & Africa (MEA) Polyamide 12 Market Insights

In 2025, the Latin America and Middle East & Africa (MEA) Polyamide 12 markets are emerging regions driven by growing industrialization, infrastructure development, and expanding automotive and energy sectors. PA12’s chemical resistance, durability, and lightweight properties make it ideal for fuel lines, connectors, industrial machinery, and emerging additive manufacturing applications. Increasing investment in oil & gas, aerospace, and healthcare infrastructure is boosting adoption. Countries such as Brazil, Mexico, and the UAE are leading demand, creating opportunities for manufacturers to expand specialty and high-performance PA12 applications across these developing markets.

Competitive Landscape for Polyamide 12 Market:

Evonik Industries AG is a global specialty chemicals leader, producing high-performance polymers including Polyamide 12 (PA12) for automotive, aerospace, medical, and industrial applications. Known for lightweight, durable, and sustainable solutions, Evonik drives innovation in additive manufacturing, bio-circular materials, and advanced polymer technologies, meeting growing global PA12 demand.

- In March 2025, Evonik partnered with 3DChimera to distribute its INFINAM® selective laser sintering (SLS) PA12 powders in the U.S., enhancing availability of industrial 3D‑printable PA12 materials optimized for flexibility, temperature resistance, and stiffness.

Arkema S.A. is a French specialty chemicals company and global producer of high‑performance materials, including Rilsamid® PA12 and other polyamides for automotive, electronics, healthcare, and industrial applications. It recently expanded its Rilsan® Clear transparent polyamide production unit in Singapore, tripling capacity to meet demand for sustainable, high‑performance transparent polymers across eyewear, consumer electronics, and medical devices. Arkema leads in bio‑based and recyclable polyamide materials, advancing sustainable polymer solutions worldwide.

- In January 2026, Arkema announced that its new Rilsan® Clear transparent polyamide production plant on Jurong Island (Singapore) is now operational.

Polyamide 12 Market Key Players:

- Evonik Industries AG

- Arkema S.A.

- EMS-Chemie Holding AG

- UBE Industries, Ltd.

- BASF SE

- RTP Company

- DuPont de Nemours, Inc.

- Solvay S.A.

- Toray Industries, Inc.

- Mitsubishi Chemical Corporation

- RadiciGroup

- Ascend Performance Materials LLC

- DSM Engineering Plastics

- Lanxess AG

- Kuraray Co., Ltd.

- Asahi Kasei Corporation

- Kolon Plastics, Inc.

- SABIC (Saudi Basic Industries Corporation)

- Celanese Corporation

- Honeywell International Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1.54 Billion |

| Market Size by 2035 | USD 2.50 Billion |

| CAGR | CAGR of 5.02% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Standard Polyamide 12, Reinforced / Modified Polyamide 12, Bio-based Polyamide 12, and Specialty & High-Performance Grades) • By Form (Pellets / Granules, Powder (Additive Manufacturing & Coatings), Filaments, and Sheets & Tubes) • By End-Use Industry (Automotive & Transportation, Industrial Manufacturing, Oil & Gas / Energy, and Healthcare & Medical Devices) • By Application (Automotive Components, Electrical & Electronics, Industrial & Machinery, and Additive Manufacturing (3D Printing)) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Evonik Industries AG, Arkema S.A., EMS-Chemie Holding AG, UBE Industries, Ltd., BASF SE, RTP Company, DuPont de Nemours, Inc., Solvay S.A., Toray Industries, Inc., Mitsubishi Chemical Corporation, RadiciGroup, Ascend Performance Materials LLC, DSM Engineering Plastics, Lanxess AG, Kuraray Co., Ltd., Asahi Kasei Corporation, Kolon Plastics, Inc., SABIC, Celanese Corporation, Honeywell International Inc. |