Polyurethane Dispersions Market Report Scope & Overview

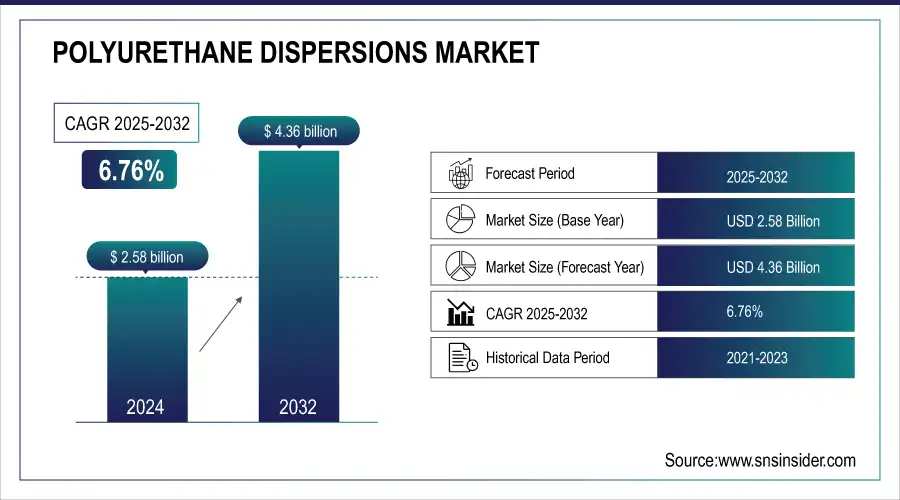

The Polyurethane Dispersions Market was valued at USD 2.58 billion in 2024 and is expected to reach USD 4.36 billion by 2032, growing at a CAGR of 6.76% from 2025-2032.

The report offers key statistical insights and trends to guide market understanding. The report offers a detailed analysis of production capacity and utilization by country and type, with data from 2023. It also highlights feedstock prices, regulatory impacts, and environmental metrics, including emissions data and sustainability initiatives by region. In addition, innovation and R&D investments are examined, showcasing trends in product development by type. The report also addresses adoption rates of polyurethane dispersions by region, providing insights into the growing use of this technology. Furthermore, a deep dive into key product features and regulatory adherence across various regions is included. These insights help companies understand current dynamics and plan for future opportunities.

To Get more information on Polyurethane Dispersions Market - Request Free Sample Report

Polyurethane Dispersions Market Size and Forecast

-

Polyurethane Dispersions Market Size in 2024: USD 2.58 Billion

-

Polyurethane Dispersions Market Size by 2032: USD 4.36 Billion

-

CAGR: 6.76% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Polyurethane Dispersions Market Trends

-

Rising demand for eco-friendly and low-VOC coatings is driving polyurethane dispersions (PUDs) adoption.

-

Increasing use in paints, adhesives, leather finishing, and textiles is boosting market growth.

-

Advancements in waterborne technologies are enhancing performance, durability, and sustainability.

-

Growing regulations on solvent-based products are accelerating the shift to PUDs.

-

Expanding applications in automotive, construction, and furniture industries are widening market scope.

-

Development of bio-based and recyclable PUDs is aligning with circular economy initiatives.

-

Collaborations between chemical manufacturers, coating companies, and R&D institutions are fostering innovation.

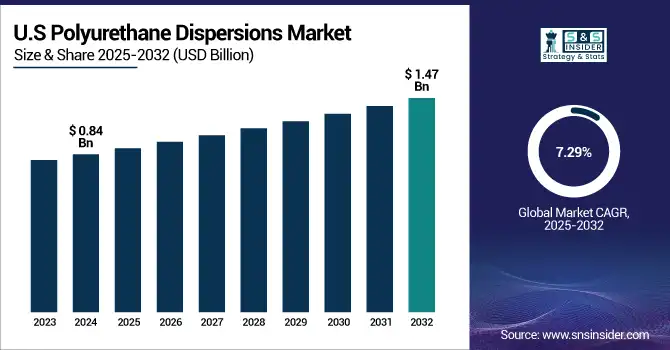

The U.S. Polyurethane Dispersions Market was valued at USD 0.84 billion in 2024 and is expected to reach USD 1.47 billion by 2032, growing at a CAGR of 7.29% from 2025-2032.

This is due to several key factors. Firstly, the U.S. boasts a highly developed industrial base, with strong demand for polyurethane dispersions in sectors such as automotive, construction, textiles, and packaging. The growing emphasis on sustainability and eco-friendly products in the U.S. has further boosted the demand for waterborne polyurethane dispersions, which are considered environmentally superior due to their lower volatile organic compound (VOC) content. Additionally, the U.S. government’s regulatory frameworks, including stringent environmental standards, have incentivized the adoption of greener alternatives in manufacturing processes. Furthermore, the presence of major players like Lubrizol Corporation, Dow Inc., and other industry leaders, along with continuous investment in R&D for innovative products, solidifies the U.S. as a key player in the global market, making it the largest market share holder.

Polyurethane Dispersions Market Growth Drivers:

-

Rising Demand for environmentally friendly coatings and adhesives drives the polyurethane dispersions market growth.

The increasing demand for sustainable and eco-friendly coatings and adhesives is a major driver for the polyurethane dispersions market. As industries, especially automotive, construction, and textiles, push for greener alternatives, waterborne polyurethane dispersions are gaining prominence due to their low volatile organic compound (VOC) emissions and non-toxic properties. Regulatory pressures from governments worldwide, such as the European Union’s REACH regulations and the U.S. Environmental Protection Agency’s (EPA) policies, have also catalyzed the demand for eco-friendly products. This trend is particularly strong in developed regions like North America and Europe, where environmental standards are stringent, driving the adoption of low-VOC and water-based solutions. The push for more sustainable products is expected to continue driving the market's growth in the coming years.

Polyurethane Dispersions Market Restraints:

-

High raw material costs and price volatility restrain polyurethane dispersions market growth.

One significant restraint affecting the polyurethane dispersions market is the high cost of raw materials and price volatility. Key raw materials used in the production of polyurethane dispersions, such as isocyanates, polyols, and solvents, are subject to fluctuations in global supply chains. The price volatility of these raw materials can lead to increased production costs, thereby raising the overall cost of polyurethane dispersions. This can deter smaller manufacturers from entering the market or cause established companies to raise prices, potentially limiting the adoption of polyurethane dispersions, particularly in price-sensitive markets. Additionally, geopolitical tensions, trade barriers, and natural disasters can disrupt the supply of raw materials, further exacerbating the issue.

Polyurethane Dispersions Market Opportunities:

-

Growing demand for waterborne coatings presents significant opportunities in the polyurethane dispersions market.

The growing shift towards waterborne coatings, driven by the increasing demand for low-VOC, non-toxic solutions, presents significant opportunities for the polyurethane dispersions market. Waterborne polyurethane dispersions are increasingly used in industries such as automotive, textiles, and packaging, where sustainability and regulatory compliance are becoming more important. The demand for these eco-friendly solutions is expanding due to their superior performance, durability, and minimal environmental impact. Additionally, the expansion of the construction industry, driven by urbanization and infrastructure development, provides new avenues for polyurethane dispersions, especially in coatings that enhance the aesthetics and performance of residential and commercial buildings. This growing focus on sustainability will likely continue to open new growth opportunities in various application sectors.

Polyurethane Dispersions Market Challenge:

-

Challenges in Achieving Consistent Quality and Performance Standards for Polyurethane Dispersions.

One of the main challenges faced by the polyurethane dispersions market is maintaining consistent quality and performance standards. The production of polyurethane dispersions requires precise control over the formulation of the dispersions, as even small variations in the synthesis process can lead to significant differences in product performance. Ensuring uniformity in quality while scaling up production can be difficult, especially for companies striving to meet the high-performance standards required by industries such as automotive and construction. Additionally, as the demand for more specialized and customized polyurethane dispersions grows, manufacturers must invest in advanced technologies and processes to meet these requirements, which can be both time-consuming and costly.

Polyurethane Dispersions Market Segment Analysis

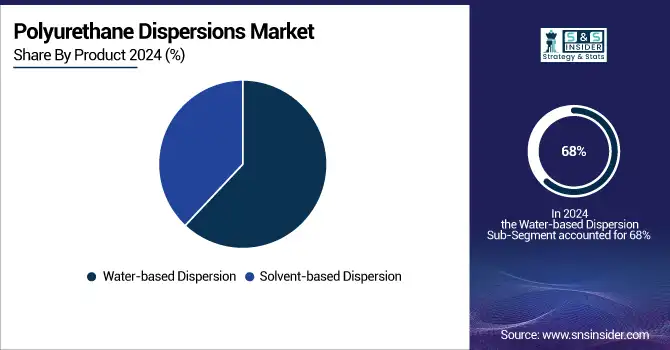

By Product, Water-based dispersion dominates the polyurethane dispersions market

Water-based Dispersion held the largest market share, around 68%, in 2024. Due to the high number of benefits associated with water-based dispersions compared to solvent-based dispersions, water-based dispersions had the largest market share in the polyurethane dispersions market. With much lower VOCs these dispersions provide a more sustainable option and are compliant with the growing number of high environmental standards around the globe, especially in North America and Europe. As consumers are becoming smarter and more aware about harmful products that are created by hazardous chemical products, manufacturers are stepping towards waterborne systems, which are safer for user and to environment. In addition, waterborne polyurethane dispersions give excellent performance for diverse applications like coatings, adhesives, and textiles are flexible, durable, and resistant to weathering. With sustainability at the forefront in all areas of industry, the movement towards and dominance of water-based solutions is undeniably ever-increasing.

By Application, Paints & coatings dominate the polyurethane dispersions market

Paints & Coatings held the largest market share, around 38%, in 2024. It is due to their widespread application across various industries, including construction, automotive, and industrial manufacturing. Polyurethane dispersions are ideal for paints and coatings because they offer excellent durability, flexibility, abrasion resistance, and superior adhesion to various surfaces. These properties are highly valued in protective coatings for both interior and exterior applications, where long-lasting performance and aesthetic appeal are crucial. Additionally, as the global demand for eco-friendly and low-VOC solutions increases, water-based polyurethane dispersions, which are commonly used in paints and coatings, align well with regulatory standards and sustainability trends. The continued growth in the construction and automotive sectors, particularly in emerging markets, further contributes to the dominance of paints and coatings in the polyurethane dispersions market.

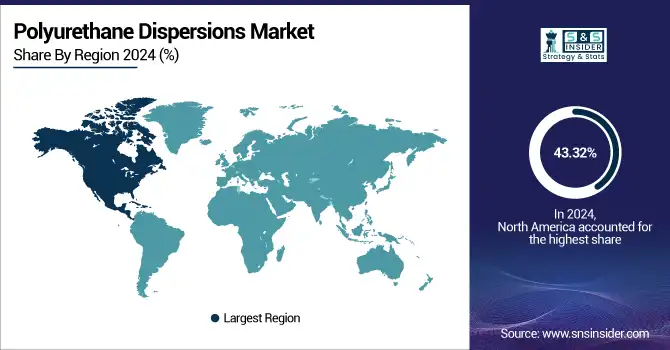

Polyurethane Dispersions Market Regional Analysis

North America Polyurethane Dispersions Market Insights

North America held the largest market share, around 43.32%, in 2024. This can be attributed to the increasing demand for eco-friendly and high-performance coatings. This is primarily witnessed in the U.S. Due to the environmental regulations of the region, including the U.S. Environmental Protection Agency (EPA), the changeover is taking place at a rapid pace toward low-VOC and water-based polyurethane dispersions. This has spurred innovation and transpired into adoption across several sectors, such as construction, automotive, and industrial coatings, with a high focus on durability along with sustainability. North America also leads the charge due to its established manufacturing infrastructure and the presence of numerous key market players, as well as increasing investments in sustainable practices. Consumer knowledge of green products is also high in the region, coupled with an increasing need for durable and protective coatings for the residential and commercial sectors. The various drivers combined to reinforce the dominating position of North America in the market space.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Polyurethane Dispersions Market Insights

The Asia Pacific region dominates the Polyurethane Dispersions (PUD) market, driven by rapid industrialization, urbanization, and expanding construction and automotive sectors. Growing demand for eco-friendly coatings, adhesives, and textiles supports market growth. Strong manufacturing capabilities in countries like China, India, and Japan, coupled with rising disposable incomes and government initiatives promoting sustainable materials, position Asia Pacific as a key hub for innovation and adoption in the global PUD market.

Europe Polyurethane Dispersions Market Insights

Europe holds a significant position in the Polyurethane Dispersions (PUD) market, fueled by stringent environmental regulations and a strong focus on sustainable, waterborne coatings. Growing applications in automotive, construction, and furniture sectors drive demand, while advanced manufacturing technologies and well-established chemical industries support innovation. Countries such as Germany, France, and the UK are leading adoption, making Europe a key region for high-performance, eco-friendly PUD solutions in the global market.

Middle East & Africa and Latin America Polyurethane Dispersions Market Insights

The Middle East & Africa and Latin America are emerging markets in the Polyurethane Dispersions (PUD) industry, driven by rising construction, automotive, and furniture sectors. Increasing awareness of eco-friendly coatings and adhesives, along with expanding industrial infrastructure, supports adoption. Countries like Brazil, Mexico, UAE, and Saudi Arabia are witnessing growing demand, while partnerships with global PUD manufacturers enhance accessibility, positioning these regions as high-growth areas in the global polyurethane dispersions market.

Polyurethane Dispersions Market Competitive Landscape:

BASF SE

BASF SE is a leading player in the Polyurethane Dispersions (PUD) market, offering innovative solutions for coatings, adhesives, and specialty applications. The company focuses on sustainable, waterborne dispersions that meet environmental standards while delivering high performance. With strong R&D capabilities and global production infrastructure, BASF SE continues to expand its footprint, catering to the growing demand for eco-friendly and high-quality polyurethane dispersions across diverse industries.

-

2025 – BASF inaugurated a second polymer dispersions production line at its Daya Bay site in Greater China, expanding its capacity for polyurethane dispersions.

-

2024 – BASF partnered with STOCKMEIER Urethanes USA to supply biomass-balanced Lupranate MDI for sustainable polyurethane binders in playground and recreational surfacing applications.

-

2024 –BASF introduced Basonol AC 2120 W, a water-borne binder dispersion offering high gloss, clarity, fast drying, and chemical resistance ideal for 2K polyurethane topcoats.

Covestro AG

Covestro AG is a prominent player in the Polyurethane Dispersions (PUD) market, focusing on sustainable, high-performance solutions for coatings, adhesives, and specialty applications. The company emphasizes low-carbon, waterborne, and circular PUDs, catering to environmentally conscious industries. With strategic investments in production facilities and collaborations for upcycling polyurethane waste, Covestro strengthens its market presence while addressing the growing demand for eco-friendly and innovative polyurethane dispersions.

-

2025 – Covestro India signed an MOU with CSIR-NCL to develop sustainable upcycling solutions for polyurethane waste, aiming to transform end-of-life materials into valuable chemical feedstocks and boost circularity.

-

2024 – Covestro plans to launch mass-balanced PUDs in the Asia-Pacific region starting Q1 2024. These low-carbon formulations contain up to 80% alternative raw materials while matching traditional PUD performance.

-

2023 – Covestro completed construction of a new PUD production facility in Shanghai, due online Q1 2024, delivering environmentally compatible waterborne PUDs with more circular components.

Key Players

-

BASF SE (Bayhydrol, Desmophen)

-

Covestro AG (Bayhydur, Desmodur)

-

Huntsman Corporation (Hybond, Terol)

-

The Dow Chemical Company (VORALUX, VORAMER

-

DSM (NeoRez, NeoRad)

-

Wacker Chemie AG (Elastosil, Silpur)

-

Lubrizol Corporation (Noveon, Carbopol)

-

LANXESS AG (Dispercoll, Baybond)

-

Eastman Chemical Company (Aquazol, Hydrosize)

-

H.B. Fuller (H-Bond, Advantra)

-

Allnex (Ebecryl, Setalux)

-

SABIC (Ultem, Sabic Innovative Plastics)

-

Arkema Group (Rilsan, Orgasol)

-

Mitsui Chemicals (Micropoly, Polyplast)

-

Kraton Polymers (Kraton G, Kraton D)

-

Celanese Corporation (Celcon, Celcryl)

-

Solvay S.A. (Solef, Rhodia)

-

Teijin Limited (Panlite, Teijinfilms)

-

Asahi Kasei Corporation (Leona, Rheoclean)

-

Mapei S.p.A. (Mapefloor, Mapei Kerapoxy)

| Report Attributes | Details |

| Market Size in 2024 | USD 2.58 Billion |

| Market Size by 2032 | USD 4.36 Billion |

| CAGR | CAGR of 6.76 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Water-based Dispersion, Solvent-based Dispersion) •By Application (Textile Finishing, Natural Leather Finishing, Synthetic Leather, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Covestro AG, Huntsman Corporation, The Dow Chemical Company, DSM, Wacker Chemie AG, Lubrizol Corporation, LANXESS AG, Eastman Chemical Company, H.B. Fuller, Allnex, SABIC, Arkema Group, Mitsui Chemicals, Kraton Polymers, Celanese Corporation, Solvay S.A., Teijin Limited, Asahi Kasei Corporation, Mapei S.p.A. |