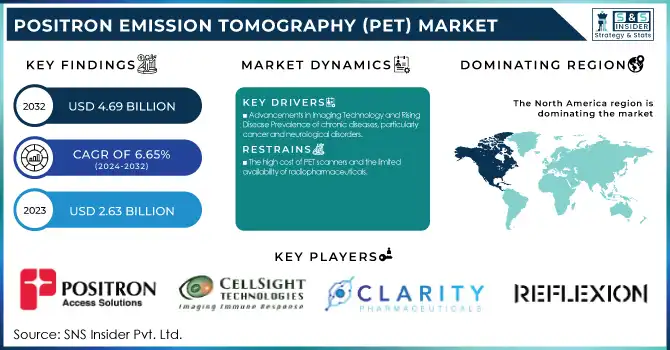

Positron Emission Tomography Market Size & Overview:

The Positron Emission Tomography (PET) Market size was estimated at USD 2.63 billion in 2023 and is expected to reach USD 4.69 billion by 2032 with a growing CAGR of 6.65% during the forecast period of 2024-2032.

Get More Information on Positron Emission Tomography Market - Request Sample Report

This study analyzes the incidence and prevalence of conditions that need PET scans, with regional variations in demand fuelled by rising cancer incidence and neurological disorders. The research discusses trends in prescribing by region, with emphasis on the increasing use of PET technology in diagnostics and personalized medicine. Device volume by region is reviewed, illustrating how PET adoption is increasing, especially in developed economies with sophisticated healthcare infrastructure. Moreover, medical spending by region is examined, with a view to how investments in diagnostic equipment and medical imaging are increasing, driven by government policies and private investment.

Positron Emission Tomography Market Dynamics

Drivers

-

Advancements in Imaging Technology and Rising Disease Prevalence of chronic diseases, particularly cancer and neurological disorders.

PET imaging is used extensively in the detection of early diseases, and oncology represents about 50% of PET applications. The World Health Organization reports that 19.3 million new cancer diagnoses were reported worldwide in 2020, which increased demand for high-accuracy imaging technologies such as PET/CT and PET/MRI. PET scans are also being increasingly used to diagnose and monitor neurological diseases like Alzheimer's and Parkinson's disease, which impact more than 55 million individuals globally.

Technological advances, such as digital PET scanners, time-of-flight technology, and artificial intelligence-based imaging analysis, are dramatically improving the accuracy, efficiency, and resolution of PET scans. AI-powered PET solutions, like those by GE Healthcare and Siemens Healthineers, enhance image interpretation, optimize radiation doses, and decrease scan times. The growing integration of PET with hybrid imaging devices such as PET/CT and PET/MRI further accelerated its applications in the clinical setting, thus becoming a chosen diagnostic tool for precision medicine. Furthermore, enhanced investments in research and the design of new PET tracers such as Gallium-68 and Amyloid-based radiotracers are stretching the applications of PET beyond cancer into neurology and cardiology. Therefore, the global proliferation of PET technology is projected to maintain its steady growth path with the driving forces of the demand for precise, non-invasive diagnostic tools for early disease identification and treatment planning.

Restraints

-

The high cost of PET scanners and the limited availability of radiopharmaceuticals.

The average PET/CT system is priced between USD 1 million and USD 3 million, and hence it is a high-capital-outlay investment for healthcare facilities, especially in developing countries. Apart from the initial cost, operational costs like maintenance, training, and regulations also contribute to the high total cost. The high cost reduces access to PET technology, particularly in low-income healthcare facilities.

The radiopharmaceutical supply chain, specifically short-lived PET tracers such as Fluorodeoxyglucose (FDG-18), is another major constraint. PET radiotracers are produced and distributed using specialized cyclotrons and radiopharmacies, which are not very common in most areas. Furthermore, PET tracers have extremely short half-lives—FDG-18 has a half-life of 110 minutes, and Carbon-11 has a half-life of 20 minutes—so they must be used immediately after production. This renders it challenging for health centers that are distant from manufacturing sites to implement PET imaging efficiently. In addition, rigorous regulatory approvals of new radiopharmaceuticals delay their launch into the market. Organizations like the FDA (United States), EMA (Europe), and IAEA enforce rigorous guidelines on PET tracer manufacturing, handling, and clinical application. These regulatory intricacies, with associated high expenses and logistical issues, limit the broad application of PET technology, especially in developing countries. Overcoming these cost and supply constraints will be essential to increasing access to PET imaging worldwide.

Opportunities

-

Growing Applications in Neurology and Emerging AI Integration

The PET market offers huge growth prospects, especially in neurology and AI-based imaging solutions. Historically dominated by oncology applications, PET imaging is increasingly growing in the diagnosis and monitoring of neurodegenerative diseases like Alzheimer's, Parkinson's, and epilepsy. Alzheimer's disease, according to the WHO, affects more than 55 million individuals across the globe and is anticipated to triple by the year 2050. PET scans, particularly amyloid and tau tracers, are fast becoming a critical early-stage diagnostic tool and monitor of dementia disorders. Firms such as Biogen and Lilly are creating PET-based diagnostics that are being designed to enhance the tailored treatment regimes of neurodegenerative conditions.

Another significant opportunity is artificial intelligence integration in PET imaging. AI-based software improves image reconstruction, minimizes scan times, and optimizes radiation doses, enhancing overall diagnostic efficiency. Siemens Healthineers, GE Healthcare, and Philips are at the forefront of developing AI-based PET solutions, which enable improved image clarity, automatic detection of lesions, and predictive analytics in oncology and neurology. Furthermore, the availability of new PET radiotracers, i.e., Gallium-68 and Fibroblast Activation Protein Inhibitors tracers, is growing PET's therapeutic applications beyond cancer into inflammatory diseases and fibrotic diseases. The increasing fascination with theranostics, i.e., the use of PET imaging and targeted therapies hand-in-hand, further solidifies PET's application in precision medicine. With growing AI and emerging tracers enabling better PET images, these breakthroughs will accelerate new market growth and broaden the scope of PET's applications to various disease groups.

Challenges

-

The shortage of skilled professionals required to operate advanced PET scanners and interpret complex imaging results.

PET imaging requires highly advanced equipment and techniques that need expertise in nuclear medicine, radiology, and radiopharmaceutical preparation. The number of trained professionals in these areas is not adequate to cater to increasing demand, especially in developing countries. The World Federation of Nuclear Medicine and Biology states that there is a worldwide shortage of nuclear medicine experts, which restricts the use of PET imaging on a large scale. The absence of trained staff routinely leads to diagnostic delays, misinterpretation, and ineffective application of PET technology, with an overall effect on patient care.

The growing need for PET imaging in oncology and neurology amplifies the need for efficient and stable tracer delivery systems. Players such as Jubilant Radiopharma and Cardinal Health are investing in PET radiopharmaceutical production to meet this need. Nevertheless, overcoming labor shortages and streamlining tracer logistics continue to be fundamental challenges that need to be met to facilitate continued growth and access to PET imaging globally.

Positron Emission Tomography Market Segmentation Insights

By Product

PET/CT Systems led the PET market in 2023 with the highest market share of about 75%. The PET/CT system combines the functional imaging of Positron Emission Tomography (PET) with the high-resolution anatomical information provided by Computed Tomography (CT). This fusion provides unmatched diagnostic ability, particularly for intricate diseases like cancer, cardiovascular diseases, and neurological disorders. PET/CT scanners allow clinicians to measure both metabolic activity and the exact location of tumors or abnormalities within the body. The all-around imaging solution finds itself at the center of oncology, with the need for early detection and correct staging playing a critical part in treatment planning. PET/CT scanners are the preferred option in hospitals, research institutions, and diagnostic imaging centers because they are versatile, clinically proven, and cost-saving. In addition, the ongoing improvements in PET/CT technology, including enhanced resolution and shorter scan times, play a role in its continued market dominance.

The PET/MRI system, integrating the metabolic imaging feature of PET with the outstanding soft-tissue contrast of Magnetic Resonance Imaging (MRI), is the fastest-growing product category. This growth is fueled by the expanding demand for more accurate and non-invasive diagnostic tools, especially in oncology and neurology. PET/MRI is particularly valuable for brain imaging and cancer diagnosis, where high resolution and differentiation of soft tissue are paramount. As hospitals and specialized medical centers look for advanced diagnostic options, PET/MRI’s ability to deliver enhanced imaging with fewer risks and reduced radiation exposure is propelling its adoption. Over the next few years, PET/MRI systems are expected to expand rapidly, particularly in academic institutions and research-driven environments, as their value in early-stage diagnosis and longitudinal disease monitoring continues to be recognized.

By Application

Oncology was the largest application for PET scans, holding 57.4% of the market in 2023. PET is essential in oncology because it can identify metabolic alterations at an extremely early stage, well before structural changes are apparent using other imaging techniques. PET scanning plays a key role in the diagnosis, staging, and monitoring of the treatment of many forms of cancer, such as lung, breast, and lymphoma. It assists oncologists in evaluating tumor size, site, and distribution, offering key information for tailor-made treatment strategies. With cancer incidence increasing in the world, the need for efficient diagnostic means such as PET is growing incessantly. Further, with the evolution in PET technology, including its association with CT or MRI, the role of PET in precision oncology is fortified, rendering it an absolute must for diagnosis and continuous monitoring of cancer growth. The oncology segment will remain dominant in its position, driving the overall growth of the PET market further, boosted by growing investment in cancer diagnosis and expanding access to PET imaging technologies.

The neurological application of PET imaging is the most rapidly expanding sector, driven by the increasing incidence of neurodegenerative disorders like Alzheimer's, Parkinson's, and other cognitive impairments. PET scans allow clinicians to visualize brain function, identify abnormal brain metabolism, and evaluate the early phases of diseases that are frequently challenging to diagnose using standard imaging techniques. PET's potential for monitoring shifts in brain activity before structural impairments take hold is a particular advantage in detecting neurological disorders in their early stages. With an increasing aging of the world population and the rate of neurological illnesses rising, the place of PET in neurology is growing explosively. Lastly, with continuous innovations in imaging techniques and radionuclide tracers, the accuracy of PET in diagnosing brain pathology is being heightened, further bolstering its attraction to neurologists. This segment is poised to witness significant growth, fueled by an aging population and increased emphasis on early and precise neurological disease diagnosis, with a special focus on Alzheimer's and Parkinson's diseases.

By End User

Hospitals & Surgical Centers held the largest share of the PET market in 2023, with a 60% market share. These facilities are the main end-users of PET scanning systems because they have the volume and complexity of patients, which are the main reasons that they use such systems. Hospitals have the infrastructure and the budget to purchase and maintain sophisticated diagnostic tools like PET/CT and PET/MRI systems. PET imaging is pivotal in the diagnosis of intricate diseases including cancer, cardiovascular disease, and neurological disease, and hence a key resource in a clinical setup. Hospitals are also likely to host more patients, which compels the need for sophisticated imaging. Pre-surgical planning stands out as a key area where PET scans are specifically advantageous for surgical centers, providing surgeons with essential information regarding tumor localization, staging, and metabolic activity. With increasing focus on precision and personalized medicine, hospitals and surgical centers continue to be the leading players in the PET market, investing heavily in cutting-edge imaging technologies to remain competitive.

The Diagnostic & Imaging Clinics segment is the most rapidly growing end-user segment in the PET market. With outpatient services increasingly becoming popular, these specialty clinics provide patients with more accessible and cost-effective imaging services, frequently with quicker turnaround times than in traditional hospital environments. As diagnostic imaging demand grows, particularly in urban locations, these clinics are emerging as major players in the PET market. They serve a large spectrum of medical requirements, from basic cancer screenings to advanced brain and heart imaging, thus contributing to their increased market share. Diagnostic and imaging clinics also gain from improved PET technology that enables them to offer quality imaging at a reduced cost of operation. The growth of these clinics is also fueled by a trend toward medical tourism, with patients seeking quality diagnostic procedures in areas where prices are competitive. Diagnostic and imaging clinics are thus growing at a fast rate and are projected to continue their growth in the PET market.

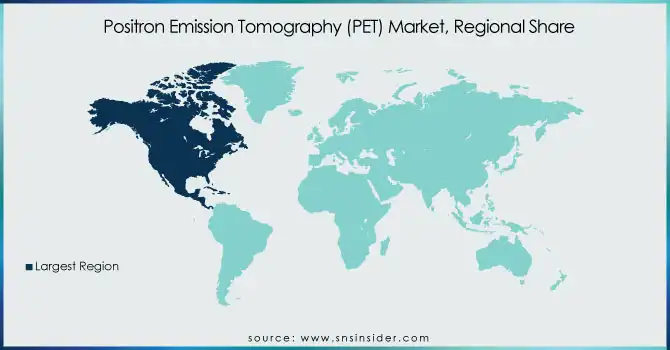

Positron Emission Tomography Market Regional Analysis

In North America, the PET market was the largest in terms of share because of the high uptake of sophisticated medical technologies and the availability of well-developed healthcare infrastructure. The United States is a major contributor, with growing investments in healthcare and the extensive use of PET for oncology, cardiology, and neurology. The growth is also supported by favorable reimbursement policies and high awareness of early disease detection.

Europe followed closely, with nations such as Germany, the UK, and France taking the PET adoption pole. Europe's market enjoys robust healthcare infrastructures, an aging population base, and increasing cancer diagnoses. In addition, PET/MRI technology advancements are fueling immense interest in this market, especially for neurological and oncology applications.

The Asia-Pacific market is the fastest-growing, propelled by growing healthcare infrastructure, rising incidence of chronic disorders, and heightened demands for sophisticated diagnostics. China, Japan, and India are all investing heavily in healthcare technology, such as PET scanners, to respond to growing demands for precise diagnostics. Also, the growth of the medical tourism industry and government efforts to enhance access to healthcare are anticipated to drive the fast growth of the PET market in this region.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

GE Healthcare - Discovery MI PET/CT, Discovery 710 PET/CT

-

Siemens Healthineers - Biograph Vision PET/CT, Biograph mCT PET/CT

-

Koninklijke Philips N.V. - Ingenuity TF PET/CT, Vereos Digital PET/CT

-

Canon Inc. - Aquilion ONE Genesis PET/CT

-

Shanghai United Imaging Healthcare Co., Ltd - uMI PET/CT, uEXPLORER PET/CT

-

Shimadzu Corporation - Trinias PET/CT

-

Positron Corporation - CardioPET, OncoPET

-

CellSight Technologies - CellSight PET Systems

-

RefleXion - RefleXion X1 PET/CT

-

Clarity Pharmaceuticals - SPECT/CT, ClarityPET

-

PETsys Electronics SA - PETsys PET Scanners

-

Blue Earth Diagnostics Limited - Axumin PET Imaging

-

Qubiotech Health Intelligence S.L. - Qubitech PET Solutions

-

Advanced Accelerator Applications - NETSPOT PET/CT

-

Lilly - Lilly PET Imaging Solutions

-

Agfa-Gevaert Group - PET/CT Systems

-

CMR Naviscan - PET Scanner, PET/CT Systems

-

Neusoft Corporation - Neusoft PET/CT Systems

-

Siemens - Biograph Vision PET/CT, Biograph mCT

-

Segamicorp - Segami PET/CT Solutions

-

ONCOVISION - Oncovision PET/CT Systems

-

MedX Holdings, Inc - MedX PET/CT Systems

-

Modus Medical Devices Inc. - PET/CT Systems

-

Radiology Oncology Systems - PET/CT Imaging Solutions

-

TOSHIBA CORPORATION - Aquilion PET/CT, PET/CT Systems

-

General Electric Company - Discovery PET/CT, Discovery MI PET/CT

Recent Developments

In Dec 2024, Continuum Therapeutics initiated patient dosing in its Phase 1b Positron Emission Tomography (PET) trial of PIPE-791. The trial aims to assess receptor occupancy of PIPE-791 in the brain and lungs across multiple cohorts using a PET tracer targeting the LPA1 receptor.

In June 2024, Jubilant Radiopharma's Radiopharmacies division announced a USD 50 million investment to expand its Positron Emission Tomography (PET) radiopharmaceutical manufacturing network. The company plans to add six new manufacturing sites across the United States, with operations expected to begin within 24 months.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.63 billion |

| Market Size by 2032 | USD 4.69 Billion |

| CAGR | CAGR of 6.65% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [PET/CT Systems (Low Slice Scanners, Medium Slice Scanners, High Slice Scanners), PET/MRI Systems] • By Application [Oncology, Neurological, Cardiovascular, Other] • By End User [Hospital & Surgical Centers, Diagnostic & Imaging Clinics, Ambulatory Care Centers, Other End Users] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GE Healthcare, Siemens Healthineers, Koninklijke Philips N.V., Canon Inc., Shanghai United Imaging Healthcare Co., Ltd, Shimadzu Corporation, Positron Corporation, CellSight Technologies, RefleXion, Clarity Pharmaceuticals, PETsys Electronics SA, Blue Earth Diagnostics Limited, Qubiotech Health Intelligence S.L., Advanced Accelerator Applications, Lilly, Agfa-Gevaert Group, CMR Naviscan, Neusoft Corporation, Segamicorp, ONCOVISION, MedX Holdings, Inc, Modus Medical Devices Inc., Radiology Oncology Systems, TOSHIBA CORPORATION, General Electric Company. |