Post-quantum Cryptography (PQC) Market Report Scope & Overview:

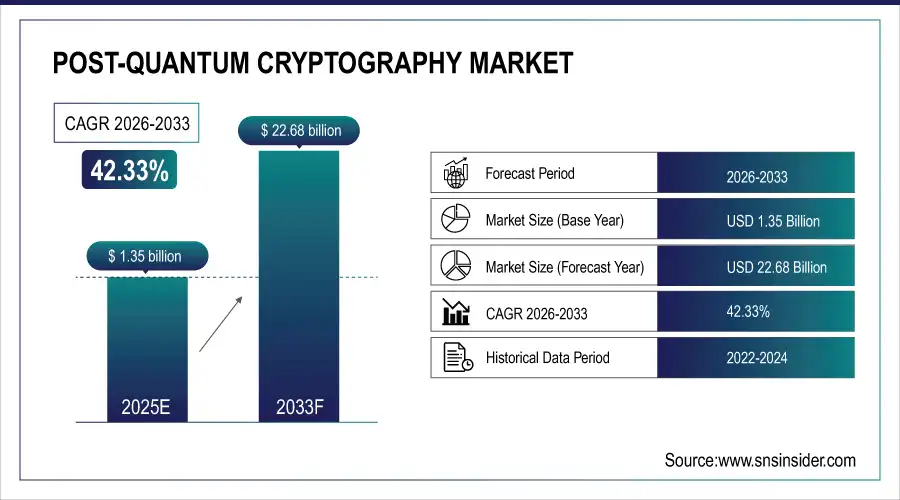

Post-quantum Cryptography (PQC) Market is valued at USD 1.35 billion in 2025E and is expected to reach USD 22.68 billion by 2033, growing at a CAGR of 42.33% from 2026-2033.

Growth in the Post-quantum Cryptography (PQC) Market is fueled by the rising threat of quantum computing to traditional encryption, pushing governments, enterprises, and cybersecurity providers to transition toward quantum-resistant security frameworks. Increasing adoption of cloud services, digital payments, and IoT devices is expanding the need for long-term data protection. Regulatory mandates and large-scale investments from defense, BFSI, and telecom industries are accelerating PQC deployments, while ongoing research collaborations and standardization efforts further strengthen market expansion.

In 2025, global PQC adoption surged by 45%, with over 60% of enterprises in defense, finance, and telecom accelerating quantum-resistant upgrades amid rising cyber-quantum risks supported by ISO/NIST standardization and cross-industry R&D partnerships exceeding USD5.2 billion in investment.

Post-quantum Cryptography (PQC) Market Size and Forecast

-

Market Size in 2025E: USD 1.35 Billion

-

Market Size by 2033: USD 22.68 Billion

-

CAGR: 42.33% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Post-quantum Cryptography Market - Request Free Sample Report

Post-quantum Cryptography (PQC) Market Trends

-

Rising adoption of quantum-resistant algorithms to protect sensitive data from future quantum computing threats

-

Increasing government and enterprise investments in PQC research, standardization, and implementation across critical infrastructure systems

-

Growing integration of PQC solutions with cloud computing, IoT, and blockchain networks for secure communications

-

Expansion of hybrid cryptography combining classical and quantum-resistant methods for gradual transition to post-quantum security

-

Development of lightweight PQC protocols for resource-constrained devices such as IoT sensors and edge computing platforms

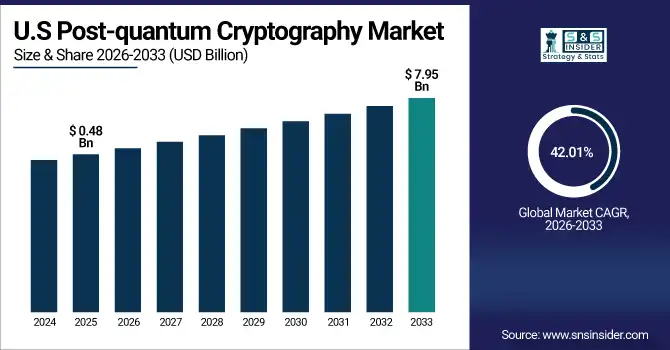

U.S. Post-quantum Cryptography (PQC) Market is valued at USD 0.48 billion in 2025E and is expected to reach USD 7.95 billion by 2033, growing at a CAGR of 42.01% from 2026-2033.

Growth in the U.S. Post-quantum Cryptography (PQC) Market is driven by rising federal cybersecurity initiatives, early adoption of quantum-safe encryption across defense and financial sectors, and increasing vulnerability of critical infrastructure to quantum threats. Strong government funding and NIST-led PQC standardization are accelerating commercial and institutional deployment.

Post-quantum Cryptography (PQC) Market Growth Drivers:

-

Rising demand for secure cloud computing, IoT, and blockchain applications presents opportunities for PQC solutions to safeguard emerging digital ecosystems

The global adoption of cloud-based systems, connected devices, and decentralized blockchain platforms is expanding rapidly across industries. While these digital ecosystems deliver efficiency and innovation, they require robust encryption to defend against evolving cyberattacks and future quantum threats. Post-quantum cryptography offers a pathway to secure machine-to-machine communication, protect multi-cloud environments, and authenticate billions of IoT endpoints. As organizations modernize cybersecurity architecture to support large-scale decentralized networks, PQC providers have the opportunity to introduce scalable, high-performance cryptographic frameworks purpose-built for next-generation digital infrastructure.

In 2025, surging adoption of cloud, IoT, and blockchain technologies drove 70% of cybersecurity leaders to prioritize PQC integration, with PQC-enabled security layers projected to protect over 30% of enterprise digital ecosystems by year-end.

-

Government and defense initiatives promoting research, funding, and adoption of quantum-resistant encryption offer growth prospects for PQC solution providers globally

Governments around the world are prioritizing quantum readiness to protect national security, military communications, and sensitive classified data. Many nations are increasing grants, R&D investments, and public-private collaborations to accelerate PQC algorithm development and standardization. Defense agencies are beginning early migration to quantum-secure encryption to mitigate long-term cyber-espionage risks. These initiatives stimulate demand for PQC solutions across multiple industries and create a favorable regulatory landscape that encourages adoption. As mandates expand into civilian sectors such as banking, healthcare, and telecom, market opportunities for PQC providers continue to strengthen.

In 2025, government and defense agencies across 55+ countries allocated over USD4 billion to post-quantum cryptography (PQC) initiatives, accelerating standards development, procurement pilots, and adoption in critical infrastructure fueling robust growth for PQC solution providers worldwide.

Post-quantum Cryptography (PQC) Market Restraints:

-

Rising demand for secure cloud computing, IoT, and blockchain applications presents opportunities for PQC solutions to safeguard emerging digital ecosystems

The global adoption of cloud-based systems, connected devices, and decentralized blockchain platforms is expanding rapidly across industries. While these digital ecosystems deliver efficiency and innovation, they require robust encryption to defend against evolving cyberattacks and future quantum threats. Post-quantum cryptography offers a pathway to secure machine-to-machine communication, protect multi-cloud environments, and authenticate billions of IoT endpoints. As organizations modernize cybersecurity architecture to support large-scale decentralized networks, PQC providers have the opportunity to introduce scalable, high-performance cryptographic frameworks purpose-built for next-generation digital infrastructure.

In 2025, demand for quantum-safe security in cloud, IoT, and blockchain systems drove a 40% increase in PQC integration trials, with 65% of enterprise security leaders prioritizing post-quantum cryptography to protect data against future quantum threats.

-

Government and defense initiatives promoting research, funding, and adoption of quantum-resistant encryption offer growth prospects for PQC solution providers globally

Governments around the world are prioritizing quantum readiness to protect national security, military communications, and sensitive classified data. Many nations are increasing grants, R&D investments, and public-private collaborations to accelerate PQC algorithm development and standardization. Defense agencies are beginning early migration to quantum-secure encryption to mitigate long-term cyber-espionage risks. These initiatives stimulate demand for PQC solutions across multiple industries and create a favorable regulatory landscape that encourages adoption. As mandates expand into civilian sectors such as banking, healthcare, and telecom, market opportunities for PQC providers continue to strengthen.

In 2025, government and defense entities in over 60 countries committed more than USD 4.5 billion to post-quantum cryptography (PQC) adoption, driving standards implementation, procurement programs, and national cybersecurity strategies creating robust growth opportunities for PQC solution providers worldwide.

Post-quantum Cryptography (PQC) Market Opportunities:

-

Rising demand for secure cloud computing, IoT, and blockchain applications presents opportunities for PQC solutions to safeguard emerging digital ecosystems

The global adoption of cloud-based systems, connected devices, and decentralized blockchain platforms is expanding rapidly across industries. While these digital ecosystems deliver efficiency and innovation, they require robust encryption to defend against evolving cyberattacks and future quantum threats. Post-quantum cryptography offers a pathway to secure machine-to-machine communication, protect multi-cloud environments, and authenticate billions of IoT endpoints. As organizations modernize cybersecurity architecture to support large-scale decentralized networks, PQC providers have the opportunity to introduce scalable, high-performance cryptographic frameworks purpose-built for next-generation digital infrastructure.

In 2024, 60% of enterprises developing cloud, IoT, and blockchain systems began integrating post-quantum cryptography (PQC), driving a 35% increase in PQC pilot projects to secure data against future quantum threats in digital ecosystems.

-

Government and defense initiatives promoting research, funding, and adoption of quantum-resistant encryption offer growth prospects for PQC solution providers globally

Governments around the world are prioritizing quantum readiness to protect national security, military communications, and sensitive classified data. Many nations are increasing grants, R&D investments, and public-private collaborations to accelerate PQC algorithm development and standardization. Defense agencies are beginning early migration to quantum-secure encryption to mitigate long-term cyber-espionage risks. These initiatives stimulate demand for PQC solutions across multiple industries and create a favorable regulatory landscape that encourages adoption. As mandates expand into civilian sectors such as banking, healthcare, and telecom, market opportunities for PQC providers continue to strengthen.

In 2024, over 45 countries launched post-quantum cryptography (PQC) initiatives, with government and defense sectors allocating USD3.2 billion to quantum-resistant encryption R&D and piloting PQC deployments across critical infrastructure and secure communication networks.

Post-quantum Cryptography (PQC) Market Segment Highlights

-

By Deployment Mode: On-Premises led with 57.4% share, while Cloud-Based is the fastest-growing segment with CAGR of 35.6%.

-

By Type: Lattice-Based Cryptography led with 41.9% share, while Isogeny-Based Cryptography is the fastest-growing segment with CAGR of 38.2%.

-

By Application: Data Encryption led with 33.7% share, while Authentication & Identity Management is the fastest-growing segment with CAGR of 36.5%.

-

By End-User: BFSI led with 29.8% share, while Government & Defense is the fastest-growing segment with CAGR of 34.1%.

Post-quantum Cryptography (PQC) Market Segment Analysis

By Deployment Mode: On-Premises led, while Cloud-Based is the fastest-growing segment.

On-Premises deployment dominates the PQC market as organizations handling highly confidential information prioritize internal data control and security. Large enterprises, government bodies, and financial institutions favor this approach for compliance with stringent encryption standards and risk mitigation. The ability to customize cryptographic systems, integrate with legacy infrastructure, and maintain full authority over encryption keys reinforces its preference for mission-critical environments. This deployment model continues to lead due to trust, reliability, and strong cyber-resilience requirements.

Cloud-Based PQC is the fastest-growing due to rapid adoption of SaaS, multi-cloud ecosystems, and the shift toward zero-trust architectures. Organizations are integrating cloud-native quantum-resistant encryption to protect distributed workflows, remote operations, and hybrid networks. The scalability, flexible implementation, reduced infrastructure cost, and rapid deployment of cryptographic updates drive adoption. Increased cyber-attacks on cloud platforms and the need for quantum-safe authentication accelerate growth as enterprises transition to cloud-first security strategies.

By Type: Lattice-Based Cryptography led, while Isogeny-Based Cryptography is the fastest-growing segment.

Lattice-Based Cryptography dominates as it is considered mathematically robust against quantum attacks and is widely supported by research institutions and standardization bodies like NIST. It offers strong performance, scalability, and efficiency in real-world applications such as digital signatures and key exchange mechanisms. Enterprises and government security systems increasingly rely on lattice-based algorithms for next-generation security infrastructure. Its compatibility with existing communication systems and relatively low computational overhead have positioned it as the most adopted PQC technique globally.

Isogeny-Based Cryptography is expanding fastest due to its extremely small key size, lightweight architecture, and efficiency for mobile, IoT, and bandwidth-constrained environments. It is gaining traction for secure communication applications where performance and minimal memory consumption are critical. Rising research investments, rapid academic advancements, and experimental deployments in cryptographic protocols are accelerating its adoption. As industries explore scalable PQC for edge devices and embedded systems, isogeny-based methods continue to grow at the highest rate.

By Application: Data Encryption led, while Authentication & Identity Management is the fastest-growing segment.

Data Encryption dominates the PQC market as enterprises and governments focus on protecting sensitive information from future quantum-based cyber threats. Industries require quantum-resistant encryption for databases, cloud storage, network traffic, and secure transactions. Large-scale digitalization, cross-border data transfer, and rising cyber-espionage risks reinforce the priority of encryption upgrades. Organizations are increasingly transitioning to quantum-safe key exchange and symmetric encryption to ensure long-term confidentiality, driving this application to hold the largest market share.

Authentication & Identity Management is the fastest-growing application due to rising identity theft, credential abuse, and cyber-fraud risks. Post-quantum authentication protects digital identities across enterprise networks, cloud platforms, IoT devices, and payment systems. Organizations are adopting PQC-enabled multi-factor authentication, digital certificates, and access control systems to strengthen identity verification. Increased regulatory pressure and digital onboarding across finance, telecom, and healthcare sectors are driving rapid adoption of quantum-safe authentication frameworks.

By End-User: BFSI led, while Government & Defense is the fastest-growing segment.

BFSI dominates the PQC market because financial institutions handle large volumes of high-value transactions and sensitive customer data, making long-term encryption crucial. Banks, insurance firms, and fintech companies are early adopters of quantum-resistant cryptography to secure digital payments, authentication systems, and online banking platforms. Strict compliance requirements, cybersecurity governance, and investment in risk mitigation accelerate the adoption of PQC. The need to future-proof financial infrastructure against quantum vulnerabilities reinforces BFSI as the leading end-user segment.

Government & Defense is the fastest-growing end-user category as national security agencies race to secure classified communications and critical infrastructure from emerging quantum threats. PQC enables protection of military networks, satellite links, intelligence systems, and diplomatic data. Rising cyber-warfare, espionage risks, and sovereign cybersecurity mandates are fueling rapid investments in quantum-safe security frameworks. Many countries are launching defense-level PQC modernization programs, making this sector the fastest to transition to quantum-resilient encryption.

Post-quantum Cryptography (PQC) Market Regional Analysis

North America Post-Quantum Cryptography (PQC) Market Insights:

North America dominated the Post-quantum Cryptography (PQC) Market with a 42.00% revenue share in 2025 due to the early adoption of advanced cybersecurity frameworks, strong presence of leading cryptography and cloud security vendors, and high government spending on quantum-resilient encryption. The region’s strict compliance mandates across BFSI, defense, telecom, and healthcare further accelerated large-scale PQC integrations to safeguard critical infrastructure and sensitive data.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Post-quantum Cryptography (PQC) Market Insights

Asia Pacific is expected to grow at the fastest CAGR of 44.83% from 2026-2033, driven by rapid digital transformation, rising cyberattacks, and increasing government investments in quantum-safe encryption to secure national digital infrastructure. Expanding cloud computing, fintech development, and smart city projects across China, India, Japan, and South Korea are boosting accelerated PQC deployment across enterprises and government sectors.

Europe Post-quantum Cryptography (PQC) Market Insights

Europe accounted for a steadily rising share of the Post-quantum Cryptography (PQC) Market in 2025, supported by strong regulatory pressure from GDPR and the EU Cybersecurity Act, which pushed enterprises to adopt quantum-resilient encryption. Increased investment in digital sovereignty, expansion of secure cloud services, and rapid PQC adoption across BFSI, government, and automotive manufacturing further strengthened the region’s market position.

Middle East & Africa and Latin America Post-Quantum Cryptography (PQC) Market Insights

Middle East & Africa and Latin America (merged) are showing gradual adoption of Post-quantum Cryptography driven by rising cyber threats, digital banking expansion, and growing cloud migration across enterprises and public institutions. Increasing government focus on national cybersecurity strategies and the modernization of telecom networks is expected to stimulate PQC adoption, though budget constraints and lower technology awareness slow large-scale deployment compared to developed regions.

Post-quantum Cryptography (PQC) Market Competitive Landscape:

IBM Corporation

IBM Corporation is a global technology pioneer actively advancing post-quantum cryptography through research, product integration, and standardization support. IBM embeds PQC algorithms into its cloud, security, and data-protection platforms to help enterprises prepare for quantum-enabled cyber threats. The company collaborates with government bodies, NIST, and cybersecurity organizations to develop and validate quantum-safe encryption standards. With strong innovation capabilities and large-scale enterprise adoption, IBM plays a key role in accelerating the transition toward quantum-resilient digital infrastructure.

-

2025, IBM announced the IBM Crypto Engine a dedicated hardware cryptographic co-processor embedded in its upcoming IBM z17 mainframe designed to deliver real-time, high-throughput post-quantum cryptography at enterprise scale.

Microsoft Corporation

Microsoft Corporation is a major contributor to post-quantum cryptography development, integrating quantum-safe algorithms across Azure cloud services, enterprise security solutions, and communication tools. The company focuses on helping organizations migrate to quantum-resilient encryption to protect long-term sensitive data. Microsoft collaborates with NIST and global cybersecurity partners to ensure standardization and interoperability of PQC technologies. With deep research investments and strong enterprise influence, Microsoft positions itself as a leading driver in the global shift toward quantum-secure digital systems.

-

2023, Microsoft began shipping hybrid post-quantum key exchange in Windows 11 24H2 and Azure TLS stacks, combining RSA-3072 with NIST-selected CRYSTALS-Kyber.

Google LLC

Google LLC plays an influential role in post-quantum cryptography, focusing on implementing quantum-safe algorithms across its ecosystem, including Google Cloud, Chrome browser, and communication protocols. The company has conducted large-scale PQC experiments, such as hybrid classical-plus-quantum encryption models, to protect latency-sensitive applications and long-term data confidentiality. Google actively participates in NIST PQC standardization efforts and supports open-source cryptographic libraries, helping organizations adopt secure frameworks that remain resilient against future quantum-computing attacks.

-

2023, Microsoft began shipping hybrid post-quantum key exchange in Windows 11 24H2 and Azure TLS stacks, combining RSA-3072 with NIST-selected CRYSTALS-Kyber.

Post-quantum Cryptography (PQC) Market Key Players

Some of the Post-quantum Cryptography (PQC) Market Companies are:

-

IBM Corporation

-

Microsoft Corporation

-

Google LLC

-

Thales Group

-

NXP Semiconductors

-

PQShield

-

ISARA Corporation

-

Quantum Xchange

-

CryptoNext Security

-

SandboxAQ

-

Entrust Corporation

-

Infineon Technologies AG

-

Rambus Inc.

-

AWS (Amazon Web Services)

-

Cisco Systems, Inc.

-

Intel Corporation

-

ID Quantique SA

-

Post‑Quantum Ltd.

-

QuintessenceLabs

-

Toshiba Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.35 Billion |

| Market Size by 2033 | USD 22.68 Billion |

| CAGR | CAGR of 42.33% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment Mode (On-Premises, Cloud-Based) • By Type (Lattice-Based Cryptography, Code-Based Cryptography, Multivariate Cryptography, Hash-Based Cryptography, Isogeny-Based Cryptography) • By Application (Data Encryption, Digital Signatures, Secure Communication, Authentication & Identity Management) • By End-User (BFSI, Government & Defense, IT & Telecom, Healthcare, Automotive & Transportation) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IBM Corporation, Microsoft Corporation, Google LLC, Thales Group, NXP Semiconductors, PQShield, ISARA Corporation, Quantum Xchange, CryptoNext Security, SandboxAQ, Entrust Corporation, Infineon Technologies AG, Rambus Inc., AWS (Amazon Web Services), Cisco Systems, Inc., Intel Corporation, ID Quantique SA, Post‑Quantum Ltd., QuintessenceLabs, Toshiba Corporation |