Potassium Sulfate Market Report Scope & Overview:

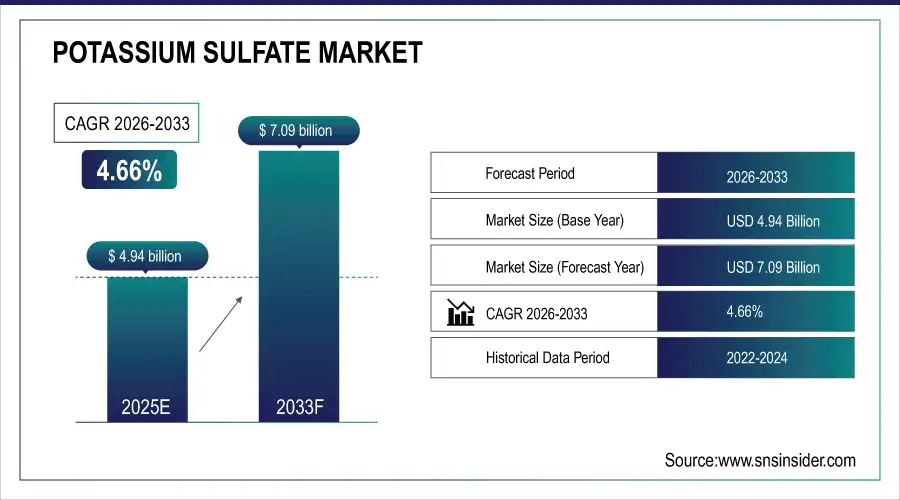

The Potassium Sulfate Market size was valued at USD 4.94 Billion in 2025E and is projected to reach USD 7.09 Billion by 2033, growing at a CAGR of 4.66% during 2026-2033.

To Get more information On Potassium Sulfate Market - Request Free Sample Report

The Potassium Sulfate Market is growing due to rising global demand for high-quality fertilizers that improve crop yield and soil health without adding harmful chloride. Increasing adoption in precision agriculture and fertigation systems, especially in Asia Pacific and North America, is driving growth. Expansion in pharmaceutical, food additive, and specialty chemical applications further supports demand. Additionally, growing awareness of sustainable farming practices, government incentives for eco-friendly fertilizers, and technological advancements in production are fueling market expansion.

Potassium sulfate is recognized as an acceptable food additive, serving as an acidity regulator in various food products, conforming to international standards like CS 13-1981 and CS 57-1981.

Key Potassium Sulfate Market Trends

-

Increasing adoption of chloride-free fertilizers to improve soil health and enhance crop yields.

-

Rising use of precision agriculture and fertigation systems for improved nutrient efficiency and reduced waste.

-

Growing demand for potassium sulfate in high-value and specialty crops such as fruits, vegetables, and organic produce.

-

Expansion of pharmaceutical-grade potassium sulfate and liquid formulations for diversified applications.

-

Strong growth potential in emerging markets like India, Brazil, and Southeast Asia driven by agricultural expansion.

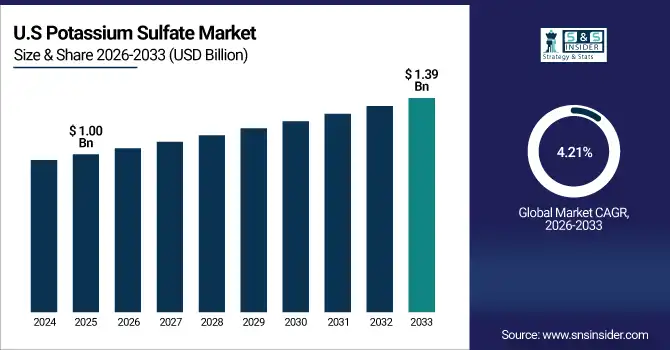

The U.S. Potassium Sulfate Market size was valued at USD 1.00 Billion in 2025E and is projected to reach USD 1.39 Billion by 2033, growing at a CAGR of 4.21% during 2026-2033. The U.S. Potassium Sulfate market is growing due to rising demand for chloride-free fertilizers, increasing adoption of precision agriculture, expansion in high-value crop farming, and growing use in pharmaceuticals and food additives for quality and sustainability.

Potassium Sulfate Market Growth Drivers:

Growing Demand for Chloride Free Fertilizers and Technological Advancements Drive Potassium Sulfate Market Growth

The Potassium Sulfate market is primarily driven by the growing need for chloride-free fertilizers that enhance crop yield and soil health without causing salinity damage. Rising global food demand, fueled by population growth and changing dietary habits, is pushing farmers to adopt high-efficiency fertilizers like potassium sulfate. Technological advancements in fertilizer production and precision agriculture, including fertigation systems, are increasing efficiency and reducing waste. Additionally, expansion in specialty applications such as pharmaceuticals, food additives, and industrial chemicals—is further supporting market growth. Government initiatives promoting sustainable agriculture and soil preservation are also significant drivers, particularly in regions like North America and Asia-Pacific.

Potassium fertilizer demand reached 38.8 million tons in 2024 and is projected to increase to 40.9 million tons in 2025, indicating a steady rise in fertilizer consumption.

Potassium Sulfate Market Restraints:

-

Raw Material Limitations and Technical Challenges Present Key Restraints for Potassium Sulfate Market Growth

Key restraints for the Potassium Sulfate market include limited raw material availability and dependence on mining operations, which can be impacted by geopolitical tensions and environmental regulations. Complex manufacturing processes for high-purity and liquid forms also pose technical challenges. Additionally, competition from alternative fertilizers, lack of awareness in some emerging markets, and logistical issues in distribution can slow adoption despite growing demand for sustainable agriculture solutions.

Potassium Sulfate Market Opportunities:

-

Rising Demand for High Value Crops and Emerging Markets Creates Potassium Sulfate Growth Opportunities

A major opportunity lies in the increasing adoption of potassium sulfate in high-value and specialty crops, such as fruits, vegetables, and organic produce, where quality and nutrient balance are critical. Growth in pharmaceutical-grade potassium sulfate and liquid formulations for fertigation presents additional potential. Expansion in emerging markets with growing agricultural sectors, such as India, Brazil, and Southeast Asia, also offers significant long-term growth opportunities for industry players.

Approximately 63% of sulfate of potash (SOP) consumption is attributed to high-value crop production, particularly fruits, vegetables, and specialty crops sensitive to chloride.

Potassium Sulfate Market Segment Analysis

-

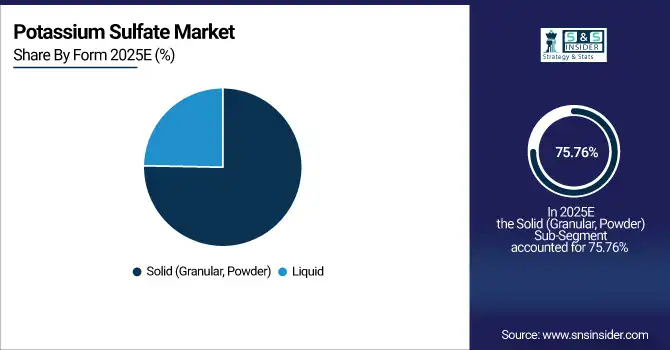

By Form, Solid (Granular, Powder) dominated with 75.76% in 2025E, and Liquid is expected to grow at the fastest CAGR of 5.47% from 2026 to 2033.

-

By Purity, Up to 99% Purity dominated with 63.27% in 2025E, and Greater than 99% Purity is expected to grow at the fastest CAGR of 5.19% from 2026 to 2033.

-

By Application, Fertilizer dominated with 69.35% in 2025E, and Drug Ingredient is expected to grow at the fastest CAGR of 6.22% from 2026 to 2033.

-

By End-Use Industry, Agriculture dominated with 53.68% in 2025E, and Pharmaceuticals is expected to grow at the fastest CAGR of 5.99% from 2026 to 2033.

By Form, Solid Form Dominates Potassium Sulfate Market While Liquid Form Drives Rapid Growth Through 2033

In 2025, the Solid (Granular, Powder) form of potassium sulfate dominates the market due to its ease of handling, storage, and widespread use in traditional agricultural practices. It remains the preferred choice for large-scale farming and industrial applications. However, the Liquid form is expected to grow fastest from 2026–2033, driven by increasing adoption of precision agriculture and fertigation systems, which enhance nutrient efficiency, reduce waste, and support sustainable farming practices globally.

By Purity, Up to 99 Percent Purity Leads Potassium Sulfate Market While Greater Purity Drives Future Growth

In 2025, Up to 99% Purity potassium sulfate dominates the market due to its widespread use in general agriculture and industrial applications, offering a cost-effective solution for nutrient supply. However, Greater than 99% Purity is expected to grow fastest from 2026–2033, driven by increasing demand in high-value sectors such as pharmaceuticals, specialty crops, and food additives. This growth is fueled by the need for higher-quality, contaminant-free fertilizers that meet strict regulatory and performance standards.

By Application, Fertilizer Dominates Potassium Sulfate Market While Drug Ingredients Drive Rapid Growth Through 2033

In 2025, Fertilizer is the dominant application of potassium sulfate, driven by its essential role in enhancing soil fertility and crop yield, particularly in chloride-sensitive crops. However, Drug Ingredient applications are expected to grow fastest from 2026–2033, fueled by increasing demand for high-purity potassium sulfate in pharmaceuticals. This growth is supported by expanding healthcare needs, stricter quality regulations, and the rising use of potassium sulfate in specialty drug formulations and medical-grade products worldwide.

By End-Use Industry, Agriculture Leads Potassium Sulfate Market While Pharmaceuticals Drives Fastest Growth Through 2033

In 2025, Agriculture dominates the potassium sulfate market, driven by its critical role in improving soil health and boosting crop yields, especially for chloride-sensitive and high-value crops. However, Pharmaceuticals is expected to grow fastest from 2026–2033, propelled by rising demand for high-purity potassium sulfate in drug formulations. Growth in this segment is supported by expanding healthcare needs, stricter regulatory standards, and increasing applications in specialty medicines and medical-grade products globally.

Potassium Sulfate Market Report Analysis

Asia Pacific Potassium Sulfate Market Insights

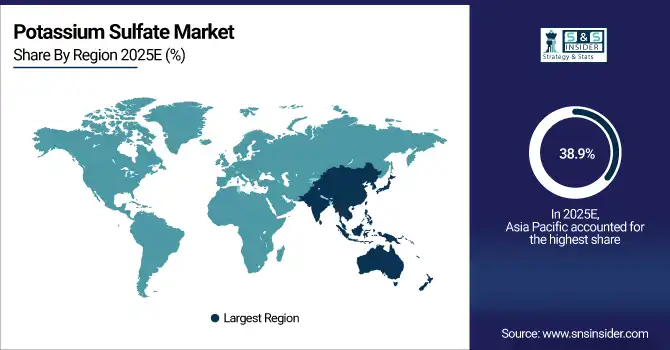

Asia Pacific dominated with 38.9% in 2025E and it is expected to grow fastest CAGR from 2026–2033. This growth is driven by increasing agricultural activities, especially in countries like China, India, and Southeast Asia, where demand for high-quality, chloride-free fertilizers is rising. Expanding cultivation of high-value crops, adoption of precision farming, and government initiatives supporting sustainable agriculture further boost demand. Additionally, growing investments in fertilizer production infrastructure and technological advancements in fertigation systems are strengthening Asia Pacific’s leading position in the global potassium sulfate market.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Potassium Sulfate Market Insights

In the Asia Pacific region, China dominates the potassium sulfate market due to its vast agricultural sector, high demand for chloride-free fertilizers, and large-scale cultivation of high-value crops, supported by government initiatives and advancements in sustainable farming practices.

North America Potassium Sulfate Market Insights

North America holds 26.64% of the potassium sulfate market in 2025. The region’s growth is driven by advanced agricultural practices, high-value crop cultivation, and increasing adoption of chloride-free fertilizers to improve soil health. The U.S. and Canada lead demand, supported by precision farming and fertigation systems. Strong regulatory support for sustainable agriculture and growing awareness of soil preservation further boost growth. Expansion in specialty applications, such as pharmaceuticals and food additives, also strengthens North America’s market position.

U.S. Potassium Sulfate Market Insights

In North America, the U.S. dominates the potassium sulfate market due to its large-scale agricultural sector, high-value crop production, advanced farming technologies, and strong adoption of chloride-free fertilizers, supported by government initiatives promoting sustainable and efficient farming practices.

Europe Potassium Sulfate Market Insights

Europe holds 17.47% of the potassium sulfate market in 2025. The region’s demand is driven by well-established agricultural practices, high-quality crop production, and strict regulations promoting sustainable fertilizer use. Key players like K+S Aktiengesellschaft support market stability. Growth is supported by increasing adoption of precision farming, rising demand for chloride-free fertilizers, and expanding applications in pharmaceuticals, food additives, and specialty chemicals across European countries.

Germany Potassium Sulfate Market Insights

In Europe, Germany dominates the potassium sulfate market due to its strong agricultural industry, advanced fertilizer production capabilities, presence of key market players like K+S Aktiengesellschaft, and high adoption of sustainable farming practices driven by strict environmental regulations.

Latin America (LATAM) and Middle East & Africa (MEA) Potassium Sulfate Market Insights

In 2025, LATAM and MEA represent growing markets for potassium sulfate, driven by expanding agricultural activities and increasing demand for high-quality, chloride-free fertilizers. In LATAM, Brazil leads due to large-scale cultivation of soybeans, sugarcane, and coffee. MEA growth is supported by agricultural modernization efforts despite challenges like water scarcity and soil salinity. Both regions offer opportunities through expanding specialty crop production and sustainable farming initiatives.

Competitive Landscape for Potassium Sulfate Market:

Nutrien Ltd. is the world's largest producer of potash, operating six low-cost mines in Saskatchewan, Canada. The company is a key player in the global potassium sulfate market, supplying high-quality fertilizers to meet the growing demand for chloride-free nutrients in agriculture.

- In August 2025, Nutrien entered into an agreement to sell its 50 percent equity position in Argentina-based nitrogen producer Profertil S.A. to Adecoagro S.A. and Asociacion de Cooperativas Argentinas Coop Ltda through a joint acquisition.

The Mosaic Company is a leading global producer of potash and phosphate fertilizers. With operations in Canada and the U.S., it plays a significant role in the potassium sulfate market, supplying essential nutrients for agriculture. The company's strategic investments and extensive production capacity support the growing demand for high-quality fertilizers worldwide

- In July 2025, The Mosaic Company announced the opening of a new fertilizer blending facility in Palmeirante, Brazil. The facility has a capacity to process 1 million tonnes of fertilizer annually, with approximately 500,000 tonnes expected to be processed in 2025.

Potassium Sulfate Market Key Players:

Some of the Potassium Sulfate Market Companies

- Nutrien Ltd.

- The Mosaic Company

- Yara International ASA

- K+S Aktiengesellschaft

- SQM S.A.

- Compass Minerals International Inc.

- Tessenderlo Group

- Sesoda Corporation

- Migao Corporation

- Intrepid Potash, Inc.

- Halogens

- LCP Leuna Carboxylation Plant GmbH

- Rusal

- Qing Shang Chemical

- China Ching Shiang Chemical Co. Ltd

- Kemira Kemi AB

- SDIC Xinjiang Luobupo Potash Co., Ltd.

- Hebei Sanyuanjiuqi Fertilizer Co., Ltd.

- Utkarsh Agrochem

- KSM Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.94 Billion |

| Market Size by 2033 | USD 7.09 Billion |

| CAGR | CAGR of 4.66% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form (Solid (Granular, Powder), and Liquid) • By Purity (Up to 99% Purity, and Greater than 99% Purity) • By Application (Fertilizer, Food Additive, Drug Ingredient, and Chemical Intermediate) • By End User (Agriculture, Pharmaceuticals, Cosmetics, Food & Beverages, and Industrial Applications) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Nutrien Ltd., The Mosaic Company, Yara International ASA, K+S Aktiengesellschaft, SQM S.A., Compass Minerals International Inc., Tessenderlo Group, Sesoda Corporation, Migao Corporation, Intrepid Potash, Inc., Halogens, LCP Leuna Carboxylation Plant GmbH, Rusal, Qing Shang Chemical, China Ching Shiang Chemical Co. Ltd, Kemira Kemi AB, SDIC Xinjiang Luobupo Potash Co., Ltd., Hebei Sanyuanjiuqi Fertilizer Co., Ltd., Utkarsh Agrochem, KSM Inc. |