Variable Frequency Drive Market Report Scope & Overview:

Get More Information on Variable Frequency Drive Market - Request Sample Report

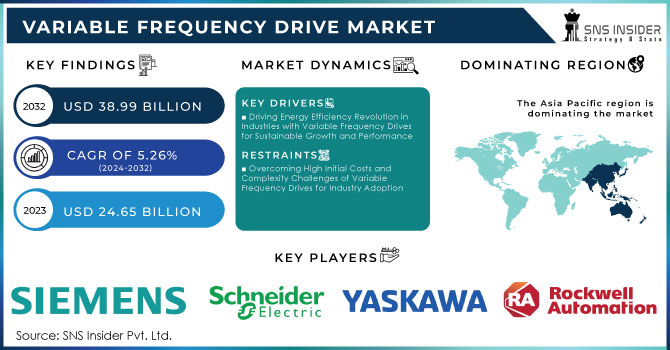

The Variable Frequency Drive Market Size was valued at USD 24.65 Billion in 2023 and is expected to reach USD 38.99 Billion by 2032 and grow at a CAGR of 5.26% over the forecast period 2024-2032.

The VFDs are growing mainly because of the service they offer to enhance energy efficiency and optimize motor control for various industries. This direct control over the speed and torque of motors helps cut energy consumption when speed does not have to be held constant in many applications. This efficiency helps save lots of money for industries such as manufacturing, HVAC, and water treatment. Moreover, VFDs further raise operational flexibility and productivity due to smooth acceleration and deceleration of motors; this greatly reduces the mechanical stress applied to equipment, further increasing machine life, decreasing maintenance costs, and improving system performance. The automation and smart manufacturing trend contribute to the demand for VFDs because they easily integrate with digital control systems, making the components indispensable for Industry 4.0 initiatives. Variable frequency drives can save continuously operating water supply systems up to 30% of electricity. They provide pump control optimization, improved motor life, and reduced maintenance costs. With around 40 million industrial motors in the U.S. accounting for 70% of total electricity usage, energy-efficient technologies like VFDs can offer 18% savings, as concluded by the Department of Energy. VFDs also ensure great operational efficiency by making it possible to have the motor speeds controlled with much precision and save a lot of water.

VFDs, therefore contribute to the efforts toward sustainability since they reduce energy waste and carbon emissions, thus fitting well within global trends toward environmental responsibility and regulatory compliance. As industries increasingly pursue lower operation costs and environmentally friendly solutions, the adoption of VFDs has constantly grown in many applications for conveyors, pumps, fans, and compressors.

Variable Frequency Drive Market Dynamics

KEY DRIVERS:

-

Driving Energy Efficiency Revolution in Industries with Variable Frequency Drives for Sustainable Growth and Performance

The major driving force behind VFD growth is the increasing interest in energy efficiency in industries. VFDs regulate motor speed because motors only operate at the speed demanded; using it thus leads to considerable energy consumption reductions, especially in quite energy-intensive applications such as pumps, fans, and compressors. In situations where industries face pressures to make their processes leaner, greener, and strictly more environmentally friendly, the quest for energy-efficient alternatives has gone into full swing. Companies must reach their energy-saving targets through VFDs, and thereby, the latter becomes an integral part of modern industrial processes.

-

Revolutionizing Industrial Automation with Variable Frequency Drives for Enhanced Precision Efficiency and Reduced Downtime

The continuing adoption of industrial automation is the main catalyst in the growing demand for VFDs. VFDs are indispensable in motor control system automation and enable any process to be run with precision and flexibility. VFDs are being paired more and more with digital control, PLCs, and the Internet of Things (IoT) for real-time monitoring and control. In addition to generally increasing efficiency in manufacturing operations, this also helps lower the rate of downtime and maintenance costs. With increased automation across all industries, the demand for high-performance motor control solutions such as VFDs would most likely increase.

RESTRAIN:

-

Overcoming High Initial Costs and Complexity Challenges of Variable Frequency Drives for Industry Adoption

The major disincentive for the VFD is the high initial investment associated with both installation and setup. Although VFDs offer long-term energy savings, a much higher investment may be incurred in the procurement, integration, and programming of such systems. A small manufacturing plant would find it hard to justify the huge investment cost to upgrade existing motor systems to VFD-controlled systems and postpone adopting energy-efficient technologies.

Another is installation and servicing complexity. VFDs are not that easy to install or maintain, setting up, faultfinding, and servicing them requires skilled technicians. One mistake in installation could cause problems such as harmonics that will affect power quality and damage the equipment. It will cause stoppages in unskilled industries such as small-scale water treatment plants through unplanned downtime and extra costs. Overcoming these requires education on long-term benefits and the availability of skilled support.

Variable Frequency Drive Market Segmentation Overview

BY PRODUCT

AC drives dominated the market with a share of 65% in 2023. This can be attributed to versatility, efficiency, and wide application for a variety of industry types. AC drives are widely used in HVAC systems, manufacturing, and even in water treatment plants where variable speed control of motors offers massive optimization of energy usage. Their compatibility with standard industrial motors and high-power loads, to increases their market presence. Technological innovations also improved AC drives in terms of efficiency, reliability, and cost-effectiveness; thus, they have become widely accepted for large and small operation systems.

DC drives to grow moderately at a CAGR of 5.2% over the forecast period. Though they are not widely used as AC drives, there are special applications of DC drives where speed must be highly controlled, especially in the automotive manufacturing and crane operations industries. DC drives reflect the trend of AC drives as concerns at best for better energy efficiency and easier maintenance. But niche markets will still exist as applications wherein the performance of a DC drive supports low-speed, high-torque needs that still keep up with operational demands.

BY RANGE

The low-power range dominated the power range segment with market revenue shares above 43% in 2023, mainly due to massive applications in small industrial and commercial applications. Low-power VFDs are suitable for controlling motors in systems that include HVAC units, conveyors, and pumps, among others. The cost-effectiveness and the ease of easy installation along with the readiness to optimize energy use in low-power applications appeal highly to small and medium-sized businesses, thereby driving the demand for low-power VFDs in low-power applications.

The medium-power range frequency drives are expected to grow at 5.8% CAGR during the forecast period. Due to more extensive use in demanding industrial environments, such as those in manufacturing, mining, and oil & gas industries, which demand more robust systems that can handle moderate to heavy loads towards energy efficiency and better control of operations. Medium-power VFDs are expected to gain wider acceptance by companies primarily as a result of growing interest in automated industries, sustainability improvements, and productivity. This development is expected to imply greater demand for medium-power VFDs as all of these factors involve medium-load motors.

BY PRODUCT

The pumps segment dominated the overall market share at 31% of revenue share in 2023, considering that pumps are critical components in a very wide range of industrial and commercial applications. In reality, pumps are closely linked to industries, such as water treatment, agriculture, oil and gas, as well as manufacturing, which demand precise control over fluid flow. Variable Frequency Drives are applied to pumps where the speed of the motor can be regulated to ensure that efficiency is enhanced as a byproduct of how well the pump operation corresponds to demand. Such applications have been characterized by huge energy savings and significantly lower running costs where large amounts of energy are used. The increased need for industrial processes to be undertaken with high efficiency has also been contributing to driving VFDs in pumps through the adoption principle based on environmental regulations.

The HVAC segment is expected to grow at a CAGR of 6.2% as energy-efficient and climate control efforts persist in emphasizing commercial and residential buildings. HVACs, which include heating, ventilation, and air conditioning systems, are one of the most energy-consuming building applications. VFDs help in the optimized control of HVAC motors through the reduction of their energy consumption under variable load conditions. With rising demand for smart building technologies and green buildings, revenue in this segment is expected to increase due to the increased use of VFDs in HVAC systems.

BY END USE

The oil and gas segment dominated the global market, with a 22% share of the revenue generated in 2023, mainly due to the high energy requirement for energy-efficient motor control systems in this area. VFDs play a vital role in improving the pump and compressor as well as drilling equipment performance in oil and gas applications since the direct influence of speed control of the motors is incredibly significant on productivity and energy savings.

The infrastructure segment is likely to expand at a CAGR of 6% over the forecast period. This is driven by investments globally in smart cities, urbanization, and more sustainable construction. The infra projects include efficient power management solutions for systems such as HVAC, lighting, elevators, and water treatment. VFDs are required to minimize energy consumption and optimize performance in such systems and hence prove indispensable in the development of modern infrastructure. As greener, energy-efficient buildings and utilities continue to drive the involvement of governments and private sectors, demand for VFDs in infrastructure applications is likely to increase as a significant driver of such robust growth trends.

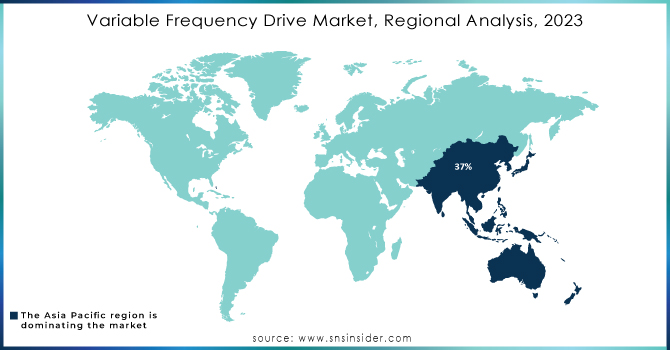

Variable Frequency Drive Market Regional Analysis

The Asia Pacific dominated the largest share in 2023, at 37%, due to rapid industrialization and urbanization across several key economies, namely China, India, and Japan. In totality, investments in manufacturing, energy, and other infrastructure projects have created demand for VFDs as industries seek to optimize energy usage and enhance operational efficiencies. The increased focus on sustainability in addition to stringent government regulations on carbon emissions has further fueled the VFD technology market in several application fields like HVAC, pumps, and motors. The strong supply chain along with the existence of giant manufacturing companies for VFDs in this region have further gained the country an edge in the market leadership.

Latin America will grow at a CAGR of 5.8% in the forecast period. This growth can be further driven by continuously rising investments in infrastructure development, especially in aspects such as water management, renewable energy, and transportation. Countries of Latin America are more eager to enhance their energy efficiency and modernize their aged infrastructure therefore, the demand for VFDs is most likely to increase further. In addition, efforts to heighten industrial automation and sustainability practices are becoming popular toward VFD technology adoption. Variable Frequency Drives (VFDs) are increasing in Latin America due to large investments in infrastructure in water management projects, mainly taking place in Brazil; renewable energy projects led by Mexico; and the improvements in transportation within Colombia with the Bogotá Metro. Companies are using VFDs for energy savings, as with the examples in Argentina industrial plants and companies in Chile by approaching sustainability, such as Codelco.

Need Any Customization Research On Variable Frequency Drive Market - Inquiry Now

Key Players in Variable Frequency Drive Market

Some of the major players in the Variable Frequency Drive Market are:

-

Siemens AG (Sirius 3RW, Sinamics G120)

-

Schneider Electric (Altivar 312, Altivar 71)

-

ABB Ltd. (ACS580, ACS880)

-

Yaskawa Electric Corporation (A1000, V1000)

-

Rockwell Automation (PowerFlex 525, PowerFlex 750)

-

Mitsubishi Electric Corporation (FR-E800, FR-A800)

-

GE Digital (AC Drive, DC Drive)

-

Danfoss (VLT AutomationDrive, VLT HVAC Drive)

-

Honeywell International Inc. (Honeywell VFD, SmartVFD)

-

Emerson Electric Co. (Control Techniques Unidrive M, Leroy-Somer)

-

Omron Corporation (MX2, 3G3MV)

-

Inovance Technology (MD600, MD800)

-

Fuji Electric Co., Ltd. (FRENIC-Ace, FRENIC-Mini)

-

Weg S.A. (CFW11, CFW300)

-

Nidec Corporation (Nidec VFD, Nidec Servo)

-

Crouzet (Millennium 3, Softstart)

-

Hitachi, Ltd. (SJ700, WJ200)

-

Schneider Electric (Telemecanique) (Altivar 32, Altivar 630)

-

SABO S.p.A. (SABO VFD, S60 Series)

-

Lenze SE (i500, 8400 StateLine)

RECENT TRENDS

-

In June 2024, Danfoss officially launched its latest intelligent variable frequency drives, the iC2 and iC7, in India, aiming to transform energy efficiency in several key sectors.

-

In September 2024, Invertek Drives, a global leader in variable frequency drive (VFD) technology, showcased its innovative Optidrive Elevator Core variable frequency drive at the National Association of Elevator Contractors (NAEC) Annual Convention.

-

In October 2024, HD Hyundai unveiled plans to manufacture low-voltage variable frequency drives (LV VFDs) for ship electrification in-house. This strategic initiative is designed to bolster the company’s capabilities in marine technology while optimizing its production processes.

| Market Size in 2023 | USD 24.65 Billion |

|---|---|

| Market Size by 2032 | USD 38.99 Billion |

| CAGR | CAGR of 5.26% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (AC Drives, DC Drives, Servo Drives) • By Range (Micro (0-5 kW), Low (6-40 kW), Medium (41-200 kW), High (>200 kW)) • By Application (Pumps, Electric Fans, Conveyors, HVAC, Extruders, Others) • By End Use |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens AG, Schneider Electric, ABB Ltd., Yaskawa Electric Corporation, Rockwell Automation, Mitsubishi Electric Corporation, GE Digital, Danfoss, Honeywell International Inc., Emerson Electric Co., Omron Corporation, Inovance Technology, Fuji Electric Co., Ltd., Weg S.A., Nidec Corporation, Crouzet, Hitachi, Ltd., Schneider Electric (Telemecanique), SABO S.p.A., Lenze SE |

| Key Drivers | • Driving Energy Efficiency Revolution in Industries with Variable Frequency Drives for Sustainable Growth and Performance • Revolutionizing Industrial Automation with Variable Frequency Drives for Enhanced Precision Efficiency and Reduced Downtime |

| RESTRAINTS | • Overcoming High Initial Costs and Complexity Challenges of Variable Frequency Drives for Industry Adoption |