Power Liftgate Market Report Insights:

Get More Information on Power Liftgate Market - Request Sample Report

The Power Liftgate Market Size was valued at USD 3.3 Billion in 2023 and is expected to reach USD 5.6 billion by 2032, growing at a CAGR of 6.1% over the forecast period 2024-2032.

The power liftgate market is experiencing remarkable growth, fueled by advancements in automotive technology and strong government initiatives promoting the adoption of smart systems. Around the world, many governments are promoting the development of new kinds of vehicles to make them safer, more efficient, and more convenient. Over 90% of passenger vehicles built in 2023 were built with advanced automation technologies, such as power liftgates, according to the U.S. Department of Transportation's National Highway Traffic Safety Administration (NHTSA). This trend fits within the agency's larger aims to reduce physical strain on vehicle users and to improve vehicle safety. There's also European Union law via the General Safety Regulation, which requires more advanced safety and convenience technologies in new vehicles starting in 2022. The penetration of power liftgates by automotive manufacturers in Europe has been strongly propelled by such regulations.

Emerging economies are also taking proactive measures to ensure that their automotive industries keep pace with global trends. As an example, India's 2022 Production-Linked Incentive (PLI) Scheme for Automobile and Auto Components allocated significant financial incentives for incentives dedicated to the integration of advanced technologies, including power liftgates, into vehicles. In addition, this is further aided by the increasing demand for mid- to high-range vehicles with smart features due to urbanization and rising disposable incomes. China's Ministry of Industry and Information Technology (MIIT) says passenger vehicle outputs reached over 23 million units in 2023, with more than 40% containing automated elements like power liftgates. All of these government-backed efforts coupled with changing consumer preferences is pushed the growth of the power liftgate market as a major automotive component across the globe.

Power Liftgate Market Dynamics

Drivers

-

The global shift towards SUVs and crossovers, which frequently include power liftgates, drives the market by catering to consumer preferences for utility and convenience.

-

Innovations such as hands-free operation, programmable height settings, and advanced safety sensors have made power liftgates more user-friendly and desirable.

-

Consumers increasingly prioritize comfort and accessibility features, like automated liftgates, enhancing convenience for families and older adults.

Power liftgates have widely been adopted to cater to the growing global demand for SUVs and crossovers in the past few years. In 2023, SUVs comprised more than 45% of global passenger vehicle sales, more than the combined share of all car segments, as consumers continue to demand vehicles that comfortably accommodate both passengers and cargo. This trend is especially pronounced in regions like North America and Europe, where SUVs dominate the automotive landscape due to their spacious interiors and versatile cargo capabilities. Power liftgates are a key feature in these vehicles, offering convenience by allowing hands-free operation through sensors or smart keys. As an example, power liftgates with height adjustment are now pretty much standard on models as consumer expectation data moves its way into showroom retail like the new Toyota RAV4, Hyundai Palisade, and Ford Explorer. This type of liftgate is especially helpful for families, older adults, and anyone with limited mobility making it one of the most desirable new SUV features.

Moreover, automakers are leveraging power liftgates as a differentiating factor to capture market share in the competitive SUV segment. With advanced technology like obstacle detection and anti-pinch sensors, they become even more useful, increasing safety standards and user experience. With the modern urban lifestyle becoming busier and consumers embracing convenience, SUVs, and crossovers featuring power liftgates will remain continuously adopted, reinforcing their role as a critical market driver.

Restrain

-

The expensive nature of power liftgate technology restricts its availability to premium vehicle segments, limiting wider adoption.

-

The intricate electronics and mechanical components require costly repairs and pose reliability challenges, deterring potential users.

-

Fluctuations in economic conditions and limited awareness in emerging markets reduce the adoption of power liftgate systems.

High implementation and maintenance cost is one of the major restraints in the power liftgate market. Utilizing high-end technologies like sensors, programmable systems, automated mechanisms, etc., power liftgates are significantly higher in production cost. These elevated costs render them available only in the premium or luxury vehicle space, preventing widespread adoption in more mass-market vehicles. Furthermore, adapting existing older vehicles with such systems can be extremely costly and thus untenable due to compatibility issues which further limits the reach of the market.

Maintenance is another money-related concern. Power liftgates have complex electronic and mechanical components that can malfunction and break, leading to costly repairs only a dealer can perform. For example, anti-pinch sensors or automatic closing often require expert servicing, leading some buyers to opt against or copy this feature. All of these factors help increase financial obstacles for a wider-base consumer market and inhibit overall growth.

Power Liftgate Market Segment Analysis

By Vehicle Type

The passenger vehicle segment held the largest share of about 59% in the power liftgate market in 2023, as OEMs are increasingly focusing on developing vehicles equipped with features that offer convenience, added value, and technology. Rising demand for mid-range and premium passenger vehicles that typically have automated systems such as power liftgates as standard equipment is the major reason for their large share in this segment. According to China’s Ministry of Industry and Information Technology (MIIT), the country produced over 23 million passenger vehicles in 2023, with a substantial share featuring advanced liftgate systems to cater to domestic and export markets.

For instance, the European Automobile Manufacturers' Association (ACEA) found around 75% of all 2023 SUVs and crossovers sold in Europe included power liftgates. This trend is particularly noticeable in countries like Germany, France, and the United Kingdom, where these vehicles are preferred for their spacious designs and family-oriented utility. In North America, the dominance of passenger vehicles equipped with automated features like power liftgates is driven by strong consumer demand for luxury and convenience. Over 8 million SUVs were sold in the U.S. in 2023, and while power liftgates are standard in most mid-range and luxury models. The growing inclination toward integrating smart features into passenger vehicles reflects broader automotive trends. With consumers turning towards functionality, safety, and convenience, automakers are adding power liftgates to their vehicles to set them apart from the competition while meeting changes in market regulation to maintain passenger vehicles as a leader in the market.

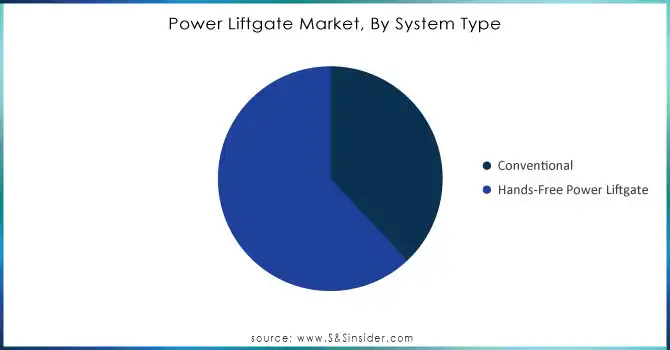

By System Type

In 2023, the hands-free power liftgate segment held the largest market share, accounting for around 62% of total revenue. This segment’s leadership is driven by the rapid adoption of gesture-based and IoT-enabled technologies, reflecting consumer demand for enhanced convenience and efficiency. Hands-free systems eliminate the need for physical interaction, allowing users to open or close the liftgate with simple gestures or proximity-based activation. This has been very popular with consumers who want smart technology integrated into cars. The U.S. Department of Transportation noted a 30% increase in hands-free system uptake in 2023, partly due to automakers incorporating the features into mid- and high-tier models. This trend has also been fueled by European regulators, who support technology adoption of smart, hands-free systems as part of an automotive innovation agenda. In this context, various projects funded by the European Union (EU) Horizon 2020 program, with a perspective of integrating IoT and AI in-vehicle systems have been identified which provide hands-free power liftgate functionalities, among others.

In addition, automotive manufacturers are continuously researching and developing systems that improve the user experience of hands-free systems. To meet this range of consumer needs, Ford and Volkswagen, among others, have started offering customizable options such as these, voicing their wishes or using a smartphone app for this same purpose. As these systems become an expected feature across a broader range of vehicles, the hands-free power liftgate segment is expected to sustain its leadership position in the market.

Need Any Customization Research On Power Liftgate Market - Inquiry Now

By Type

The automatic segment led the power liftgate market in 2023, accounting for the largest power liftgate market share about 65%. Automatic systems which allow users to use the liftgate using little amount of energy are heavily integrated into automotive design nowadays. More than 85% of vehicles sold domestically in 2023 included some form of automatic power liftgate system, according to Japan Automobile Manufacturers Association (JAMA) figures, illustrating their ubiquity. This segment’s dominance can be attributed to its ability to combine convenience with advanced safety features, such as obstacle detection and adaptive height controls. These features resolve functionality and safety issues, but also automatic systems are appealing to a wider market demographic. Additionally, Government regulations for vehicle automation have also supported the growth of this segment. For instance, under the USA's federal tax incentives for electric and hybrid vehicles with some automated technologies, manufacturers have included more automated systems in new models as standard.

Moreover, automatic power liftgates have emerged as a popular choice, especially among the luxury and premium vehicle segments in the European market. ACEA also reported that automatic liftgate systems saw a 25% year-over-year uptake in 2023. These trends highlight the significance of automation in terms of ensuring vehicle usability and consumer satisfaction.

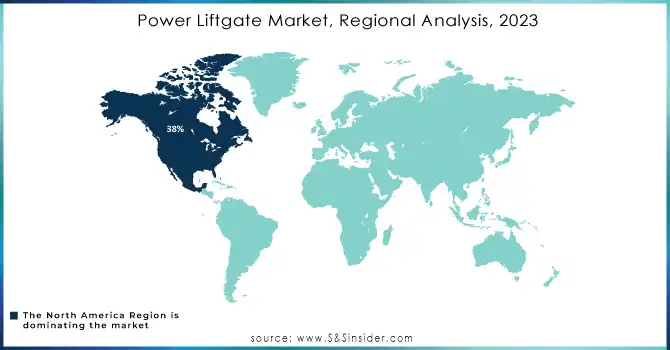

Power Liftgate Market Regional Overview

North America dominated the power liftgate market in 2023, with a 38% revenue share of the overall power liftgate market. The firm is benefitting from massive automotive technology adoption and also favourable government tax credits for each electric vehicle having smart systems. According to the U.S. Department of Energy, electric vehicle sales in the U.S. exceeded 1.3 million units in 2023, with many models featuring power liftgate systems as part of their standard configurations.

Asia-Pacific is expected to register the fastest CAGR during the forecast period. With a firm growth potential for the North American market, this region accounted significant market share in 2023. This market is driven by the increasing number of automotive production and supportive government policies. As an example, the Automotive Mission Plan 2026 in India focuses on automating and integrating smart technology across the automotive value chain. Likewise, the development of smart cities, as well as the use of electric vehicles in China, have further boosted the growth of the power liftgates market in the region.

Key Players in Power Liftgate Market

Key Service Providers/Manufacturers in the Power Liftgate Market

-

Brose Fahrzeugteile GmbH & Co. KG (SmartLift, EasyClose)

-

Magna International Inc. (Liftgate Lite, PowerLift)

-

Continental AG (AutoGate, ProLift System)

-

Huf Hülsbeck & Fürst GmbH & Co. KG (HufGate, SmoothControl)

-

Johnson Electric (Power Actuator, SmoothLift Drive)

-

Strattec Security Corporation (SecureLift, PowerGate Pro)

-

HI-LEX Corporation (EasyGate, GlideLift)

-

Aisin Corporation (AutoEase, FlexGate)

-

Stabilus SE (Power Motion, MotionControl)

-

Mitsuba Corporation (SwiftLift, AutoGate)

Users of Power Liftgate Systems:

-

Toyota Motor Corporation

-

Ford Motor Company

-

General Motors (GM)

-

Volkswagen Group

-

Hyundai Motor Company

-

BMW Group

-

Mercedes-Benz Group AG

-

Nissan Motor Corporation

-

Stellantis N.V.

-

Honda Motor Co., Ltd.

Recent Developments

-

Toyota announced its new line of hybrid SUVs will feature advanced gesture-based power liftgate systems, in March 2024. This is in line with the Japanese government's policy to incentivize smart mobility solutions using tailor-made tax incentives.

-

August 2023 General Motors offered an electric SUV range equipped with IoT-enabled power liftgate systems, which comply with new NHTSA safety standards in the United States.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.3 Billion |

| Market Size by 2032 | USD 5.6 Billion |

| CAGR | CAGR of 6.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Automatic, Semi-Automatic) • By System Type (Conventional, Hands-Free Power Liftgate) • By Vehicle Type (Passenger Vehicle {Compact, Mid-sized, SUV, Luxury}, Commercial Vehicle) • By Sales Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Brose Fahrzeugteile GmbH & Co. KG, Magna International Inc., Continental AG, Huf Hülsbeck & Fürst GmbH & Co. KG, Johnson Electric, Strattec Security Corporation, HI-LEX Corporation, Aisin Corporation, Stabilus SE, Mitsuba Corporation |

| Key Drivers | • The global shift towards SUVs and crossovers, which frequently include power liftgates, drives the market by catering to consumer preferences for utility and convenience. • Innovations such as hands-free operation, programmable height settings, and advanced safety sensors have made power liftgates more user-friendly and desirable. |

| Restraints | • The expensive nature of power liftgate technology restricts its availability to premium vehicle segments, limiting wider adoption. • The intricate electronics and mechanical components require costly repairs and pose reliability challenges, deterring potential users. |